Thank You For Attending

advertisement

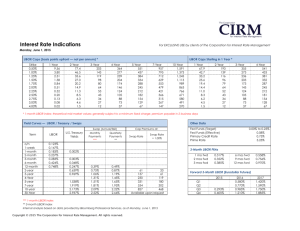

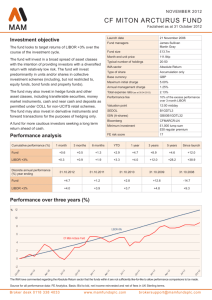

Understanding Private Loans Default Prevention Agenda Essential loan language Variable rate language ♦ Types of indexes Language for all types of loans Dissect an interest rate ♦ Variable rate history Finding the best deal What’s In It For You? Improve discussion with borrowers Better understanding of loans and terms Less stress Loan Language APR Capitalization Guarantee Fees Margin LIBOR T-Bill Origination Cap Points Negative Amortization Adjustment Period Prime Variable Know Another Language? Review the FAFSA, determine EFC, then send the AL through your FAM system. Is your school Direct or FFEL? Do you process EFT through ELM? Do you award FWS, Pell and FSEOG? Loan Language Essentials Interest Rate A charge for a loan ♦ Shown as a percent of borrowed amount One of many ways to charge for a loan ♦ Up-front fees ♦ Capitalization frequency Interest Rate Interest Student loans — monthly ♦ Credit cards — daily or monthly ♦ Earlier payments = less interest ♦ How payment is applied ♦ Fees ♦ Interest • Lowest interest rate balance • Higher interest rate balance ♦ Principal Interest Rates and Debt Secured ♦ Car ♦ Home Unsecured ♦ Credit card ♦ Personal loan ♦ Education loan What’s in an Interest Rate Cost of funds + Operations + Inflation + Risk + Profit Borrower rate Index Margin Dissecting an Interest Rate Cost of Funds1 Inflation Rate2 Operations3 Loan Losses4 Total Lender Cost Profit Loan Rate5 1,4,5 Credit Card 2.38% 2.50% 0.50% 4.85% 10.23% 2.94% 13.17% Bank sample June 2006 2Federal Reserve 3Federal Reserve Bank Functional Cost and Profit Analysis. APR Annual Percentage Rate (APR) ♦ Annual basis ♦ Up-front charges • Guarantee fees • Origination fees ♦ Compounding frequency Can make shopping easier ♦ Price tag Index Types Index and borrower rate T-Bill LIBOR Prime rate Index Index ♦ Wholesale price • Rate = price lender pays for money • Name = where lender obtains money Borrower rate ♦ Retail price • Price borrower pays for money T-Bill Treasury bill Government borrowing ♦ U.S. deficit ♦ Rate set by the government ♦ Price it will pay to borrow money Terms: 13 and 26 weeks LIBOR London Interbank Offered Rate ♦ Rate international banks in London charge each other for loans ♦ Can take place anywhere ♦ Recorded in London ♦ Similar to NYSE Index has been used for 18 years Prime Rate Retail ♦ Credit-worthy customers • Secured Private loans ♦ Wholesale price ♦ Mark-up/margin added • Borrowers lack credit history • Unsecured Margin Allowance to cover expenses ♦ Rate the borrower pays 10% ♦ Index (cost of funds) -4% ♦ Margin (covers expenses) 6% Index + Margin What the Lender pays + Lender Revenue = What the customer pays Loan Type Index Borrower Margin Rate LIBOR Index 5.36% 7.89% 13.25% Prime Index 8.25% 5.00% 13.25% T-Bill Index 4.61% 8.64% 13.25% Floor and Cap Floor ♦ Lowest rate ♦ Rarely used Cap ♦ Highest rate ♦ Limits consumer risk ♦ Also called ceiling Cap Example Prime + 3% with a cap of 12% ♦ If prime rate is 14% + 3% margin ♦ Rate is ____% Adjustment Period How often rate changes ♦ Annually, quarterly, monthly Purpose ♦ Easier budgeting ♦ Keeps lender’s margin/markup level Adjustment Period Cap Maximum rate change each period Purpose ♦ Limits borrower risk ♦ Easier to budget ♦ Benefit when rates are going up ♦ Not a benefit when rates decline Variable Rate Payment Risk Loan Amount Loan Rate Cap Payment Range Possible Increase Based on a 10-year loan term. $20,000 5.00% 25.00% $212 - $455 115% Loan Origination Fees Paid up-front Usually a percentage of the loan amount Origination ♦ Fee to start a loan ♦ Adds to the total cost of the loan ♦ Included in APR Points Point = % of loan amount One point = 1% ♦ Origination fee of 2% ♦ Two points ♦ $25,000 x 2 points = $500 Mortgage, home equity ♦ student loans Amortization Amortize = Pay off Reduction of debt ♦ Regular payments of • Interest (cost of the loan) • Principal (actual amount borrowed) Result = Loan balance decreases Negative Amortization Increasing debt Payments do not cover principal and interest Result = Loan balance grows Read the fine print Monthly payments remain fixed throughout the life of the loan. Any fluctuation in the interest rate will be reflected in the length of repayment, not in the monthly amount. Capitalization Adding interest to loan balance Capital = Money borrowed Interest is paid on capital “Capitalized” = when interest becomes part of the capital What’s a Better Deal? Low fee or a low rate $10,000 loan with 10-year term ♦ 1% fee = $100 ♦ 1% rate discount = $626 A lower rate saves more than a low fee Similar to car loan $626 savings based on an interest rate comparison of 7% and 8% on a 10-year loan term. The Right Choice LIBOR Prime rate T-Bill Indexes Mirror Each Other 25% Prime 90 Day Tbill 3 MO LIBOR Interest Rate 20% 15% 10% 5% 0% 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 Years Source: St. Louis Federal Reserve Bank and Federal National Mortgage Association Rates Mirror Each Other Margin compensates for index variety Any index + Margin = Similar loan rates Private Loan Choices Lender #1 #1 #2 #2 #3 #3 #4 #4 #4 #4 #5 #5 #5 #5 #5 #5 #6 #6 #6 #6 #7 #7 #7 #7 #8 #9 #9 # 10 # 10 Index LIBOR LIBOR PRIME PRIME PRIME PRIME LIBOR LIBOR LIBOR LIBOR LIBOR LIBOR LIBOR LIBOR PRIME PRIME PRIME PRIME PRIME PRIME LIBOR LIBOR LIBOR LIBOR LIBOR PRIME PRIME PRIME PRIME Margin 5.00% 5.00% 0.50% 4.75% 1.00% 1.00% 4.50% 4.50% 5.50% 5.50% 1.60% 1.60% 2.80% 2.80% 0.00% 0.00% 0.00% 0.00% 5.00% 5.00% 2.25% 2.25% 8.00% 8.00% 4.00% 6.50% 6.50% 4.50% 7.75% Cap None None None None None None None None None None 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% None None None None None None None None 18.00% None None None None Current Rate 10.36% 10.36% 8.75% 13.00% 9.25% 9.25% 9.86% 9.86% 10.86% 10.86% 6.96% 6.96% 8.16% 8.16% 8.25% 8.25% 8.25% 8.25% 13.25% 13.25% 7.61% 7.61% 13.36% 13.36% 9.36% 14.75% 14.75% 12.75% 16.00% Fees 4.00% 6.25% 0% 0% 0% 3% 2% 9.90% 2% 9.90% 3.75% 7.00% 3.75% 7.00% 3.75% 7.00% 0% 9% 0% 9% 0% 8% 0% 8% 0% 0% 3% 0% 0% Term 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 Index Margin Lender A LIBOR 1.00% A LIBOR 1.00% A LIBOR 2.75% A LIBOR 2.75% B PRIME -0.50% B PRIME -0.50% C LIBOR 3.75% C LIBOR 3.75% D PRIME 0.00% D PRIME 4.50% E LIBOR 0.00% E LIBOR 0.00% E LIBOR 3.50% E LIBOR 3.50% F LIBOR 3.85% G 3 Mo T-Bill 3.40% G 3 Mo T-Bill 3.40% H PRIME 1.25% H PRIME 1.25% H PRIME 2.25% H PRIME 2.25% I LIBOR 1.80% I LIBOR 1.80% J LIBOR 7.50% J LIBOR 7.50% K LIBOR 4.25% K LIBOR 4.25% K LIBOR 9.95% K LIBOR 9.95% L LIBOR 3.25% Cap None None None None None None None None None None None None None None None None None None None None None None None None None None None None None None Current Rate 6.36% 6.36% 8.11% 8.11% 7.75% 7.75% 9.11% 9.11% 8.25% 12.75% 5.36% 5.36% 8.86% 8.86% 9.21% 8.01% 8.01% 9.50% 9.50% 10.50% 10.50% 7.16% 7.16% 12.86% 12.86% 9.61% 9.61% 15.31% 15.31% 8.61% Fees Term 0% 20 8% 20 0% 20 8% 20 0% 20 9% 20 0% 20 7% 20 0% 20 0% 20 6.50% 20 10.50% 20 6.50% 20 10.50% 20 2% 20 6.50% 20 8.00% 20 0% 20 8% 20 0% 20 8% 20 0% 20 9% 20 0% 20 9% 20 2% 20 9% 20 2% 20 9% 20 6.50% 20 Comparison Shopping Determine amount to borrow Identify loan choices Interest rate index Up front costs ♦ Points, fees, etc. Term Total cost of loan ♦ Principal, interest, fees Comparison Chart Index Name Index Rate Margin Current Rate Floor Cap Adjustment Period Rate Information 91 Day Tbill Prime 1.76% 4.75% 3.25% 1.00% 5.01% 5.75% 3.00% None None 25.00% Quarterly Annually 3 mo LIBOR 1.88% 3.20% 5.08% 1.00% 18.00% 6 months Fees Origination Fee % Loan Amount Origination Fee Guarantee Fee % Guarantee Fee Other Fees Total Fees Term Payment Range 4.00% $15,000 $600 1.00% $150 $75 $825 20 years $99 to ??? None $15,000 $0.00 5.50% $75 $0.00 $75 20 years $105 to $315 8.00% $15,000 $1,200 $1,200 20 years $100 to $232 Considerations Variable Rate ♦ ♦ ♦ ♦ ♦ ♦ ♦ Index (base) Starting rate Margin Floor Cap Adjustment frequency Payment range Private Loan Choices Lender Cosigner Index Margin Adjustment Cap Current Rate Term Fees Loan # 1 Yes LIBOR + 3.85% Quarterly Loan # 2 Yes LIBOR + 3.85% Quarterly Alternative Loan Cost Comparison Lender #2 Loan #3 Yes #1 3 mo LIBOR + 3.2%#3 Quarterly Rate Information Loan 4 Yes91 Day Tbill 3 mo LIBOR + 3.2% Index#Name Prime 3 mo LIBOR Quarterly Index Rate 1.76% 4.75% 1.88% Loan #5 Optional3.25% 91 Day T-Bill + 3.15% Annually Margin 1.00% 3.20% Current 5.08% Loan # 6Rate Optional5.01% Prime5.75% + 0.0% 6 Months Floor 3.00% None 1.00% Loan #7 Yes None LIBOR + 2.90% Quarterly Cap 25.00% 18.00% Adjustment Annually + 2.90% 6 months Quarterly Loan # 8 Period Yes Quarterly LIBOR Fees Loan # 9 Fee Yes 4.00% 52 Week T-Bill + 3.10% Annually Origination None 8.00% Loan Amount $15,000 $15,000 Loan A Yes $15,000 LIBOR + 5.25% Quarterly $ Origination Fee $600 $0.00 $1,200 Loan B Fee Yes 1.00% Prime5.50% + 2.00% - Monthly Guarantee $ Guarantee Fee $75 Loan C Yes $150 Prime$0.00 + 1.00% -- Monthly Other Fees $75 Total $1,200 Loan DFees Yes $825 Prime$75 + 1.00% Monthly Loan E Yes Prime + 0.5% Quarterly Loan F Yes 91 Day T-Bill + 3.25% Quarterly Loan G Optional Prime + 0.50% Monthly Loan H Yes 91 Day T-Bill + 3.50% 6 Months Loan I Yes 91 Day T-Bill + 3.50% 6 Months None None None None None 18% None None None None None None None 25% None None None None 5.75% 5.75% 5.10% 5.10% 4.88% 4.75% 4.65% 4.65% 4.60% 7.15% 6.75% 5.75% 5.75% 5.25% 4.98% 4.83% 4.23% 4.23% 20 20 20 20 20 20 20 20 20 15 15 15 15 15 15 15 15 15 4.0% 2.0% 12.9% 7.5% 4.0% 7.5% 9.0% 4.0% 5.0% 5.0% None 9.0% None None 4.0% 3.0% 8.0% 4.0% What is a Good Deal? Affordable payment ♦ Fits in your budget Competitive rate Reasonable fees Feeling like you got a fair deal Finding the Best Deal General loan criteria ♦ Homes, cars, credit cards, etc. ♦ Most creditworthy = lower loan rate ♦ Least creditworthy = higher loan rate ♦ Private student loans Private Loan Choices Lender #1 #1 #2 #2 #3 #3 #4 #4 #4 #4 #5 #5 #5 #5 #5 #5 #6 #6 #6 #6 #7 #7 #7 #7 #8 #9 #9 # 10 # 10 Index LIBOR LIBOR PRIME PRIME PRIME PRIME LIBOR LIBOR LIBOR LIBOR LIBOR LIBOR LIBOR LIBOR PRIME PRIME PRIME PRIME PRIME PRIME LIBOR LIBOR LIBOR LIBOR LIBOR PRIME PRIME PRIME PRIME Margin 5.00% 5.00% 0.50% 4.75% 1.00% 1.00% 4.50% 4.50% 5.50% 5.50% 1.60% 1.60% 2.80% 2.80% 0.00% 0.00% 0.00% 0.00% 5.00% 5.00% 2.25% 2.25% 8.00% 8.00% 4.00% 6.50% 6.50% 4.50% 7.75% Cap None None None None None None None None None None 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% None None None None None None None None 18.00% None None None None Current Rate 10.36% 10.36% 8.75% 13.00% 9.25% 9.25% 9.86% 9.86% 10.86% 10.86% 6.96% 6.96% 8.16% 8.16% 8.25% 8.25% 8.25% 8.25% 13.25% 13.25% 7.61% 7.61% 13.36% 13.36% 9.36% 14.75% 14.75% 12.75% 16.00% Fees 4.00% 6.25% 0% 0% 0% 3% 2% 9.90% 2% 9.90% 3.75% 7.00% 3.75% 7.00% 3.75% 7.00% 0% 9% 0% 9% 0% 8% 0% 8% 0% 0% 3% 0% 0% Term 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 15 Index Margin Lender A LIBOR 1.00% A LIBOR 1.00% A LIBOR 2.75% A LIBOR 2.75% B PRIME -0.50% B PRIME -0.50% C LIBOR 3.75% C LIBOR 3.75% D PRIME 0.00% D PRIME 4.50% E LIBOR 0.00% E LIBOR 0.00% E LIBOR 3.50% E LIBOR 3.50% F LIBOR 3.85% G 3 Mo T-Bill 3.40% G 3 Mo T-Bill 3.40% H PRIME 1.25% H PRIME 1.25% H PRIME 2.25% H PRIME 2.25% I LIBOR 1.80% I LIBOR 1.80% J LIBOR 7.50% J LIBOR 7.50% K LIBOR 4.25% K LIBOR 4.25% K LIBOR 9.95% K LIBOR 9.95% L LIBOR 3.25% Cap None None None None None None None None None None None None None None None None None None None None None None None None None None None None None None Current Rate 6.36% 6.36% 8.11% 8.11% 7.75% 7.75% 9.11% 9.11% 8.25% 12.75% 5.36% 5.36% 8.86% 8.86% 9.21% 8.01% 8.01% 9.50% 9.50% 10.50% 10.50% 7.16% 7.16% 12.86% 12.86% 9.61% 9.61% 15.31% 15.31% 8.61% Fees Term 0% 20 8% 20 0% 20 8% 20 0% 20 9% 20 0% 20 7% 20 0% 20 0% 20 6.50% 20 10.50% 20 6.50% 20 10.50% 20 2% 20 6.50% 20 8.00% 20 0% 20 8% 20 0% 20 8% 20 0% 20 9% 20 0% 20 9% 20 2% 20 9% 20 2% 20 9% 20 6.50% 20 How to Find the Best Deal Separate private loans by term Sort by rate Divide into three sections ♦ Best credit ♦ Average credit ♦ Poor credit Private Loan Choices Guiding Students Before Term Credit rating Index Fees Apply Confusion Now Term Credit rating Apply Guiding Students 1% rate discount vs. 1% fee discount Rates typically mirror each other Prepare for payment to change Pay off higher interest rate debt ♦ Credit cards ♦ Private loans (if rate goes up) ♦ Deferment/forbearance options Conclusion 1. 2. 3. 4. 5. Variable rate language Types of indexes Language for all types of loans What is a good deal? Guiding students Thank you for attending Mike Stein 301-231-7557 mstein@edfund.org