Principles of Macroeconomics Fall 2014 Practice Final Exam All

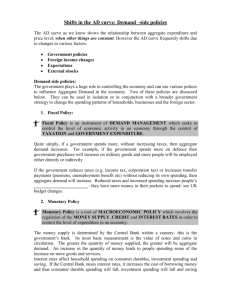

advertisement

Principles of Macroeconomics Fall 2014 Practice Final Exam All questions on the practice midterm and midterm in addition to the following: Multiple Choice: 1pt each. 1. True or false. An increase in the aggregate price level increases aggregate demand. a. True b. False x 2. The long run aggregate supply curve is vertical because a. Increasing the aggregate price level leads to an increase in long-run output b. Increasing the aggregate price level leads to an increase in real wages c. The long run aggregate supply curve is defined by market fundamentals –e.g., population, natural resources and physical capital stocks. x d. None of the above. 3. True or False. Natural-Resource-dependent countries grow more quickly than natural-resourcescarce countries do. a. True b. False x 4. Expansionary Monetary policy refers to: a. Actions taken by congress to stimulate the economy during a recession b. Actions taken by the White House to stimulate the economy during a recession c. Actions taken by the Federal Reserve to stimulate the economy during a recession x d. None of the above 5. A “Resource Curse” exists when natural-resource deposits: a. Reduce incentives to invest in human capital b. Create a so-called Dutch Disease that pulls factors of production out of non-resource sectors c. Lead to civil conflict d. All of the above x e. None of the above 6. In the short run, an increase in the price level leads to an increase in output because a. Real wages are sticky b. Nominal wages are perfectly flexible c. Nominal wages are sticky x d. None of the above 7. National Savings is equal to total investment a. True. Total savings is equal to national savings (private and public savings), and total savings is equal to investment. b. False. Total savings usually equals total investment spending, but not always. c. False. National savings is equal to private savings plus public savings. But total investment is equal to total savings, which equals national savings plus foreign savings. d. False. Total investment equals total savings, which is equal to private domestic savings, plus public savings, plus the net capital inflow. e. Both c and d are correct. x 8. Suppose the U.S. imports a television worth $500 from China. This implies that the Chinese producer of the television received 500 U.S. dollar bills. The producer of the television can do one of two things with this money: 1. buy 500 U.S. dollars worth of U.S. goods or 2. Loan a U.S. interest 500 U.S. dollars with an expectation of earning a positive rate of return. If the U.S. economy is strong and stable and the Chinese economy is weak and volatile, what are they more likely to do? a. Buy U.S. goods b. Buy U.S. assets (loan the money to a U.S. interest) x 9. Related to the question above, if the U.S. economy is relatively strong and stable, is the U.S. likely to run a trade deficit (i.e., import more than it exports)? a. Yes x b. No The following is a figure depicting private domestic savings and private domestic investment in the U.S. from 1947 to 2013. Private Savings and Private Investment 4000.0 3500.0 3000.0 2500.0 2000.0 1500.0 1000.0 500.0 Private Savings Private Investment 2013 2010 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 1962 1959 1956 1953 1950 1947 0.0 10. Assume the U.S. is in autarky. In this case, what was most likely the cause of the divergence of private savings from private investment in 2008? a. Statistical noise. b. Obamacare c. The federal government running a budget deficit x d. The federal government running a budget surplus e. None of the above. 11. Congress is expected to decrease the corporate income tax rate next year. What effect is this likely to have on real interest rates? a. This is likely to increase the supply of loanable funds, leading to an increase in the real interest rate. b. This is likely to decrease the supply of loanable funds, leading to a decrease in the real interest rate. c. This is likely to increase demand for loanable funds, leading to an increase in the real interest rate. x d. This is likely to increase the demand for loanable funds, leading to a decrease in the real interest rate. e. None of the above. 12. Banks are required to hold “required reserves” which are intended to a. Protect banks from loan defaults b. Protect CEO’s from being prosecuted c. Protect against “bank runs” x d. None of the above 13. Suppose that in an effort to stimulate the economy, the federal government enacts a fiscal stimulus of 500 billion dollars. Is a stimulus package of 500 billion dollars a reasonable figure? In other words, has the government ever passed a stimulus bill that large before? a. Yes x b. No 14. Suppose that, in an effort to increase spending in the economy, the government increases spending by 500 billion. Is this likely to increase interest rates and if so, how would this effect investment spending? a. Deficit spending will tend to increase interest rates. This will lead to an increase in investment spending. b. Deficit spending will tend to decrease interest rates. This will lead to a decrease in investment spending. c. Deficit spending will tend to decrease interest rates. This will lead to an increase in investment spending. d. If deficit spending significantly increases interest rates, this will lead to a decrease in investment spending. x 15. The difference between a stock and bond is: a. Issuing stock is akin to selling part of a company. Issuing bonds is akin to borrowing money. x b. Issuing stock is akin to borrowing money. Issuing bonds is akin to selling part of a company. c. They are basically the same thing. d. A stock is a bond that pay dividends. 16. True or False. An increase in the supply of money will lead to a decrease in interest rates and investment. a. True b. False, it will not lead to a decrease in interest rates c. False, it will lead to a decrease in interest rates, and an increase in investment expenditures x d. None of the above. 17. The long run rate of return on bonds is 7% and the long run rate of return on stocks is 2%. This is because a. Bonds are a riskier investment than stocks and investors need to be compensated for that risk. b. The initial statement is incorrect. In the long run, stocks pay on average 7% and bonds pay on average 2% because stocks are riskier than bonds. x c. Stocks and bonds pay the same interest rates in the long run – otherwise no one would ever invest in the asset that paid a lower rate of return. d. Stocks pay a lower rate of return because they represent promises to pay back. 18. Suppose that the marginal propensity to save is .20. If the government gives 1billion in tax cuts, total spending in the economy would increase by: a. 2billion b. ½ billion c. 5 billion x d. Less than 5 billion if the tax cut led to a significant increase in interest rates e. More than 5 billion. Consider the following diagram: AE = GDP AE Planned AE planned a 100 Real GDP 19. At a level of GDP equal to 100: a. Actual inventories equal planned inventories b. Actual inventories are less than planned inventories c. Actual inventories are greater than planned inventories x d. The diagram doesn’t make any sense 20. Referring to the question above, at an output level of 100, in the near future unemployment is likely to rise. a. True x b. False 21. What is the slope of the dotted line in the figure above? a. 1 x b. Greater than 1 c. Less than 1 d. Not enough information is given to answer this question. 22. Which of the following explain why the aggregate demand curve is downward sloping? a. The income effect b. The wealth effect c. The earned interest tax credit effect d. The interest rate effect e. Both b and d are correct x 23. Suppose that the housing market collapses and within 2 months the value of people’s homes, across the country depreciate in value by 40%. How would this effect the aggregate economy in the short run? a. The effective decrease in wealth would lead to an increase in the aggregate demand curve b. The effective decrease in wealth would lead to an increase in the aggregate supply curve c. The effective decrease in wealth would not shift the aggregate demand curve, it would correspond to a movement along the aggregate demand curve. d. None of the above x 24. Referring the previous question, suppose that the economy is operating at the short-run equilibrium. Optimal monetary policy would include: a. Selling bonds, raising the required reserve ratio and increasing the discount rate b. Lowering taxes and increasing spending c. Purchasing bonds, decreasing the required reserve ratio and decreasing the discount rate. x d. None of the above 25. Suppose the required reserve ratio is 10% and that people don’t hold any cash. If the Federal Reserve purchases $1billion in government bonds, this increases the amount of money in circulation by a. $1 billion b. $10 billion x c. More than $10 billion d. None of the above 26. True or false. The long run effect of monetary policy is a change in the aggregate price level, nothing “real” (e.g., output, employment) are affected. a. True x b. False 27. Unemployment benefits are an example of a. Monetary Policy b. An automatic stabilizer x c. What’s wrong with the country d. None of the above 28. Suppose that planned inventory is 500 billion and actual inventory is 200 billion. In the near future, GDP growth is likely to a. Increase x b. Decrease c. Remain the same d. Not enough information is given to answer this question The following equation describes a consumption function: c = 100 + .75*GDP (in billions). Assume the economy is in autarky and that government taxation and transfer payments are both zero. 29. What is the mpc? a. .75 x b. .25 c. 1 d. Not enough information has been given to answer this question 30. Referring to the question above. Suppose that GDP is $100 billion. What is the value of savings? a. 75 billion b. 100 billion c. More than 75 billion d. -25 billion x e. Not enough information has been given to answer this question Short Answer Questions. 10 pts each. 1. Critically evaluate the following statement: “During a recession, the government should increase taxes so as to avoid a budget deficit”. 2. Use an income-expenditure model to derive the aggregate demand curve (won’t ask this question on the final, sorry for the false alarm). 3. Using an AS-AD-LRAS model, illustrate the short-run effect of an increase in pessimism on behalf of consumers and investors. Is this pessimism likely to lead to expectations of deflation? If so, what effect would this have on the aggregate demand curve? What could the government do to avoid this result? 4. During the Great Depression, the Federal Reserve decreased the money supply in an effort to decrease the aggregate price level and increase real wages. Was this a good idea? Why or why not? 5. Suppose that the American public grows weary of fraudulent actions taken by bankers on Wall Street and decide to withdraw their checking deposits from banks and hold the cash at home instead. Is this action likely to affect interest rates? 6. Critically evaluate the following statement, “Wage contracts should define the real wage a person is paid, not the nominal wage. This would decrease the severity of recessions”.