AGGREGATE DEMAND – the total amount demanded of

advertisement

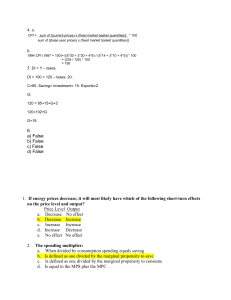

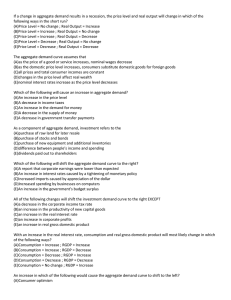

Section 3.3 AGGREGATE DEMAND – the total amount demanded of economic goods and services produced in a given economy at a given price. AD = C + I + G + X-M C = Consumer spending on goods and services, including durable and nondurable goods. Durable goods’ service lasts over time, it is not used up all at once (refrigerator, washer/dryer, etc.). Non-durable goods are used up very quickly or when they are used once (food, fuel, paper products, etc.) This is only as a function of disposable income – income minus taxes. I = Investment spending by companies on capital goods. This includes spending on working capital, like stocks of finished goods and work in progress. (Aka: Gross domestic fixed capital formation) G = Government Spending on goods and services that are publicly provided. This includes public goods and merit goods. Transfer payments, such as social security benefits (pensions, job-seekers allowance, etc.) are not included because they are not payments to a factor of production for the output produced. (Aka: General government final consumption). X = Exports of goods and services sold overseas. These are an inflow of demand in the circular flow of income of the economy and they add to the demand of domestically produced output. M = Imports of goods and services. These are withdrawals form the circular flow of income and spending in the economy. Goods and services enter the economy but money leaves the economy. Because of this, imports are subtracted from the aggregate demand equation. *note – net exports (NX) = exports – imports The slope of the Aggregate Demand curve is downward sloping because as the price level drops, the quantity of out put demanded increases. - Keynes’s interest-rate effect is one of the reasons the aggregate demand curve is downward sloping. The quantity of money demanded depends on price level. Therefore, at a high price a relatively large amount of currency is needed to make purchases. Therefore, consumers demand large quantities of currency when the price level is high and when the price level is low, consumers demand a small amount of currency because it takes a relatively small amount of currency to make purchases. Thus, consumers keep more money in the bank causing the amount of currency in the bank to increase and increasing the supply of loans. The increase in the supply of loans causes the interest rate (the cost of loans) to decrease. A low interest rate increases the demand for investment as the cost of investment falls with the interest rate. Therefore, a decrease in the price level decreases interest rates which increases demand for investment and thereby increases aggregate demand. AGGREGATE SUPPLY – measures the amount of output produced in an economy at a given price. Short Run AS is determined by the productive capacity of the economy and the costs of production (the supply side of the economy) In the short run, economic producers respond directly to changes in price level – as price increases, output increases and as price decreases – output decreases. Long Run AS is determined by the productivity resources available to meet the amount demanded and the productivity inputs – land labor and capital Long run aggregate supply is determined by factors other than price and demand such as improvements in productivity and by an expansion of available inputs making supply independent of the level of price. Full Employment Level of National Income National Income is determined by the sustainability of full employment and a sustained flow of services. Full employment, actual employment and the employment level are necessary to maintain sustainable income for the economy. There exists a widening gap between actual income and environmentally sustainable income. Equilibrium Level of National Income Where AS meets AD at full employment Inflationary Gap The gap between actual output and full employment output; the excess of AD at the full employment level of real GDP Deflationary Gap The gap between full employment output and actual output; the shortfall in AD at the full employment level of real GDP The Business Cycle Mini IA http://www.reuters.com/article/newsOne/idUSN053061482009030 5 As the U.S continues to experience the recession, further demand for goods fall. Many factory workers are now unemployed. The article states that we now have the highest unemployment rate of 16 and half years. The government’s stimulus package to jump start the economy is associated with the theory of AD. Since government spending is a component of AD, AD should shift out. The stimulus plan also encourages investment another component of AD, also trying to shift AD out. There is also a fall in AS there is less human capital and thus less productivity, which in turn affects AD as no one has money to purchase goods.