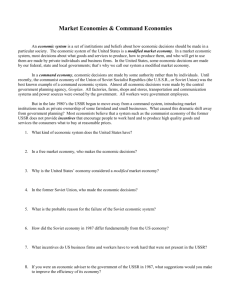

Command Economy

Command Economy

• Why study command?

– The command system creates initial conditions for transition

– Legacies from command critical for transition

• Path dependence

• Two types of legacies

– Structural

• The result of past investments and other decisions

• Enterprises, locational choices

– Institutional

• Behavioral patterns

• How to reverse past decisions

• Start with the analysis of command system

Command Economy

• Attempt to replace markets

– The command principle strives to fully and effectively replace the operation of market forces in the key industrial and developmental sectors of the economy, and render the remaining (peripheral) markets manipulable and subordinate to political direction.

• Two Basic Imperatives

– Growth

– Control

3 Key Purposes

1. maximum resource mobilization towards urgent and over-riding national objectives, e.g. rapid industrialization or the prosecution of war;

• Used by many countries in wartime

2. radical transformation of the socio-economic system in a collectivist direction based on ideological tenets and power-political imperatives; and

3. not the least, as an answer to the disorganization of a market economy through price control, possibly occasioned by inflationary pressure arising from (1) and/or (2).

Basic Features of the STE

• state-ownership of the means of production

• centralized control by means of an administered system of planning in physical terms.

– The system replaces the market with a set of directives from the center to the production units throughout the economy.

– These directives are commands, not suggestions. They are directives that have the force of law, and subordinates are responsible for fulfilling them, even if the plans are not feasible.

• The absence of markets implies loss of information about opportunity cost

• absence of private property, except for households

STE

• STE created by Stalin in 1928

• Exported to Eastern Europe after WW2

• Imported by China after 1949

• Yugoslavia mutates in mid-50’s

– Self-management

• North Korea, Vietnam, Cuba are underdeveloped examples of command economies

Basic Feature Continued, Implications

• soft-budget constraints

• chronic sellers market

• emphasis on heavy industry

• dynamic incentives problems

• state control of investment

• restrictions on entry, no exit

Socialist

Coun tries a

Total Man ufacturin g

Average employ ment per firm

Percentage of those employ ed in firms with more than 500 workers

Textile In dustry

Average employ ment per firm

Percentage of those employ ed in firms with more than 500 workers

Ferrous Metals

Average employ ment per firm

Percentage of those employ ed in firms with more than 500 workers

197

66

355

75

2,542

95

Machin ery

Average employ ment per firm

Percentage of those employ ed in firms with more than 500 workers

Chem icals

Average employ ment per firm

Percentage of those employ ed in firms with more than 500 workers

Food Processin g

Average employ ment per firm

253

61

325

79

103

Percentage of those employ ed in firms with more than 500 workers 39

Source: Ehrlich (1985) a

Sample, including Czechoslovakia, GDR, Hungary , and Poland.

b

Sample, including Austria, Belgium, France, Italy , Japan, and Sweden

Capitalist

Coun tries b

80

350

79

32

81

17

16

104

35

65

82

28

Distribution of Employment by Size

West Germany

France

Italy

0-100

14.1

22.5

32.3

100-500 500 and more

23.9

62

24.9

27.3

52.6

40.4

GDR

Czechoslovakia

Hungary

Poland

1

0.1

4.5

1.4

11.1

3.4

16.3

18.2

87.9

96.5

79.3

80.4

source: OECD data for West Germany, France and Italy are for 1987,

and for the other countries are for 1989.

Structural Differences

Agriculture Industry Services

OECD (1991)

8 richest countries 5.5

8 middle countries 5.8

8 poorest countries 17.9

29.8

30.4

29.5

64.7

63.9

52.6

Centrally Planned

Economies (1998)

GDR

Czechoslovakia

Hungary

Poland

10

11.6

17.5

27.2

44.1

46.8

36.1

36.3

45.9

41.6

46.4

36.4

Ownership

• Not just commanding heights

• In the Soviet Union, for example,

– the state and collective sectors accounted for some 88% of the value added in agriculture; controlled 98% of retail trade, and owned 75% of urban housing space

– The industrial sector was exclusively state owned.

• In 1985, for example, 91% of employment was in state enterprises, and another 6% was in kolkhozy.

– The extensive control of retail trade means that the smallest shops were state owned.

• But key factor is hierarchical control

Sample Hierarchy

Steel Trust

Steel Plant

#1

Steel Plant

#2

Ferrous

Metals

Rolling Mills Coke Trust

Central

Planning

Board

Chemicals

Chemical

Plant

#1

Chemical

Plant

#2

Chemical

Plant #3

Defense Consumer

Goods

Coke Plant

#1

Coke Plant

#2

Old Gosplan (currently Duma)

Hierarchy

• Only vertical information flows

– But there are informal horizontal flows

• Only at the top of the hierarchy can opportunity cost be assessed

– Lower level agents cannot assess tradeoffs

– Implies subordinate control crucial

• Bureaucracy must exercise full control and discretion

– But subordinates have their own interests, which implies:

• Incentive problems

• Need for monitoring systems (police, party, banks)

• Corruption

• Fundamental issue: how to get agents to reveal information and follow orders

Soviet Growth Model

• Mechanism for extensive growth

• Paradoxical attitude towards time

– planners have a very low discount rate -- they are willing to sacrifice lots of current consumption for future consumption

– On the other hand, haste implies that they want to industrialize fast. So they cut corners, and ignore side effects and other costs.

• Diabetes example

• Key point

– Haste sowed the seeds of the barriers to longer-term performance.

– In that sense, the rapid growth in output of the first couple of five year plans represent borrowing from future performance.

• Balloon payment

• Key defect of the SGM is that output growth is pursued without regard for the opportunity cost of that growth

– E.g., environmental mess

Extensive vs

Intensive Growth

• Suppose that output is given by

• Then the growth rate of output is given by

– Thus growth occurs either thru growth of inputs (more K and/or more L) or technological change (growth in A)

– Extensive growth is the former, intensive growth is the latter

• Growth thru greater efficiency in use of inputs

• Extensive growth is growth thru accumulation of inputs

Consumption Paths

• Whose utility is being maximized?

– Households versus planners’ objectives

– Planners willing to defer present consumption versus future consumption

– Planners combine haste with patience

• Their haste for fast growth with public’s patience for deferred consumption

– High rate of time preference on part of owners, cost paid for by public

Aral Sea

Soviet Growth Model (cont.)

• Growth implies maximize investment

– How? Via control of consumption

• State is sole employer => monopsony

cˆ

cˆ

Y

L

F ( K L

– Then investment is maximized, for given level of K,

L L

Industrialization Strategy

• Heavy industry

• Maximize investment

• Collectivization

– Surplus labor argument

• Transfer from rural to urban

• State control over resources

– But peasant response

• Output growth versus welfare

USSR, Inc.

• Soviet economy as a single corporation

• The corporation owns a large stock of natural resources,

– has no outside shareholders

– (so that all "profits" can be retained for investment)

– hires labor

– Moreover, as a monopsonist in the labor market, USSR Inc. can minimize the expenditure on labor.

• Transactions between enterprises are merely transfer prices between "divisions."

• The exceptions are purchase of labor and engagement in foreign trade.

Exceptions

• Labor is allocated partly by choice

– State determines demand, but labor is supplied

• Though vagrancy is a crime – full employment

• Foreign Trade controlled by FTM

– FTM trades with ROW

• Intermediary between producers and ROW

– Insulates domestic prices from world prices

– Purchases (sells) goods at state prices and sells (buys) at world prices

Haste

• Command system is good at mobilizing

– achieving specific objectives

– Extensive growth

• Growth through accumulation of inputs

• It is bad at assessing costs and tradeoffs

– May be important for intensive growth

• Growth via greater efficiency

• Crucial Role of Resource Abundance

– Delay in reaching BoP constraint

Growth Problems

• Over time growth rates decline in all STE’s

– Despite continued growth in capital-worker

• Why?

– Failure to transition to intensive growth

• Extensive growth trap

– Inability to substitute capital for labor

– Innovation Problems

• The system worked best when the fruit was lowhanging

– mobilization

Soviet Growth

Rates Decline

Intensive vs Extensive Growth

• Start with

• Then the growth rate of output can be written as:

• Intensive growth means high

• Extensive growth means accumulation

– But notice that as capital accumulates, increases

– What happens to rate of return?

K

L

Two Explanations of Slowdown

• TFP growth declines due to increased complexity of the economy

– Difficulty with diffusing innovation

• Low elasticity of substitution

– K/L increase due to high savings rate and limits to growth in labor force

– If substitution is difficult output growth is reduced

• Note that this is organizational, not technological

– No entry, limited exit

– Input-output conservatism in planning

• Extensive growth and natural resources

– Energy was underpriced and over-utilized

– when prices are liberalized many industries are producing negative value added

Price System

• Prices unrelated to social costs

– Socially necessary costs

• Average not marginal

• Non-existent charges for rent and capital

• Raw materials underpriced

• Costs of production were thus calculated based on an incomplete enumeration of costs.

• Prices biased based on user

• Circus mirror effect

• Does it matter?

– USSR, Inc., => transfer pricing

– But illusion about sources of value

• Implications for transition

Price System (cont.,)

• Why have prices in a planned economy?

– an accounting device

– Monitoring of plan performance

– Related question, why have money?

• Active and passive money

• Soft-budget constraint (Kornai)

– If budget constraints are not binding a resource constraint must eventually be reached

• Implies that shortage is an equilibrium phenomenon in STE’s

• Leads to sellers’ markets

SBC

• Dynamic Commitment problem

– Subsidy available ex post not ex ante

– Effort costly for manager, bonus for fulfillment is B

– Effort is sufficiently costly so

• If effort is low, Y = 0 with no bailout, Y – R with bailout

– If low effort manager must be bailed out because low output is bad for planner

– Manager knows this so he supplies low effort

SBC

Chronic Sellers’ Market

• Primary cause => the emphasis on growth at all costs

• Taut plans => uncover hidden reserves

• Soft-budget constraints

– Plan fulfillment imperative

– Excess demand for labor

• Shortage and priority

– Personality dominates

• Lack of quality

Dynamic Incentives Problems

• Planning from the achieved level

Y

ˆ t

( 1

) Y t

1

• Enterprise exploits hidden information

– Agents must be induced to reveal information

• Simple 2-person game

– Enterprise director can tell the truth or lie

– Planner can issue a feasible or a taut plan

Preferences

• Director’s preferences

:

• Planners’ preferences

:

• Illustrative payoff matrix

• Equilibrium: both lie

Bonus Function

• To get director to reveal information planner implements a

• But why pay to overfulfill?

– Need for extra resources to meet shortages

– Increase effort

Canonical Bonus Function

B q

More on the Bonus Function

• Solves static problem

• Assume that effort is required to produce more output

– Moral hazard

• But that this differs depending on productivity

– Hidden information (adverse selection)

– Then preferences depend on the nature of the enterprise

Canonical Bonus Function

B

U

L

U

H

B

0

B

B

0 q q

1 q

Canonical Bonus Function

• Generates separation

• If no bonus for overfulfillment, then pooling

• Sets up the dynamic incentives problem

– Fulfillment today risks fulfillment tomorrow

• Consequences

– Need for a safety factor

– Ratchet effect

– Taxing high performance

Dynamic Problem

– Let be utility for fulfilling the plan for the high productivity enterprise

– Current gain from overfulfilling is:

– Loss from revealing information is

– Then director must compare

Dynamic Problem

• LHS is the current gain from revealing (CG)

• RHS is the present value of future losses (DFL)

– Depends on the time horizon of the agent

• Whenever DFL > CG the director will conceal true capacity

– Ratchet effect => fear of a higher future target lowers current performance

Shchekino

Experiment

• Planning experiment

– Planners commit not to change targets for 5 years

– Enterprise can keep costs savings

– Labor productivity rose so fast, 52% in first year, planners reneged

• Changed plan targets 7 times in 10 years

• Another plant 17 times in 5 years

• Inability of planners to commit

Ratchet Effect

• More severe the greater is

– Time horizon

– Utility loss

• And the smaller is

– The discount rate

• Leads to reduced incentives to perform and innovate

weightlifting records

– Slow

Result

• Who said this?

• Yuri Andropov, General Secretary, CPUSSR

– Top officials know the problem, can’t solve it

Lack of Observability

• Inflated reports – simulation – is commonplace

• Difficulty of monitoring

• Occasional audits show this:

Enron, Global Crossing, Stock options

• Similar problems occur in corporations

• Directors and managers engage in simulation

– simulation of performance to achieve bonuses

– Simulate earnings to benefit from options

– Incomplete information necessary but not sufficient

• it is also necessary that rewards be skewed toward the present,

– especially if those costs can be shifted on to others in the future.

• Much harder to keep simulations hidden in markets

– Need to hide losses, but Soviet pricing does not reveal losses

Vasily Alexeev

Date of First Adoption versus Diffusion

(proportion of output produced in 1982)

Structure of Command Economy

• Imperative is microbalance

• Planning by material balances

– Feasibility, not optimality

– Iterative process of vertical information flows

• Basic idea

– Sources = uses, good by good

– For good j we have:

Xˆ

• The input requests from other enterprises

• Where does this come from?

Material Balances, cont.

• Planners start with a target for sector j: X j

0

• Enterprise calculates its input needs assuming fixed coefficients:

• So multiply to get needs:

• Now planner adds. E.g. for sector 1 (such an equation for each sector of course):

Schematic

X j

0

Steel Plant j

CPB

Steel

Steel Plant #2

Chemicals

Steel Plant #3 Chemical Plant #1 Chemical Plant #2 Chemical Plant #3

Material Balances, cont.

• Put the sum back into the material balance:

– No reason to assume it equals zero.

– So adjust output targets:

– Now we have a new set of input needs for each enterprise.

For j we have:

– And we just repeat the whole process, again, and again…

Material Balances, cont.

• Process continues till all the D j

’s are zero

• Notice how simple are the operations

• If the process goes on long enough a feasible plan result

– But the number of iterations could be very large

– In practice only one or two iterations

• So plan as implemented is infeasible

– Some plans taut, others slack

• Note emphasis on intermediate goods

– But optimal plans look at final goods

• Central control and subordinate responsibility

– Micro-balance is the imperative

• Process assumes truthful revelation

Incentives versus Complexity

• Mises, Hayek thought central planning problem was too complex to solve

• Lange and Lerner suggested market solutions

– Set Q such that MC = P

– But this ignores incentives problems

– Why would managers follow the rules?

– Private information (about actions or conditions) is valuable

• Agents must be induced to reveal this

Command Problems

• Detailed planning and the corresponding directives are often late, are insufficiently detailed, may lack the requisite information, hence often cannot be effectively coordinated

– Owing to their rigidity they are peculiarly vulnerable to uncertainty

• Planning in a command economy must be largely in physical terms due to the crucial importance of balance.

– The bottom line of the planning process must be available physical units of required inputs, in appropriate assortment, quantity and timing, necessitating physical targets for production and input utilization.

• Success indicator problem

Success Indicator Problem

• Bonuses are

produces imbalances

– No secondary market

– Planners cannot know tradeoffs at each enterprise

• Pollution permits

• Emphasize priority

– Quality problems shifted to users

– Because micro-balance is priority

– Teaching versus research?

• Bonus for retention

Command

• Command is good for well-defined measurable tasks

– Build the Atom Bomb

• Don’t worry about cost = $25.7 billion at current prices

• Command is bad at assessing tradeoffs

– No prices to measure opportunity cost

– Physical indicators lead to success indicator bias

– Teaching is harder to measure than research

Shortage

• SBC, fixed prices, output fixation => shortage

– In production, to avoid wasted resources; full utilization to achieve growth

– In consumption, because planners do not want to divert output

– Of course, flexible prices could eliminate shortage, but command means dominance over market

• Market allocation weakens central control

• Implication: Generalized shortage

Shortage

P S

P *

Pˆ

Excess Demand

Qˆ

D

Q

The Big Nail

Problems with Linear Pricing

quality

SW enterprise

2

B enterprise

1

A P

P quantity

Mormon Comparison

• Many similarities

– Sense of encirclement

– Holistic vision of utopia

• Virtuous haste

– Totalitarian leadership (without terror)

– Primacy of collective over individual

– Hostility to speculation, private initiative

– Insulation and isolation

• Need for autarky to conserve foreign exchange

• Like the Soviet economy, economy was collectivist, mobilizational, centrally planned, largely command-managed, and often redistributional in regard to factors, products, and the economic surplus.

Mormon comparison, cont.

• More similarities

– Property owned by church

– Capital formation

• Via tithes, mostly in kind

– Prices as accounting devices, economy demonetized

– Frequent reforms

– Cooperative forms of organization

• Key differences

– Voluntary, not coercion

– Building on virgin soil

Seeds of Transformation

• End of isolation

– Immigration of gentile tradesman

• Like the second economy of USSR

– Railroads lower transportation costs

• Raises cost of autarky

• Hostile US legislation

• Trade leads to corruption and sub-rosa privatization

Second Economy

• Informal economy arises to meet challenges of command

– Precisely because command economy cannot achieve balance, and as terror dissipates

• 2 nd economy defined as “all production and exchange activity that meets at least one of two criteria:

1. being directly for private gain;

2. being in some significant respect in knowing contravention of existing law.” See Grossman, 1977, p. 25.

• These market-mediated activities are at times supportive, helping to achieve tolerable micro-balance in the increasingly complex economy,

– but they often are in violation of planned implementation and regime values.

Second Economy

• Brezhnev on second economy

– You don't know life. No one lives on wages alone. I remember in my youth we earned money by unloading railroad freight cars. So, what did we do? Three crates or bags unloaded and one for ourselves. That is how everybody lives in [our] country.

– Blat markets

• 2 nd economy activity necessarily introduces discretion

– Potential for diversion

Second Economy

• Virtually every area of economic life is touched upon, and often entangled with, ‘second economy’ activities

– legal private activity naturally opens a loophole for illegal trading and entrepreneurship, generally below the purview of the authorities.

• Dual contradictory roles of 2 nd economy:

– First, it addresses a number of the problems of coordination and balance endemic to the command mechanism

– But, second, it mocks the pretense of social direction and control, subverts its egalitarian impulse, accentuating differences in access and income, and gives lie to the pretense of a ‘new’ ideologically correct (‘Soviet’) man

Evaluation and Size

• 2 nd economy completes the cancerous development of agent autonomy

– Generates undesirable (system perspective) redistribution of incomes ,

• although recipients, including many high placed officials, find it very desirable.

• Size

– Estimates based on the surveys of Soviet emigrants relate to the second half of 1970’s and range approximately between 10% and 30% of incomes of urban households.

– An alternative set of estimates based on the Soviet-era official family budget survey data puts the second economy at around 23% of household income (Kim, 2003).

– Could be as large as 12% of GDP in 1979

• But double counting

Legacies

• Two types

– Structural legacies

– Institutional legacies

• Financial underdevelopment

• Absence of rule of law

– Khruschev: ”Who’s the Boss: we or the law? We are masters over the law, not the law over us — so we have to change the law; we have to see to it that it is possible to execute these speculators.”

• FTM

Structural legacies

• Industrial structure

bias

• Industry intentional, agriculture unintentional

• Under-provision of services

• Hypermilitarization

• Industrial concentration

– Gigantomania

– Absence of small enterprises

Distribution of Capital Stocks

Structure by Labor Force

Indicators of Raw Materials and Energy Consumption, 1988

35

30

25

20

15

10

5

0

Enterprise Size in US and Russia

50 to 99 100 to 249 250 to 999

Russia US

1000 to 9999 GT 10,000

Hypermilitarization and Climate

• Size estimates difficult

– Pricing distorts measurement

– Cost shifting

• Defense burden unsustainable

– Locational burden

– Interaction with climate problems

• Soviet Union got colder in 20 th century !

• Too many people in the wrong places

– Big problem for market economy

Location in Russia

Population of Siberia and Far East in 1989: 37 mln (25% of RF total)

Manufacturing employment: 1.8 mln (16% of RF total)

Location in Canada

Population: 85 000. (0.34% of Canadian total) Manufacturing employment:

295…people (0.017% of Canadian total)

TPC in Canada, USA, and Russia

15

10

25

20

5

0

Duluth, population = 86,000

Duluth January Daily Temperatures, 1994-2002

Mean: -11.7

Coldest decile: <-22.1

Omsk, population = 1.2 million

Omsk January Daily Temperatures, 1994-2002

25

20

15

10

5

0

2

Mean: -16.8

Coldest decile: <-27.2

-2 -6 -10 -14 -18 -22 -26 -30 -34 -38

25

20

15

10

5

0

Perm, population = 1.008 million

Perm January Daily Temperatures, 1994-2002

Mean: -12.5

Coldest decile: <-22.7

How Cold is Cold?

Finally, use the

-6

T em p.

(°C )

-10

-15

-20

-25 to –30

-30

-30 to –35

-35 to –40

Effects on Stan dard Soviet M achin er y

Internal com bustion engines require pre-start engine heaters

D estruc tion of som e standard m etal dredge com ponents

H igh -carb on steels b reak ; c ar batteries m ust be heated; first critical thres hold for s tandard equipm ent

Standard c ompress ors w ith internal c om bus tion engines cease to operate; standard ex cavator hiltbeam s break; destruction of som e tow er c rane com ponents, dredging buc kets, and bulldoz er blades

U nallo yed steels b reak ; car-engine space, fuel tank s, and oil tank s m ust be ins ulated; frost-resis tant rubber required; non-frost resistant convey or belts and standard pneum atic hos es break ; som e cranes fail

M inim um tem per atu re fo r use o f an y stan dard equ ipm en t

T restle cranes fail; s om e tractor shoes break

A lloyed steel com po nen ts (ball b earing s, etc.) shatter ; s aw fram es and circ ular s aws stop work; all com pres sors stop w ork ; stan dard steels and structures ru ptur e on mass scale

Source: Dogay ev , cited in Mote.

10

Internal vs External Inefficiency

• Internal inefficiency

– Lack of high-powered incentives

– Input combinations and X-inefficiency

• External inefficiency

– Lack of market pricing

• allocative

• Dynamic inefficiency

– Lack of innovation

Legacy of Never-ending Reform

• Waves of reform

• Why a treadmill?

– Rejection of alien organisms

• Pitfalls of partial reform

– Cooperatives

– Supply diversion

• Timber and boxcars

Example

• Efficient rationing of timber

• Plan price = P, excess demand in housing

– Cooperatives bid for timber

• x units of timber diverted to housing from boxcars

Supply Diversion

• Notice that P* is the shadow price of timber

– With freedom to sell, timber sector sells q sector m to the housing

(cooperative) sector, cutting back deliveries to the boxcar

– Shadow value of timber is now much higher in boxcars

• Consumer surplus falls by A in boxcars and rises by C in housing; note A >> C

• Producer surplus in boxcars falls by B = 2C

• Notice that the problem arises because the boxcar industry cannot compete for timber, and the capital in that sector cannot flow to housing.

– The moral of this story is that as the state loses control over the state sector, diversions make things worse.

– But China will be different!

Achievements

• Full employment

– By law => no unemployment insurance

– Soft budget constraint

• Free health care

– Good at infections, bad at modern diseases

• Low income inequality

– Gini Coefficient

• Ratio of the area between the Lorenz curve and OB, and the whole area OAB.

– Wealth v income, and access to goods

Lorenz Curve

Earnings Distribution, Full-time workers

US Income of Top Decile

Social Uncertainty

• Command economy minimizes income shocks

– Full employment, socialized medicine

• Social insurance is high

– Underemployment vs unemployment

• Risk taking is low

• Institutions to cope with uncertainty in modern economy are absent

Life Expectancy at Birth, Russia, 1958–59, 1961–62,

1963–64, 1965–2002

An Alternative Factor

• Decline of

– When rents exploded, so did commitments

• Rents = market value of revenues less natural costs of extraction

• Including subsidies to Eastern Europe

– When rents declined hard to cut commitments

• Resource abundance is addictive

• increase in energy investment between 1981 and 1985 absorbed nearly 90 pct of increment allocated to industry

• Production maintained by borrowing from future

– Tightened the resource constraint

An Alternative Factor

Russian Oil & Gas Rents 1970-2005

OIL

1970 1975 1980

GAS

1985 1990 1995 2000

Real (2005)

USD blns/yr

$300

$250

$200

$150

$100

$50

2005

$0

Rents and GDP

Russian GDP in 1990

PPP (1970=100)

160

150

140

130

120

110

100

90

80

70

1970 1975 1980 1985 1990 1995 2000

Oil and Gas Rent

(2005 dollars)

$350

$300

$250

$200

$150

$100

$50

2005

$0

Rents, Addiction

• Resource rents postponed day of reckoning

– "In sum, the Soviet economic system became what it is in part thanks to the country's rich resource base, which permitted the planners largely to ignore the day-to-day discipline of the balance of payments and therefore also the imperatives of the market place and the pains of real economic cost. On this basis an elaborate and rigid institutional edifice sprang up.

This economic system thrived for two human generations and achieved marked successes by its own criteria. But inevitably it hardened and came to be supported and protected by powerful vested interests [Grossman,

1983: 202].

• addiction to rents postponed fundamental reforms, made the system more fragile

• The lesson is that resource abundance, misapplied, can be addictive

Addiction

• Addiction leads to short-time horizon

– This leads to an inability to implement reforms.

• Three characteristics

– tolerance - the need for an increasing amount of the substance to obtain the same effect

– withdrawal - severe unpleasant effects when the addict ceases to use the substance craving –

– "willingness to sacrifice all (to the point of self-destructiveness)" in order to obtain and use the substance.

• In Soviet case tolerance arose because windfall was used for many new activities

– defense, East European subsidies and other international adventures

– interests created that depend on rents, makes withdrawal painful

– where is the methadone for an addicted Soviet economy?

Defense Addiction

• Marshal Akhromeev on addiction

• Why it was necessary to produce so many weapons?

Akhromeev answered:

– "Because at a great cost of many sacrifices we created firstclass factories, no worse than the American ones. Would you order them to stop work and begin producing cooking pots?"

– Shakhnazarov described the "military-industrial mentality" as a "cancerous growth" that had metastasized to every sphere of Soviet life

• This is an example of addiction. The investment in factories created interests that were very costly to reverse.

Aspects of Collapse

• Macroeconomic

– Budget crisis, inflationary finance

• Shortages, stolen hours, more queues

• Weaker state lower tax collection

• Microeconomic

– Misallocation of resources

– Lack of property rights

– Pseudo privatization

Two Views on Collapse

• Essentialists

– Essentialists hold that the Soviet system collapsed because it was essentially abnormal

– The nature of the Soviet system made its eventual collapse inevitable and even predictable

• Of course, few made this prediction before the system collapsed. Autopsies are easier on dead bodies.

• Voluntarists

– Soviet economy was murdered, or its death was decisively hastened, by voluntary acts of policy, though the consequences may have been unintended.

• “We tend to confer the mantle of inevitability on accomplished facts, and arguing that what happened did not have to happen is likely to be dismissed as inventing excuses for the losing side. But the collapse of the Soviet system was the unintended result of a small number of disastrous decisions by a few individuals”

Was Demise Inevitable?

• Productivity growth slowed, but never turned negative

– The odds on overtaking fell

– Reforms upset performance

• Reforms made the system more fragile

– Monitoring costs rose and deterring corruption became more costly

• Erosion of belief in system

– So small shocks could lead to collapse

Weakening of Central Control

• Critical difficulty for central planning

– Brezhnev Communism = Stalinism without terror

– Raises the prices of information and action

• Loss or resources at center

• Agents have two options

– Fulfill the plan, F

– Don’t fulfill the plan, NF

– Payoffs depend on whether observed or not

Stalinist Incentives

• Let be the payoff to NF if unobserved

• Suppose that and

• Then the expected payoffs are

• Planners want

– Two instruments, detection and punishment

– We can plot this

Stalin v Brezhnev

• Stalinist system set punishment = - infinity

– Lowers cost of detection

• Brezhnev system

– Cheating is optimal for larger range of

• Problem is more severe with greater complexity

– Glasnost makes it even worse

– Explosion of Second Economy

– Loss of central revenue

Multiple Equilibria

• The same system can have two equilibria

– High output

– Low output

• Consider the producer’s decision to supply effort

– Depends on gains and penalties

– And whether this is observed

Producer’s Choice of Effort

Producer works hard, if

Gain from working hard > cost of working hard

If work is hard and monitoring is strict , then

Work hard if reward gained + penalty avoided > cost of effort

If work is hard and monitoring is lax, then

Don’t work hard

Gain reward for working hard, avoid penalty for not working hard, spend effort working hard

No rewards gained, low effort supplied

Dictator’s Choice

• Dictator wants to deter stealing

– Two key parameters:

• Cost of incentives provided

• Costs of monitoring

• Over time these parameters shift

– Complexity raises monitoring costs

– Weakening center (decline in oil revenue) raises costs of providing incentives

• High output is no longer an equilibrium

Dictator’s Decision

Dictator Monitors if

Effort is high, and if Effort is low and if

Cost of monitoring < value of output stolen + future output lost

Else, don’t monitor Costs of monitoring

< output stolen + future output loss

Else, don’t monitor

Parameter Shift

• Evolution of the system led to parameter shift

– Complexity raises monitoring costs

– Information flow weakens central authority

– Value of incentives decreases as their cost rises

– Second economy grows

• High output is no longer the equilibrium

• Reforms weaken the structure

– Do not lower monitoring costs

– Reforms make defection easier

• Cooperatives

• Law on state enterprise

Bank Run

• Why the sudden collapse?

• As center weakens officials defect

• Race to cash in on assets

• Key to bank run

– Illiquidity

– Sudden loss of trust

Solnick

• “...the image of a "disintegrating" state...is...seriously incomplete.

Soviet institutions did not simply atrophy or dissolve but were actively pulled apart by officials at all levels seeking to extract assets that were in any way fungible. Where organizational assets were more specific to their particular use by the state, as in the case of draft boards, for example, hierarchical structures proved more resilient. Where organizational assets were chiefly cash and buildings, hierarchical breakdown was almost total. At both ends of the spectrum, the catalysts of state collapse were the agents of the state itself. Once the bank run was on, these officials were not merely stealing resources from the state, they were stealing the state itself."

Shock to Loyalty

• Income of an official is

• Probability of detection

– Strength in numbers

• Expected value of defection

• Critical

Critical Loyalty Value

K y Kn 2

( 1 ) w w

n* 1 n

Add Theft

• Race to cash in

– Each defecting agent steals

• Not enough to steal, illiquidity

• Official income is now

• Output falls faster

– Critical value reached sooner

– Agents know nothing will be left if

The Bank Run Case

K w w

( 1 )

w y Kn 2 y K

1 ( 1 n ) n 2

( 1 ) w

n* n' 1 n

Conclusion

• Was the collapse a disaster?

• Implications for transition

– Political and economic collapse

• Is this more difficult than just economic reform?

– Macroeconomic imbalance

– Window of opportunity

– Agenda for reform?

• No blueprints

Midterm One Results

14

12

10

8

Mean

Standard Error

Median

Mode

Standard Deviation

V ariance

Kurtosis

Skew ness

Range

Minimum

Maximum

Sum

Count

79.58462

1.471695

82

89

12.40072

153.7779

1.166432

-1.13572

57

40

97

5173

65

6

4

2

0

40 43 46 49 52 55 58 61 64 67 70 73 76 79 82 85 88 91 94 97 100