TY-15-Scenario-5 - Earn It! Keep It! Save It!

advertisement

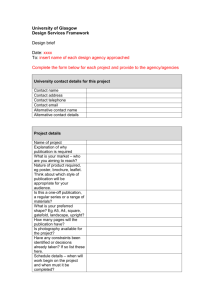

EKS Training Scenario Five Ground Rules o Don’t work ahead – stay on the current task o Turn off your cell phone o Question/Comments – raise your hand, stay in your seat o No side conversations - don’t even ask your neighbor for help o Returning volunteers sit next to new volunteers o Bring your materials every day o At least try to do your homework – bring your questions 4 Steps: Class Structure 1. As a class, we will review Interview Notes, Intake & Interview Sheet (13614-C) & supporting documents for each scenario. 2. Instructor will teach Tax Law – referencing Publication 4012 and 13614-C 3. Instructor will show you how to enter information into TaxWise. WATCH! 4. Now DO! Students will enter information on TaxWise Scenario #5 What you will learn in this scenario: 1. 2. 3. 4. Scenario #5 Dividends Social Security Income Cancellation of Debt – Credit Card Affordable Care Act – Marketplace coverage and premium tax credit What you will review in this scenario: 1. 2. 3. 4. 5. Filing Status Personal Exemptions Income – W-2 Itemized Deductions versus Standard Deduction Form 8888 Let’s review Anthony and Courtney’s Information: Scenario #5 Interview Notes Intake & Interview sheet - 13614-C Tax Documents Interview Notes Review What did you learn about Anthony and Courtney? Deep Dive with the 13614-C Did they bring all the required documents? Everything accurate? Intake & Interview What’s missing/wrong/mismatched that needs to be changed? Compare tax documents and interview notes Make any corrections needed on 13614-C Fill out greyed out boxes (dependency and ACA) Publication 4012, Tabs K-3 and K-4 Does this taxpayer need to file their return? Who should Or should they? file? Publication 4012, Tab A Is client eligible for VITA services? In Scope? What certification level is needed to prepare this return? Publication 4012, pages 8-10 Scope of Services Chart You Got This! Scenario #5 Determine filing status and personal exemption Publication 4012, Tab B-1 and Tab C-1 You Got This! TaxWise Enter Anthony and Courtney’s: Personal information on Main Information Sheet Everything on page one of 13614-C goes on Main Info Publication 4012, K-6 to K-11 for Main Info You Got This! TaxWise Enter Anthony and Courtney’s: Income documents: W-2 Publication 4012, D-3 to D-9 for Income Dividend Income Tax Law Topic #1 Corporate distributions such as ordinary dividends, qualified dividends, capital gain distributions and nondividend distributions are reported on 1099-DIV Ordinary dividends are corporate distributions paid out of the earnings and profit of the corporation Qualified dividends are ordinary dividends that qualify for lower, long term capital gains tax rates Capital gains distributions come from mutual funds and real estate investment trusts Nondividend distributions are nontaxable because it is part of a taxpayers cost or other basis They are treated like interest income in TaxWise – you’ll enter them on the Dividend Statement Publication 4012, Tab D-3 to D-5 and D-10 to D-11 Students: WATCH instructor TaxWise Enter Anthony’s 1099-DIV on the Dividend Statement Publication 4012, Tab D-10 through D-11 Students: Enter Anthony’s 1099-DIV on the Dividend Statement TaxWise Publication 4012, Tab D-10 through D-11 Social Security Income Tax Law Topic #2 Taxpayers receive a SSA -1099 if they receive benefits from Social Security Administration – retirement, survivor and disability benefits If taxpayers have other income, part of their Social Security benefits may be taxable Social Security income alone does not require someone to file their taxes in most cases Publication 4012, Tab D-26 Students: WATCH instructor Enter Courtney’s social security benefits on 1040 Worksheet 1 TaxWise Publication 4012, Tab D-26 Students: WATCH instructor Enter Courtney’s social security benefits on 1040 Worksheet 1 TaxWise Publication 4012, Tab D-26 Cancellation of Debt Tax Law Topic #3 Any debt forgiven by a creditor is considered income by the IRS. Creditors and debt collectors that agree to accept at least $600 less than the original balance of the debt are required by law to file a 1099-C form with the IRS and to send it to debtor. There are exclusions - use the screening tool in Publication 4012 Tab D-33 to determine if the client’s COD is in scope of VITA services. Publication 4012, Tab D-33 Students: WATCH instructor Enter Courtney’s cancelled credit card debt on Line 21 – link to worksheet 7 TaxWise Publication 4012, Tab D-33 Students: Enter Courtney’s cancelled credit card debt on Line 21 – link to worksheet 7 TaxWise Publication 4012, Tab D-33 You got this! Enter the Websters’ deductions on Schedule A. TaxWise Mortgage Interest Real Estate Taxes Charitable Contributions Interview notes & Publication 4012, Tab F-5 Affordable Care Act - Marketplace & APTC Did the Websters have coverage all year? If no, let’s review the exemptions before assessing the Tax Law Topic #4 Shared Responsibility Payment Did they purchase coverage from the marketplace (Covered CA)? If yes, did they receive the advanced premium tax credit (APTC)? Interview Notes, 13614-C, 1095-A and Publication 4012, Tab ACA You got this! TaxWise Enter coverage information for Courtney on the ACA worksheet Publication 4012, Tab ACA Students: WATCH instructor Enter Anthony’s marketplace coverage information (1095-A) on Form 8962 TaxWise Publication 4012, Tab ACA Students: TaxWise Enter Anthony’s marketplace coverage information (1095-A) on Form 8962 Publication 4012, Tab ACA Completing the CA return 1. Get the red out! Most information will automatically populate from the federal return 2. State EITC Form – 3514* 3. If you have entered more than one W-2 on the 1040, you will have to manually add the additional W-2’s. The first W-2 will carry over, but the rest won’t. 4. Make sure to complete the direct deposit or balance due portion of the return 5. Complete the CA Renters Credit Worksheet when applicable. *At the time of this ppt creation, details on what TaxWise will auto populate are not available You got this! TaxWise Complete the Websters’ CA return (540) Do the Websters want to direct deposit their refund? If so, are they requesting to split their refund? Do they want to buy a savings bond? Refund 13614-C and Interview Notes Ask Every Taxpayer (AET)! Remind the Websters of the savings option Savings Answer Questions Be enthusiastic and positive! You got this! TaxWise Enter checking and savings account information for the Websters on Form 8888 Remember to enter the 540 account numbers twice Publication 4012, Tab ACA THINGS YOU NEED TO KNOW ABOUT FINISHING A RETURN Finishing the return 1. Ask the questions in the Prep Use Fields 2. All returns must be Quality Reviewed (checklist on 13614-C) Tab, K-25 3. Run Diagnostics to check for errors 4. Print returns (Federal and State) for Taxpayer 5. Review return with taxpayer (Formula 1040 activity) 6. Have Taxpayer and Spouse sign 8879s for Federal and State and remind them they are responsible for their return and by signing, they are agreeing it is accurate: One copy for the taxpayer One copy for the VITA Site Publication 4012, Tab K Do we have matching AGI, refund? Let’s review entry of: Check our work - W-2 - Schedule A - 1040 Worksheet 1 - Dividend Statement - Line 21 - ACA Marketplace and Premium Tax Credit Where do we enter Dividends in TaxWise? Publication 4012, Tab D-11 Dividend Statement True or False: All Social Security benefits received are always taxable. Look it up! Publication 4012, Tab D-26 False – depends on what other income was received; automatically calculated by TaxWise Name a reason that cancelled debt would be out of scope for VITA. Publication 4012, Tab D-33 Insolvency, related to a business, didn’t receive a form What form will a taxpayer receive if they purchased insurance on Covered CA? Publication 4012, Tab ACA 1095-A Look it up! True or False: The amount of advance premium tax credit reported on the 1095-A is always what the taxpayer is eligible for. Publication 4012, Tab ACA False– it will depend on actual income information on the tax return.