TY-15-Scenario-4 - Earn It! Keep It! Save It!

advertisement

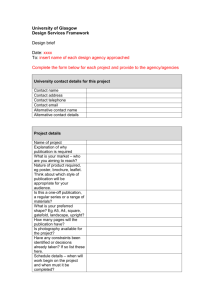

EKS Training Scenario Four Ground Rules o Don’t work ahead – stay on the current task o Turn off your cell phone o Question/Comments – raise your hand, stay in your seat o No side conversations - don’t even ask your neighbor for help o Returning volunteers sit next to new volunteers o Bring your materials every day o At least try to do your homework – bring your questions 4 Steps: Class Structure 1. As a class, we will review Interview Notes, Intake & Interview Sheet (13614-C) & supporting documents for each scenario. 2. Instructor will teach Tax Law – referencing Publication 4012 and 13614-C 3. Instructor will show you how to enter information into TaxWise. WATCH! 4. Now DO! Students will enter information on TaxWise Scenario #4 What you will learn in this scenario: Scenario #4 1. ITINs 2. Retirement Income 3. Self-employment/Business income with expenses 4. State Refund Income 5. Itemized Deductions 6. Affordable Care Act – Exemptions for ITIN and Shared Responsibility Payment What you will review in this scenario: 1. Filing Status 2. Personal and Dependency Exemptions 3. Income – W-2 4. Credits: 5. Itemized Deductions versus Standard Deduction 6. ACA- 1095-C Employer Coverage 7. Form 8888 Child Tax Credit, Additional Child Tax Credit, Child and Dependent Care Credit, Let’s review Mary and Kevin’s Information: Scenario #4 Interview Notes Intake & Interview sheet - 13614-C Tax Documents Interview Notes Review What did you learn about Mary and Kevin? ITIN Tax Law Topic #1 Individual Taxpayer Identification Number, issued by the IRS to taxpayers without a valid SSN (start with a 9 – taxpayer will have a letter from IRS with the number on it) When applying for an ITIN, a taxpayer submits a W-7 with their tax return along with documentation like a passport, birth certificate and/or other identification VITA sites can file returns for taxpayers with ITINs – just like any other return Some VITA sites can help taxpayers apply for the number – called Certifying Acceptance Agents Deep Dive with the 13614-C Did they bring all the required documents? Everything accurate? Intake & Interview What’s missing/wrong/mismatched that needs to be changed? Compare tax documents and interview notes Make any corrections needed on 13614-C Fill out greyed out boxes (dependency and ACA) Publication 4012, Tabs K-3 and K-4 Does this taxpayer need to file their return? Who should Or should they? file? Publication 4012, Tab A Is client eligible for VITA services? In Scope? What certification level is needed to prepare this return? Publication 4012, pages 8-10 Scope of Services Chart Tax Law Topic #2 Determine filing status for a married couple Publication 4012, Tab B-1 You Got This! TaxWise Enter Mary and Kevin’s: Personal information on Main Information Sheet Everything on page one of 13614-C goes on Main Info Publication 4012, K-6 to K-11 for Main Info You Got This! TaxWise Enter Mary and Kevin’s: Income documents: W-2 Publication 4012, D-3 to D-9 for Income Retirement Income Retirement income such as pensions, 401k’s or IRAs are reported on a 1099-R Tax Law Topic #3 Box 7 will let you know what kind of distribution is being reported What codes do Mary’s two 1099-R’s have? What do they mean? Tab D-21 and D-22 Taxable amount box empty or taxable amount not determined box checked – use simplified method Publication 4012, Tab D-20 through D-24 Students: WATCH instructor TaxWise Enter Mary’s 1099-Rs Remember the simplified method! Publication 4012, Tab D-20 through D-24 Students: Enter Mary’s 1099-Rs Remember the simplified method! TaxWise Publication 4012, Tab D-20 through D-24 Business Income with expenses Which one’s EZ? Tax Law Topic #4 Schedule C-EZ Schedule C Only one per return (TP and SP both have businesses won’t work) Multiple per return possible Simplified expenses Must categorize expenses (advertising, insurance, supplies, licenses, etc.) Has limit of $5,000 expenses No expense limit* Publication 4012, Tab D-13 to D-15 *$25,000 for VITA Scope Students: WATCH instructor Enter Kevin’s cash income and expenses on Schedule C-EZ TaxWise Publication 4012, Tab D-13 to D-15 Students: Enter Kevin’s cash income and expenses on Schedule C-EZ TaxWise Publication 4012, Tab D-13 to D-15 State Refund as Income When a taxpayer itemizes their deductions, they can use state income tax paid as a deduction Tax Law Topic #5 In turn, any refund received that year needs to be reported as income The state refund is reported on 1099-G You will need the taxpayer’s prior year return to fill in: Taxable income Itemized deductions total State income tax paid Publication 4012, Tab D-13 to D-15 Students: WATCH instructor Enter the Kents’ state refund on the State Tax Refund Worksheet from 1040, line 10 TaxWise Publication 4012, Tab D-12 Students: TaxWise Enter the Kents’ state refund on the State Tax Refund Worksheet from 1040, line 10 Publication 4012, Tab D-12 Itemized Deductions: Deductions reduce a taxpayer’s taxable income Tax Law Topic #6 Taxpayer can take Standard or Itemized Deductions (should take the larger): Standard – a fixed dollar amount based on filing status Itemized – uses your qualified expenses like mortgage interest, medical or dental expenses, charitable contributions Publication 4012, Tab F & Schedule A Itemized Deductions: Tax Law Topic #6 Mortgage interest is the major indicator that someone does or should itemize Use Tabs F-3 and F-4 to interview the taxpayer More details in Publication 17 Publication 4012, Tab F-3 through F-8, Publication 17 & Schedule A Students: WATCH instructor Enter the Kents’ deductions on Schedule A: TaxWise Mortgage Interest Real Estate Taxes Charitable Contributions Interview notes & Publication 4012, Tab F-5 Students: TaxWise Enter the Kents’ deductions on Schedule A. Interview notes & Publication 4012, Tab F-5 You Got This! TaxWise Enter the Kents’ childcare expenses on Form 2441 for the Child and Dependent Care Credit Interview Notes & Publication 4012, Tab G-5 Let’s review credits calculated on TaxWise: TaxWise Did the Kents qualify for these credits? Child Tax Credit Additional Child Tax Credit Affordable Care Act Exemptions Did the Kents have coverage all year? Tax Law Topic #7 If no, let’s review the exemptions before assessing the Shared Responsibility Payment Interview Notes, 13614-C, 1095-C and Publication 4012, Tab ACA You got this! TaxWise Enter exemption information for Kevin on ACA Worksheet and 8965 Enter coverage information for Mary and Melissa on the ACA worksheet Interview Notes, Publication 4012, Tab ACA Completing the CA return 1. Get the red out! Most information will automatically populate from the federal return 2. State EITC Form – 3514* 3. If you have entered more than one W-2 on the 1040, you will have to manually add the additional W-2’s. The first W-2 will carry over, but the rest won’t. 4. Make sure to complete the direct deposit or balance due portion of the return 5. Complete the CA Renters Credit Worksheet when applicable. *At the time of this ppt creation, details on what TaxWise will auto populate are not available You got this! TaxWise Complete the Kents’ CA return (540) Do the Kents want to direct deposit their refund? If so, are they requesting to split their refund? Do they want to buy a savings bond? Refund 13614-C and Interview Notes Ask Every Taxpayer (AET)! Remind the Kents of the savings option Savings Answer Questions Be enthusiastic and positive! Students: WATCH instructor Direct Deposit into one account requires that you enter the account information in two places: TaxWise Main Info Sheet Page 2 of the 1040 Check “same as federal” for the state return Publication 4012, Tab K-14 Students: Direct Deposit into one account requires that you enter the account information in two places: TaxWise Main Info Sheet Page 2 of the 1040 Check “same as federal” for the state return Publication 4012, Tab K-14 THINGS YOU NEED TO KNOW ABOUT FINISHING A RETURN Finishing the return 1. Ask the questions in the Prep Use Fields 2. All returns must be Quality Reviewed (checklist on 13614-C) Tab, K-25 3. Run Diagnostics to check for errors 4. Print returns (Federal and State) for Taxpayer 5. Review return with taxpayer (Formula 1040 activity) 6. Have Taxpayer and Spouse sign 8879s for Federal and State and remind them they are responsible for their return and by signing, they are agreeing it is accurate: One copy for the taxpayer One copy for the VITA Site Publication 4012, Tab K Do we have matching AGI, refund? Let’s review entry of: Check our work - W-2 - Schedule C-EZ - State Refund Worksheet - Schedule A - Form 2441 - Direct Deposit - ACA Exemptions and Full Year MEC What Schedule is required to report non-employee compensation from a 1099-MISC? Publication 4012, Tab D-3 Schedule C or Schedule C-EZ Look it up! True or False: If a self-employed taxpayer has $11,000 in business expenses it is out of scope. Publication 4012, Tab D-14 True Which ACA exemption do taxpayers with ITINs qualify for? Publication 4012, Tab ACA Exemption Code C – citizens living abroad and certain noncitizens What must be done if box 2a on Form 1099-R is empty or box 2b is not checked? Publication 4012, Tab D-24 Use the simplified method worksheet Look it up! Where do you enter bank account information if the taxpayer wants to direct deposit their refund into only one account? Publication 4012, Tab K-14 Main Info and 1040 page 2 What large deductible expense is common among taxpayers who itemize their deductions? Publication 4012, Tab F-3 Mortgage Interest Try your Scenario 5 Homework Let’s review the scenario now… You’ll need to know about: Before next week… Social Security Benefits Cancellation of Debt Dividend Income ACA – Marketplace Coverage and Advanced Premium Tax Credit