BUDGETING FOR COLLEGE:

EMPLOYEE COMPENSATION

AND BENEFITS

Andrea Morgan, Gary Moore, and Melissa Greenslade

Program Coordinators

Office of Financial Aid

University of Arkansas

CONSIDERATIONS FOR YOUR FIRST JOB

Compensation

Pay

Overtime

Taxes

Cost of Living

Benefits

Insurance

Retirement

Leave Time

Other Benefits

EMPLOYEE COMPENSATION

Salary

Annual rate of pay

Set amount of pay per paycheck

Work until the job is done; no overtime pay

Often referred to as exempt employees

Wage

Hourly rate of pay

Minimum wage is currently $7.25/hour

Paid based on the number of hours actually worked

Paid overtime if over 40 hours worked per week

Overtime = 1.5x wage

Often referred to as non-exempt employees

COMPENSATION TERMS

Gross Pay – total amount of your pay before any

deductions

Take-Home (Net) Pay – pay actually received by an

employee after deductions, including taxes, health

insurance premiums, retirement contributions, etc.

Commission – payment based on employee meeting

certain sales goals; usually a percentage of those sales

Bonus – money given to an employee in addition to

the employee’s usual compensation

At-Will Employee – Most employees are “at will”

meaning that your employment can be terminated at

any time for any lawful reason

EMPLOYMENT FORMS/TAXES

Form I-9

Employment Eligibility Verification From

Verifies your eligibility to work in the U.S.

Must provide documentation to prove eligibility: driver’s

license, passport, social security card, birth certificate, or other

documentation

W-4 Form

Tells the employer how much money to withhold from your

pay for federal taxes (exemptions)

The fewer exemptions you claim, the more that will be

withheld from your paycheck

If you withhold too much then you will get a refund when

you file taxes, but are not paid that money during the year

If you withhold too little, then you could end up having to

pay taxes at the end of the tax year

EMPLOYMENT TAXES

Federal income taxes

Social Security and

Medicare Withholdings

Also called FICA taxes

Approximately 7.65% of

your pay

State and Local Income

Taxes

Vary by location

States can have no income

tax, flat tax, or progressive

tax

OTHER PAY CONSIDERATIONS

Pay Periods

How often are you paid?

Monthly (12 pay periods/year)

Bi-weekly (26 pay periods/year)

Other

Cost of Living

How much it costs to meet your basic needs where

you live

COST OF LIVING EXAMPLE

Fayetteville, AR vs. San Diego, CA

If you make $30,000 in Fayetteville, to have the same

standard of living in San Diego, you would need to

make $43,032

Groceries will cost 17% more in San Diego

Housing will cost 148% more

Utilities will cost 20% more

Transportation will cost 26% more

Healthcare will cost 22% more

Cost of Living (Comparison) Calculators

Data from CNN Money: www.cgi.money.cnn.com/tools/costofliving/costofliving.html

EMPLOYEE BENEFITS

Non-wage compensation offered to employees

Health Insurance

Other Insurance

Flexible Spending Accounts

Retirement

Leave Time

Other Benefits

On average employee benefits provide a 31%

boost to employee compensation

HEALTH INSURANCE

Enrollment is often allowed only within 30 days of hire,

during open enrollment periods, or if there is a qualified

change in family status

Qualified change = change in marital status, change in number

of family members (birth, adoption, child reaches age 26, etc),

change in coverage to spouse or dependent

Types of Health Insurance Plans

HMO (Health Maintenance Organization) – coverage is limited

to doctors who contract with the HMO, a primary care physician

(PCP) oversees your care and refers you to specialists as needed

PPO (Preferred Provider Networks) – allows subscribers to use

doctors, hospitals, and providers outside of network for a fee, no

PCP required

High Deductible Health Care Plan – high deductible plan with

low monthly premiums designed to offer minimal day-to-day

coverage but protect you in the event of a catastrophe

Point of Service Plans – combines aspects of HMOs and PPOs;

generally requires a PCP to make referrals to other doctors

within the network

HEALTH INSURANCE TERMS

Health Insurance Premium – the employee’s cost of

the insurance, often withheld from each paycheck

Co-Pay/Co-Insurance – your share of the healthcare

cost

Deductible – the amount you have to pay out of

pocket before the insurer covers costs

See Sample Health Insurance Chart handout

OTHER INSURANCE

Employers

may offer other forms of

insurance

Vision

Dental

Disability – pays a portion of your salary if you

become disabled or unable to work due to

injury or illness

Life – Pays an amount to your beneficiary if

you die

You must choose (and update) your beneficiary or

beneficiaries

CAFETERIA PLAN

A Cafeteria Plan is a plan that offers flexible

benefits using pre-tax income

Employees choose their benefits from a selection

offered by the employer.

The selections can include medical, accident, disability,

vision, dental, group term life insurance, and

reimbursement for child care or medical expenses

Once you opt in to a Cafeteria Plan, you may not

change until the end of the plan year unless you have

certain special circumstances

FLEXIBLE SPENDING ACCOUNTS (FSA)

Designated, pre-tax amount of your gross income is

deposited into an account to pay for eligible costs

Reduces taxable gross income

Subject to maximums set by the IRS

You are reimbursed from the account for eligible costs

You lose unused amounts in the account at the end of the year

Healthcare FSA

Eligible expenses: deductibles, co-pays, over-the-counter

medicines (requires prescription), physical therapy, contacts,

braces, etc.

Entire designated annual amount is available January 1 or

after the first contribution is made

Dependent Care FSA

Reimbursement for daycare or other dependent care expenses

that allow you to go to work

Qualified dependents: children under 13, dependents of any age

that are physically or mentally incapable of caring for themselves

RETIREMENT BENEFITS

Defined Benefit Plan – pays an amount based on a predetermined formula; often called a pension

Defined Contribution Plan – retirement amounts are

based on the contributions of employee and employer,

and any investment earnings on the account

401(k) – offered by public or private for-profit companies

403(b) – offered by tax-exempt or non-profit organizations

Employer Match – many employers match a portion of

the contributions employees make to their accounts

Vesting – your right to the money in your account

You are always 100% invested in the money you contribute

Employers may have a vesting schedule that outlines how

much of their contributions you own

LEAVE TIME

The amount of time off you may take from your job

Vacation, Personal, and/or Sick Leave

Paid Time Off (PTO)

Bank of leave time not allotted to any specific category

Unpaid Leave of Absence

Some employers divide your time off into these categories

Time off that is not paid; employer’s discretion whether

allowed, unless it is FMLA

Family Medical Leave (FMLA)

Mandates unpaid, job-protected leave for up to 12 weeks a

year to care for a sick or injured family member (spouse,

child, or parent) or recover from your own illness or injury

Does not apply to small businesses (less than 50

employees); part-time workers, or for short-term illnesses

OTHER BENEFITS

Employers may also offer a variety of other

benefits:

Tuition Reimbursement

Fitness Center Access

Parking Fees

Childcare

Mileage/Gas Reimbursement

Etc.

GETTING PAID

Employers

use different methods of paying

their employees:

Paycheck with a paycheck stub

Direct Deposit

a physical check with attached information to show

deductions; the employee is responsible for handling the

check

Pay is directly deposited into your bank account

Payroll Card

A prepaid card that has money electronically loaded on

it, used similar to a debit card

There may be fees associated with using a payroll card

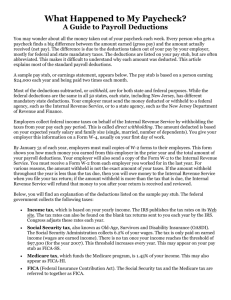

UNDERSTANDING YOUR PAYCHECK

Included on every paycheck stub:

Pay Period – time period covered by the check (weekly, biweekly, twice a month, monthly)

Gross Pay – total amount earned before deductions

Net Pay – amount the employee “takes home” after

deductions

Federal Withholding Tax (FT or FWT) – amount withheld to

pay federal taxes

Based on information provided on the W4

State Withholding Tax (ST or SWT) – amount withheld to

pay state taxes

Social Security (SS, SSWT or OASDI) and Medicare (MWT or

Med) or FICA Taxes

May be combined or listed separately on your pay stub

Year-to-date (YTD) – totals of pay and/or deductions made for

the year up to the pay period on the paycheck

UNDERSTANDING YOUR PAYCHECK,

CONT’D.

Items that may also appear on your check stub:

Local Tax – may apply to employees of certain cities, counties

or school districts

Insurance Deductions– amount withheld for medical benefit

premiums

Retirement – amount you contribute to your retirement plan

Childcare Assistance/Dependent Care Deduction

Leave Time – vacation hours or sick hours used to date and

remaining

Other Voluntary Deductions from your paycheck (parking,

donations, gym membership)

Important Notices – a portion of the paycheck may be

designated to communicate important information like wage

increases or tax information

UNEMPLOYMENT BENEFITS

Payment from the government to unemployed people

The amounts of previous earnings and time worked (base

period) are used to determine the benefit amount

The average weekly benefit is 36% of your previous weekly

wage

Must register and document seeking work

Previously part-time, temporary, and self-employed

workers do not qualify

Generally, the worker must be unemployed through no

fault of his/her own

Register with the state unemployment agency,

ex: Arkansas Department of Workforce Service

COBRA HEALTH INSURANCE

Provides certain (former) employees and dependents the

right to temporary continuation of health insurance

coverage at group rates.

Must have been covered under the group health plan of

an employer with 20 or more employees the day before

the qualifying event

The qualifying event determines who the qualified

beneficiaries are

More expensive than the insurance for active employees

since the employer will not be paying part of the premium.

You, spouse, and dependent children can receive COBRA

benefits for 18 months if employment is terminated

SELF-EMPLOYMENT

Speak to an attorney and an accountant

regarding the many ways you might structure

your business and the many legal and financial

considerations to take into account.

Remember that as a self-employed person, you

will need to pay employment taxes to the IRS at

tax time.

You will also want to consider health insurance

coverage and retirement plans.

NEGOTIATING SALARY AND

BENEFITS FOR YOUR FIRST JOB

Do not immediately accept: ask for time to consider the offer

Consider the entire job package – not just the wages/salary

Think about responsibilities, benefits, perks, hours, work

environment, flexibility, and other preferences you may have

Research the typical pay for similar jobs (remember cost of

living adjustments) and your level of education and experience

Try not to discuss salary until you have an offer; if pressed,

say you are flexible or provide a range, not a specific amount

Even if you are not able to get the salary you wanted, you can

negotiate some benefits, such as signing bonus, education,

vacation time, flexibility, etc.

Keep your goals reasonable: Remember a new graduate will

not have the same negotiating power as someone who has been

working in the field for many years

BACKGROUND CHECKS

References & Credentials Check

Criminal Records Check

Education, Employment, Licenses, Military Service Record,

Workers Compensation Claims

County, State, and Federal Criminal Record Searches,

Civil Record Search, Sex Offender Registry, Fingerprinting

Identity and Credit Check

Confirm identity and right to work in this country

Provide insight into personal responsibility & reliability

Can check up to 10 years into your past

Driving Records Check

If required to operate a vehicle for business purposes

Can check the past 3-7 years

Physical/Substance Abuse Tests

BEFORE YOU GO…

Please complete and submit the evaluation form

PowerPoint presentation and handouts will be

posted on our website with all other Budgeting

For College Seminars

THANK YOU!

Contact Information:

Office of Financial Aid; Andrea, Gary, and Melissa

Campus location: 114 Silas Hunt Hall

Phone: 479-575-3806

Fax: 479-575-7790

Website: http://finaid.uark.edu/

And find us on Facebook at University of Arkansas

Financial Aid!