Supply of loanable funds

advertisement

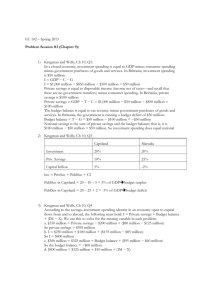

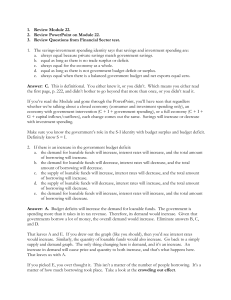

Chapter: 10 Savings, Investment >> Spending, and the Financial System Krugman/Wells ©2009 Worth Publishers Matching Up Savings and Investment Spending A major function of the financial system is to transfer funds from those who have more than they currently need (saving) to those who need more than they currently have (investment spending) Needed so that business firms will be able to purchase the physical capital goods that are a source of productivity growth. Needed so that savers don’t get stuck earning nothing on their surplus funds. This occurs because those who purchase both physical and human capital by necessity often use other peoples funds for their purchases. According to the savings–investment spending identity, savings and investment spending are always equal for the economy as a whole. Indirect Finance Funds Deposits Shares Polices Financial Intermediaries Commercial Banks Savings & Loans Credit Unions Mutual Funds Money Market Mutual Funds Pension Funds Life Insurance Illiquid Assets Loans, etc Borrowers Spenders Funds Lenders Savers Illiquid, Risky Assets Funds Funds Financial Markets Stocks Bonds Treasury Bills Other Direct Finance Illiquid, Risky Assets Funds Matching Up Savings and Investment Spending If most investment spending comes from business firms, where does the saving come from? 1. Private saving from individual citizens, and business firms with a lack of investment opportunities. 2. Public saving from governments SG = Taxes – Transfers – Purchases A budget surplus – positive government saving A budget deficit – negative government saving 3. Foreign saving If foreign citizens put funds (net) into another country this is called a Capital inflow. National Savings is the sum of Private Saving and Government saving. The total amount of savings generated within the economy. The Savings–Investment Spending Identity In a simplified private economy: (1) Total Income = Total Spending (2) Total income = C + S Spending consists of either consumption spending or investment spending: (3) Total spending = C + I Putting these together, we get: (4) C + S = C + I Subtract consumption spending from both sides, and we get: (5) S = I PITFALLS Investment versus investment spending When macroeconomists use the term investment spending, they almost always mean “spending on new physical capital.” This can be confusing, because in ordinary life we often say that someone who buys stocks or purchases an existing building is “investing.” The important point to keep in mind is that only spending that adds to the economy’s stock of physical capital is “investment spending.” In contrast, the act of purchasing an asset such as a share of stock, a bond, or existing real estate is “making an investment” or better yet a “portfolio decision”. The Savings–Investment Spending Identity In an open economy, foreigners can also put funds into a country, which is called a capital inflow (KI). If saving in a country is not high enough for the amount of investment spending in an economy, foreigners can put their savings into that country (if the rate of return is good enough). When they do this the country that receives the capital inflow will always run a trade deficit. Therefore, a trade deficit is a rough measure of a net capital inflow. The next slide shows this in symbols. The Savings–Investment Spending Identity Private Saving: SP = GDP + TR − T − C Government Saving: SG = T − TR − G National Saving: NS = SP + SG = (GDP + TR − T − C) + (T − TR − G) = GDP − C − G. In an open economy: GDP = C + I + G + X – IM so NS = GDP – C – G = I + X – IM. Therefore, NS = I + X – IM or: I = NS + (IM – X) IM – X is the trade deficit, which is the measure of a capital inflow (that is how foreigners earn income to save in another country) Investment spending = National savings + Capital inflow in an open economy I = NS + KI or I = SP + SG + KI The Savings–Investment Spending Identity Share of GDP 25% Share of GDP 25% (a) United States 20 15 10 5 0 Investment –5 spending Budget deficit –10 Capital inflows 20 Private savings 10 (b) Japan 15 Private savings 5 0 Savings –15 Investment Capital –5 spending outflows –10 –15 Budget deficit Savings Japanese investment spending U.S. investment spending in 2007 = equal to 18.8% of GDP in 2007 = 23.8% of GDP. Financed by a combination of private savings (15.7% of GDP) and capital inflows (5.2% of GDP), which were partially offset by a budget deficit (−1.6% of GDP). Source: Bureau of Economic Analysis; OECD. It was financed by a higher level of private savings as a percentage of GDP (32.1%), which was offset by both a capital outflow (−4.9% of GDP) and a relatively high budget deficit (−3.4% of GDP). PITFALLS The different kinds of capital It’s important to understand clearly the three different kinds of capital: physical capital, human capital, and financial capital. Physical capital consists of manufactured resources such as buildings and machines. Human capital is the improvement in the labor force generated by education and knowledge. Financial capital is funds from savings that are available for investment spending. So a country that has a positive capital inflow is experiencing a flow of funds into the country from abroad that can be used for investment spending. FOR INQUIRING MINDS Who Enforces the Accounting? The savings–investment spending identity is a fact of accounting. By definition, savings equals investment spending for the economy as a whole. But who enforces the arithmetic? The short answer is that actual and desired investment spending aren’t always equal. Suppose that households suddenly decide to save more by spending less. The immediate effect will be that unsold goods pile up. And this increase in inventory counts as investment spending, albeit unintended. So the savings–investment spending identity still holds. Similarly, if households suddenly decide to save less and spend more, inventories will drop—and this will be counted as negative investment spending. The Market for Loanable Funds The loanable funds market is a hypothetical market that examines the market outcome of the demand for funds generated by borrowers and the supply of funds provided by lenders. The interest rate is the price, calculated as a percentage of the amount borrowed, charged by the lender to a borrower for the use of their savings for one year. The interest rate is what determines the allocation of savings in the loanable funds market The Market for Loanable Funds From chapter 11 we determined that a business firm will purchase a capital goods project if the rate of return >= interest rate. The rate of return on a project is the profit earned on the project expressed as a percentage of its cost. There are usually more projects at lower rates of return than at higher rates of return. So as interest rates decline, more projects become profitable and more investment spending is done. Therefore, the demand for loanable funds will be downward sloping. The Demand for Loanable Funds Interest rate 12 10 A 8 6 4 2 B Factors that can cause the demand curve for loanable funds to shift include: 1. Changes in perceived business opportunities Changes in technology, investment tax credits, “animal spirits” 2. Changes in the government’s borrowing Demand for loanable funds 0 $150 $550 Quantity of loanable funds ($ billions) The demand curve for loanable funds slopes downward: the lower the interest rate, the greater the quantity of loanable funds demanded The Supply of Loanable Funds Savers make a sacrifice of current consumption, that is their opportunity cost. Interest earned on their saving is the reward for sacrificing current consumption; that is they get greater future consumption. So we would expect that the higher the interest rate the more households would be willing to sacrifice current consumption, that is they would save more. Therefore, the supply of loanable funds will be upward sloping. The Supply for Loanable Funds Interest rate Supply of loanable funds 12 10 B 8 6 4 A 2 0 $100 Factors that can cause the supply of loanable funds to shift include: 1. Changes in private savings behavior 2. Changes in capital inflows $450 Quantity of loanable funds ($ billions) The supply curve for loanable funds slopes upward: the higher the interest rate, the greater the quantity of loanable funds supplied. Shifts of the Supply for Loanable Funds Factors that can cause the supply of loanable funds to shift include: Changes in private savings behavior: Between 2000 and 2006 rising home prices in the United States made many homeowners feel richer, making them willing to spend more and save less This shifted the supply of loanable funds to the left. Changes in capital inflows: The U.S. has received large capital inflows in recent years, with much of the money coming from China and the Middle East. Those inflows helped fuel a big increase in residential investment spending from 2003 to 2006. As a result of the worldwide slump, those inflows began to trail off in 2008. Equilibrium in the Loanable Funds Market Interest rate Projects with rate of return 6% or greater are funded. 12 S 10 8 r* 6 Offers not accepted from lenders (to borrowers) who demand interest rate of more than 6%. Projects with rate of return less than 6% are not funded. E 4 2 0 Offers accepted from lenders (to borrowers) willing D Q* to lend at interest rate of 6% or less. $400 Quantity of loanable funds ($ billions) At the equilibrium interest rate, the quantity of loanable funds supplied equals the quantity of loanable funds demanded. Here, the equilibrium interest rate is 6%, with $400 billion of funds lent and borrowed. An Increase in the Demand for Loanable Funds Interest rate .. . leads to a rise in the equilibrium interest rate. If the quantity of funds demanded by borrowers rises at any given interest rate, the demand for loanable funds shifts rightward from D1 to D2 S1 E2 r2 r1 An increase in the demand for loanable funds . . . E 1 D2 D1 Q1 Q2 Quantity of loanable funds ($ billions) Crowding out occurs when a government deficit drives up the interest rate and leads to reduced investment spending. An Increase in the Supply for Loanable Funds Interest rate . leads to a fall in the equilibrium interest rate. An increase in the supply of loanable funds . . . .. S1 S2 E1 r1 E2 r2 D1 Q1 Q2 Quantity of loanable funds ($ billions) If the quantity of funds supplied by lenders rises at any given interest rate, the supply of loanable funds shifts rightward from S1 to S2 Inflation and Interest Rates Anything that shifts either the supply of loanable funds curve or the demand for loanable funds curve changes the interest rate. Historically, major changes in interest rates have been driven by many factors, including: Changes in government policy, such as incentives to invest or increases and decreases in budget deficits. Technological innovations that created new investment opportunities. However, arguably the most important factor affecting interest rates over time is changing expectations about future inflation. This shifts both the supply and the demand for loanable funds. This is the reason, for example, that interest rates today are much lower than they were in the late 1970s and early 1980s. Inflation and Interest Rates Real interest rate = nominal interest rate - expected inflation rate In the real world neither borrowers nor lenders know what the future inflation rate will be when they make a deal. Actual loan contracts, therefore, specify a nominal interest rate rather than a real interest rate. Nominal interest rate = real interest rate + expected inflation rate According to the Fisher effect, an increase in expected future inflation drives up the nominal interest rate, leaving the expected real interest rate unchanged. The Fisher Effect Nominal Interest rate 14 4 D0 and S0 are the demand and supply curves for loanable funds when the expected future inflation rate is 0%. S10 E10 S0 E0 D10 An increase in expected future inflation pushes both the demand and supply curves upward by 1 % for every 1 % increase in expected future inflation D0 Q1 Quantity of loanable funds ($ billions) The expected real interest rate remains at 4%, and the equilibrium quantity of loanable funds also remains unchanged. ►ECONOMICS IN ACTION Changes in the U.S. Interest Rates Over Time (b) Changes in Expected Rate of Return on Investment Spending and Interest Rates (a) Changes in Expected Inflation and Interest Rates 10-Year Treasury constant maturity rate, inflation rate 10-Year Treasury constant maturity rate During 1998–2008, expectations of future inflation were relatively constant, but the interest rate first rose and then fell sharply 16% 7% 14 12 6 10 8 5 6 4 4 2 3 1958 1970 1980 1990 2000 2008 Year 1998 2000 2002 2004 2006 2008 Year High current inflation leads to expectations of high future inflation, which results in a rise in the interest rate. The Financial System: Definitions A household’s wealth is the value of its accumulated savings. A financial asset is a paper claim that entitles the buyer to future income from the seller. This takes place in financial markets A physical asset is a claim on a tangible object that gives the owner the right to dispose of the object as he or she wishes. The purchase of a preexisting asset is called investing, while to spend funds to add to the capital stock (a new capital good) is referred to as investment spending. A liability is a requirement to pay income in the future. Wealth = Value of Assets – Value of Liabilities An asset to one person or financial institution is a liability to another. A loan is an asset to a bank, but a liability to a firm. The Financial System: Definitions Transaction costs are the expenses of negotiating and executing a deal. These can include brokerage fees, loads for mutual funds, time it takes to go to a bank. Financial risk is uncertainty about future outcomes that involve financial losses and gains. Some assets are riskier than others. Some participants want to reduce this risk and some are willing to take on more risk – for a price. Most people are risk averse – don’t like risk unless given suitable compensation – higher expected returns. Risk averse individuals are willing to compensate others who take on risk they don’t. Risk-Averse Attitudes Toward Gain and Loss Change in individual welfare (a) Typical Individual Welfare gain from gaining $1,000 Change in individual welfare $1,000 $1,000 0 0 Welfare loss from losing $1,000 –1,200 (b) Wealthy Individual Welfare gain from gaining $1,000 Welfare loss from losing $1,000 –2,000 Differences in wealth lead to differences in attitudes toward risk. The typical individual represented in panel (a) experiences a $1,000 loss as a much more significant hardship than the wealthy individual represented in panel (b). This reflects the fact that wealthy individuals, although still riskaverse, tend to be more tolerant of risk than individuals of modest means. Three Tasks of a Financial System Reducing transaction costs ─ the cost of making a deal. By specializing and doing may similar types of transactions financial institutions can take advantage of economies of scale and lower transactions cost. Reducing financial risk – uncertain outcomes gains/losses Limited liability with corporations means you can only lose what you put into that business. Sell stock to others who are willing to take some of the risk for you in exchange for expected profit. An individual can engage in diversification by investing in several different things so that the possible losses are independent events. Mutual funds or exchange traded funds do this for you. Banks offer products where you are guaranteed not to lose any principal over time. Reducing Financial Risk Risk Sharing – A borrower can transfer risk to many different savers Saver A Financial Asset Saver B issued by a corporation Saver C Risk Diversification - by purchasing financial assets from many different borrowers (who face separate types of risks) a saver can stabilize returns. Asset A from Corporation 1 Portfolio of a Saver Asset B from Corporation 2 Asset C from Corporation 3 Three Tasks of a Financial System Providing liquid assets An asset is liquid if it can be quickly converted into cash without a great loss of value. The greater the number of participants in a given market for an asset the greater the liquidity. An asset is illiquid if it cannot be quickly converted into cash or it loses a large amount of it’s value if it has to be sold for cash quickly. Risk and illiquidity go together. Illiquid assets have greater risk. Cash and their equivalents are the ultimate in liquidity. The financial system provide a continuum of liquid to illiquid assets. Types of Financial Assets There are four main types of financial assets: Loans a lending agreement between a particular lender and a particular borrower. Car loans and Mortgages are examples. Somewhat high transactions costs A default occurs when a borrower fails to make payments as specified by the loan or bond contract. Bonds an IOU issued by a borrower to many buyers Pays periodic interest and principal at maturity Somewhat high transactions costs since have to investigate the company. Bond rating agencies can help with that. Easier to resell than loans, more liquid than loans Types of Financial Assets A Loan-backed security is an asset created by pooling individual loans and selling shares in that pool. Stocks This is called securitization. Any pool of assets can work, but the most common are mortgage backed securities, which have been aided by the government is establishing a market Represent ownership in a corporation. Reduces risk of ownership. Entitles owner to future profit of firm. If firm goes bankrupt the value of a stock is $0 Bank deposits is a claim on a bank that obliges the bank to give the depositor his or her cash when demanded. Checking accounts, savings accounts, certificate of deposits. Safe, liquid assets that have low return. Financial Intermediaries A Financial intermediary is an institution that transforms the funds it gathers from many individuals into financial assets. A mutual fund is a financial intermediary that creates a stock portfolio and then resells shares of this portfolio to individual investors. There are many types of mutual funds that hold more than just stocks. Some hold only very safe government bonds, other hold real estate, gold, other much riskier assets A pension fund is a type of mutual fund that holds assets in order to provide retirement income to its members. These are for defined benefit plans Often referred to an institutional investors Financial Intermediaries A life insurance company sells policies that guarantee a payment to a policyholder’s beneficiaries when the policyholder dies. This reduce risk to the policyholders family and some policies can act like a savings account. A bank is a financial intermediary that provides liquid assets in the form of bank deposits to lenders and uses those funds to finance the illiquid investments or investment spending needs of borrowers. A bank lends most of it’s deposit in order to earn profit. It borrows short term and lends long term so it can have a cash flow problem (only if all depositor try to take their funds out at the same time). Deposit insurance from the FDIC helps with this potential problem. Financial Fluctuations Financial market fluctuations can be a source of macroeconomic instability. Stock prices are determined by supply and demand as well as the desirability of competing assets, like bonds: A stock price is a reflection of what investor’ believe about expected profits of that company. If investors believe that it will be worth more in the future, they will demand more of the asset today at any given price. Consequently, today’s equilibrium price of the asset will rise. When the interest rate rises, stock prices generally fall and vice versa since interest on a bond is more of a “sure thing” than expected profits. Financial Fluctuations A single family home or condo is an illiquid asset. The owner pays a “rent” to themselves. The price of a house depends on what house buyers believe about the future “rents” of housing. If expected “rent” rises or house prices are expected to rise in the future, this increases demand for housing and prices rise today. Interest rates, income, and the prices of competing assets also have an influence on demand. If interest rates rise, mortgages are more expensive and demand will fall and so will house prices. FOR INQUIRING MINDS How Now, Dow Jones? Financial news reports often lead with the day’s stock market action, as measured by changes in the Dow Jones Industrial Average, the S&P 500, and the NASDAQ. All three are stock market indices. Like the consumer price index, they are numbers constructed as a summary of average prices. The Dow, created by the financial analysis company Dow Jones, is an index of the prices of stock in 30 leading companies, The S&P 500 is an index of 500 companies, created by Standard and Poor’s. The NASDAQ is compiled by the National Association of Securities Dealers. The movement in an index gives investors a quick, snapshot view of how stocks from certain sectors of the economy are doing. Financial Fluctuations: Asset price expectations There are two principal competing views about how asset price expectations are determined. One view, which comes from traditional economic analysis, emphasizes the rational reasons why expectations should change. The other, widely held by market participants and also supported by some economists, emphasizes the irrationality of market participants. Financial Fluctuations: Asset price expectations One view of how expectations are formed is the efficient markets hypothesis, which holds that the prices of financial assets embody all publicly available information. Investors looks at fundamentals: Consumer buying habits, tax policy, cost of production, management, etc. Any new “news” about a company will change the price of the stock. It implies that fluctuations are inherently unpredictable on a daily basis—they follow a random walk. It also implies that it is very difficult to beat the “market” on a regular basis. Irrational Markets? Many market participants and some economists believe that, based on actual evidence, financial markets are not as rational as the efficient markets hypothesis claims. This would mean you could use technical means to figure out stock prices. Using charts, moving averages, patterns, to evaluate stock price. It is more likely to happen in illiquid markets. This could lead to “bubbles”. There is some evidence that stock price fluctuations are too great to be driven by fundamentals alone. However, you can always get lucky once, but it is still very difficult to beat the market over long periods of time since investors will exploit any pattern to earn profit. ►ECONOMICS IN ACTION The Great American Housing Bubble Between 2000 and 2006, there was a huge increase in the price of houses in America. A number of economists argued that this price increase was excessive—that it was a “bubble”. Yet there were also a number of economists who argued that the rise in housing prices was completely justified. They pointed, in particular, to the fact that interest rates were unusually low in the years of rapid price increases. They argued that low interest rates combined with other factors, such as growing population, explained the surge in prices. ►ECONOMICS IN ACTION The Great American Housing Bubble Alan Greenspan, the chairman of the Federal Reserve, conceded in 2005 that there might be some “froth” in the markets but denied that there was any national bubble. Unfortunately, it turned out that the skeptics were right. Greenspan himself would later concede that there had, in fact, been a huge national bubble. In 2006, as home prices began to level off, it became apparent that many buyers had held unrealistic expectations about future prices. Home prices began falling, and the demand for housing fell drastically. ►ECONOMICS IN ACTION The Great American Housing Bubble New Index (2000 = 100) single-family houses sold (thousands) 220 200 1,400 180 1,200 160 140 1,000 120 800 100 600 80 2000 2002 2004 2006 2008 Year There was a large run-up in home prices after 2000, which some economists argued was not justified by fundamentals. By 2007 it was clear that there had indeed been a bubble driven by unrealistic expectations about future prices. 2000 2002 2004 2006 2008 Year When expectations of rising prices turned into expectations of falling prices, the demand for homes slumped. SUMMARY 1. Investment in physical capital is necessary for long-run economic growth. So in order for an economy to grow, it must channel savings into investment spending. 2. According to the savings–investment spending identity, savings and investment spending are always equal for the economy as a whole. The government is a source of savings when it runs a positive budget balance or budget surplus; it is a source of dissavings when it runs a negative budget balance or budget deficit. In a closed economy, savings is equal to national savings, the sum of private savings plus the budget balance. In an open economy, savings is equal to national savings plus capital inflow of foreign savings. When a capital outflow, or negative capital inflow, occurs, some portion of national savings is funding investment spending in other countries. SUMMARY 3. The hypothetical loanable funds market shows how loans from savers are allocated among borrowers with investment spending projects. In equilibrium, only those projects with a rate of return greater than or equal to the equilibrium interest rate will be funded. By showing how gains from trade between lenders and borrowers are maximized, the loanable funds market shows why a well functioning financial system leads to greater long-run economic growth. Government budget deficits can raise the interest rate and can lead to crowding out of investment spending. Changes in perceived business opportunities and in government borrowing shift the demand curve for loanable funds; changes in private savings and capital inflows shift the supply curve. SUMMARY 4. Because neither borrowers nor lenders can know the future inflation rate, loans specify a nominal interest rate rather than a real interest rate. For a given expected future inflation rate, shifts of the demand and supply curves of loanable funds result in changes in the underlying real interest rate, leading to changes in the nominal interest rate. According to the Fisher effect, an increase in expected future inflation raises the nominal interest rate one-to-one so that the expected real interest rate remains unchanged. SUMMARY 5. Households invest their current savings or wealth by purchasing assets. Assets come in the form of either a financial asset or a physical asset. A financial asset is also a liability from the point of view of its seller. There are four main types of financial assets: loans, bonds, stocks, and bank deposits. Each of them serves a different purpose in addressing the three fundamental tasks of a financial system: reducing transaction costs—the cost of making a deal; reducing financial risk—uncertainty about future outcomes that involves financial gains and losses; and providing liquid assets— assets that can be quickly converted into cash without much loss of value (in contrast to illiquid assets, which are not easily converted). SUMMARY 6. Although many small and moderate-size borrowers use bank loans to fund investment spending, larger companies typically issue bonds. Bonds with a higher risk of default must typically pay a higher interest rate. Business owners reduce their risk by selling stock. Although stocks usually generate a higher return than bonds, investors typically wish to reduce their risk by engaging in diversification, owning a wide range of assets whose returns are based on unrelated, or independent, events. Most people are risk-averse. Loanbacked securities, a recent innovation, are assets created by pooling individual loans and selling shares of that pool to investors. Because they are more diversified and more liquid than individual loans, trading on financial markets like bonds, they are preferred by investors. It can be difficult, however, to assess their quality. SUMMARY 7. Financial intermediaries—institutions such as mutual funds, pension funds, life insurance companies, and banks—are critical components of the financial system. Mutual funds and pension funds allow small investors to diversify, and life insurance companies reduce risk. 8. A bank allows individuals to hold liquid bank deposits that are then used to finance illiquid loans. Banks can perform this mismatch because on average only a small fraction of depositors withdraw their savings at any one time. Banks are a key ingredient of long-run economic growth. SUMMARY 9. Asset market fluctuations can be a source of short-run macroeconomic instability. Asset prices are determined by supply and demand as well as by the desirability of competing assets, like bonds: when the interest rate rises, prices of stocks and physical assets such as real estate generally fall, and vice versa. Expectations drive the supply of and demand for assets: expectations of higher future prices push today’s asset prices higher, and expectations of lower future prices drive them lower. One view of how expectations are formed is the efficient markets hypothesis, which holds that the prices of assets embody all publicly available information. It implies that fluctuations are inherently unpredictable—they follow a random walk. SUMMARY 10.Many market participants and economists believe that, based on actual evidence, financial markets are not as rational as the efficient markets hypothesis claims. Such evidence includes the fact that stock price fluctuations are too great to be driven by fundamentals alone. Policy makers assume neither that markets always behave rationally nor that they can outsmart them.