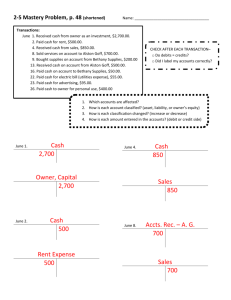

Description Debit Credit

advertisement

Chapter F5 Power Notes Accounting for Merchandising Businesses Learning Objectives 1. Nature of Merchandising Business 2a. Accounting for Purchases 2b. Accounting for Sales C5 2c. Transportation Costs 2d. Merchandise Transactions 3. Merchandising Chart of Accounts 4. Merchandising Income Statement 5. Merchandising Accounting Cycle 6. Financial Analysis and Interpretation C5 - 1 Chapter F5 Power Notes Accounting for Merchandising Businesses Slide # Power Note Topics 3 6 8 13 25 27 34 • Nature of Merchandising Businesses • Inventory Costs and Relationships • Perpetual Inventory Systems • Merchandising Transactions • Merchandising Chart of Accounts • Merchandising Financial Statements • Ratio of Net Sales to Assets Note: To select a topic, type the slide # and press Enter. C5 - 2 Merchandising and Inventory Merchandising involves selling inventory Inventory is usually an important asset Inventory must be accounted for periodically or perpetually Traditional periodic method is often being replaced by perpetual inventory accounting C5 - 3 Income Statement Comparison Service Business Fees earned Operating expenses Net income $150,000 120,000 $ 30,000 20% of revenues Merchandising Business Sales revenue Cost of mdse. sold Gross profit Operating expenses Net income $600,000 450,000 $150,000 120,000 $ 30,000 5% of revenues C5 - 4 Income Statement Comparison Service Business Fees earned Operating expenses Net income $150,000 120,000 $ 30,000 20% of revenues Merchandising Business Sales revenue Cost of mdse. sold Gross profit Operating expenses Net income $600,000 450,000 $150,000 120,000 $ 30,000 75% of revenues 5% of revenues C5 - 5 Inventory Costs and Relationships LIABILITIES Merchandise Inventory ASSETS OWNER’S EQUITY Net Income Cost of Mdse. Sold COSTS &EXPENSES REVENUES If merchandise inventory is . . . . . . . overstated Cost of merchandise sold is . . . . . . understated Gross profit and net income are . . . overstated Ending owner’s equity is . . . . . . . . . overstated C5 - 6 Inventory Costs and Relationships LIABILITIES Merchandise Inventory ASSETS OWNER’S EQUITY Net Income Cost of Mdse. Sold COSTS &EXPENSES REVENUES If merchandise inventory is . . . . . . . understated Cost of merchandise sold is . . . . . . overstated Gross profit and net income are . . . understated Ending owner’s equity is . . . . . . . . . understated C5 - 7 Advantages of Using Perpetual Inventory Continuous determination of inventory value Continuous determination of gross profit Affordable with computers, scanners, and bar codes on most products Perpetual inventory accounting provides management controls Managers know which items are selling fastest and the profit margin on those items C5 - 8 Accounting for Merchandise Transactions Scully Company (Seller) Description Debit Credit Burton Co. (Buyer) Description Debit Credit Cash 4,000 Accts. Receivable 4,000 Accts. Payable Cash 4,000 Accts. Receivable 12,500 Sales 12,000 Cash 500 Cost of Mdse. Sold 7,200 Mdse. Inventory 7,200 Mdse. Inventory Accts. Payable Cash 12,260 Sales Discounts 240 Accts. Receivable 12,500 Accts. Payable 12,500 Mdse. Inventory 240 Cash 12,260 4,000 12,500 12,500 July 28. Scully Company received payment from Burton Co. less discount (2% x $12,000). C5 - 9 Perpetual Inventory System General Journal Description A Mdse. Inventory Accts. Payable General Ledger Debit Credit 5,000 5,000 Mdse. Inventory A 5,000 Cost of Mdse. Sold A Purchase on account B Return of merchandise In a perpetual system, Mdse. Inventory is an active asset account. All changes are recorded as they occur. C5 - 10 NetSolutions Income Statement (Multiple-Step) For Year Ended December 31, 2004 Revenue from sales: Sales Less:Sales returns and allow. Sales discounts Net sales Cost of merchandise sold Gross profit $ 720,185 $ 6,140 5,790 11,930 $708,255 525,305 $182,950 Continued C5 - 11 NetSolutions Merchandising Chart of Accounts Income Statement Accounts 400 Revenue 410 Sales 411 Sales Returns and Allowances 412 Sales Discounts 600 Other Income 610 Rent Revenue 611 Interest Revenue 700 Other Expense 710 Interest Expense 500 510 520 521 522 Costs and Expenses Cost of Merchandise Sold Sales Salaries Expense Advertising Expense Depreciation Expense— Store Equipment 523 Transportation Out 529 Misc. Selling Expense 530 Office Salaries Expense 531 Rent Expense 532 Depreciation Expense— Office Equipment 533 Insurance Expense 534 Office Supplies Expense 539 Misc. Admin. Expense C5 - 12 Perpetual Inventory System General Journal Description A Mdse. Inventory Accts. Payable B Accts. Payable General Ledger Debit Credit 5,000 5,000 A 5,000 1,000 B Bal 4,000 1,000 Mdse. Inventory Mdse. Inventory 1,000 Cost of Mdse. Sold A Purchase on account B Return of merchandise C Sale of merchandise In a perpetual system, Mdse. Inventory is an active asset account. All changes are recorded as they occur. C5 - 13 NetSolutions Income Statement (Single-Step) For Year Ended December 31, 2004 Revenues: Net sales Interest revenue Rent revenue Total revenues Expenses: Cost of merchandise sold Selling expenses Administrative expenses Interest expense Total expenses Net income $708,255 3,800 600 $712,655 $525,305 74,620 34,890 2,440 637,255 $ 75,400 C5 - 14 NetSolutions Balance Sheet December 31, 2004 Assets Current assets: Cash Notes receivable Accounts receivable Interest receivable Merchandise inventory Office supplies Prepaid insurance Total current assets $ 52,950 35,000 55,880 200 62,150 480 2,650 $209,310 Continued C5 - 15 NetSolutions Balance Sheet December 31, 2004 Assets Property, plant, and equipment: Land $ 20,000 Store equipment $ 27,100 Less accum. depreciation 5,700 21,400 Office equipment $ 15,570 Less accum. depreciation 4,720 10,850 Total property, plant, and equipment 52,250 Total assets $261,560 Continued C5 - 16 NetSolutions Balance Sheet December 31, 2004 Liabilities Current liabilities: Accounts payable Note payable (current portion) Salaries payable Unearned rent Total current liabilities Long-term liabilities: Note payable (due 2001) Total liabilities Owner’s Equity Capital stock Retained earnings Total liabilities and owner’s equity $ 22,420 5,000 1,140 1,800 $30,360 20,000 $ 50,360 $ 25,000 186,200 211,200 $261,560 C5 - 17 Perpetual Inventory System General Journal Description A Mdse. Inventory Accts. Payable General Ledger Debit Credit 5,000 5,000 B Accts. Payable 1,000 Accts. Receivable Sales C Cost of Mdse. Sold Mdse. Inventory 3,250 Mdse. Inventory 1,000 Mdse. Inventory A 5,000 1,000 B 2,500 C Bal 1,500 Cost of Mdse. Sold 3,250 C 2,500 2,500 A Purchase on account B Return of merchandise C Sale of merchandise 2,500 In a perpetual system, Mdse. Inventory is an active asset account. All changes are recorded as they occur. C5 - 18 Perpetual Inventory System General Journal Description A Mdse. Inventory Accts. Payable General Ledger Debit Credit 5,000 5,000 B Accts. Payable 1,000 Accts. Receivable Sales C Cost of Mdse. Sold Mdse. Inventory 3,250 Mdse. Inventory 1,000 Mdse. Inventory A 5,000 1,000 B 2,500 C Bal 1,500 Cost of Mdse. Sold 3,250 C 2,500 2,500 A Purchase on account B Return of merchandise C Sale of merchandise 2,500 In a perpetual system, Mdse. Inventory is an active asset account. All changes are recorded as they occur. C5 - 19 Credit Terms, Cash Discounts Credit Terms: 2/10, n/30 Is invoice paid within 10 days of invoice date? Full amount is due No within 30 days of invoice date. C5 - 20 Credit Terms, Cash Discounts Credit Terms: 2/10, n/30 Is invoice paid within 10 days of invoice date? Full amount is due No within 30 days of invoice date. Yes 2% of invoice amount is allowed as a cash discount. C5 - 21 Credit Terms, Cash Discounts Credit Terms: 2/10, n/30 Is invoice paid within 10 days of invoice date? Yes 2% of invoice amount is allowed as a cash discount. Full amount is due No within 30 days of invoice date. Example: Merchandise was purchased for $1,500 with credit terms of 2/10, n/30. Payment within 10 days is calculated as: Invoice $1,500 Less 2% discount 30 Net cost paid $1,470 C5 - 22 Selling and Buying Merchandise Inventory Seller Description Accts. Receivable Sales Cost of Mdse. Sold Mdse. Inventory Buyer Debit Credit 1,500 1,500 900 900 Description Mdse. Inventory Accts. Payable Debit Credit 1,470 1,470 Recorded at net cost $1,500 - $30 (discount) Jan 12. Merchandise was sold with credit terms of 2/10, n/30. Jan 22. Payment was made within the discount period. C5 - 23 Selling and Buying Merchandise Inventory Seller Description Accts. Receivable Sales Cost of Mdse. Sold Mdse. Inventory Buyer Debit Credit 1,500 1,500 900 900 Description Mdse. Inventory Accts. Payable Debit Credit 1,470 1,470 Recorded at net cost $1,500 - $30 (discount) Jan 12. Merchandise was sold with credit terms of 2/10, n/30. Cash 1,470 Sales Discounts 30 Accts. Receivable 1,500 Accts. Payable Cash 1,470 1,470 Jan 22. Payment was made within the discount period. C5 - 24 Selling and Buying Merchandise Inventory Seller Description Accts. Receivable Sales Cost of Mdse. Sold Mdse. Inventory Buyer Debit Credit 1,500 1,500 Description Mdse. Inventory Accts. Payable Debit Credit 1,500 1,500 Recorded at full cost 900 900 Jan 12. Merchandise was sold with credit terms of 2/10, n/30. Cash 1,470 Sales Discounts 30 Accts. Receivable 1,500 Accts. Payable Mdse. Inventory Cash 1,500 30 1,470 Jan 22. Payment was made within the discount period. C5 - 25 Accounting for Merchandise Transactions Scully Company (Seller) Description Accts. Receivable Sales Cost of Mdse. Sold Mdse. Inventory Debit Credit 5,000 5,000 Burton Co. (Buyer) Description Mdse. Inventory Accts. Payable Debit Credit 5,000 5,000 3,500 3,500 July 5. Scully Company sold merchandise on account to Burton Co., $5,000, terms FOB destination, n/30. The cost of the merchandise sold was $3,500. C5 - 26 Accounting for Merchandise Transactions Scully Company (Seller) Description Accts. Receivable Sales Cost of Mdse. Sold Mdse. Inventory Transportation Out Cash Debit Credit 5,000 5,000 3,500 Burton Co. (Buyer) Description Mdse. Inventory Accts. Payable Debit Credit 5,000 5,000 3,500 250 No entry. 250 July 7. Scully Company paid transportation costs of $250, for delivery of merchandise sold to Burton Co. C5 - 27 Accounting for Merchandise Transactions Scully Company (Seller) Description Debit Credit Accts. Receivable Sales Cost of Mdse. Sold Mdse. Inventory 5,000 Transportation Out Cash 250 5,000 Burton Co. (Buyer) Description Mdse. Inventory Accts. Payable Debit Credit 5,000 5,000 3,500 3,500 No entry. 250 Sales Ret. & Allow. 1,000 Accts Receivable 1,000 Mdse. Inventory 700 Cost of Mdse. Sold 700 Accts. Payable Mdse. Inventory 1,000 1,000 July 13. Scully Company issued Burton Co. a credit memo for merchandise returned, $1,000. The merchandise cost was $700. C5 - 28 Accounting for Merchandise Transactions Scully Company (Seller) Description Debit Credit Cash 4,000 Accts. Receivable 4,000 Burton Co. (Buyer) Description Accts. Payable Cash Debit Credit 4,000 4,000 July 15. Scully Company received payment from Burton Co. for purchase of July 1. C5 - 29 Accounting for Merchandise Transactions Scully Company (Seller) Description Debit Credit Burton Co. (Buyer) Description Cash 4,000 Accts. Receivable 4,000 Accts. Payable Cash Accts. Receivable 12,500 Sales 12,000 Cash 500 Cost of Mdse. Sold 7,200 Mdse. Inventory 7,200 Mdse. Inventory Accts. Payable Debit Credit 4,000 4,000 12,500 12,500 July 18. Scully Company sold merchandise on account to Burton Co., $12,000, terms FOB shipping point, 2/10, n/eom. Scully Company prepaid transportation costs of $500. Cost of merchandise sold was $7,200. C5 - 30 NetSolutions Merchandising Chart of Accounts Balance Sheet Accounts 100 Assets 110 Cash 111 Notes Receivable 112 Accounts Receivable 113 Interest Receivable 115 Merchandise Inventory 116 Office Supplies 117 Prepaid Insurance 120 Land 123 Store Equipment 124 Accumulated Depreciation— Store Equipment 125 Office Equipment 126 Accumulated Depreciation— Office Equipment 200 Liabilities 210 Accounts Payable 211 Salaries Payable 212 Unearned Rent 215 Notes Payable 300 Stockholders’ Equity 310 Capital Stock 311 Retained Earnings 312 Dividends 313 Income Summary C5 - 31 Operating expenses: Selling expenses: Sales salaries expense $60,030 Advertising expense 10,860 Depr. expense–store equip. 3,100 Miscellaneous selling expense 630 Total selling expenses $ 74,620 Administrative expenses: Office salaries expense $21,020 Rent expense 8,100 Depr. expense–office equip. 2,490 Insurance expense 1,910 Office supplies expense 610 Misc. admin. expenses 760 Total admin. expenses 34,890 Total operating expenses 109,510 Income from operations $ 73,440 Continued C5 - 32 Other income: Interest revenue Rent revenue Total other income Other expense: Interest expense Net income $ 3,800 600 $ 4,400 2,440 1,960 $75,400 C5 - 33 Profitability Analysis Profitability is the ability of an entity to earn profits. This ability to earn profits depends on the effectiveness and efficiency of operations as well as resources available. Profitability analysis focuses primarily on the relationship between operating results reported in the income statement and resources reported in the balance sheet. C5 - 34 Profitability Measures — Effective Use of Assets Ratio of Net Sales to Assets Net sales Total assets: Beginning of year End of year Total Average 2003 1992 $1,498,000 $1,200,000 $1,053,000 $1,010,000 1,044,500 1,053,000 $2,097,500 $2,063,000 $1,048,750 $1,031,500 C5 - 35 Profitability Measures — Effective Use of Assets Ratio of Net Sales to Assets 2003 2002 $1,498,000 $1,200,000 Net sales Total assets: Beginning of year $1,053,000 $1,010,000 End of year 1,044,500 1,053,000 Total $2,097,500 $2,063,000 Average $1,048,750 $1,031,500 Ratio of net sales to assets 1.4 1.2 Use: To assess the effectiveness in the use of assets. C5 - 36 Chapter F5 Power Notes Accounting for Merchandising Businesses This is the last slide in Chapter F5. Note: To see the topic slide, type 2 and press Enter. C5 - 37