AlbrechtFinancialAcc..

advertisement

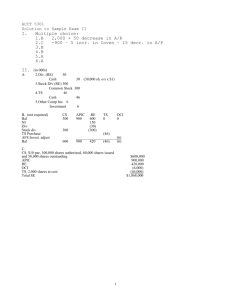

Chapter 8 Completing the Operating Cycle Albrecht, Stice, Stice, Swain COPYRIGHT © 2008 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. 1 Employee Compensation • Payroll – Recognize the expense. – FICA taxes and Federal income withholdings. • Withholding these taxes for the government. • They should not be recognized as an expense of the company. • Employer payroll taxes – Employer’s portion of FICA taxes. – Federal and state unemployment taxes. – Added to taxes payable to the government. 2 Payroll Journal Entries Salaries Expense. . . . . . . . . . . . . . . . . . . . . . FICA Taxes Payable, Employee. . . . . . . Federal Withholding Taxes Payable . . . State Withholding Taxes Payable . . . . . Salaries Payable . . . . . . . . . . . . . . . . . . . To record employees’ salary. 2,700 180 486 243 1723 Payroll Tax Expense. . . . . . . . . . . . . . . . . . . 278 FICA Taxes Payable, Employer . . . . . . . 180 Federal Unemployment Taxes Payable. 30 State Unemployment Taxes Payable. . . 68 To record liabilities associated with employees’ salary. 3 Other Employee Compensation • Bonuses – Recorded just like payroll. – Many times they are earnings based. • Good incentive for management improvement but can also provide incentives to manipulate earnings. • Compensated absences – Recognized as the employee earns the right to these absences. 4 Other Employee Compensation • Stock options – Fair value of the options are recognized over the period the options are earned. • Postemployment benefits – Severance or other benefits. – Estimated and accrued in the period the employees are terminated. 5 Other Compensation Journal Entries Salaries Expense . . . . . . . . . . . . . . . . . . . . . . Sick Days Payable. . . . . . . . . . . . . . . . . . . To recognize accrued sick pay. 125 125 Sick Days Payable . . . . . . . . . . . . . . . . . . . . . 125 Various Taxes Payables. . . . . . . . . . . . . . 35 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90 To record payment of sick day net of FICA, federal, and state taxes. Salaries Expense . . . . . . . . . . . . . . . . . . . . . . 150,000 Various Taxes Payables. . . . . . . . . . . . . . 60,000 Bonus Payable . . . . . . . . . . . . . . . . . . . . . 90,000 To record bonus earned by employees. 6 Pensions • Defined contribution plan – Employer contributes specific amount every year to be paid to employee after retirement. – Employee receives what was contributed plus the earnings. – The employee bears the risk of poor returns. • Defined benefit plan – Employee receives amount defined in the plan. – Usually based on the number of years worked. – Company sets aside money to cover the obligation, but the risk of poor returns remains with the company. 7 Pensions • Pension fund – Money set aside to fulfill pension obligation. • Pension benefit obligation – Estimated liability of retirement payments. • Pension-related interest cost – The increase in the pension obligation resulting from interest on the unpaid obligation. • Service Cost – The increase in the pension obligation resulting from an employee working another year. • Return on pension fund assets – The return the company earns on its pension fund. 8 Pensions Pension Benefit Obligation – Pension Fund Assets = Net Pension Liability Interest Cost + Service Cost – Expected Return on Fund Assets = Pension Expense 9 Sales Taxes • Paid by customer, but collected by the company for the government. Example: Bonds’s Barbeque sold a 100 sandwiches for $340. What is the journal entry assuming the state charges a 5 percent sales tax? Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sales Revenue. . . . . . . . . . . . . . . . . . Sales Tax Payable. . . . . . . . . . . . . . . 357 340 17 From sale of sandwiches, including 5% sales tax. 10 Property Taxes • Assessed by county. • Usually paid for a year in advance. Example: The City of Riverton assesses property taxes on land and buildings. Bond’s Barbeque pays its property taxes on a calendar-year basis and paid Riverton $6,200 last year for the current year. Make Bond’s appropriate journal entry. 12/31 Property Tax Expense . . . . . . . . . 6,200 Prepaid Property Taxes. . . . . . 6,200 To record property tax expense by using up prepaid property taxes. 11 Income Taxes • Based off income. • May be different from actual taxes paid. Example: Bond’s Barbeque’s pretax income is $385,000. Its income tax rate for the year for both federal and state is 30 percent. Prepare an adjusting entry at year-end showing the company’s tax expense. 12/31 Income Tax Expense . . . . . . . . 115,500 Income Tax Payable. . . . . . . 115,500 To record income tax expense and tax liability on $385,000 pretax income for year using a 30 percent effective tax rate. 12 Deferred Taxes • Occur because of timing differences in revenue and expense recognition according to GAAP rules versus IRS rules. Example: Bond’s Barbeque’s owes $80,000 in taxes on its income. It also has gains on a mutual fund that will not be taxed until the mutual fund is sold. These taxes will be $40,000. Prepare an entry showing the company’s tax expense. Income Tax Expense. . . . . . . . . Income Tax Payable. . . . . . . Deferred Tax Liability. . . . . . 120,000 80,000 40,000 To record income tax expense and deferred tax liability due to unrealized gains on mutual funds. 13 Contingencies • Contingent Liabilities – Depend on some future event to determine if a liability actually exists. • Environmental Liabilities – Liability definitely exists, but measurement is difficult. – Minimum liability established. – Extensive note disclosure. 14 Accounting for Contingent Liabilities Term Definition Accounting Probable The future event is likely to occur. Estimate the amount of the contingency and make the appropriate journal entry; provide detailed disclosure in notes. Possible The chance of the future event occurring is more than remote but less than likely. Provide detailed disclosure of the possible liability in the notes. Remote The chance of the future event occurring is slight. No disclosure required. 15 Capitalize vs. Expense • Research and Development – Expenditures should be expensed when incurred. – Uncertainty of future benefits. • Advertising – Expenditures should be expensed when incurred. – Uncertainty of future benefits. – Exception for targeted marketing to previous customers. 16 Income Statement Revisited • Gross Margin – Net Sales minus Cost of Goods Sold. • Other Revenues and Expenses – Items earned or incurred outside of, or peripheral to, the normal operations of a firm. – (i.e. dividends received from investments) • Extraordinary Items – Nonoperating gains and losses • Unusual in nature. • Infrequent in occurrence. • Material in amount. – Reported net of taxes. – (i.e. losses from floods, fires, earthquakes, etc.) 17 Review the Income Statement Format Revenues – Cost of goods sold = Gross margin – Selling expenses – General and administrative expenses = Operating income +/– Other revenues and expenses = Income before taxes – Income tax = Income after taxes +/– Extraordinary items = Net income 18 Earnings Per Share • Net income divided by shares outstanding. • Basic Earnings Per Share – Based on historical information. • Diluted Earnings Per Share – Considers the effect on net income and shares outstanding of stock transactions that might occur in the future. 19