Forex Weekly Apr 6

advertisement

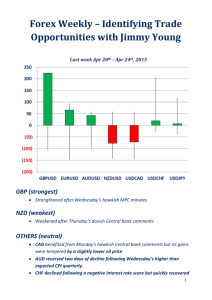

Forex Weekly – Identifying Trade Opportunities with Jimmy Young Last week Mar 30th – Apr 3rd, 2015 AUD (weakest) Metal prices continue to crater (iron ore down sharply and very close to lows) USD (second weakest) Friday’s bearish employment report sunk the USD. CAD, CHF, EUR (strongest) CAD benefiting from a slightly firmer oil price EUR aided by slightly higher than expected inflation numbers GBP, JPY and NZD (neutral) Nothing special to report 1 Tier 1 Scheduled News Releases Apr 6th – Apr 10th, 2015 This week there are two Tier 1 scheduled news events: TUE Apr 7th at 05:30BST: AUD interest rate announcement and statement Only about 25% of economists calling for an interest rate cut but the futures prices are putting the chances of a rate cut at closer to 75%. The economist expecting an interest rate cut point to the collapse of iron ore prices by about another 20% since the last AUD interest rate announcement. Iron ore exports make up a substantial chunk of Australia’s exports. This would foretell a weaker Aussie economy and more of a reason to anticipate an interest rate cut to help the economy. The economist not expecting an interest rate point to the issue of lower interest rates causing real estate, particularly Sydney real estate prices, to increase, perhaps more than the central bank prefers. The not expecting an interest rate camp also says the Australian Central bank wants to wait and see the AUD quarterly inflation numbers due out a week after the upcoming interest rate announcement. Here is our TRADEFINDER spreadsheet to get still more perspective: THINKING INTEREST RATE CUT The Central bank talked about lowering interest rates further in the last statement. Since then the combination of much lower iron ore prices and a weak US employment report would argue for another interest rate cut. The Central bank also mentioned the 2 currency has not declined much versus currencies other than the USD, despite huge declines in metal prices and Aussies terms of trade. Bottom line; think the Central bank has enough reasons to cut interest rates another quarter percent. FRI Apr 10th at 13:30BST: CAD employment report The Bank of Canada (Central Bank) unexpectedly lowered interest rates at the end of January in anticipation of a weakening economy. For this reason I favor a worse than expected Canada employment report. Here is our TRADEFINDER spreadsheet to get more perspective: Left blank purposely 3 EURUSD Trade View: BULLISH TECHNICALS Downtrend: retracing; highest close in a month on Friday EUR FUNDAMENTALS Bearish: Quantitative easing (QE); Greece remains a wildcard Bullish: Economic numbers improving recently. USD FUNDAMENTALS Bullish: FOMC dropped “patience” from statement two weeks ago; indicating interest rates will be increased in 2nd or 3rd quarter of 2015. Janet Yellen’s comments late on Friday were more hawkish than expected. Bearish: Statement and Janet Yellen press confidence two weeks ago less hawkish than expected. Bearish: Friday significantly worse than expected non-farm payroll number and negative revisions TIER 1 ECONOMIC NEWS None 4 GBPUSD Trade View: NEUTRAL TECHNICALS Downtrend: consolidating. GBP FUNDAMENTALS Bullish: Economy strong; GDP revised higher last week. Bearish: CPI at zero. USD FUNDAMENTALS Bullish: FOMC dropped “patience” from statement two weeks ago; indicating interest rates will be increased in 2nd or 3rd quarter of 2015. Janet Yellen’s comments late on Friday were more hawkish than expected. Bearish: Statement and Janet Yellen press confidence two weeks ago less hawkish than expected. Bearish: Friday significantly worse than expected non-farm payroll number and negative revisions TIER 1 ECONOMIC NEWS None 5 AUDUSD Trade View: BEARISH TECHNICALS Downtrend; very weak AUD FUNDAMENTALS Bearish: Feb surprise interest rate cut indicates a weaker economy ahead. Bearish: RBA minutes were dovish two weeks ago. Bearish: Iron ore prices collapsed recently. USD FUNDAMENTALS Bullish: FOMC dropped “patience” from statement two weeks ago; indicating interest rates will be increased in 2nd or 3rd quarter of 2015. Janet Yellen’s comments late on Friday were more hawkish than expected. Bearish: Statement and Janet Yellen press confidence two weeks ago less hawkish than expected. Bearish: Friday significantly worse than expected non-farm payroll number and negative revisions TIER 1 ECONOMIC NEWS TUE Apr 7th at 05:30BST: AUD interest rate announcement and statement 6 NZDUSD Trade View: NEUTRAL TECHNICALS Unclear: breakout above consolidation but no follow through. NZD FUNDAMENTALS Bullish: No interest rate cuts; Central bank is critically concerned about lower interest rates increasing house prices. Bearish: milk prices rumored to be set to slip further. USD FUNDAMENTALS Bullish: FOMC dropped “patience” from statement two weeks ago; indicating interest rates will be increased in 2nd or 3rd quarter of 2015. Janet Yellen’s comments late on Friday were more hawkish than expected. Bearish: Statement and Janet Yellen press confidence two weeks ago less hawkish than expected. Bearish: Friday significantly worse than expected non-farm payroll number and negative revisions TIER 1 ECONOMIC NEWS None 7 USDCAD Trade View: NEUTRAL TECHNICALS Consolidating; seems stuck in a range for now CAD FUNDAMENTALS Bearish: Feb surprise interest rate cut indicates a weaker economy ahead. Bearish: oil prices appear ready to slide again following last Friday’s drop. Bullish: Bank of Canada (BOC) Governor Poloz speech on Thursday, March 26th was less dovish than expected. USD FUNDAMENTALS Bullish: FOMC dropped “patience” from statement two weeks ago; indicating interest rates will be increased in 2nd or 3rd quarter of 2015. Janet Yellen’s comments late on Friday were more hawkish than expected. Bearish: Statement and Janet Yellen press confidence two weeks ago less hawkish than expected. Bearish: Friday significantly worse than expected non-farm payroll number and negative revisions TIER 1 ECONOMIC NEWS Friday April 10th at 13:30BST: CAD employment report 8 USDJPY Trade View: NEUTRAL TECHNICALS Sideways; consolidating JPY FUNDAMENTALS Neutral; Central bank monetary policy steady USD FUNDAMENTALS Bullish: FOMC dropped “patience” from statement two weeks ago; indicating interest rates will be increased in 2nd or 3rd quarter of 2015. Janet Yellen’s comments late on Friday were more hawkish than expected. Bearish: Statement and Janet Yellen press confidence two weeks ago less hawkish than expected. Bearish: Friday significantly worse than expected non-farm payroll number and negative revisions TIER 1 ECONOMIC NEWS None 9 LAST WEEK SUMMARY The USD traded higher on Monday and Tuesday, following through on its strength in the later part of the prior week. The shine came off the dollar following Wednesday’s bearish US ADP payroll report. The USD gave up all of the week’s remaining gains and went into the red on Friday following a much lower than expected US non-farm payroll number and negative revisions to the prior two months. THIS WEEK’S TRADE VIEW Buy EURAUD. The EURUSD pair closed at a one month high close on Friday and the AUDUSD had the least gains of all the majors by far. I like the idea of the EUR outperforming the AUD this coming week. Fundamentally, long EUR is vulnerable to unexpected negative Greece news; on the other hand, positive news about Greece could help the EUR as well. Fundamentally, the Aussie central Bank pointed out that the Aussie should probably be weaker than it actually is; so playing off of that and also I expect the central bank to cut interest rates this week in response to the collapse of the price of iron ore the past month. Best, JIMMY 10