Forex Weekly Apr 27

advertisement

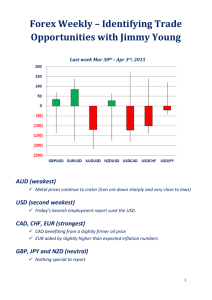

Forex Weekly – Identifying Trade Opportunities with Jimmy Young Last week Apr 20th – Apr 24th, 2015 GBP (strongest) Strengthened after Wednesday’s hawkish MPC minutes NZD (weakest) Weakened after Thursday’s dovish Central bank comments OTHERS (neutral) CAD benefited from Monday’s hawkish Central bank comments but its gains were tempered by a slightly lower oil price AUD reversed two days of decline following Wednesday’s higher than expected CPI quarterly. CHF declined following a negative interest rate scare but quickly recovered 1 Tier 1 and Tier 2 Scheduled Releases Apr 27th – May 1st, 2015 Tier 1 Release Histories 2 Indication FUNDAMENTAL: Traders reaction to this coming Wednesday’s FOMC statement will likely determine the direction of most of the major pairs. The key question is how much further economy / higher interest rates driven USD strength is likely, given the recent weakness in many of the key US economic indicators. Other factors weighing on the USD versus the other key currencies include: 1. An unexpected bounce in commodity prices is benefiting AUD, NZD and CAD 2. The ECB’s upbeat European countries economic outlook is helping the EUR 3. Bank of England’s hawkish MPC minutes (next interest rate move will be up) The short list of key fundamental factors to track this coming week includes: EUR – Greece GBP – Election and GDP release CAD – Oil AUD – Iron Ore NZD – Milk and Monetary policy statement CHF – Negative interest rates USD – FOMC statement and GDP TECHNICAL: The weekly charts of the major pairs tell a story of on-going retracement: From purely a technical perspective, there is no clear evidence of further USD strength in the near term; my best guess is the USD retracement will continue this coming week. 3 EURUSD Trade View: NEUTRAL TECHNICALS Consolidating; last two weeks has been positive EUR FUNDAMENTALS BEARISH Bearish: QE, Greece Bullish: ECB President Draghi indicated Eurozone is doing better (Apr 18). USD FUNDAMENTALS BULLISH Bullish: Interest rate hike expected in the summer or fall Bearish: Latest employment (Apr 3) and latest retail sales(Apr 14) were bearish TIER 1 AND TIER 2 ECONOMIC NEWS 4 GBPUSD Trade View: BULLISH TECHNICALS Retracing; increased 9 of 10 last days GBP FUNDAMENTALS BULLISH Bullish: Economy strong; Hawkish MPC minutes (Apr 22) Bearish: Election uncertainty; CPI at zero (Apr 14); Retail sales bearish (Apr 23) USD FUNDAMENTALS BULLISH Bullish: Interest rate hike expected in the summer or fall Bearish: Latest employment (Apr 3) and latest retail sales(Apr 14) were bearish TIER 1 AND TIER 2 ECONOMIC NEWS 5 AUDUSD Trade View: BULLISH TECHNICALS Retracing; one month high close on Friday AUD FUNDAMENTALS BULLISH Bearish: Feb surprise interest rate cut. Iron ore prices have collapsed. Bullish: Bullish CPI (Apr 22); bullish employment (Apr 16); bullish retail (Apr 7) USD FUNDAMENTALS BULLISH Bullish: Interest rate hike expected in the summer or fall Bearish: Latest employment (Apr 3) and latest retail sales(Apr 14) were bearish TIER 1 AND TIER 2 ECONOMIC NEWS 6 NZDUSD Trade View: NEUTRAL TECHNICALS Upswing NZD FUNDAMENTALS NEUTRAL Bullish: High and steady interest rates Bearish: Dovish Central Bank (Apr 22); Negative CPI (Apr 19) USD FUNDAMENTALS BULLISH Bullish: Interest rate hike expected in the summer or fall Bearish: Latest employment (Apr 3) and latest retail sales(Apr 14) were bearish TIER 1 AND TIER 2 ECONOMIC NEWS 7 USDCAD Trade View: BEARISH TECHNICALS Retracing further following a breakout below consolidation CAD FUNDAMENTALS BULLISH Bearish: Feb surprise interest rate cut; oil price collapse (increasing lately) Bullish: Hawkish Central bank (Apr 19); bullish retail sales (Apr 15) higher than expected (Apr 10); Employment report better than expected (Apr 10) USD FUNDAMENTALS BULLISH Bullish: Interest rate hike expected in the summer or fall Bearish: Latest employment (Apr 3) and latest retail sales(Apr 14) were bearish TIER 1 AND TIER 2 ECONOMIC NEWS 8 USDJPY Trade View: NEUTRAL TECHNICALS Consolidating JPY FUNDAMENTALS Neutral; Central bank monetary policy steady USD FUNDAMENTALS Bullish: Interest rate hike expected in the summer or fall Bearish: Latest employment (Apr 3) and latest retail sales(Apr 14) were bearish TIER 1 AND TIER 2 ECONOMIC NEWS 9 This Week’s Trade Ideas Summary Generally Bearish USD for the coming week Most recent economic news (employment, retail sales) casts doubts on the strength of the US economy The economic story for many of the other currencies appears to be getting somewhat better Major pair charts are reflecting this (USD retracing) Specifically Bullish GBPUSD o Bearish USD fundamentally and technically (one week or less view) o Bullish GBP fundamentally and technically (one week or less view) Views might possibly change based upon this coming week’s news releases and or price action Bullish AUDUSD o Bearish USD fundamentally and technically (one week or less view) o Bullish AUD fundamentally and technically (one week or less view) Views might possibly change based upon this coming week’s news releases and or price action Bearish USDCAD o Bearish USD fundamentally and technically (one week or less view) o Bullish CAD fundamentally and technically (one week or less view) Views might possibly change based upon this coming week’s news releases and or price action Good luck Best, JIMMY 10