Document

advertisement

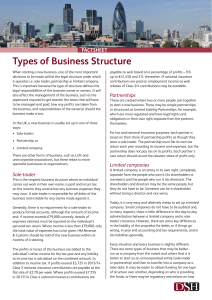

Accounting and Financial Management ACC5502 Course Overview Introduction • Module 1:Introduction to accounting and business structures • Module2: Business sustainability, ethics and corporate governance Financial Accounting • Module 3:The process of accounting and the balance sheet • Module 4: The income statement • Module 5: Statement of cash flows • Module 6: Financial Statement Analysis Management Accounting • Module 7: Budgeting • Module 8: CVP analysis • Module 9:Costing in an entity • Module 10: Performance Measurement Finance • Module 11: Capital Investment Decisions • Module 12: Financing the Business Activity A friend runs a clothes boutique. She has asked you for a substantial loan. What information would you like to know before making your decision? Activity Continued Your friend has provided you with the following information; Sales Costs Profit $75,000 $55,000 $20,000 How could the information be changed to make it more useful? Module One: Introduction to Accounting What is accounting? • collection, analysis and communication of economic information What is the role of accounting information? • Decision making • Planning • Control Module One: Introduction to Accounting Who uses accounting information • Both internal users and external users • Managers • Resource providers – owners, lenders, suppliers, employees • Recipients of goods and services - customers • Reviewers – auditors, government, unions, competitors, special interest groups Uses of accounting information • • • • • Efficient use of resources Long term stability Liquidity – short term survival Compliance Social responsibility Module One: Introduction to Accounting Accounting information system • • • • Identification Recording and analysis Reporting Decision Making Characteristics of accounting information • • • • • Relevance Reliability Comparability Understandability Cost/benefit Module One: Introduction to Accounting The planning process The control process Planning Organising Controlling Directing Module One: Introduction to Accounting Objectives of Business • • • • • • • • • • Maximise profit Maximise shareholder return Own your own business Financial survival Growth Wealth enhancing Financial stability Best in the business To do something you enjoy Satisficing Financial versus Management Accounting Aspect Financial accounting Management accounting (1) Focus External Reporting Internal Reporting (2) Nature General Purpose (Range of Users) Specific Purpose (Particular Need) (3) Level of Detail Aggregate Overview Underlying Detail (4) Regulation Professional, Industry or Statutory Requirements Flexible to meet individual business or managers needs (5) Frequency Maybe limited to annual or semi-annual production Timely reporting to facilitate management control (6) Time horizon Restricted largely to past historic information Incorporates future expectations and non financial information (7) Examples Balance Sheet; Profit and Loss Statement; Cashflow Statement Budgets; Standards; Variances Main Financial Accounting Reports General Purpose Financial Reports • Profit and Loss Statement or Income Statement (Statement of Financial Performance) • Balance Sheet (Statement of Financial Position) • Cash Flow Statement (Statement of Cash Flow) Further Issues Accounting versus bookkeeping • Bookkeeping is strictly the recording and summarising of financial transactions and preparing basic financial reports • Bookkeeping is part of a much larger accounting function What does an auditor do? • A financial statement auditor independently and objectively assesses the fairness of accounting reports • Auditing is designed to add value and improve an entity’s operations • It evaluates and improves the effectiveness of risk management, control and governance processes in an entity Limitations of Accounting Information Time-lag in the distribution of the information to users The historical nature of accounting information (financial information is from past data and is therefore often outdated) Subjectivity of information – e.g. firms can choose a particular depreciation method Cost of providing accounting information Information costs – costs of gathering, storing, preparing, analysing and disseminating information Proprietary information costs – costs in releasing private company information Changes in accounting Corporate collapses Multi-national global focus International Financial Reporting Standards Traditional areas of accounting Public accounting Private sector Government and non profit sector New areas of accounting Forensic accounting Personal Financial planning Ecommerce Social and environmental accounting International accounting (transfer pricing and financial derivatives) Professional Accounting Associations CPA Australia ICAA – Institute of Chartered Accountants NIA – National Institute of Accountants CIMA – Chartered Institute of Management Accountants ACCA – Association of Chartered Certified Accountants Common Business Structures SoleTrader Partnership Company Trust SoleTrader A Sole Trader • Owns, controls and manages his/her enterprise • Therefore responsible for all debts and decides on what to do with all profits • Is not a separate legal entity SoleTrader Advantages • Easy and cheap to establish and wind down • Minimum regulatory requirements • Flexible decision structure (owner makes decisions) • Owner claims all profits (& losses) SoleTrader Disadvantages • Unlimited liability for all business debts Including negligent acts of employees • Limited Life • Limited access to funds • Pay be paying more tax compared to company • Limited skill and time • Non-legal status may restrict business SoleTrader Financial Reports • Income less expenses • One Capital account • No taxation shown • Net Profit/Loss added to capital account SoleTrader Income Sales Less Expenses Cost of goods sold Gross profit Less Operating expenses Admin. Expenses Rent Wages & salaries Net Profit $ 5000 2500 2500 300 400 400 1100 1400 SoleTrader Owner’s Equity Capital + net profit $ 5000 1400 $ 6400 Partnership A partnership is the relationship that exists between two or more persons who carry on business ‘in common’ with a view to generating a profit Is not a separate legal entity (but is a separate accounting entity) Does not pay tax – individual partners pay tax Unlimited liability for debts Not bound by any formal business reporting requirements Assets co-owned and shared Partnerships Agreement between partners can be written, oral or implied by action Profits and Losses shared according to agreement Normally separate records kept for contributions (capital), withdrawals (drawings) and share of undistributed profits Partnership Agreements • Business name • Each partners contribution, values, responsibilities, profit/loss entitlement • Procedures for admission, dissolution and dispute • Bookkeeping requirement • Any issue not covered will be decided by law Partnerships Advantages • Easy and simple to set up • Informal business structures • More access to capital • Pooling of knowledge, skills, time • Possible taxation advantages (income splitting) Partnerships Disadvantages • Unlimited Liability • Mutual agency – each partner an agent of the business and each other • Limited Life • Limited access to funds Partnerships Income Sales $ 5000 Less Expenses Cost of goods sold 2500 Gross profit 2500 Less Operating expenses Admin. Expenses 300 Rent 400 Wages & salaries 400 1100 Net Profit 1400 Distribution to partners (assume equally) Salary Tyronne 700 Raymond 700 1400 Partnerships Partners’ Equity Capital –Tyronne Capital – Raymond Current – Tyronne Current – Raymond $ 8000 4000 700 700 $ 12000 1400 13400 Company Separate legal entity (all the rights of an individual person; can sue and be sued) Governed by Corporations Act • Accounting Standards Creation application and ongoing reports lodged with Australian Securities and Investment Commission (ASIC) Company At least one owner Normally many owners that own a ‘share’ of the company Constitution Limited Companies have perpetual life Limited Companies can be public or private Company Types of Companies • Propriety Companies (Pty Ltd) Limited by shares Minimum 1 and maximum 50 shareholders One or more directors Common for SMEs and family owned • Public Companies (Ltd) Either • Limited by shares • Limited by guarantee • No liability companies – shareholders not responsible to repay any uncalled portion of their shares Large in size and highly regulated • Unlimited Company Shareholders have no limits placed on their liability Company Advantages • • • • • • • • • • Limited liability for shareholders Promotes risk taking Specialist skilled management Perpetual life Potentially favourable taxation Potentially more access to owner and debt funding Separate legal entity Ease of ownership transfer and share price increases Potential business network increase Separation of ownership and control Company Disadvantages • • • • • • • • • • Time consuming and costly to set up and maintain Highly regulated Loss/dilution of original ownership Loss of control by owners Taxed (30%) from the 1st dollar Limited liability may hamper borrowing eg. banks may want director guarantees Greater accountability and public scrutiny Reduced flexibility of management Pressure for short term performance Separation of ownership and control Company Income Fees Less Operating expenses Admin. Expenses Rent Wages & salaries $ 50000 2000 3000 20000 25000 Net Profit before tax Taxation expense (@30%) 25000 7500 Net profit after tax 17500 Reconciliation of retained profits Retained profits at start 45000 Add net profits after tax 17500 Less Dividends paid 12000 Retained profits at end 50500 Company Shareholder’s Equity $ $ Share capital 50,000 Retained profits 50,500 100,500 Company Owners' Claim (Shareholders' Equity) Shares (original investment) Different types Reserves (Profits and gains subsequently made) Different types Company Capital - Shares • Shares basic unit of ownership • Distributions of profit are termed dividends • 2 common classes Ordinary – bear the risk; voting rights Preference – rank higher for dividends and capital return but generally no voting rights • Constitution lists rights of different classes of shareholders Company Capital – reserves • Represents profits and gains not distributed • Retained Profits – profit put back into company • Other reserves – eg. asset revaluation reserve Company Directors • Appointed by shareholders • Legal duty to act in good faith in the best interest of company to act with care and diligence to avoid conflicts of interest between their role and any of their personal interests • Corporate Governance • Specific Duties as set out in Corporations Law including Furnishing financial statements and accompanying notes; Directors’ declaration about truth and fairness Directors’ report Company Financial Statements must comply with accounting standards • AASB – Australian Accounting Standards Board • AAS – Australian Accounting Standards • IASC – International Accounting Standards Committee ASX listed companies are subject to further rules Shareholders appoint auditors Controlling Interest Consolidated Financial Statements Trust A business structure which obligates a person to hold property for the benefit of others Types of trusts • Family Trust Established to benefit one family and its members Trustee normally given wide discretionary powers to acquire, distribute and dispose of the trust’s income and assets • Unit Trust Business and joint venture participants Beneficiaries can own units in the trust Trustee must distribute income according to the unit holdings Beneficiaries can sell their unit Advantages of trusts Tax advantages Limited liability Easy to form with limited government controls Disadvantages of trusts Law of trusts is complicated Use of trusts require knowledge, skill and care