Consumer Discretionary

advertisement

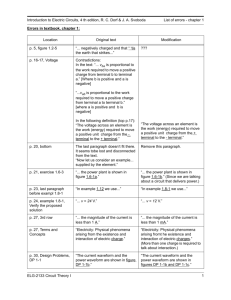

Consumer Discretionary Company Presentation Arshan Ameen Brian Beck Josh Bernath Ryan Calloway Bryan Chard March 10, 2009 – FIN 724/824 Agenda • • • • • • Review of Sector Presentation Proposal Abercrombie & Fitch Best Buy McDonald’s Summary Sector Presentation Review • • • • Current SIM portfolio weighting is 10.84% S&P’s weight is 8.31% Currently overweight 253 bps We recommended reducing the weight in the SIM portfolio by 303 bps to 7.81% (or 50 bps underweight) Consumer Discretionary vs. S&P 500: 10-Year 160 140 120 100 80 60 40 20 • Why underweight? – Sector is cheap, and rightfully so, as it has underperformed the S&P 500 for the past 10 years • Relative to market, we still expect lower returns for sector – Sole bright spot for sector is that oil prices stay at current levels – Risks going forward: • Unemployment rises (high probability) • Further deterioration in consumer spending (high probability) – Consumer confidence and sentiment remain at historical lows 0 Mar-99 Mar-00 Mar-01 Mar-02 Mar-03 Feb-04 Consumer Discretionary Feb-05 Feb-06 Feb-07 Feb-08 Feb-09 S&P 500 Consumer Discretionary vs. S&P 500: YTD 105 100 95 90 85 80 75 Dec-08 Jan-09 Jan-09 Jan-09 Jan-09 Jan-09 Consumer Discretionary Feb-09 Feb-09 S&P 500 Feb-09 Feb-09 Mar-09 Current SIM Composition As of 6-Mar-2009 close Company Abercrombie & Fitch Best Buy Comcast TOTAL • Ticker ANF BBY CMCSA Value $295,581 602,924 304,706 $1,203,211 Portfolio Weighting (bps) 266 543 275 1084 Class voted to reduce our position by 303 bps or 50 bps underweight the S&P 500 Our Proposal Company Abercrombie & Fitch Best Buy Comcast McDonald's TOTAL Current Weight (bps) 266 543 275 0 1084 Current SIM Weighting A&F 25% Buy / Sell Sell all - 266 bps Sell - 275 bps Hold Buy - 238 bps Proposed Weight (bps) 0 268 275 238 781 Proposed SIM Weighting McDonald's 31% Best Buy 50% Comcast 25% Best Buy 34% Comcast 35% Abercrombie & Fitch (ANF) • • ANF offers casual sportswear apparel under Abercrombie & Fitch, abercrombie, Hollister, and RUEHL brands. The company also operates Gilly Hicks branded stores for women ANF targets teenagers and young adults through 1,035 stores in the U.S., Canada, and the United Kingdom, as well as websites and catalogue Abercrombie & Fitch Industry Apparel Stores Current Price (US$) 52-Week Range (US$) Market Capitalization (m, US$) Beta P/E (ttm) Dividend Yield 17.49 13.66 - 80.50 1,520.0 1.33 5.74 3.20% 52-Week Change S&P 500 52-Week Change YTD Return (75.23)% (47.16)% (24.19)% McDo Business Analysis: ANF • Upsides – 4Q results demonstrate that management is actively managing expenses, while at the same time protecting the brand for the long term – On the doorstep of becoming a truly international brand • U.K. expansion is posting strong results – Do not drive business with promotion, it is driven by fashion and in-store experience Preserves brand • Downsides – Visibility is low with no sales or EPS guidance from 4Q earnings call – Selling and macro environment remains weak – Opened 90 new domestic stores in 2008 and seven internationally; and is only planning nine new domestic stores and six international in 2009 – U.S. malls are suffering – Management’s focus is on long-term positioning, while sacrificing shortterm performance Sell Financial Analysis: ANF DuPont Analysis 2008 2007 2006 2005 2004 Margin Asset % Turnover 20.25 1.56 20.25 1.64 19.73 1.75 17.46 1.45 19.61 1.32 Leverage 1.59 1.68 1.91 1.83 1.63 Quarterly Mean Estimates EPS Mean High Low ROE % 31.47 35.18 41.12 31.63 25.7 Q1 Apr 0.04 0.14 -0.15 Annual Mean Estimates EPS Mean High Low FY1 2009 1.79 2.25 1.22 IS RATIOS Gross Profit Margin (%) Net Profit Margin Adjusted (%) Return on Average Total Equity (%) Return on Average Assets (%) 2008 66.97 12.69 31.47 19.76 2007 66.57 12.72 35.18 20.91 2006 66.49 12.29 41.12 21.55 2005 66.36 11.95 31.63 17.32 2004 63.42 11.99 25.7 15.8 BS RATIOS Cash Items/Total Capital (%) Quick Ratio Current Ratio Net Working Capital ($Mil) Asset Turnover 2008 40.07 1.29 2.1 597 1.56 2007 37.7 1.12 2.14 581 1.64 2006 46.41 1.02 1.93 456 1.75 2005 50.61 0.88 1.56 242 1.45 2004 60.75 1.7 2.42 442 1.32 Q2 Jul 0.29 0.48 -0.05 FY2 2010 2.19 3.00 1.38 Q3 Oct 0.42 0.58 0.22 FY3 2011 2.45 2.72 2.20 Q4 Jan 1.02 1.36 0.63 Financial Analysis: ANF • Trend is down for every metric, which we expect to continue through 2009 ABERCROMBIE & FITCH COMPANY (ANF) Price 17.49 1999 2000 2001 2002 2003 2004 2005 2006 2007 StockVal® 2008 2009 2010 16 HI LO ME CU 14 12 14.0 8.5 12.3 8.5 10 04-30-1999 01-31-2009 8 NET PROFIT MARGIN ADJUSTED % 200 HI LO CU GR 110 60 98.6 -79.3 -52.4 -7.2% 40 03-05-1999 03-06-2009 20 TOTAL RETURN % 50 HI LO ME CU 40 30 71.3 17.2 33.1 17.2 20 04-30-1999 01-31-2009 10 RETURN ON EQUITY % 10 HI 5.26 LO 1.03 ME 2.10 CU 3.38 GR 12.9% 4 2 04-30-1999 01-31-2009 1 EARNINGS-PER-SHARE Valuation Analysis: ANF Discounted Cash Flow Analysis Year 2008E Free Cash Flow YOY growth Terminal Value NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 234,683 1,584,968 1,346,119 510,317 1,856,437 12.64% Shares Outstanding $ 17.49 Implied equity value/share $ 20.28 Cash Debt 2010E 2011E 2012E 275,033 17% 221,634 -19% 217,408 -2% 224,711 3% 233,663 4% Terminal Discount Rate = Terminal FCF Growth = 12.0% 3.0% 73% 27% 243,785 4% 2015E 2016E 2017E 2018E 255,880 5% 268,237 5% 281,590 5% 138,492 -51% 91,523.0 Current Price Upside/(Downside) to DCF Forecast 2013E 2014E 2009E 15.97% 50 6,182 Slight upside, but there are better opportunities in the sector over the next twelve months Terminal P/E EV/EBITDA Free Cash Yield Terminal Value 1,584,967.8 5.0 3.18 8.74% Best Buy (BBY) • • • BBY is the leading consumer electronics retailer in the U.S. It operates 923 Best Buy stores, 19 Pacific Sales showrooms, 13 Magnolia Audio Video stores, nine Best Buy Mobile stand-alone stores and seven Geek Squad stand-alone stores in the U.S. The Company also operates 51 Canada Best Buy stores, 131 Future Shop stores in Canada, 160 Five Star stores in China, and one Best Buy China store Best Buy Industry Electronics Stores Current Price (US$) 52-Week Range (US$) Market Capitalization (m, US$) Beta P/E (ttm) Dividend Yield 26.02 16.42 - 48.03 10,220.0 1.33 8.94 1.90% 52-Week Change S&P 500 52-Week Change YTD Return (38.02)% (47.16)% (12.10)% Business Analysis: BBY • Upsides – – – – • Best-of-class U.S. consumer electronics retailer with knowledgeable sales staff and digital product focus Circuit City bankruptcy will likely increase market share Opening stores in Europe, which will bear long-term fruit Initiatives, such as Geek Squad, Best Buy Mobile and Apple Store within-a-store differentiate BBY in a competitive marketplace Downsides – – Consumer spending and Disposable personal income are correlated to stock price, these are likely to get worse before they get any better Management is taking action to cut back investment spending in business, specifically by approximately 50 percent vs. previous year Fewer new store openings both domestically and internationally Financial Analysis: BBY DuPont Analysis 2008 2007 2006 2005 2004 Leverage is an unfavorable method of increasing ROE, unless you’re KKR Margin Asset % Turnover 5.72 3.04 6.01 2.83 5.68 2.78 5.42 2.9 5.41 3 Leverage 2.46 2.22 2.28 2.41 2.66 Annual Mean Estimates EPS Mean High Low ROE % 26.11 23.86 23.49 24.32 26.01 FY1 2009 2.62 2.78 2.5 FY2 2010 2.39 2.95 1.67 IS RATIOS Gross Profit Margin (%) Net Profit Margin Adjusted (%) Return on Average Total Equity (%) Return on Average Assets (%) 2008 23.85 3.49 26.11 10.6 2007 24.4 3.8 23.86 10.75 2006 25.05 3.7 23.49 10.29 2005 23.68 3.49 24.32 10.1 2004 23.92 3.26 26.01 9.79 BS RATIOS Cash Items/Total Capital (%) Quick Ratio Current Ratio Net Working Capital ($Mil) Long-Term Debt/Equity (%) Total Debt/Total Assets (%) Asset Turnover 2008 29.16 0.3 1.08 573 13.98 6.4 3.04 2007 55.57 0.69 1.44 2780 9.51 4.79 2.83 2006 69.71 0.7 1.32 1929 3.39 5.02 2.78 2005 67.27 0.75 1.39 1944 11.87 5.83 2.9 2004 66.6 0.65 1.27 1223 14.09 9.82 3 FY3 2011 2.58 3.02 1.36 Mean EPS expectations indicate contraction in 2009 and 2010 Unfavorable trend given that sales may remain under pressure Financial Analysis: BBY • BBY shows strong returns when consumers are spending and the economy is doing well BEST BUY COMPANY INCORPORATED (BBY) Price 24.71 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 StockVal® 2009 2010 5 HI LO ME CU 4 4.1 2.4 3.4 2.9 3 05-31-1999 11-30-2008 2 NET PROFIT MARGIN ADJUSTED % 290 • This will occur, just not in the near-term, thus we are reducing our exposure HI LO CU GR 180 110 189.5 -51.5 31.7 2.8% 70 03-05-1999 03-06-2009 40 TOTAL RETURN % 40 HI LO ME CU 35 30 38.3 22.1 25.2 27.2 25 05-31-1999 11-30-2008 20 RETURN ON EQUITY % 3.6 HI 3.21 LO 0.52 ME 1.61 CU 2.95 GR 19.9% 2.0 1.2 0.8 05-31-1999 11-30-2008 0.4 EARNINGS-PER-SHARE Valuation Analysis: BBY Discounted Cash Flow Analysis Year 2007 2008 2009 2010 2011 2012 Free Cash Flow YOY growth 861 780 -9% 870 12% 890 2% 1,041 17% 1,208 16% 25,154 6,724 8,859 15,583 5.53% Current Price $ 24.71 Implied equity value/share $ 34.41 Upside/(Downside) to DCF 43% 57% Shares Outstanding (M) Cash Debt 1,438 1,465 Terminal Disc. Rate = Terminal FCF Growth = 11.0% 4.0% 1,303 8% 2014 2015 2016 2017 1,414 8% 1,511 7% 1,618 7% 1,693 5% Terminal P/E EV/EBITDA Free Cash Yield 452.9 Terminal Value 25,154.4 12.2 5.73 6.73% 39.24% Terminal FCF Growth Rate Terminal Value NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield Forecast 2013 0% 1% 2% 3% 4% 5% 8% 57% 71% 89% 114% 152% 215% 9% 37% 47% 59% 76% 99% 134% 10% 21% 28% 37% 49% 64% 85% Discount Rate 11% 12% 9% -2% 14% 2% 20% 7% 29% 13% 39% 21% 53% 30% 13% -11% -8% -4% 1% 6% 13% 14% -19% -16% -13% -10% -5% 0% 15% -25% -23% -21% -18% -15% -11% Valuation Analysis: BBY Absolute Valuation: BBY P/Forward E P/S P/B P/EBITDA P/CF High 46.90 1.53 16.50 32.10 49.60 Low 7.20 0.18 1.60 2.70 4.00 Mean 18.20 0.73 5.10 10.70 14.80 Current 11.80 0.27 2.60 4.40 6.60 Average Target Price $39.15 56.17 48.60 34.64 25.09 $40.73 12-Month Target Price Calculation DCF: $34.41 Multiples: $40.73 Target Target x Multiple per share 15.00 2.61 0.70 81.00 4.50 10.80 8.00 4.33 13.00 1.93 $37.57 Equal Weighting 44.4 percent Upside McDonald’s (MCD) • • MCD franchises and operates McDonald’s restaurants in more than 100 countries globally. The restaurants are either operated by the Company or by franchisees Current focus is on alignment around five factors known as “Plan to Win” – (1) Menu Variety and Beverage Choice; (2) Better Restaurant Operations; (3) Customer Convenience; (4) Everyday Predictable Low Prices; and (5) Ongoing Restaurant Reinvestment McDonald's Industry Restaurants Current Price (US$) 52-Week Range (US$) Market Capitalization (m, US$) Beta P/E (ttm) Dividend Yield 52.12 45.79 - 67.00 58,040.0 0.80 13.85 3.80% 52-Week Change S&P 500 52-Week Change YTD Return (0.29)% (47.16)% (16.19)% Gam Business Analysis: MCD • Upsides – Resilience • – – In November 2008, opened one-thousandth store in China – fastest market to reach that number of stores Opening 1,000 new stores in 2009 in a weak real estate market • – • 165 in United States; 245 in Europe; 475 in Asia-Pacific, Middle East and Africa Large portion of capital expenditures are being spent on store re-imaging, which is improving customer perceptions and driving sales • – One of only two names within the Dow 30 to experience stock price appreciation in 2008 7,000 McCafe’s by mid-2009 and these investment projects are meeting management’s expectations Negative correlation with Consumer Confidence and Consumer Sentiment; and no correlation with Unemployment and Disposable Personal Income Downsides – – Commodity markets are volatile, which could impact suppliers’ prices FX volatility has made it nearly impossible to predict the potential impact with much certainty • FX negatively impacted fourth quarter 2008 EPS by 7 cents – all due to the strengthening dollar McDonald’s Comparable-Store Sales and Operating Income Growth U.S. Europe Asia Pacific, Middle East and Africa Change in Comparable Restaurant Sales 4th Quarter 5.0% 7.6% 10.0% Change in Comparable Restaurant Sales 2008 4.0% 8.5% 9.0% Operating Income Growth for Quarter 11.0% 13.0% 38.0% Operating Income Growth for 2008 8.0% 17.0% 28.0% Financial Analysis: MCD DuPont Analysis 2008 2007 2006 2005 2004 ROE increases largely driven by expanding profit margins Margin Asset % Turnover 28.4 0.81 17.51 0.78 21.83 0.71 21.03 0.66 19.9 0.67 Leverage 2.02 1.9 1.93 1.97 2.05 ROE % 29.34 23.05 19.39 17.16 18.78 Annual Mean Estimates EPS Mean High Low FY1 2009 3.84 3.99 3.68 IS RATIOS Gross Profit Margin (%) Net Profit Margin Adjusted (%) Return on Average Total Equity (%) Return on Average Assets (%) 2008 36.73 17.87 29.34 14.53 2007 34.69 15.55 23.05 12.14 2006 33.18 14.2 19.39 10.07 2005 32.31 13.17 17.16 8.71 2004 33 13.74 18.78 9.16 BS RATIOS Cash Items/Total Capital (%) Quick Ratio Current Ratio Net Working Capital ($Mil) Asset Turnover 2008 8.75 1.18 1.39 980 0.81 2007 8.77 0.67 0.8 -917 0.78 2006 8.92 0.99 1.76 2241 0.71 2005 17.69 1.23 1.51 2111 0.66 2004 6.12 0.6 0.81 -663 0.67 FY2 2010 4.19 4.38 4.00 FY3 2011 4.52 4.73 4.24 Mean expectations indicate a 3-Year EPS CAGR of 8.5 percent MCD is generating more earnings from its assets Financial Analysis: MCD • Metrics are all trending upwards MCDONALDS CORPORATION (MCD) Price 52.12 1999 2000 2001 2002 2003 2004 2005 2007 2008 2009 2010 18 HI LO ME CU 16 • Profit margins and Earnings-per-share are hitting 10-year highs amidst the economic slowdown 2006 StockVal® 14 17.9 10.9 13.7 17.9 12 03-31-1999 12-31-2008 10 NET PROFIT MARGIN ADJUSTED % 160 HI LO CU GR 100 60 30 51.4 -71.0 24.6 2.2% 03-05-1999 03-06-2009 20 TOTAL RETURN % 36 HI LO ME CU 30 24 30.3 15.1 19.2 30.3 18 03-31-1999 12-31-2008 12 RETURN ON EQUITY % 10 HI 3.67 LO 1.29 ME 1.51 CU 3.67 GR 11.3% 4 2 03-31-1999 12-31-2008 1 EARNINGS-PER-SHARE Valuation Analysis: MCD Discounted Cash Flow Analysis Year 2009E 2010E 2011E 2012E 2013E Forecast 2014E 2015E Free Cash Flow YOY growth 5,266 5,068 -4% 5,654 12% 7,011 24% 8,086 15% 9,242 14% Terminal Value NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 156,531 47,883 36,113 83,996 6.27% Shares Outstanding 1,200.0 Current Price $ 52.50 Implied equity value/share $ 70.00 Upside/(Downside) to DCF 33.33% Cash Debt 2,063 10,816 57% 43% Terminal Discount Rate = Terminal FCF Growth = 13.0% 3.0% 10,519 14% 2016 2017E 2018E 2019E 11,782 12% 12,978 10% 14,170 9% 15,197 7% Terminal P/E EV/EBITDA Free Cash Yield Terminal Value 156,530.5 10.6 7.03 9.71% Valuation Analysis: MCD Terminal Discount rate Sensitivity Table for DCF 10% 10.50% 11% 11.50% 12% 12.50% 13% 13.50% 14% 5% 4.50% 149.85% 134.47% 125.14% 112.95% 104.66% 94.84% 87.42% 79.42% 72.73% 66.12% 60.07% 54.56% 49.05% 44.42% 39.38% 35.46% 30.83% 27.49% Terminal FCF Growth 4% 3.50% 3% 121.66% 110.82% 101.53% 102.64% 93.80% 86.14% 86.43% 79.14% 72.77% 72.48% 66.41% 61.05% 60.35% 55.25% 50.71% 49.71% 45.39% 41.53% 40.31% 36.64% 33.33% 31.96% 28.81% 25.95% 24.49% 21.77% 19.30% 2.50% 93.48% 79.44% 67.14% 56.29% 46.66% 38.06% 30.33% 23.36% 17.04% 2% 86.44% 73.52% 62.14% 52.03% 43.01% 34.91% 27.61% 20.99% 14.98% Valuation Analysis: MCD Comparative Multiples Analysis Absolute Valuation P/Forward E PEG Ratio P/Adjusted Cash Flow P/Sales P/EBITDA High Low Mean Current Target Multiple 33.70 2.80 25.00 5.36 18.50 8.90 1.00 6.00 1.13 5.20 15.70 1.80 12.60 2.60 9.00 13.50 1.50 11.00 2.54 7.50 15.70 1.80 12.60 2.60 9.00 Target x Per Share Target Price 4.52 35.00 5.19 21.60 7.00 $70.96 63.00 65.39 56.16 63.00 Average $63.70 12-Month Target Price Calculation DCF: $70.00 Multiples: $63.70 $66.85 Equal Weighting 27.3 percent Upside Summary • Buy: – 238 bps of McDonald’s • Sell: – Entire position in Abercrombie & Fitch – 275 bps of Best Buy What questions do you have? GameStop (GME) • • GameStop is the world's largest video game and entertainment software retailer, offering new and used video games The company operates 6,207 retail stores in 17 countries worldwide. The company also operates two e-commerce sites, GameStop.com and EBgames.com, and publishes Game Informer magazine, a leading multi-platform video game publication GameStop Industry Electronics Retail Current Price (US$) 52-Week Range (US$) Market Capitalization (m, US$) Beta P/E (ttm) Dividend Yield 22.38 16.91 - 59.13 3,670.0 1.40 10.54 0.00% 52-Week Change S&P 500 52-Week Change (47.56)% (47.16)% Business Analysis: GME • Upsides – – – – • New hardware sales grew 29 percent in January, led by Nintendo’s WII, DS and Microsoft’s Xbox 260 Business model set up so consumers trade in old video games and immediately purchase new games GameStop provides the currency, attractive in tough economy Recently acquired Micromania, the largest retailer of video games in France with 332 stores and now have an extremely well positioned company in the second largest European market Based on GameStop's view that the U.S. and European markets each have a potential to absorb approximately 7,000 stores, we believe the market is far from saturated Downsides – Amazon just announced it will be introducing a competing trade-in video game platform via the internet • • – GameStop’s CEO says, "...While customers wanted to buy a new game, say, Killzone 2, they weren't going to wait the week or two weeks it took to get the credit, then buy Killzone 2. They want Killzone 2 the day it comes out. They need the money and the credit right now." Consumers have an immediacy for currency when they want a video game, Amazon’s platform does not provide that Potential impact of lower consumer spending, although correlation is only .09 with Disposable Personal Income Analysis of New Used-Game Competition Super Smash Bros Brawl Street Fighter IV Skate 2 Call of Duty: World at War Final Fronts Mario Kart DS Wii PS3 360 PS2 DS Trade-in Values Amazon.com GameStop.com $22.00 $20.00 33.00 30.00 26.50 24.00 18.50 17.00 16.50 15.00 Financial Analysis: GME DuPont Analysis 2008 2007 2006 2005 2004 Margin Asset % Turnover 7.09 1.99 6.37 1.67 6.16 1.57 5.48 2.03 6.7 1.85 Annual Mean Estimates EPS Mean High Low FY1 2009 2.4 2.41 2.37 Leverage 2.2 2.56 2.37 1.6 1.5 ROE % 18.31 13.36 13.84 11.32 11.11 FY2 2010 2.84 3 2.7 FY3 2011 2.97 3.1 2.71 ROE is growing, mostly driven by profit margins and higher turnover Leverage is declining, which is good in a tough economic environment Mean EPS expectations are increasing steadily through 2011 Financial Analysis: GME • Profit margin increasing as revenue shifts towards used games • Total return trending upward • Return on equity and Earnings-per-share have stayed strong during the recession GAMESTOP CORPORATION (GME) Price 22.38 1999 2000 2001 2002 2003 2004 2005 2006 StockVal® 2007 2008 2009 2010 6 HI LO ME CU 4 4.5 -1.2 3.4 4.4 2 01-31-2001 10-31-2008 0 NET PROFIT MARGIN ADJUSTED % 630 HI 524.2 LO -60.2 CU 124.9 GR 12.2% 290 140 60 02-15-2002 03-06-2009 30 TOTAL RETURN % 40 HI LO ME CU 32 24 100.0 9.5 12.2 17.9 16 01-31-2001 10-31-2008 8 RETURN ON EQUITY % 3 HI LO ME CU GR 2 1 2.17 -0.13 0.57 2.13 NMN 0 01-31-2001 10-31-2008 -1 EARNINGS-PER-SHARE Valuation Analysis: GME Discounted Cash Flow Analysis DCF Valuation 3/7/2009 Terminal Discount Rate = Terminal FCF Growth = Ticker: GME Bryan Chard 11.5% 3.5% Forecast Year Revenue 2009E 8,800,000 % Growth Operating Income Operating Margin Interest - net Interest % of Sales Taxes Tax Rate Net Income % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow YOY growth 9,680,000 10.00% 660,000 7.50% 46,640 0.53% 220,810 36.0% 392,550 % Growth Add Depreciation/Amort 2010E 750,200 7.75% 51,304 0.53% 251,603 36.0% 447,293 2011E 10,502,800 8.50% 813,967 7.75% 55,665 0.53% 272,989 36.0% 485,313 2012E 11,237,996 7.00% 865,326 7.70% 55,665 0.50% 291,478 36.0% 518,183 2013E 11,968,466 6.50% 897,635 7.50% 55,665 0.47% 303,109 36.0% 538,861 2014E 12,686,574 6.00% 926,120 7.30% 55,665 0.44% 313,364 36.0% 557,091 Terminal 2015E 2016E 13,384,335 14,053,552 5.50% 950,288 7.10% 55,665 0.42% 322,064 36.0% 572,559 5.00% 969,695 6.90% 55,665 0.40% 329,051 36.0% 584,979 2017E 14,685,962 4.50% 983,959 6.70% 55,665 0.38% 334,186 36.0% 594,109 2018E 15,273,400 4.00% 992,771 6.50% 55,665 0.36% 337,358 36.0% 599,748 2019E 15,807,969 3.50% 1,027,518 Value Terminal Value NPV of free cash flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 8,558,233 3,270,135 2,317,852 5,587,987 6.37% Shares Outstanding 167,995.0 6.50% 55,665 0.35% 349,867 Current Price $ 22.38 Implied equity value/share $ 33.26 36.0% 621,986 14% 9% 9% 8% 7% 6% 5% 4% 4% 4% 130,270 145,200 157,542 168,570 179,527 190,299 200,765 210,803 220,289 229,101 237,120 1.48% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 39,520 8,268 23,760 27,903 28,095 29,921 31,716 33,461 35,134 36,715 38,184 0.09% 0.25% 0.27% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 175,000 145,200 157,542 168,570 179,527 190,299 200,765 210,803 220,289 229,101 237,120 1.99% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 1.50% 356,088 471,053 513,216 546,278 568,782 588,808 606,020 620,113 630,823 637,931 661,506 32% 9% 6% 4% 4% 3% 2% 2% 1% 4% Upside/(Downside) to DCF 48.63% Valuation Analysis: GME 80.0% 70.0% Average Upside 34.7% Upside 60.0% 50.0% 13% Terminal Discount with 2.5% Terminal FCF Growth 21.2% Upside 40.0% 30.0% 20.0% 10.5% 11.0% 11.5% 12.0% 12.5% 13.0% 13.5% 10.0% 0.0% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% MCD 5-Yr Price Performance