Property Tax Administration

advertisement

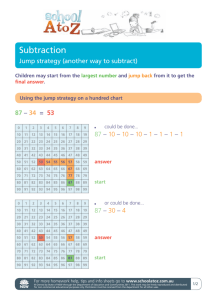

Property Tax Administration Tax Districts District Tax Calculation Assessment Calculation of Tax Obligations Next page QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. Jump to first page QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. Fire Districts Jump to first page QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. School Districts Jump to first page QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. Waste Management Districts Jump to first page Jump to first page QuickTime™ and a TIFF (Uncompressed) decompressor are needed to see this picture. Jump to first page Jump to first page District Tax Levy • Compute tax base (add up the assessed values of all the taxable real property in the district = $100 million). • Set the budget ($2.5 million) • Subtract intergovernmental aid ($1M) • Divide the remainder ($1.5 million) by the tax base ($100 million) to calculate the statutory property tax rate = .015 or 1.5 percent or 15 mills Jump to first page Mill Levy Property tax rate. A mill is equal to $1.00 of tax for each $1,000 of assessment, or .1 percent. To calculate the property tax multiply the assessment of the property by the mill rate and then divide by 1,000. For example, a property with an statutory assessed value of $500,000 located in a municipality with a mill rate of 10 mills would have a property tax bill of $5,000.00 per year Jump to first page Rate Based Systems • Specify a Mill Rate (or Percentage Tax Rate) • Apply to tax base • Fit budget to anticipated revenues • Propose a change in tax rate consistent with spending plans Jump to first page Rate Based Systems • Specify a Mill Rate (or Percentage Tax Rate, e.g., 15 or 1.5%) • Apply to tax base • Fit budget to anticipated revenues • Propose a change in tax rate consistent with spending plans Jump to first page Rate Based Systems • Specify a Mill Rate (or Percentage Tax Rate, e.g., 15 or 1.5%) • Apply to tax base ($100M = $1.5M) • Fit budget to anticipated revenues • Propose a change in tax rate consistent with spending plans Jump to first page Rate Based Systems • Specify a Mill Rate (or Percentage Tax Rate, e.g., 15 or 1.5%) • Apply to tax base ($100M = $1.5M) • Fit budget to anticipated revenues ($2.5M = $1M + $1.5M) • Propose a change in tax rate consistent with spending plans Jump to first page Rate Based Systems • Specify a Mill Rate (or Percentage Tax Rate, e.g., 15 or 1.5%) • Apply to tax base ($100M = $1.5M) • Fit budget to anticipated revenues ($2.5M = $1M + $1.5M) • Propose a change in tax rate consistent with spending plans (if necessary) Jump to first page Assessment • True market value • Method of comparables • Econometric (hedonic pricing) assessment* • Book (acquisition cost minus depreciation), replacement cost, cash flows Residential Real Estate Commercial Real Estate *Accuracy is a function of frequency Jump to first page Proportional Assessment • Usually expressed as as proportion of market value • Often used to discriminate in favor of certain property types • Other statutory standards Oregon = AV 1994 plus 3% Per annum = 1.65(AV 1994), or MV, whichever is less, in FY2011 Jump to first page Jump to first page Statutory vs Effective Property Tax rates • Property tax bill is calculated by multiplying the sum of tax rates that apply to the property by the property’s AV. • The effective tax rate is found by dividing the tax bill by MV Jump to first page Statutory vs Effective Property Tax rates • Property tax bill is calculated by multiplying the sum of tax rates that apply to the property by the property’s AV. • The effective tax rate is found by dividing the tax bill by MV (a better measure might take account of the MV of all the property in a jurisdiction and not just the taxable property). Jump to first page Jump to first page Thought Questions • In a levy-based system, what happens to tax rates if you add to the tax base? To a district’s revenues? What happens to your tax bill if your neighbor’s property increases in value and yours doesn’t? • In a rate-based system, what happens to tax rates if you add to the tax base? To a district’s revenues? What happens to your tax bill if your neighbor’s property increases in value and yours doesn’t? Jump to first page