2014 SCO Supplier Education Presentation

advertisement

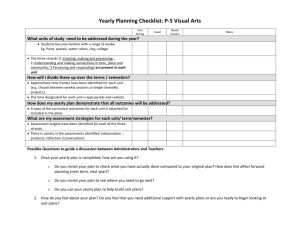

2014 SCO Supplier Education Presentation Introduction and Background Items Addressed • Introduction and Background • SCO Auction Process • Delivery Obligation - Demand and Supply Curves • Capacity Portfolio and Required Assignment • Ohio Production / City Gate Supply • Annual Cash Out / Reconciliation • Statewide Btu Value • CHOICE / SCO Supplier Payments • CHOICE / SCO Customer Eligibility • CHOICE / SCO Customer Billing • CHOICE / SCO Reconciliation Rider • Website information • Contact Information 2 Introduction and Background Columbia SCO Auctions • Settlement extends through March 31, 2018 • April 1, 2012 through March 31, 2013 SCO Auction – Five suppliers awarded a total of 16 tranches – Retail Price Adjustment of $1.53 added to NYMEX final settlement price each month • April 1, 2013 through March 31, 2014 SCO Auction – Six suppliers awarded a total of 16 tranches – Retail Price Adjustment of $1.29 added to NYMEX final settlement price each month 3 SCO Auction Process The Nature of the SCO Arrangement • Winning Standard CHOICE Offer (“SCO”) Suppliers will be allocated CHOICE eligible customers (not already with a CHOICE Supplier) as well as a pro rata share of the total estimated Default Sales Service (“DSS”) demand based on the number of tranches supplied by each SCO Supplier. DSS includes transition customers, those customers not eligible to participate in the CHOICE program or a Governmental Aggregation Program, and PIPP customers. • Columbia will use its best efforts to establish relatively equivalent tranches allocated based on revenue class, annual demand, PSP and credit rating. Since the peak day quantities for each tranche by PSP will be based on the assigned customer demand, the capacity allocation will vary to a certain extent. • Monthly allocation of newly eligible SCO customers to SCO Suppliers will be done by random assignment by PSP, based on the number of tranches supplied by each SCO Supplier. • The purpose of the auction is to secure firm supply for those customers falling under the SCO • Columbia will release Firm Transportation and Firm Storage upstream pipeline capacity to SCO Suppliers for their use • Firm gas supply will be delivered by SCO Suppliers every day to the Columbia city gates, and will be nominated on Aviator, Columbia’s on-system scheduling website 4 SCO Auction Process The Nature of the SCO Arrangement (Continued) • The daily delivery volumes will be determined via Demand and Supply Curves provided by Columbia each month • SCO Suppliers will be credited with and pay for volumes received under the peaking service that Columbia provides, using pipeline transportation and storage contracts that it retains, under the annual true-up mechanism • Each month, Columbia will pay SCO Suppliers the SCO Price for gas consumed by SCO Customers assigned to that Supplier as well as a pro rata share of the DSS consumption in that billing cycle less costs for local gas purchase requirement, etc. • A true up mechanism is used to balance the volumes paid for by Columbia with the annual volumes delivered by the SCO Suppliers including the local gas purchase requirement. • The SCO Supplier’s name and phone number will appear on the Customer’s invoice. • Suppliers must agree to sell and assign to Columbia the SCO accounts receivable and all related security and collections with respect to the receivables and will grant to Columbia a first priority security interest in all of SCO Supplier’s right, title and interest in and to all SCO accounts receivable. This does not apply to the DSS volumes. 5 SCO Auction Process Enrollment and Data Files • Upon completion of the allocation process, SCO Suppliers will be provided with specific customer information including, but not limited to, customer name, account number, billed usage, billed charges, enrollments and drops. • All SCO Suppliers must utilize Columbia’s internet-based website in order to receive file transactions for customer billing and enrollment information. 6 SCO Auction Process Timing of SCO Auction (Program Outline Section 8) • Please refer to the Timeline for the 2014 SCO Auction located on the website for important dates and deadlines. • In mid-March, the capacity allocation process for April 2014 business will take place • SCO gas supply will begin flowing to Columbia’s city gates on April 1, 2014 and continue for the twelve month period ending March 31, 2015 7 SCO Auction Process SCO Auction Process (Program Outline Section 9) • For bidding purposes, Columbia’s SCO supply requirements will be divided into 16 “tranches” of demand – At the outset, each tranche will contain comparable volumetric demand, released capacity and delivery location requirements – The current forecast of total SCO Customer demand (including DSS) is 84 Bcf / year for an average of 5.3 Bcf / year per tranche. This is subject to change. – A bidder may choose to bid on up to 4 tranches – Bidders that are affiliated with each other or have part ownership in other bidders will collectively be limited to bidding on 4 tranches in total 8 SCO Auction Process SCO Auction Process (Continued) • World Energy will perform as the outside auctioneer for this SCO Auction • Bidding will occur over the internet using World Energy’s web based auction system • A “descending clock” or “descending price” approach will be used – A pre-established price will be used for bidding in the initial round – The price being bid represents the “Retail Price Adjustment” or “RPA”, which will be added to the NYMEX final settlement price each month to determine the monthly SCO Price – During the bidding rounds, bidders will bid the number of tranches they would like to serve at the price announced by the auctioneer – A report period will follow each bid round – Assuming that more than sixteen tranches in total are bid in round one, the process will move on to round two, with a new, lower price announced by the auctioneer 9 SCO Auction Process SCO Auction Process (Continued) – A bidder may reduce the number of tranches that they bid from one round to the next, but are not allowed to increase the number of tranches bid from one round to the next – The process continues, with each round opening at a lower price until exactly 16 tranches are bid, in which case, the auction is over – If less than 16 tranches are bid in a round • The auction bid price will move back to the last price at which more than 16 tranches were bid less one cent • Rounds will continue with only one cent decrements in the price in each round, until exactly 16 tranches are bid • If fewer than 16 tranches are bid in a round during this phase of the auction, then the immediately prior round, with bids in excess of 16, will be considered the final round – Because there will be more than 16 tranches awarded in this case, the size of each tranche will be reduced accordingly 10 SCO Auction Process SCO Auction Process (Continued) • Bidders will not see bids submitted by others • Neither the number of bids or the number of tranches bid will be revealed during the auction rounds • All bids submitted throughout the process are binding • Following the auction, the Staff of the Public Utilities Commission of Ohio (PUCO) will submit the results of the Auction to the Commission for its approval • Names of successful bidders shall be kept confidential until authorized by the PUCO to be made public 11 SCO Auction Process SCO Gas Price (Program Outline Section 10) • The SCO Price will be the final NYMEX settlement price for each month plus the RPA resulting from the auction – For example, • If the NYMEX final settlement price is $3.524 per Dth, and • And the RPA is $1.88, then • The SCO Price to be paid will be $5.404 per Mcf • SCO Customers will receive a billing cycle invoice based on an SCO Price of $0.5404 per Ccf – Note that part of the role of the RPA is to convert the NYMEX Dth price to an Mcf price and ultimately, to a Ccf price on the SCO Customer bills. This includes the impact of Columbia’s LAUF. – An SCO Supplier’s payment from Columbia will be based on multiplying the SCO Price by the consumption of the customers allocated to the SCO Supplier plus the SCO Supplier’s pro rata share of the total volume consumed by the DSS Customers in that billing cycle 12 SCO Auction Process SCO Supplier Qualifications (Program Outline Section 12) • Potential bidders must be certified by the PUCO in order to supply competitive retail natural gas service in the State of Ohio. This can be a lengthy process. Please refer to the PUCO website for pertinent information. • Potential bidders must submit a completed Retail Natural Gas Suppliers Registration Application to Columbia by the deadline set forth in the timeline, that includes – Company and contact information – Financial information for credit review and $50 credit evaluation fee – Executed confidentiality agreement related to the Credit Process • Applicant must submit a completed Bidder Registration Form to Columbia by the deadline set forth in the timeline, that includes – Designation of the number of tranches on which the applicant wishes to be able to bid – Required financial security – Various certifications and acknowledgements as detailed in the Bidder Registration form • Acknowledge receipt of auction rules and procedures and agree to abide by those rules • Acknowledge receipt of forecasted supply requirement data • Certify whether bidder has any affiliate companies also bidding • Acknowledge that if determined to be one of the winning bidders, the applicant will sign the SCO Supplier Agreement • Applicant must be certified at this time and provide its certification number. 13 SCO Auction Process SCO Supplier Information and Education (Program Outline Section 13) • Documents are available on website www.columbiasuppliers.com under Columbia Gas of Ohio Auctions: April 2014 – March 2015 (SCO) • Additional documents will be posted as they become available • On-line Auction Preview / Trial Auction with World Energy held on the date set forth in the timeline 14 SCO Auction Process SCO Supplier Agreement (Program Outline Section 14) • The SCO Supplier Agreement is posted on the website • The Agreement must be signed by a winning bidder and provided to Columbia within one week of the approval of the RPA by the Commission • $250 set up fee required for each new supplier • The SCO Supplier agrees to sell and assign to Columbia the SCO accounts receivable and all related security and collections with respect to the receivables and will grant to Columbia a first priority security interest in all of SCO Supplier’s right, title and interest in and to all SCO accounts receivable. This does not apply to the DSS volumes. • The SCO Supplier must be CRNGS certified by the PUCO and maintain that certification during the period in which the SCO Supplier serves in that capacity. 15 SCO Auction Process SCO Supplier Security Requirements (Program Outline Section 15) • Through the Application process, potential bidders will provide financial data to Columbia for purposes of determining if, and to what extent, Columbia will extend unsecured credit • Columbia will then notify the applicant of any unsecured credit being extended • In the Bidder Registration process, potential bidders will compare the initial financial security requirement per tranche, times the number of tranches they select to bid on, with any unsecured credit level communicated to them by Columbia, to determine the level, if any, of financial security to provide to Columbia at that time • The initial security requirements per tranche shall include: – the cost of three months of released capacity demand charges – an amount representing an average month’s incremental gas cost exposure – the sum of the exposures above multiplied by 150% to account for the additional volumes that could be assigned to the SCO Supplier in the case of another supplier’s default – Based on current tranche size and currently effective pipeline demand rates, that amount will be $2.23 Million per tranche. This security requirement is subject to change. 16 SCO Auction Process SCO Supplier Security Requirements (Continued) • Security must be pre-approved for form and content by Columbia and may include cash, letter of credit, or parent guaranty from approved credit support providers • If a bidder becomes an SCO Supplier, ongoing credit evaluations may be conducted from time to time by Columbia to determine if the level of security provided is appropriate • Letter of Credit and Deposit for SCO Suppliers – In addition to any security required by the process described above, by March 1 following the auction, successful bidders will provide a letter of credit to Columbia in an amount equal to fifty cents per Mcf times the forecasted annual supply requirements for those tranches won by each bidder. In the event of default by a Supplier, any money Columbia is able to collect under the letter of credit with the defaulting Supplier will be allocated to replacement Suppliers on a pro rata basis. – Suppliers shall also provide to Columbia by March 1 following the auction, a cash deposit of six cents per Mcf multiplied by the forecasted annual supply requirements for those tranches won by each bidder. This will be used to meet supply default expenses incurred by Columbia and unused funds will be transferred to the CSRR at the end of the respective program year. 17 SCO Auction Process CHOICE/SCO Supplier Failure to Perform (Program Section 16) • In the event of an SCO or CHOICE Supplier default – If not cured by defaulting Supplier within five days, Supplier will be terminated from further activity within the CHOICE and SCO programs – Columbia will recall the released capacity and insure continuity of service to customers in the short term • Customer quantities that are not served due to a Supplier default will be allocated to remaining SCO Suppliers, in concert with the monthly development of demand curves, in the next available monthly cycle. – Non-defaulting SCO Suppliers will receive their pro rata share of the SCO customers by random assignment, by PSP, and a pro rata share of the estimated DSS demand, by PSP, based on the number of tranches served by the non-defaulting SCO Supplier – Such allocations to SCO Suppliers will be capped at 150% of each SCO Supplier’s initial annual delivery requirement measured as of April 1 following the auction – Columbia will assume supply responsibility for any unallocated requirements that result from implementation of the 150% limit 18 Terms and Definitions Terms used herein • Pipeline Scheduling Point (PSP) – a single delivery point or set of delivery points grouped or designated by an upstream pipeline for purposes of scheduling gas supplies for delivery by such upstream pipeline • Demand Curve – an estimate of CHOICE or SCO customer demand provided monthly by Columbia. Establishes the CHOICE/SCO Supplier’s supply delivery obligation to Columbia by PSP • Supply Curve – establishes: a) the requirement for supplies at non-TCO PODs or b) supply requirements of an upstream pipeline at an upstream POD with another pipeline 19 System Map Sandusky PSP Parma PSP Maumee New Castle PSP Toledo PSP Alliance PSP Dungannon Lima PSP Ohio Misc PSP Ohio Valley PSP Columbus PSP Dayton PSP Mansfield PSP Portsmouth PSP 20 Delivery Obligation – Demand and Supply Curves 1. Demand Curves (Program Outline Section 27) a. b. Specify the total delivery obligation for each PSP. Developed based on the most recent 12 months normalized demand of participating customers • CHOICE Demand Curves developed based on actual customers of the CHOICE Suppliers • SCO Demand Curves developed based on actual customers allocated to the SCO Suppliers plus a pro rata share of the DSS customers, based on the number of awarded tranches. • Each SCO Supplier will receive a Demand Curve for each PSP and each CHOICE Supplier will receive a Demand Curve for each PSP in which they have customers. • Should a Supplier be both a CHOICE Supplier and an SCO Supplier, the demand curves and supply curves will be combined into a single curve with nomination groups by PSP. Define the total confirmed supply that a Supplier must deliver to Columbia each day by PSP • For the months of October through April, the delivery requirements change with temperature. The confirmed deliveries must match the curve specified quantity at the actual temperature posted on Aviator at the end of the day for each PSP. The forecasted temperature may be used as a guideline. • For the months of May though September, the Demand Curves specify a constant volume each day of the month. Thus, there is no matching to actual temperatures required. 21 Delivery Obligation – Demand and Supply Curves Demand Curves (Continued) c. d. e. f. Demand Curves are Updated Monthly Demand Curve Adjustment for Balancing • Daily delivery requirements for the months of October and November are reduced to facilitate balancing of demand uncertainty • Projected under delivered quantities for October and November are delivered to COH in the months of May through August Failure to deliver confirmed volumes equal to Demand Curve specified requirements will result in the assessment of a Noncompliance Charge on the difference between the confirmed volume and required deliveries • Non OFO/OMO days = higher of $10/Dth or 150% of the TCO Daily Index • OFO/OMO days = higher of $30/Dth or 150% of the TCO Daily Index • Applicable pipeline penalties are additive Columbia will provide weather forecasts in the afternoon for the current day in order to provide additional information to the Suppliers for scheduling purposes. 22 Delivery Obligation – Demand Curve Example 23 Delivery Obligation – Demand and Supply Curves 2. Supply Curves (Program Outline Section 27) a. b. c. d. Establishes the delivery obligations/limitations at non-TCO PODs. Developed based on the operational requirements and/or ability of non-TCO PODs to accept supplies. Supply Curves will be provided for deliveries from PEPL to Columbia at Maumee and from Tennessee to TCO at Dungannon and only apply to the PSPs in which the POD is located. Suppliers will only receive a Supply Curve if they have a delivery obligation in the PSP where the Supply Curve POD is located. Should a Supplier be both a CHOICE Supplier and an SCO Supplier, the supply curves will be combined into a single curve for each location. Each SCO Supplier will receive a copy of each Supply Curve. Each CHOICE Supplier will receive a Supply Curve for each PSP in which they have customers. Supply Curve delivery requirements will be determined based on the Forecasted Temperature for the PSP in which the Supply Curve POD is located • The use of Forecasted Temperatures is necessary because Columbia does not have no-notice capacity similar to TCO FSS/SST that can be assigned to Suppliers 24 Delivery Obligation – Demand and Supply Curves Supply Curves (Continued) e. Volumes scheduled into Columbia pursuant to a Supply Curve can be allocated to CHOICE/SCO requirements, TS customers, sold to another supplier, or a combination • • • f. g. If a CHOICE/SCO Supplier is also a TS customer supplier, it may allocate Supply Curve deliveries to a TS customer or pool All daily Supply Curve volumes allocated to CHOICE/SCO will be part of the Supplier’s daily Demand Curve Requirements for the PSP in which the Supply Curve is located Supply Curve required deliveries cannot be assigned to another party except for those situations when the CHOICE/SCO Supplier has named an alternate Supplier as its agent for purposes of meeting the Supply Curve delivery requirements Columbia may request intra-day changes to these nominations if it experiences sufficient differences between forecasted and actual temperatures to risk operational problems Maumee Gate Supply Curve: delivery volume to Maumee must match the curve • • • • Deliveries from PEPL to Columbia at the Maumee Gate are required operationally during the winter months Confirmed deliveries at the Maumee Gate are required to match the Supply Curve requirements at the Forecasted Temperature Assigned PEPL capacity in total will be equal to the maximum (plateau) delivery requirement for the Maumee Gate No Maumee Gate deliveries are allowed during the summer months 25 Delivery Obligation – Demand and Supply Curves Supply Curves (Continued) h. Dungannon Supply Curves: minimum required volume • Deliveries from Tennessee to TCO at Dungannon are required operationally at colder temperatures for TCO to meet city gate obligations downstream of Dungannon in the Alliance PSP. Deliveries at Dungannon are not applied directly to any Demand Curve as they must be scheduled on TCO for delivery to Columbia. • Deliveries from Tennessee to TCO are required beginning at Forecasted Temperatures of approximately 42°F • There are limited secondary delivery rights on the Tennessee contract containing Dungannon as the primary POD i. Failure to deliver volumes as specified shall result in the assessment of the same Noncompliance charges that apply to demand curves. 26 Capacity Portfolio and Required Assignment Columbia Gas of Ohio, Inc. Pipeline and Ohio Production Contracts City Gate Columbia Transmission Panhandle Eastern Rate Schedule FSS-MDQ FSS-SCQ SST FTS PSP All All 6&9 15 All but 15 and 4 4 Demand Rate* $1.5090 $0.0289 $5.3510 $3.9630 $5.5210 $5.5210 $5.5210 Upstream Pipeline Notes: N/A N/A TCO FSS Columbia Gulf Tennessee (Broad Run) Columbia Gulf Tennessee (Dungannon) FS-MDQ FS-SCQ EFT EFT EFT 1 N/A All Upstream Columbia Gulf Transmission FTS-1 Point of Delivery TCO-Leach, KY $4.2917 Receipt Point Rayne, LA Tennessee Gas Pipeline FT-A TCO-Broad Run, KY TCO-Dungannon, OH $5.7798 $8.7610 500 Leg Pool 500 Leg Pool FT PEPL-Bourbon, IN $0.1326 Patterson-ANR Ohio Production Trunkline 1 1 1 $2.9700 $0.0354 $3.9000 $13.4300 $0.0885 N/A N/A PEPL FS N/A Trunkline N/A *All rates are subject to change 27 Daily rate Retained by Columbia and used with Peaking Service Released at a daily rate Released at a daily rate Daily rate Capacity Portfolio and Required Assignment Capacity Allocation Process (Program Outline Section 19) 1. Capacity Allocated/Assigned on “Level Playing Field” Basis – Equal percentage levels of storage and FTS assigned to each PSP and equal percentage level of Columbia provided Peaking Service provided in each PSP – Percentages are identical for CHOICE and SCO 2. Capacity Assignment based on Columbia’s peak day demand – The initial capacity assignment will be made effective April 1 following the auction and will be refreshed monthly, i.e. capacity will be released for one month at a time – Releases of TCO capacity will be made by contract with releases to multiple PSPs performed in single release whenever possible – Suppliers may re-release the capacity assigned by Columbia subject to recall by Columbia. Releases of assigned PEPL capacity does not entitle any third party access to Columbia’s distribution system unless such third party has specifically been named as an agent for the releasing Supplier for purposes of meeting that Supplier’s Supply Curve requirements – A re-release of TGP capacity does not alter the Supplier’s responsibility to abide by the delivery requirements of its Dungannon Supply Curve – All costs associated with the released capacity will be paid directly to the pipelines by the CHOICE/SCO Suppliers pursuant to applicable pipelines’ capacity release payment procedures 28 Capacity Portfolio and Required Assignment Capacity Allocation Process (Continued) – 3. 4. Columbia holds certain discounted contracts on PEPL, Trunkline and Tennessee where the utilization of unauthorized alternate points may cause Columbia to incur significant additional costs. Any incremental costs incurred by Columbia as a result of a Supplier or another party to which a Supplier has released the Columbia assigned capacity utilizing an unauthorized alternate point shall be paid by the Supplier. See tariff for full details. Columbia will assign (including peaking services) up to 100% of the design peak day requirements of the Supplier’s customers. – Columbia will retain TCO FSS/SST to provide Standby Service to TS customers that sign up for the service – Columbia shall retain 11,500 Dth of TCO FTS capacity for release/assignment to TS customers If an SCO Supplier is also a CHOICE Supplier, the demand curves, supply curves and the capacity release transactions will be combined where applicable. 29 Capacity Portfolio and Required Assignment Capacity Allocation Process (Continued) 6. Allocation steps followed by Columbia in determining the amount of assets to be assigned by PSP are as follows: i. Overall percentage of capacity Columbia shall assign including the peaking service will be up to 100% of Supplier’s peak day demand. For the 2014-2015 winter, Columbia assigned capacity will equate to approximately 100% of the Supplier’s peak day demand. Supplier should not be required to deliver its own capacity before peaking service is available. ii. Columbia will retain capacity equivalent to approximately 22% of peak day demand to provide Non-Temperature Balancing Services for CHOICE and SCO Suppliers iii. Columbia will assign approximately 55% of the peak day demand as storage. • For the PSP that includes the Maumee Gate the percentage of storage assignment shall include PEPL FS and TCO FSS. iv. Columbia will assign approximately 16% of the peak day demand as FTS • PEPL FTS will be included in the FTS assigned to the Toledo PSP • For the Alliance and Portsmouth PSPs, the TCO FTS assignment shall include Tennessee FT-A as the upstream pipeline • All other TCO FTS assigned shall also have Columbia Gulf FTS-1 assigned as the upstream pipeline v. Capacity that is not able to be assigned under this methodology will be retained by Columbia as Operationally Retained Capacity and be used in providing its Peaking Service vi. Total capacity utilized by Columbia to provide peaking is approximately 29% of peak day demand 30 Capacity Allocation Example for One SCO Tranche Tranche Example November through March TCO FSS MDQ 3045 1,445,102 55.21% Used for Allocation 22 PORTSMOUTH 23-1 TOLEDO 23-3 LIMA 23-4 ALLIANCE 23-5 COLUMBUS 23-6 DAYTON 23-8 MANSFIELD 23-9 OHIO MISC 23N-2 PARMA 23N-7 SANDUSKY 24-35 PITTSBURGH 24-39 NEWCASTLE TOTAL Monthly Demand Chrg Monthly Demand 962 8,577 1,506 1,921 22,211 9,518 4,836 3,203 6,317 2,840 1,707 48 63,646 PEPL FS MDQ 18601 26,667 22 PORTSMOUTH 23-1 TOLEDO 23-3 LIMA 23-4 ALLIANCE 23-5 COLUMBUS 23-6 DAYTON 23-8 MANSFIELD 23-9 OHIO MISC 23N-2 PARMA 23N-7 SANDUSKY 24-35 PITTSBURGH 24-39 NEWCASTLE TOTAL Monthly Demand Chrg Monthly Demand 531 4,467 831 1,061 12,263 5,255 2,670 1,769 3,488 1,568 943 27 34,873 $1.5090 $52,623 PEPL FS SCQ 18601 2,000,000 TCO FSS SCQ 3045 80,441,913 29,558 248,657 46,258 59,061 682,623 292,521 148,626 98,472 194,160 87,283 52,492 1,503 1,941,213 $0.0289 $56,101 PEPL EFT-Stor Nov-Mar 18606 26,338 TCO SST Oct-Mar 3044 1,445,102 531 4,467 831 1,061 12,263 5,255 2,670 1,769 3,488 1,568 943 27 34,873 $5.3510 $186,605 PEPL EFT-Stor Apr-Oct 18606 10,244 TCO SST Apr-Sept 3044 722,551 CGT FTS-1 80061 273,629 266 2,234 416 531 6,132 2,628 1,335 885 1,744 784 472 14 17,441 $0.0000 $0 TCO FTS Percentage 0 283 240 0 3,538 1,516 770 511 1,006 452 272 8 8,596 $4.2917 $36,891 Trunkline FT Nov-Mar 18122 29,223 PEPL EFT 18605 15,000 0.00% 3.29% 15.85% 0.00% 15.85% 15.85% 15.85% 15.85% 15.85% 15.85% 15.85% 15.85% 0 282 239 0 3,520 190 766 -54 1,001 450 271 8 6,673 $5.5210 $36,842 PEPL EFT Nov-Mar 18604 28,662 271 20,325 268 104 370 721 707 271 $2.9700 $805 20,325 $0.0354 $720 268 $3.9000 $1,045 104 $0.0000 $0 370 $13.4300 $4,969 721 $3.9780 $2,868 707 $2.6550 $1,877 31 TCO FTS 80152 238,186 TCO FTS 85154 45,538 15.85% Tenn FT-A 46986 40,000 TCO FTS 82544 38,974 15.85% 157 Tenn FT-A 63440 30,000 TCO FTS 82545 29,231 15.85% 153 312 304 312 $8.7610 $2,733 304 $5.5210 $1,678 1,318 562 1,880 $3.9630 $7,450 157 $5.7798 $907 153 $5.5210 $845 Capacity Allocation Example for One SCO Tranche Total Demand 22 PORTSMOUTH 23-1 TOLEDO 23-3 LIMA 23-4 ALLIANCE 23-5 COLUMBUS 23-6 DAYTON 23-8 MANSFIELD 23-9 OHIO MISC 23N-2 PARMA 23N-7 SANDUSKY 24-35 PITTSBURGH 24-39 NEWCASTLE TOTAL 962 8,577 1,506 1,921 22,211 9,518 4,836 3,203 6,317 2,840 1,707 48 63,646 Total Storage City Gate 531 4,735 831 1,061 12,263 5,255 2,670 1,769 3,488 1,568 943 27 35,141 55.21% Total Transport City Gate 153 1,359 239 304 3,520 1,508 766 508 1,001 450 271 8 10,087 15.85% Total Released Local 684 6,094 1,070 1,365 15,783 6,763 3,436 2,277 4,489 2,018 1,214 35 45,228 71.06% 32 Retained 16 141 25 32 364 156 79 53 104 47 28 1 1,046 1.64% 50 444 78 99 1150 493 250 166 327 147 88 2 3,294 5.18% Peaking 213 1,897 333 425 4,913 2,105 1,070 709 1,397 628 378 11 14,079 22.12% Local+Pk by COH 279 2,482 436 556 6,427 2,754 1,399 928 1,828 822 494 14 18,419 28.94% Total COH 963 8,576 1,506 1,921 22,210 9,517 4,835 3,205 6,317 2,840 1,708 49 63,647 100.00% Capacity Portfolio and Required Assignment System Balancing (Program Outline Section 23) 1. Columbia shall retain approximately 22% of the peak day demand to provide System Balancing – Majority of retained storage will be TCO FSS/SST to balance differences between deliveries by Suppliers (Demand Curve requirements) with the actual demand of the CHOICE/SCO customers – Small portion of retained storage will be PEPL FS/EFT to balance the Maumee Gate 2. CHOICE/SCO customers will be charged a Balancing Charge of $0.27 per Mcf. – All costs incurred by Columbia to provide balancing, along with all balancing revenue received by Columbia, will be charged/credited to the CHOICE/SCO Reconciliation Rider (CSRR) 3. Columbia shall utilize the retained storage assets to provide CHOICE/SCO balancing and to provide its non-firm Banking and Balancing Service for its TS Customers – The daily balancing component of the non-firm Banking and Balancing Service will be reduced or interrupted when the retained assets are required to provide CHOICE/SCO balancing and/or peaking services – All Banking and Balancing fees collected by Columbia will be credited to the CSRR 33 Capacity Portfolio and Required Assignment Storage Management (Program Outline Section 26) Any 2013 SCO Supplier not continuing, or continuing but with a fewer number of tranches, as a Supplier for the 2014 SCO Period must offer for sale to the succeeding SCO Supplier(s) (and the replacement SCO Supplier must purchase) an amount of storage inventory equal to 2% of the SCQ initially assigned per tranche for the 2014 SSO Period. The sale in April 2014 shall be completed using the price formula set forth in the Tariff. 34 Capacity Portfolio and Required Assignment Storage Management (Program Outline Section 26) a. b. c. d. Based on Columbia’s historical planning practices the following minimum storage inventory levels are recommended: Nov. 1 98% Feb. 15 30% Mar. 5 20% Mar. 22 10% Apr. 1 2% Outside the SCO Supplier’s storage inventory purchase requirement stated earlier, all CHOICE and SCO Suppliers have the sole responsibility to fill and manage the storage inventories of the TCO FSS and PEPL FS capacity assigned to them on a monthly basis For the months of October through April, CHOICE/SCO Suppliers shall manage natural gas supply nominations and deliveries to Columbia to match deliveries as specified by their individual Demand Curves at the actual temperatures posted by Columbia through utilization of TCO FSS and SST capacity. Such utilization shall generally consist of adjustments to their FSS/SST nomination at the end of the gas day such that all confirmed supplies delivered to Columbia (including the FSS/SST nomination adjustment) in each PSP match the specified Demand Curve volumes at the actual temperature as posted by Columbia. Each CHOICE and SCO Supplier is solely responsible for ensuring that they have adequate injection and/or withdrawal rights to match their Demand Curve obligations 35 Ohio Production / City Gate Supply Ohio Production (Program Outline Section 25) 1. Columbia purchases certain Ohio gas production in small quantities or to satisfy location-specific customer supply requirements that cannot be served via other means 2. By their nature and/or contractual limitations, these supplies do not lend themselves to assignment to multiple Suppliers 3. The peak day and seasonal supplies associated with Columbia’s purchases of Ohio Production will be utilized to benefit all CHOICE and SSO Suppliers equally a. Columbia will utilize these Ohio Production volumes as a component of its Peaking Service b. Impact of seasonal/annual supplies discussed under Local Gas Purchase Adjustment City Gate Supply 1. Columbia serves the majority of its needs for the city of Brewster under a firm city gate supply arrangement. The minimal size of this requirement does not lend itself to allocation to multiple CHOICE/SCO Suppliers. a. Columbia will utilize these purchases for Brewster as a component of its Peaking Service b. Impact of seasonal/annual supplies discussed under Local Gas Purchase Adjustment 36 Ohio Production / City Gate Supply Local Gas Purchase Adjustment (Program Outline Section 25) 1. Columbia will manage the daily, seasonal and annual supplies provided by the Ohio Production contracts, city gate service for Brewster, and the Operationally Retained capacity. These supplies are sufficiently large to impact system operations. 2. Columbia will manage this system impact by adjusting each Demand Curve equally by a percentage known as the Local Gas Purchase Adjustment 3. Columbia will estimate annually the level of supplies it will purchase under these contracts. This estimate will be converted to a Local Gas Purchase Adjustment that will be used to modify the daily delivery obligations of all Demand Curves equally, i.e. daily deliveries across PSP’s will be reduced equally on a percentage basis 4. Since (a) Columbia will be purchasing these volumes daily; (b) customers will be consuming these volumes daily; (c) all Demand Curves will be adjusted to reflect these volumes; and (d) each Supplier’s monthly payments will reflect the consumption of these supplies, each CHOICE and SCO Supplier will be required to purchase from Columbia the amount of gas represented by the Local Gas Purchase Adjustment each month 5. The amount of gas to be purchased monthly from Columbia shall be known as the Local Gas Purchase Requirement 37 Ohio Production / City Gate Supply Local Gas Purchase Adjustment (Continued) 6. The purchase price for the Local Gas Purchase Requirement shall be the TCO Monthly Index plus a fixed dollar amount per Mcf (“Local Gas Purchase Price”) 7. Columbia shall determine the prospective fixed dollar amount annually, at the same time the Local Gas Adjustment Percentage is determined, by performing a historical analysis of actual purchases. These purchases are normalized, with actual purchase prices applied to the normalized volumes. The demand costs associated with these purchases are also included in the calculation. The resulting costs are then compared to the TCO Monthly Index price weighted by the normalized purchases by month to determine the fixed dollar amount. 8. Actual costs incurred by Columbia for its Local Gas Purchase Requirement, including demand costs, shall be charged to the CSRR. All revenue received from the CHOICE/SCO Suppliers from the Local Gas Purchase Requirement shall be credited to the CSRR. 9. All Local Gas Purchase Requirement purchases shall be included in the annual volume reconciliation process for CHOICE/SCO Suppliers 38 Annual Cash-Out / Reconciliation (Program Outline Section 29) 1. COH will cash out all CHOICE and SCO imbalances annually (April through March) 2. Imbalances represent the difference between the volumes that each Supplier is paid for and the volumes that they deliver. – Imbalances are determined for each PSP – Payment volumes are based on monthly cycle-billing – Deliveries are calculated on calendar months • Deliveries include all confirmed nominations from an upstream pipeline and the Local Gas Purchase Requirement volumes • Confirmed nominations from upstream pipelines will be converted to Mcf utilizing the Statewide BTU conversion factor and adjusted by Columbia’s System-Wide Retention Factor. The Statewide BTU conversion factor will be posted to the website by February 1st. – CHOICE Suppliers will continue to be reconciled under the existing CHOICE reconciliation process • Columbia shall calculate and incorporate an unbilled adjustment into the CHOICE Customer’s consumption determination • Columbia shall continue to incorporate a like-in-kind adjustment for CHOICE Suppliers 39 Annual Cash-Out / Reconciliation (Continued) 3. CHOICE and SCO Suppliers will have two annual cash-out options: – Arithmetic Average Option – the arithmetic average of the monthly cash-out index price for the annual April through March period shall be applied to the difference between the annual payment volumes and the annual deliveries for the same April through March period – Weighted Average Option – the monthly cash-out index price will be applied to the monthly difference between payment volumes and delivered volumes and these monthly results summed at the end of the annual April though March period to determine the annual cashout requirement. Please note that any under delivery that results in a payment due Columbia under this option is subject to the Natural Gas Excise Tax. This tax requirement will not be offset against payments due the Supplier resulting from excess deliveries. – Each CHOICE Supplier elects the option they wish to utilize via its Aggregation Service Agreement. The election continues from year to year unless changed by executing a new Aggregation Service Agreement. SCO Suppliers will elect the option they wish to utilize on the SCO Supplier Agreement. If the SCO Supplier is an existing CHOICE Supplier, its election under the SCO Supplier Agreement must be the same as its existing election under the CHOICE Program. 4. All annual reconciliation adjustments will be run through the CSRR 40 Statewide Btu Value (Program Outline Section 28) 1. The Btu value for CHOICE and SCO processes will be fixed for each April through March period and will apply equally to all PSPs. All Demand Curves and billing statements shall reflect the same Btu value 2. Columbia will provide all CHOICE and potential SCO Suppliers the Btu value to be effective on April 1st of each year no later than February 1st of the same year 41 CHOICE / SCO Supplier Payments CHOICE / SCO Supplier Payments (Program Outline Section 17) • Payments to Suppliers will be made on a net basis • Examples of offsets to CHOICE / SCO Supplier payments include the following: – Local Gas Purchase Charges – Demand Curve Non-Compliance Charges – Credit Evaluation Fees – Annual Reconciliation Charges/Credits • Net payments will be rendered each month, by the 25th day of the month, for the prior month’s activity • Columbia will pay SCO Suppliers the amount billed to their allocated SCO Customers, including sales tax, plus their pro-rata share of the DSS dollars billed each month, less costs and charges owed Columbia • CHOICE Suppliers will be paid for the dollars billed to their CHOICE customers (if Columbia performs dual billing) 42 CHOICE / SCO Supplier Payments Example of CHOICE/SCO Supplier Monthly Payment Timeline Month prior to flow of supplies 15th (1) Monthly CHOICE file closed to new additions, removals or changes th th 16 - 20 Columbia allocates SCO customers and develops monthly demand curves st rd 21 - 23 Columbia provides demand curves to CHOICE and SCO Suppliers st (2) 21 - EOM Columbia determines the assignment of capacity for CHOICE and SCO, and notifies Suppliers of the capacity to be released and the associated offer numbers. Suppliers are required to take the necessary steps to accept the capacity being released by Columbia. Month of Flow 1st 28th - 31st First gas day of flow under new demand curve Last gas day of flow under current demand curve Month Following Flow of Supplies 5th - 23rd Columbia gathers customer billing and flow information for billing purposes 25th (1) Columbia provides payment to CHOICE and SCO Suppliers (1) If this date falls on a w eekend or holiday, the date under this example shall be the immediately preceding business day (2) End of Month (EOM) w hether the 28th, 29th, 30th or 31st 43 CHOICE / SCO Customer Eligibility Customer Eligibility (Program Outline Section 30) CHOICE/SCO Customer Eligibility • All customer accounts using less than 6,000 Mcf per year and all human needs customer accounts using 6,000 Mcf or more per year Transportation Service Customer Eligibility • Non-residential customer accounts using less than 6,000 Mcf/yr that have subscribed to 100% Backup Service. • Non-residential Human Needs customer accounts with operable alternative fuel capabilities that consume 6,000 Mcf or more annually. • Other non-residential customer accounts that consume 6,000 Mcf or more annually. • Asphalt plants and grain dryers with annual usage less than 6,000 Mcf • Public School Districts that were receiving Transportation Service as of October 7, 2009, including any new or existing facility placed into service in any such Public School District prior to March 31, 2013. • A TS customer account that is currently grandfathered and not paying the PIPP or DSM rider as of June 3, 1994, will continue to be grandfathered and will not pay the PIPP or DSM rider after April 1, 2012 whether it defaults to CHOICE or SCO service or elects to remain on Transportation Service. 44 CHOICE / SCO Customer Billing CHOICE / SCO Customer Billing (Program Outline Section 34) • Billing month will be comprised of 21 billing units. • Customers will continue to be billed on a billing cycle basis. There will be no proration of bills to compensate for the variance between calendar month deliveries and billing cycle usage • CHOICE customers will be billed at the monthly effective CHOICE Supplier rate, converted to Ccf (if Columbia performs dual billing) plus sales tax • SCO and DSS Customers will be billed at the monthly effective SCO Price, converted to Ccf. The SCO Customers will be billed sales tax while the DSS Customers will be billed gross receipts tax on the gas supply costs. • CHOICE and SCO Customers are responsible for providing tax exemption certificates. • CHOICE and SCO customers will be subject to all applicable service charges, billing adjustments and riders as set forth in Columbia’s tariff • CHOICE Supplier names will appear on their customers’ bills • For each SCO Customer, the name of the customer’s SCO Supplier will appear on each customer’s bill in the same manner that a customer’s CHOICE Supplier name appears on a CHOICE customer’s bill. SCO Supplier names will not appear on the DSS customer bills. 45 CHOICE / SCO Reconciliation Rider CHOICE / SCO Reconciliation Rider (“CSRR”) (Program Outline Section 39) • CSRR is applicable to CHOICE and SCO customers (including DSS) • Billed monthly on all gas consumed per CHOICE/SCO/DSS customer account • Provides for recovery or pass back of: – Imbalances in gas cost expense and recoveries – Refunds and penalties – Off-System Sales and Capacity Release (OSS/CR) Revenue sharing – Billing Enhancement costs – Six cent cash collateral not required for reimbursement to Columbia for Supplier default costs 46 Website information SCO and Certification information SCO information: http://www.columbiasuppliers.com/ under Columbia Gas of Ohio Auctions: April 2014 – March 2015 (SCO) Certification: http://www.puco.ohio.gov/puco/ and more specifically at http://www.puco.ohio.gov/puco/index.cfm/puco-forms/competitive-retail-naturalgas-provider-forms/ 47 Primary Contacts for SCO/CHOICE Tom Heckathorn 614-460-4996 theckathorn@nisource.com Alan Catron 614-460-6222 acatron@nisource.com Michele Caddell 614-460-6841 mcaddell@nisource.com Kent Koch 614-460-4959 kkoch@nisource.com 48