FinRep Spring 2010 Cash Handling

advertisement

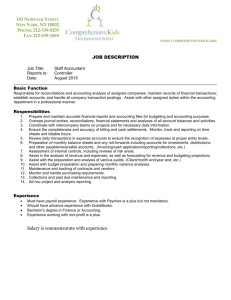

CASH HANDLING BASICS AND UPDATES DAN WUSSLER What is a Cash Collection Point? Any department, event, club or other entity which collects more than $1,000 annually, with the exception of those whose collections occur infrequently and are for the recovery of expenditures such as telephone, copies, etc. All Cash Collection Points must be authorized by the Controller’s Office before collections begin. Cash Handling Training 2 How do you get authorized? Complete a Cash Collection Point Application (TM-01) Submit to Treasury Management for review and approval or recommendations Applications should be submitted at least 4 weeks prior to start of collections Ensure cash handling staff have: ◦ Read and understand the University’s Cash Management Policy ◦ Signed a copy of the Employee Acknowledgement Form (TM-03) Cash Handling Training 3 Before Collections Begin . . . “The Planning Checklist” Departmental Cash Handling Supervisor Develops Plan: Is a Change Fund Needed? How Will Cash be Received (Mail or In Person)? Who Will Collect the Cash? Record the Cash? Who Will Prepare the Deposit? How? Who Will do Reconciliations? Management Review? Is Training Required? Have Departmental Policies & Procedures Been Developed? Departmental P&P Template Cash Handling Training 4 Cash and Equivalents Cash is defined to include: Coins Currency Checks & Money Orders Credit / Debit Cards Electronic Funds Transfers (ACH & Wires) Cash Handling Training 5 Cash Handling Policy Changes OP-D-2-B3 Departments are now required to be re-authorized as Cash Collection Points every three years. OP-D-2-B4 C Cash handling duties should be assigned to different employees for collections, deposit preparation, and reconciliations. If there is a justifiable reason for not doing so, alternative or compensating control procedures must be in place. ◦ (This section regarding segregation of cash handling duties is a clarification of similar requirements in the old policy.) Cash Handling Training 6 Cash Handling Policy Changes OP-D-2-B4 E Deposits are still required to be made daily. Exceptions may be made when collections of currency and coin are less than $100 (no change) or checks total less than $500 (up from $300). However, all collections should still be deposited within five business days, regardless of amount. OP-D-2-B4 G Detailed written procedures for the handling and control of cash collections and change funds are to be developed by the department (not previously specified) and provided to all persons with assigned cash handling responsibilities. Cash Handling Training 7 Cash Handling Policy Changes OP-D-2-B5 B1 ◦ In order to validate the person’s identity, checks received from University students, faculty or staff should have the following information recorded on them: full name, residence address, phone number, and the last eight digits of the individual’s FSU Card number (changed from the last four digits of their SSN). Cash Handling Training 8 Cash Handling Policy Changes OP-D-2-B6 Departments must request permission from the Controller’s Office for an agency to electronically transfer payments into the University’s bank account. ◦ The Controller’s Office will provide the customer with the necessary banking information. Prior to each receipt, departments must provide the Controller’s Office with a completed Notice of Expected Electronic Transmission Form (ET3031). This will facilitate the tracking of the incoming payment and will result in the proper recording of the funds. (This section is a new clarification regarding payments received by EFT, ACH or Wire Transfer.) Cash Handling Training 9 Cash Handling Policy Changes OP-D-2-B6 ◦ Detailed written procedures for the handling and control of cash collections and change funds are to be developed by the department (not previously specified) and provided to all persons with assigned cash handling responsibilities. Cash Handling Training 10 Cash Handling Policy Changes OP-D-2-B8 D ◦ Credit and debit card collections are to be transmitted daily (not previously specified). ◦ A copy of the summary total report along with a University Revenue Deposit form should be forwarded to Student Financial Services within two business days of transmittal (not previously specified). Cash Handling Training 11 Internal Controls Basics of Cash Handling Segregation of Duties—billing, collecting, depositing & reconciling duties must be separated Security—storage & access to collections as well as confidential data must be secured at all times Reconciliation—ensure collections receipted were properly deposited & recorded in OMNI departmental ledgers Management Review—randomly review receipt logs, deposits and reconciliations Documentation—receipt logs on daily collections w/signatures, deposit slips, reconciliations Cash Handling Training 12 The Basics of Segregation of Duties Assignment Segregation of Duties A. Biller/Invoicer Cannot also be B, C, or D B. Cashier Cannot also be A, D, or E C. Cash Point Supervisor Cannot also be A or E D. Deposit Preparer Cannot also be A, B, or E E. Cannot also be B, C, or D Reconciler Cash Handling Training 13 Collecting — in person Proper receipting devices such as pre-numbered receipt forms or cashiering terminals are to be used Employees should not work simultaneously from same receipt book or terminal Only official University receipt forms obtained from FSU Printing Services may be used (unless an exception is granted) Unused pre-numbered receipt forms should be adequately secured and accounted for Cash Handling Training 14 Collecting — in person All customers paying in person should be provided with a receipt or cash register tape Voided receipts or transactions should be approved by supervisory personnel and all copies of the voided receipt should be retained Checks should be restrictively endorsed immediately Collections should be secured at all times Persons collecting cash should not have other cash handling duties Cash Handling Training 15 Collecting — through the mail Upon receipt checks should be immediately restrictively endorsed and logged Check log should include Payer Name Check Number Check Amount Check Date Date Check Received Collector’s Initials Date Deposited Deposit Slip Number Depositor’s Initials Collections should be secured at all times and access limited to authorized personnel Cash Handling Training 16 Deposits Persons preparing deposits should not be involved with collecting cash, opening the mail, or monthly reconciliations Deposits should generally be made daily. Exceptions may be made when daily coin & currency are less than $100 or daily checks are less than $500 No collections should be held more than 5 business days before being deposited Credit / Debit card payments should be settled daily with Student Financial Services Deposits should not be sent through campus mail Cash Handling Training 17 Deposits Deposits should be forwarded to the Office of Student Financial Services or if armored car service is available directly to the bank Departments should ensure that appropriate security is provided when deposits are transported across campus or from off-campus sites Departments not on the cashiering system must submit a University deposit ticket Revenue Deposit Form (DT118) to the Office of Student Financial Services regardless of how the deposit is routed to the bank Individuals delivering deposits to Student Financial Services should obtain a validated receipt at the time the deposit is delivered Cash Handling Training 18 Reconciliation Person with no cash handling responsibility (does not collect or deposit) to do reconciliation Daily Ensure amount receipted for is equal to actual amount on hand Any discrepancies to be investigated, resolved, and signed off on Ensure that all funds receipted for were properly deposited and recorded Cash Handling Training 19 Reconciliation Monthly Compare daily receipt logs to OMNI departmental ledger reports to ensure that all deposits were properly recorded and that only appropriate transactions have been recorded in the ledger Reconciliation should be completed, reviewed, and signed off on prior to end of second succeeding month. Individual reviewing and signing off on should not be person performing reconciliation Reconciling items which cannot be identified by end of second succeeding month shall be identified and resolved as soon as possible, but no later than the end of the third succeeding month Cash Handling Training 20 Petty Cash or Change Fund Petty Cash Permanent Fund – is a cash advance from the Revolving Fund that is issued for on-campus operations, including, but not limited to, small office purchases, etc. A specified expiration date is not required Temporary Fund – is a cash advance from the Revolving Fund that is issued for limited on-campus operations, field trips, research projects or other offcampus projects with a specified expiration date Permanent and Temporary petty cash funds from sources other than the Revolving Fund are unauthorized Cash Handling Training 21 Petty Cash or Change Fund A Change Fund is a cash advance from the Revolving Fund that is issued to provide change for cashier functions within the University. Change funds from sources other than the Revolving Fund are unauthorized. To request cash for either a petty cash fund or a change fund, complete FSU form FA 252, Request for Revolving Fund Advance, and submit to General Accounting UCA 6310. If requesting a Temporary Petty Cash fund, supporting documentation detailing how the money will be used is required Cash Handling Training 22 New Treasury & Cash Management Website http://control.vpfa.fsu.edu/Treasury-CashManagement Policies & Procedures Forms Cash Handling Resources ◦ Guidelines ◦ Internal Control Questionnaire ◦ Templates Procedures Check Log Cash Drawer Reconciliation ◦ FAQs Cash Handling Training 23 Treasury Management Contacts Gayla Burdick Accounting Specialist A6314 University Center Mail Code: 2390 Phone: 850-644-9480 gburdick@admin.fsu.edu Michelle Hill Accounting Specialist A6312 University Center Mail Code: 2390 Phone: 850-644-1821 mahill@admin.fsu.edu Dan Wussler Assistant Controller A6315 University Center Mail Code: 2390 Phone: 850-644-1823 dwussler@admin.fsu.edu Cash Handling Training 24 CASH HANDLING INTERNAL CONTROLS JANICE FOLEY 25 Internal Controls Protect the University Without controls: Cash can be stolen Cash can be lost Revenues can be lost The University or program’s reputation can be damaged Cash Handling Training 26 Internal Controls Protect the Employee Without controls: Trust can be lost Individual reputations can be damaged Finger pointing/Accusations can be directed at individual employees You could lose your job! Cash Handling Training 27 Internal Controls Basics of Cash Handling Segregation of Duties Security Reconciliation Management Review Documentation Cash Handling Training 28 Simple Segregation of Duties OMNI Cash Log Reconcile Deposit University Cashiering Cash Handling Training 29 Security Background Checks Cash Credit Cards Cash Logs Cash Handling Training 30 Security Background Checks University Policy OP-C-7-G12(A) 1. Pre-employment criminal history background checks shall be required for the following categories of staff employees: a. A&P, USPS, and OPS positions that handle cash (except petty cash), checks, or credit/debit cards 2. Effective for all persons hired into positions with cash handling responsibilities after January 30, 2007 Cash Handling Training 31 Security Background Checks Need for background check should be in job description and in OMNI For OPS: ◦ Complete the Background Request Form ◦ Contact your individual recruiter $27.00 Usually 48 hours turnaround time Cash Handling Training 32 Security Cash During Working Hours ◦ Should have a separate cash box with a lock ◦ Cash box should be secured when not in use Overnight ◦ Secure the cash box in locked drawer ◦ Secure the cash box in a safe Secure keys Change combinations periodically and after someone leaves Cash Handling Training 33 Security Credit Cards Payment Card Policy (OP-D-2-G) ◦ PCI-DSS Security Requirements ◦ Employee Training Requirement Other Policies ◦ Records Management (OP-F-3) ◦ Destruction and Shredding of Confidential Documents and Records (OP-F-6) ◦ Safeguarding of Confidential and Personal Information (OP-F-7) Cash Handling Training 34 Security Cash Log Secure your cash logs If electronic: ◦ Limit access ◦ Write protect Cash Handling Training 35 Reconciliation Basics Person who does not receive cash, record the financial transaction or prepare the deposit should: Compare the receipt received from the University Cashier to the department deposit Compare the cash log/receipt book to OMNI financial records Initial and date these reconciliations! Cash Handling Training 36 Reconciliation Management Review Review reconciliation documentation Add your initials and the date reviewed Cash Handling Training 37 Document Procedures Helps to ensure consistency with laws, rules, and University policies and procedures Records the knowledge of experienced staff Provides a tool to assist new staff perform regular duties Cash Handling Training 38 Tips on Documenting Cash Handling Procedures Complete the Cash Handling Procedures Template Compare your procedures to the University’s Cash Handling Policy Identify needed changes Record or revise written procedures Implement Cash Handling Training 39 Recent Audit Observations Credit card transactions not handled properly ◦ Credit card numbers are: Being taken over the phone Written down and not destroyed Written down and scanned to files ◦ Old credit card documents containing full information not adequately secured Background Checks not completed Cash Handling Training 40