Calculating the cost of a credit purchase

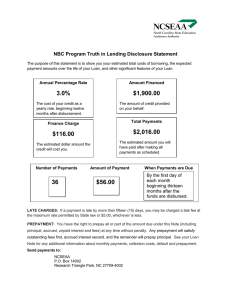

advertisement

Credit Calculations (Calculating the cost of a credit purchase) How much does something truly cost if we finance it? Sometimes consumers are tempted to buy an item before they might normally purchase the item simply because it is on sale. Yet, very often they turn around and finance the purchase using a costly source of credit. So, how much did the purchase really cost? This exercise will help you make those comparisons of cash purchase versus credit purchase. For example, let’s assume you bought $2,500 worth of furniture on sale and financed it for 24 months at the store’s interest rate of 18 percent annually with payments of $124.81 per month. When you figure the actual amount you wound up paying for the furniture, you find that it was 124.81 X 24 = $2,995.44, which is $495.44 more than the original $2,500 purchase price. Math Review 24(123.45) – 2,500 = 36(237.73) – 6,400 = 18(67.31) – 1,000 = (30 x 167.34) – 4,000 = (48 x 202.11) – 8,000 = (60 x 111.38) – 5,000 = Apply Your Knowledge 1. How much in interest will Jamison pay for a 36-month $3,000 loan that charges 10 percent interest? The payments will be $96.80 per month. 2. Salinda Borrowed $4,200 to buy some furniture. Her monthly payments over four years with an interest rate of 24 percent are $136.93 per month. How much in total interest will she pay? 3. Jesse is thinking about buying an entertainment system that will cost $1,800. The store will finance the purchase for 12 months at 20 percent interest. His payments will be $166.74. How much will he pay in interest over the life of the loan? 4. Quantrell bought a television set on sale for his apartment for $1,500, but he will spread the payments over two years. The store charges 18 percent interest for financing, and his payments will be $74.89. How much will he pay in interest over the life of the loan? 5. Ava’s payments on her new furniture will be $162.88 per month for 60 months. Assuming the furniture cost $7,000 on sale, how much will she pay in interest by the time her loan is paid in full?