here

advertisement

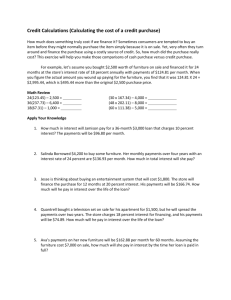

Test 1 solution sketches Note for multiple-choice questions: Choose the closest answer Loan calculations Billy’s Pianos receives a loan of $180,000 today. The stated annual interest rate is 8.4%, compounded monthly. Payments are monthly, starting one month from today. The loan is amortized over 30 years. Loan calculations If Billy pays an equal amount of principal each month, how much will the first payment be? Monthly rate = .0084 / 12 = 0.7% Amount of principal paid each month = $180,000 / 360 = $500 Amount of interest accrued in first month = $180,000 * .007 = $1,260 First payment = 500 + 1,260 = $1,760 Loan calculations If Billy makes equal month payments each month, how much will the first payment be? 180,000 = C / .007 * [1 – 1 / (1.007)360] 180,000 = 131.262 * C C = $1,371.31 Loan calculations If Billy pays an equal amount of principal each month, how much will the last payment be? Principal owed in 359 months = 180,000 / 360 = 500 Interest owed = 500 * .007 = 3.50 Last payment = 500 + 3.50 = $503.50 Loan calculations If Billy makes equal month payments each month, how much will the last payment be? Note: equal payments means first = last (so same answer as #2) 180,000 = C / .007 * [1 – 1 / (1.007)360] 180,000 = 131.262 * C C = $1,371.31 Profitability Index Carly Rae pays $50,000 to open her dating service. She receives $2,700 per year in cash flow, starting in two years. Annual discount rate is 5%. What is the profitability index? PV of benefits = 2700 / .05 * 1 / 1.05 = 51,429 PV of costs = 50,000 PI = 51,429 / 50,000 = 1.029 Effective Discount Rates If the effective annual discount rate is 15%, then what is the effective discount rate for 8 months? (1.15)8/12 – 1 = 9.76534% PV of Annuity Wolfgang will receive royalty payments of $500 every year, starting 5 years from today and ending 25 years from today. What is the present value of these payments if the effective annual discount rate is 15%? Annuity formula for 21 payments, discounted by 4 years due to 1st payment in year 5 500/.15 * [1 – 1 / 1.1521] * 1 / 1.154 = $1,804.59 Real payments If the inflation rate this year is 5% and the nominal interest rate is 15%, then what is the real interest rate? (1 + real)(1 + inflation) = (1 + nominal) (1 + real)(1.05) = 1.15 1 + real = 1.15 / 1.05 = 1.0952381 Real = 9.52381% Discounted vs. undiscounted payback periods Reba’s Rabbits invests $50,000 today, and will earn $10,000 each year starting one year from today. The effective annual discount rate is 9%. If Reba uses discounted cash flows, how many years is the payback period for this investment? 50000 = 10000/.09 (1 – 1/1.09T) 61111 = (10000/.09)/(1.09T) 1.09T = (10000/.09)/61111 = 1.81818 T = ln(1.81818)/ln(1.09) = 6.93726 ≈ 7 Discounted vs. undiscounted payback periods If Reba uses undiscounted cash flows, how many years is the payback period for this investment? 50000 / 10000 = 5 Pyotr’s Beauty Products Pyotr’s Beauty Products is considering buying a new device. This machine would cost $8,000 today, and require maintenance costs of $600 every three years, starting in 2 years and ending in 11 years. The machine lasts 12 years, and the effective annual discount rate is 14%. Part (a) What is the present value of all costs of the machine over its life? Purchase cost today and maintenance costs in years 2, 5, 8, and 11 8000 + 600/(1.142) + 600/(1.145) + 600/(1.148) + 600/(1.1411) = $9,125.61 Part (b) Pyotr pays $X per year for five years, starting today. These payments will have the same present value as the answer you got from part (a). Find X. X + X/1.14 + X/(1.142) + X/(1.143) + X/(1.144) = 9125.61 3.91371 * X = 9125.61 X = $2,331.70 Yield to Maturity A bond has a face value of $750. It pays a coupon of 10% today, one year from today, and two years from today. Two years from today, the bond matures. If the current selling price of the bond is $800, what is the yield to maturity (expressed as an effective annual discount rate)? Yield to Maturity 800 = 75 + 75/(1+r) + 825/(1+r)2 725(1+r)2 – 75(1+r) – 825 = 0 725r2 + 1375r – 175 = 0 29r2 + 55r – 7 = 0 Ignore negative root. r = 0.119716 so r = 11.97%. Or… Yield to Maturity 800 = 75 + 75/(1+r) + 825/(1+r)2 725(1+r)2 – 75(1+r) – 825 = 0 Let x = 1+r 29x2 – 3x – 33 = 0 Ignore negative root. x = 1.1197 so r = 11.97% Balloon Payment Michael is taking out a loan of $1,000,000 today and he will pay $22,000 per month for the next 10 years (120 payments, starting one month from today). The stated annual interest rate is 24%, compounded monthly. 13 years from today, Michael will make one additional payment to pay off the loan. How much will this payment be? Balloon Payment PV of monthly payments: PV of payment made in 13 years: 22000/.02 * [1 – 1/(1.02120)] = 997,818.55 1,000,000 – 997,818.55 = 2,181.45 FV of payment made in 13 years: 2,181.45 (1.02)12*13 = $47,904.10