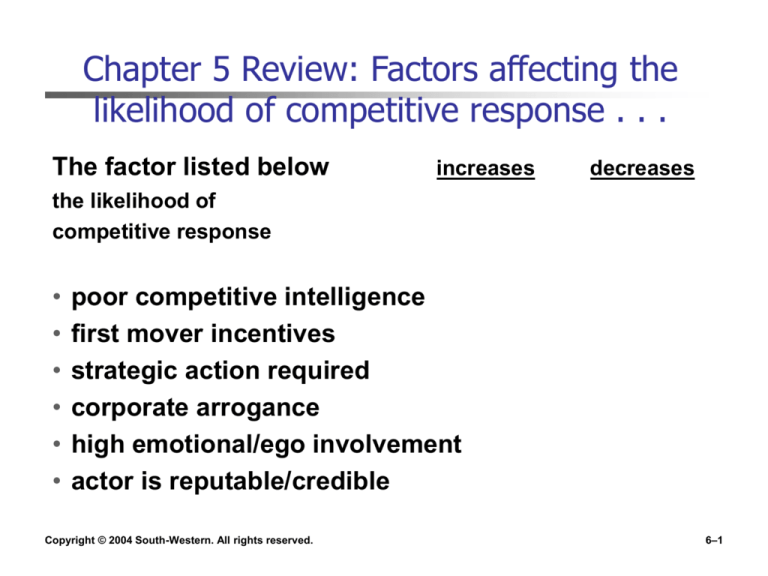

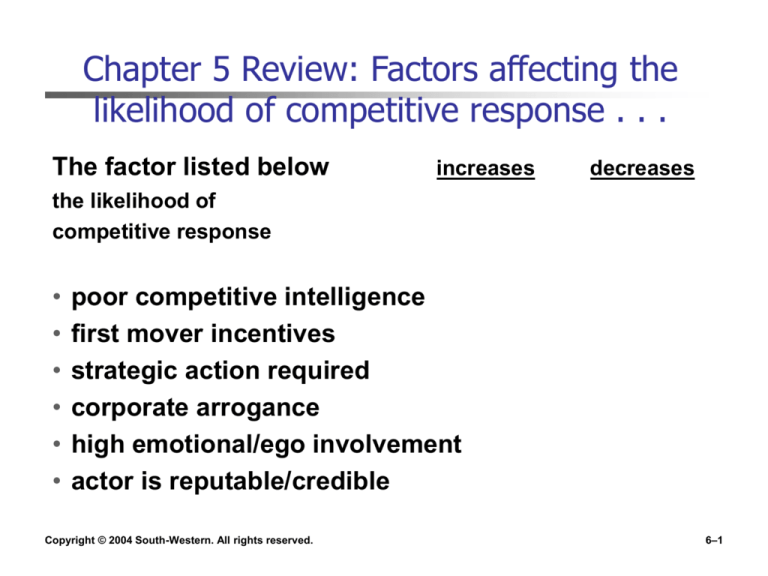

Chapter 5 Review: Factors affecting the

likelihood of competitive response . . .

The factor listed below

increases

decreases

the likelihood of

competitive response

•

•

•

•

•

•

poor competitive intelligence

first mover incentives

strategic action required

corporate arrogance

high emotional/ego involvement

actor is reputable/credible

Copyright © 2004 South-Western. All rights reserved.

6–1

The Strategic

Management

Process

Figure 1.1

Copyright © 2004 South-Western. All rights reserved.

6–2

Chapter 6: Corporate-Level Strategies

• Corporate-level strategies;

advantages and disadvantages of each

- single business

- dominant business

- vertical integration

- related diversification

(activity sharing and skill transfer)

- unrelated diversification

(capital reallocation; restructuring)

• Core business

Copyright © 2004 South-Western. All rights reserved.

6–3

Corporate-level strategy encompasses the

entire organization;

Business-level strategy is at the

____________ level

PepsiCo

Soft Drinks

Copyright © 2004 South-Western. All rights reserved.

Frito-Lay

Tropicana

6–4

Two Strategy Levels

• Business-level Strategy (Competitive)

Each business unit in a diversified firm chooses

a business-level strategy as its means of

competing in individual product markets

• Corporate-level Strategy (Companywide)

Specifies actions taken by the firm to gain a

competitive advantage by selecting and

managing a group of different businesses

competing in several industries and product

markets

Copyright © 2004 South-Western. All rights reserved.

6–5

Corporate-Level Strategy: Key Questions

• Corporate-level Strategy’s Value

The degree to which the businesses in the

portfolio are worth more under the management

of the company than they would be under other

ownership

What businesses should

the firm be in?

How should the corporate

office manage the

group of businesses?

Business Units

Copyright © 2004 South-Western. All rights reserved.

6–6

Some Corporate-Level Strategy Questions:

• McDonald’s Chipotle Grill? C-stores? hotel? rec center?

• Ebay purchase of Skype internet phone provider?

• John Deere & Company wholesale landscaping business?

• Ford Motor Company Hertz Rent-A-Car?

• New York Times ownership of papermills?

Copyright © 2004 South-Western. All rights reserved.

6–7

“few corporate-level strategies actually

create value . . . “ - pg. 170

Yet again,

strategy formulation might be easier than

strategy implementation!

Synergies (where the whole is greater than

the sum of the parts) are easier to

conceptualize than to actually realize.

Copyright © 2004 South-Western. All rights reserved.

6–8

Levels and Types of Diversification

Figure 6.1

SOURCE: Adapted from R. P. Rumelt, 1974, Strategy, Structure and Economic Performance, Boston: Harvard Business School.

Copyright © 2004 South-Western. All rights reserved.

6–9

Common evolution pattern of

corporate-level strategies

• Single business

• Dominant business

• Vertical integration

• Vertical integration with by-products

diversification

• Related-constrained diversification

• Related-linked diversification

• Unrelated diversification

• Related-constrained diversification

Copyright © 2004 South-Western. All rights reserved.

6–10

Single- and Dominant- Business Strategy

Advantages

Copyright © 2004 South-Western. All rights reserved.

Disadvantages

(Why move away from

these strategies toward

diversification?)

6–11

Vertical Integration Strategy

When a firm produces its own inputs =

__________________ integration

When a firm owns its own means of

distribution = ________________ integration

Copyright © 2004 South-Western. All rights reserved.

6–12

Forward and Backward Vertical Integration

Forward vertical integration

supplies

manufacturing

distribution

retail

Backward vertical integration

Copyright © 2004 South-Western. All rights reserved.

6–13

Vertical Integration Strategy

Advantages/

Reasons for Use

Copyright © 2004 South-Western. All rights reserved.

Disadvantages/Hazards

6–14

Alternatives to Vertical Integration?

Copyright © 2004 South-Western. All rights reserved.

6–15

Diversification Strategy =

participation in >1 industry (segment),

structuring into separate divisions,

with no single division contributing

>70% of sales revenue

Johnson & Johnson

Consumer Products

18% of sales;

13% of operating profit

Pharmaceuticals

47% of sales;

61% of operating profit

Copyright © 2004 South-Western. All rights reserved.

Devices and Diagnostics

35% of sales;

26% of operating profit

6–16

Diversification Strategy

Advantages

Copyright © 2004 South-Western. All rights reserved.

Disadvantages/Pitfalls

6–17

Strategic Motives for Diversification

To Enhance Strategic Competitiveness:

• Economies of scope (related diversification)

Sharing activities

Transferring core competencies

• Market power (related diversification)

Blocking competitors through multipoint competition

(Vertical integration)

• Financial economies (unrelated diversification)

Efficient internal capital allocation

Business restructuring

Table 6.1a

Copyright © 2004 South-Western. All rights reserved.

6–18

Incentives and Resources for Diversification

Incentives and Resources with Neutral

Effects on Strategic Competitiveness

• Antitrust regulation

• Tax laws

• Low performance

• Uncertain future cash flows

• Risk reduction for firm

• Tangible resources

• Intangible resources

So - these are not the best reasons to diversify!

Table 6.1b

Copyright © 2004 South-Western. All rights reserved.

6–19

Managerial Motives for Diversification

Managerial Motives (Value Reduction)

• Diversifying managerial employment risk

• Increasing managerial compensation

“managerial opportunism” (Chapter 10)

Table 6.1c

Copyright © 2004 South-Western. All rights reserved.

6–20

The Curvilinear Relationship between

Diversification and Performance

Figure 6.3

Copyright © 2004 South-Western. All rights reserved.

6–21

Related Diversification

• Firm creates value by building upon or

extending its:

Resources

Capabilities

Core competencies

Copyright © 2004 South-Western. All rights reserved.

6–22

Best resource/capabilities for diversification

are typically found in a firm’s core business:

“Core business”

represents the business unit or division

containing the firm’s most developed skills;

often can be identified by

• high proportion of firm’s profit

• high proportion of a firm’s assets

• original business of the firm

• division serving primary target markets

Copyright © 2004 South-Western. All rights reserved.

6–23

Related Diversification - Economies of Scope

• Value is created by extending important

resources/capabilities/core competencies

through:

Operational relatedness in sharing activities -

value chain activities are shared among units

Corporate relatedness in transferring skills competencies are transferred across units

Copyright © 2004 South-Western. All rights reserved.

6–24

In related diversification:

implementation to realize synergies Example of PepsiCo

Shared Activities

(operational relatedness)

• distribution

• sales

• market research

Copyright © 2004 South-Western. All rights reserved.

Skill Transfer

(corporate relatedness)

• product development

• brand development

• brand excitement

6–25

Activity sharing and skill transfer . .

• can create efficiencies (especially activity

sharing)

• can provide competitive advantages that are

valuable, rare, and difficult to imitate due to

complexity and combining tangible and

intangible resources

• can fail due to implementation

complications - managed interactions

across business units are required

Copyright © 2004 South-Western. All rights reserved.

6–26

Advice for sharing activities

or transferring skills

Since sharing activities and transferring skills

adds management complications,

only select those that are

competitively meaningful, with strong

potential to add competitive advantage,

or it generally isn’t going to be

worth the trouble!

Copyright © 2004 South-Western. All rights reserved.

6–27

Unrelated Diversification

• Financial Economies

Are cost savings realized through improved

allocation of financial resources

Create value through two types of financial

economies:

Efficient internal capital allocation

Purchasing other corporations and

restructuring their assets

Copyright © 2004 South-Western. All rights reserved.

6–28

Unrelated Diversification Efficient Internal Capital Market Allocation

Acquire sound, attractive autonomous

companies that need growth capital

Corporate office distributes capital from low

growth divisions to high growth divisions to

create value for overall company

Operation like an “internal capital market”

Corporate

office gains proprietary access to

information about those businesses’ actual

and prospective performance

Copyright © 2004 South-Western. All rights reserved.

6–29

Otter Tail Corporation - partial view

Otter Tail Corporation

Electricity

30% of sales revenue;

75% of net income

Manufacturing

26% of sales revenue;

16% of net income

Copyright © 2004 South-Western. All rights reserved.

Health Services

13% of sales revenue;

7% of net income

6–30

Unrelated Diversification: Restructuring

• Restructuring creates financial economies

A firm creates value by buying and selling other

firms’ assets in the external market

The idea is basically, “buy low, sell high”

“The corporate fixer-upper” - buy

underperforming firms or units, fix the problems,

and sell for a higher price

Copyright © 2004 South-Western. All rights reserved.

6–31

Unrelated Diversification Implementation Considerations

• Can be considered easier to implement than

related diversification

• No required commonalities and/or

interactions between units

• Each unit is basically “stand-alone”, and

operates independently of the other units,

except for centralized resource allocation

Copyright © 2004 South-Western. All rights reserved.

6–32

Unrelated Diversification:

Performance Reputation

• “diversifiction”

• “diworseification”

• the conglomerate discount

• conclusion = unrelated diversification

generally produces poor performance

Copyright © 2004 South-Western. All rights reserved.

6–33