Mr.A.Mohan

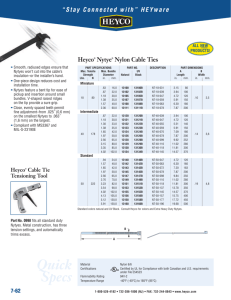

advertisement

TDSAT SEMINAR DISPUTE RESOLUTION AND REDRESSAL OF CONSUMER GRIEVANCES IN BROADCASTING SECTOR (March 13, 2010) Presented by: A. Mohan Executive Vice President Zee Network, India amohan@siti.esselgroup.com This presentation depicts the personal views of the speaker and should not be treated as the views of the Company. 2 INDIA – one of the largest media market 500+ television channels; 600m viewers : 2x the population of United States 100m+ newspaper circulation across 50,000+ editions : Next only to China 3.5bn movie tickets sold annually for 1000+ movies : 2.5x the size of the second largest market 87m Cable and Satellite homes :Next only to USA and China Sources : IDFC/SSKI - India Entertainment & Media - February 2010 - Nikhil Vora / Bhushan Gajaria / Swati Nangalia 3 BROADCASTING VS TELECOMMUNICATION • Three fastest means of communications: – Tele-communication – Tele-vision – ????? 4 WHAT WE PROVIDE We, provide you content on 365 days a year on 24X7 basis. Broadcasters are required to invest heavily in acquisition / procurement of content which inter-alia include: News & Current Affairs content disseminating news, views & infotainment, business affairs. Entertainment programmes such as serials, quiz shows, celebrity shows, talent hunts. Movies rights. Religious content. Events Rights & Sports Broadcasting rights. Huge expenditure on setting-up broadcast facilities, uplinking teleports & leasing transponder space on satellites to effect delivery of channels to distributors of channels. Rate regulation and price controls distort the market and lead to a misallocation of resources. Artificially low prices deter any further investment in new Channels and programming, affecting consumer choice and creating a shortage of quality channels and variety in programming. A Myth - Channel prices are quite high and need regulation.- Newspaper example ARPU in India – $3.5 - $ 4 - lowest in the world (Vs $ 65 in US)* Regulator needs to balance “equity” and “consumer interest”. *WIPO Report dt.30/11/2009 5 Projected growth of Indian Television Industry 2009-2013 In Millions 2008 2009f 2010f 2011f 2012f 2013f TV Households % Change 118.0 2.6% 120.0 1.7% 125.0 4.2% 130.0 4.0% 132.0 1.5% 135.0 2.3% 2.7% Pay TV Households % Change 80.0 8.8% 87.5 8.7% 94.0 8.0% 100.0 6.4% 107.0 7.0% 115.0 7.5% 7.5% Cable TV households % Changes 71.0 1.4% 72.0 1.4% 74.0 2.8% 75.0 1.4% 77.0 2.7% 80.0 3.9% 2.4% DTH Households % Changes 9.0* 157.1% 15.0 66.7% 20.0 33.3% 25.0 25.0% 30.0 20.0% 35.0 16.7% 31.2.0% 2009f 2010f 2011f 2012f 2013f CAGR 2009-13 In Millions 2008 Television Distribution % Change 150.0 9.9% 165.0 10.0% 185.0 21.1% 205.0 10.8% 225.0 9.8% 250.0 11.1% 10.8% Television Advertising % Change 84.2 7.9% 91.0 8.1% 100.0 9.9% 112.0 12.0% 130.0 16.1% 150.0 15.4% 12.2% Television Content % Changes 10.5 11.7% 11.5 9.5% 13.0 13.0% 15.0 15.4% 17.0 13.3% 20.0 17.6% 13.8% Total % Changes 244.7 9.3% 267.5 9.3% 298.0 11.4% 332.0 11.4% 372.0 12.0% 420.0 12.9% 11.4% Sources : Industry estimates and PWC analysis; PWC – Indian Entertainment and Media Outlook 2009 CAGR 2009-13 6 Subscriber Break-Up FY09 others, 4% Digital Cable, 3% Subscriber Break-Up FY15E Other, 4% DTH, 13% DTH, 31% Analogue Cable, 80% Analogue, 50% Digital, 15% Source : Industry, Elara Securities Research Elara Capital – Cable & Satellite Industries – Future is digital – Media & Entertainment 19 November, 2009 7 Sources: Group M, KPMG Interviews, KPMG Analysis 8 9 Sources: Group M, KPMG Interviews, KPMG Analysis ANALOGUE VALUE CHAIN FAVOURS LCO Broadcasters Multiple Due to lack of addressability, forced to sell negotiated lump sum rather than at a fair rate per end subscriber. However, advertisement revenue has been their relief. MultiSystem Operators 6,000 Local Cable Operators 60,000 Clutter of MSOs Too many Monopoly in their areas of operation. suppliers of the same content targeting max 1-2 LCOs per area. Easy substitution of content from one MSO with content from another. Forced to resort to undercutting in order to widen subscriber base. Hence high bargaining power with MSOs Households 90 Million Have to bear monopoly at the last mile leading to inferior quality services and monopolistic LCOs. Dissatisfaction with Analogue cable. Eager for an alternative. Source : Elara Securities Research Elara Capital – Cable & Satellite Industries – Future is digital – Media & Entertainment 19 November, 2009 10 REVENUE LEAKAGES Distribution of Revenues C&S homes 80m X Average ARPU USD4/ Month = Annual cable collection Broadcaster’s share USD 3.8 bn (Rs.17,100 Cr.) _ USD 500M USA UK Australia Japan India 60% 63% 65% 65% 90% 40% 37% 35% 35% 10% • Unorganised nature of cable distribution; 7,000 MSOs and 40,000 LCOs (Rs.2,250 Cr.) • Cash transaction MSOs and DTH operator’s shares LEAKAGE USD 500M (Rs.2,250 Cr.) USD 2.8 bn • Lack of addressability – analogue distribution (Rs.12,600 Cr.) Sources : IDFC/SSKI - India Entertainment & Media - February 2010 - Nikhil Vora / Bhushan Gajaria / Swati Nangalia 11 Cost of Piracy in 2009 – US$ 1280 million (Rs. 5,760 Cr.) Continued rapid growth in market size – US$5.3 billion (Rs.23,850 Cr.) – 20% up in 2008 Individual illegal connections US$ 22 million (Rs. 99 Cr.) Piracy levels up 7% although actual piracy cost up 12% due to increased ARPU and currency movements Grey market for cable operators is the biggest factor With nearly $1.3 billion (Rs.5,850 Cr.) of revenue leakage in India continues to be the largest monetary contributor in Asia Digital Deployment, Asia-Pacific, Pay-TV, Industry Study, November 2009 Indian grey market US$ 1258 million (Rs. 5,661 Cr.) 12 2006-09 – digitization remained a ‘concept’ What has gone wrong for the cable industry? • • Mandated CAS in notified areas • • • Voluntary digitization • • • MSOs not funded for seeding STB Execution a failure - high resistance from LCOs Lack of political will Consumer Psyche – If digital is mandated, why not switch to DTH, a professionally managed service Lack of funds to subsidize customer acquisition DTH industry funded to the tune of USD4bn-5bn Subsidies on DTH as high as Rs2500-3000 per connection Absence of clear cut road map and lack of regulations 13 FUTURE - MULTIPLE LAYERS OF CONVERGENCE YESTERDAY TODAY (Silos into the home) (Convergence of services, networks & devices) 14 Most affected Broadcaster Dispute MSO Dispute Channel(s) Switch off LCO Dispute Most affected Subscriber 15 DISPUTES LCO Service Quality Price discrimination Limited choice of channels Interruption in cable services Change in channel placements No effective consumer redressal system No value for money Non availability of channel guides Subscriber 16 DISPUTES MSO Non disclosure of complete subscriber base by LCO. Piracy of signals/Inserting advertisements. Non payment of subscription fees. Non renewal of service agreements. Frequent change in loyalty of the LCOs i.e. migration from one MSO to another leaving subscription dues/arrears. Resistance to adapt themselves to changing technology. LCO 17 DISPUTES Broadcaster Subscriber base. Territory issue – transmission in unauthorised MSO areas. Digital Transmission without paying any additional subscription. Non payment of subscription fees. Non renewal of service agreements. Alleged unreasonable clauses in service agreements. Piracy of signals/violation of copyrights. Resistance to adapt to changing technology. Limited bandwidth capacity. Change in channel placements. Interruption of cable services at their own. Undue advantage of regulations. Compliance cost. 18 SOLUTIONS OF DISPUTES DIGITALISATION WITH ADDRESSABILITY 19 SOLUTIONS LCO Written agreement in place between the LCO & consumer. (QSR for CAS and Non-CAS areas) Subscription fee receipts to be issued by the LCO. (Tariff Order dt.4/10/07 – Cl.4B & Cl.9 of QSR) LCO providing technical support at the time of any cable breakdown (QSR dt.24/2/09). 21 days notice for discontinuation of channel(s). LCO providing complete channel guides. LCO upgrading their network & improving the quality of services (Cl.18 of QSR). Local body to be authorized for settlement of disputes. (TRAI recommendations) Discourage monopoly and encourage healthy Subscriber competition. 20 SOLUTIONS MSO Maintaining contractual agreement with LCOs. (Interconnection Regulations/Agreements) MSO maintaining detailed records of subscriber base served by the LCO. (Interconnection Regulations – SLR) Appointing independent piracy check agencies. MSOs facilitating LCOs to help them in investing in better infrastructure. MSO coordinating with local bodies to shoulder the accountability of consumer complaints (QSR). Digitalisation. LCO 21 SOLUTIONS Broadcaster MSO maintaining a record of number of franchisees served & their individual HH connections through a transparent system. (Interconnection Regulations – SLR) Timely payment & renewal of agreement. (Interconnection Regulations – SLR) Appointing independent piracy check agencies. Broadcaster providing relevant information. Joint public awareness campaigns on the channel list, new programmes etc. Both should encourage healthy competition. Digitalisation MSO 22 Section 14A of TRAI Act provides as under: 1) The Central Government local or a State Government or a authority or any person may make an application to the Appellate Tribunal for adjudication of any dispute referred to in clause (a) of Section 14. 2) The Central Government or a State Government or a local authority or any person aggrieved by any direction, decision or order made by the Authority may prefer an appeal to the Appellate Tribunal. 23 Broadcasting Services – categorized as Essential Services Hon’ble TDSAT in its judgment dt. 27/02/2007 in Case of Set Discovery Vs. TRAI & others has observed as under: “Cable broadcasting may not be an essential commodity in the sense that it is not an item of food without which one cannot survive, yet looking to the figures of TV viewership in this country its importance cannot be underestimated. Available figures suggest a TV viewership of 68 million for the whole country. This shows that television viewing has almost attained the status of an essential service in this country.” 24 • Three fastest means of communications: – Tele-communication – Tele-vision – ????? 27