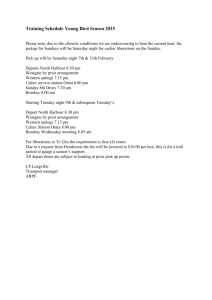

Economics For Business Assignment: Autumn 2011

advertisement

Economics For Business Assignment: Autumn 2011 1) Unlike a Perfectly Competitive Market, or a Monopolistic Competitive market in which is characterized by a large number of firms competing in the market, and relatively low barriers to entry, an Oligopoly is defined as a market structure in which: Natural or legal barriers prevent the entry of new firms. A small number of large firms compete Because of the small number of large firms competing, these firms are interdependent, and linked in so far as the profit of one firm may depend on the actions of another. ACCC Chairman Graeme Samuel said “The acquisition of these sites by Caltex would be likely to lead to reduced retail competition, resulting in higher fuel prices for consumers.” (Speedy, 2009) I agree with Mr Samuel’s opinion because if Caltex were allowed to acquire the extra Mobil stations, it would significantly increase its market share in the fuel industry, reducing competition in the fuel market and thus resulting in a dominant firm oligopoly. Caltex would have an advantage over most of the other firms competing in the fuel market, ergo allowing Caltex to set its price and output to maximise its profit, therefore inducing higher fuel prices for consumers. 2) Firstly, the most important features of national trade practice laws are the Trade Practices Act (TPA) 1974, which has been renamed the Competition and Consumer Act 2010, and the National Competition Policy Act of 1995, which stationed the Australian Competition and Consumer Commission (ACCC). The role of the ACCC is to constitute fair trade within the market place in the benefit of social interest. In regard to trade practices law, the ACCC prohibits activities that oppose social benefits such as, misuse of market power, mergers, vertical restraints, collusion and price fixing. The ACCC undertook an investigation to consider the impacts of the proposed acquisition of 302 Mobil service stations by Caltex in the fuel market. The ACCC’s decision to disallow the Caltex takeover was due to the influence it would have on the fuel market, leading to reduced competition, and incurring higher fuel prices for consumers, which was not in the benefit of social interest. Three factors were considered by the ACCC in denying this takeover. Consumers - Higher fuel prices will not benefit consumers. Business - Larger market share established dominant firm oligopoly. Community – Increased presence of Caltex stations prompts higher prices. 3) In the prisoner’s dilemma, the rules describe the setting of the game, the actions the players may take, and the consequences of those actions. In this case, two petrol stations, Mobil and Caltex, in each petrol station has the option to either cheat (collude) or comply. If the two petrol stations, Mobil and Caltex are physically next to each other, they have two options. They could either collude, in which they will both implement higher fuel prices for the Phillip Samanov - 11219286 consumers, leading to higher profits, however this is illegal. Or they could comply, in which they allow the market forces of supply and demand to influence price, thus even if one station raises prices, the other keeps its price the same to gain higher profits from the other one raising prices. However, after the takeover, in which the Mobil stations now become Caltex stations, this gives Caltex the ability to raise prices for consumers without competition, thus increasing revenue for Caltex without cheating because they are not colluding. This increase in market share establishes Caltex as a dominant firm oligopoly, thus instigating such an objection from the ACCC. Phillip Samanov - 11219286