Transforming Rental Assistance (TRA)

advertisement

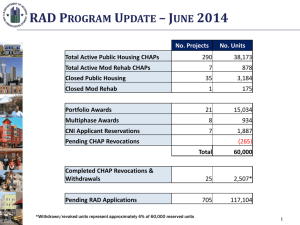

RAD Workshop WCAH July 25, 2013 Presented by: C. Ray Baker & Associates WHY RAD? • Most of America’s 1.2 million Public Housing units were built as temporary housing beginning in 1937. • These units are old, outdated and in desperate need of major capital repairs. • RAD will allow PHAs and their developer partners to convert Public Housing units to Section 8 PBV units. • During this transformation a combination of LIHTCs and debt will provide the funding necessary to modernize these units. • Only a small fraction of the nations 3,200 Housing Authorities have the expertise necessary to implement RAD. 2 CURRENT CHALLENGES Public Housing • Capital repair needs in excess of $25.6B across portfolio, or $23,365/unit • Section 9 funding platform unreliable (pro-rations, cuts), inhibits access to private debt and equity capital (declaration of trust) • Losing 10,000-15,000 hard units/year Section 8 Moderate Rehabilitation (Mod Rehab) • Cannot renew on terms needed to secure financing Rent Supplement (Rent Supp) & Rental Assistance Payment (RAP) • No option to renew when contracts expire 3 1ST COMPONENT • Public Housing & Mod Rehab • Can compete to convert assistance to: – Project-Based Rental Assistance (PBRA) or – Project-Based Vouchers (PBV) • Cap of 60,000 units (applications must be received by 9/30/2015) • Convert at current funding only • Choice-Mobility, with limited exemptions • Extensive waiver authority to facilitate conversion 4 2ND COMPONENT • Mod Rehab, Rent Supp & RAP • Upon contract termination/expiration, convert Tenant Protection Vouchers (TPVs) to PBVs • No cap, but subject to availability of TPVs • Choice-Mobility requirement per PBV program rules • Limited waiver authority to facilitate conversion • Prospective conversion authority through 9/30/2013 • Retroactive conversion authority back to 10/1/2006 (convert by 9/30/2013) 5 RAD VS. HOPE VI • In nine months there are more Public Housing Authorities engaged in RAD than there were in the first two years of the HOPE VI program. • There are more Public Housing units in the RAD program than there were in the first two years of the HOPE VI program. • The RAD program has not required any additional funding from Congress. 2/2/2012 6 RAD BASICS What? • Allows 60,000 public housing units to convert to long-term Section 8 rental assistance contracts Why? • Access private debt and equity to finance capital needs • Program simplification/streamlining • Better platform for long-term preservation Conversion Options • Project-Based Rental Assistance (PBRA) • Project-Based Vouchers (PBV) 7 RAD WORKSHOP • What is RAD? HUD demonstration program that combines public housing operating and capital subsidy into a Section 8 HAP contract • What kinds of developments are being done with RAD? Minor rehab; major rehab; new construction; mixed income; off-site replacement housing • How do I determine if I have a project/portfolio that would be a good candidate for RAD conversion? Use the RAD Inventory Assessment Tool in the Resources section of www.hud.gov/rad • How would RAD affect: • Residents: No change; 30% of income for rent • PHA Functions: Dependent on cash flow, fees, strong management; puts them on the more secure Section 8 funding platform; Gives them the affordable housing tools of other nonprofit developers • Resources: www.hud.gov/rad; www.radcapitalmarketplace.com; www.radresource.net 8 RAD BASICS (CONT.) • Ownership – Public or non-profit, except to facilitate tax credits • Contract Rents Operating Fund (with Operating Fund Allocation Adjustment) + Capital Fund + Tenant Rents = RAD Contract Rent Notes: • HUD will honor the FY 2012 RAD contract rents for all applications received before end of CY 2013 (applies to individual applications, portfolio awards, and multi-phase awards) • PHA may adjust Contract Rents across multiple projects as long as aggregate subsidy does not exceed current funding (“rent bundling”) 9 PUBLIC HOUSING CONVERSION RENT LEVELS Sample Public Housing Conversion Per Unit Monthly (PUM) $900 $800 $700 $600 Operating Fund $330 Housing Assistance Payment $474 $500 $400 Capital Fund $144 $792 $300 $200 Tenant Payment $318 Tenant Payment $318 Pre-Conversion Post-Conversion $100 $- ACC Section 8 10 NONPROFIT DEVELOPER OBJECTIVES • • Partner with PHAs to: • Modernize aging family & elderly properties • Substantial rehab of deteriorated properties • Demolish/replace severely distressed/obsolete properties • Thin densities/mix incomes via RAD HAPs and transfer authority Place RAD HAP contracts in off-site units in high amenity locations • Increase QAP scoring by serving more VLI families • New 20 year HAP contract funding 11 RAD FINANCING Debt • Conventional • Soft secondary • Credit enhancement FHA Insurance • FHA Mortgagee Letter for RAD transactions • LIHTC Pilot LIHTCs • 4% availability & considerations • 9% availability & considerations 12 FHA MULTIFAMILY MORTGAGE INSURANCE Section 223(f) • Refinance or acquisition • Minor/moderate repairs ($6,500/unit*high cost factor) • Permanent debt with repair escrow - up to 35 years Section 221(d)(4) • Substantial rehab: 2 major building systems • Construction/permanent debt all in one - initial/final closing • 40-year financing Mortgagee Letter for RAD Transactions issued 10/12 • Eligibility, underwriting criteria, processing & materials 13 FHA LIHTC PILOT PROGRAM Streamlined-Enhanced FHA 223(f) & LIHTCs • Rehab expenditures of up to $40,000/unit • Tax credit or Bond Cap allocation in hand • Processed in Multifamily Hubs • Using MAP lenders approved for the Pilot • Goal of 3-4 month turnaround on applications 14 FEDERAL HOME LOAN BANK AHP Affordable Housing Program (AHP) • This program is funded with 10% of the Federal Home Loan Banks' net income each year. • Most effective when paired with other programs and funding sources, like Low-Income Housing Tax Credits. • More than 776,000 housing units have been built using AHP funds, including 475,000 units for very low-income residents. • $4.6 billion in total AHP dollars since 1990. That’s 200 million per year. • AHP loan funding often comes with an equal amount of grant funding. 15 RAD & LIHTCS RAD Sweet Spot—Debt Only • Abt study—$24k/unit average capital need • Opex at $4,500 pupy + $300 replacement reserves • FHA debt at 3.45%; 1.2 DCR • Feasible with RAD rents above ~$610/month 16 RAD & LIHTCS RAD Sweet Spot—4% LIHTCs • Rehab needs above $24k/unit to ~$40k/unit • Ease of meeting 50% test with RAD rents • Available P-A Volume Cap • Non-competitive • QAPs favoring preservation, green • Evolving, accessible short-bond structure • Historically low borrowing rates 17 RAD & LIHTCS Short Bond Structure for 4% LIHTCs • At Closing – TE bonds with 24 month term issued (1.25%) – FHA 221(d)(4) or 223(f) closes • During Construction – Construction draws: Standard GNMA certificates – Bonds paid down & paid off at construction completion – Reduces negative arbitrage costs • Long Term – Project benefits from 40-year loan at FHA rate of 3.45% 18 RAD & LIHTCS RAD Sweet Spot—9% LIHTCs • Targeted prospects for substantial rehab & replacement housing • No Section 18 review • Income mixing • Split project (AMP) – 9% LIHTC used to help cover relo/demo/first phase – 4% LIHTC for balance of site • RAD HAP contract(s) for off-site replacement – Acquisition/rehab – New construction 19 RAD ACROSS THE COUNTRY – 1ST COMPONENT Northeast Midwest South West PHAs and Mod Rehab Units Awarded 949 1,279 Total 9,997 2,556 14,781 949 Units 1,279 Units 2,556 Units 9,997 Units 20 RAD ACROSS THE COUNTRY 1st Component • 132 CHAP awards, representing 14,781 units • 51% conversion to PBRA, 49% conversion to PBV • Over 60% of proposals planning to use LIHTCs (the vast majority being 4% credits) • Over 60 partnering lenders and investors • Expected to raise $816M in debt and equity instruments 2nd Component • Approved 5,000 units in 48 projects • Expecting additional 2,000 unit approvals by end FY 2013 • Over 120 projects awaiting approval with additional authority 21 KEY CHANGES IN THE RAD NOTICE • • Eliminates caps on units that can convert for: Public housing Mode Rehab Creates new awards for: Portfolio conversions PHA defines “portfolio” of projects, either the entire PHA inventory or some subset PHA must submit applications for at least half of the projects in portfolio HUD will reserve award for remaining units in portfolio PHA must submit application for remaining projects in portfolio within 365 days Multi-phase conversion Allows PHAs to reserve conversion authority for projects with multiple development phases with applicable contract rent for all phases PHA has until July 1, 2015 to submit application for final phase PHA required to fulfill all CHAP milestones for each CHAP awarded Upon application acceptance, HUD will issue CHAP for initial phase and multi-phase award letter covering all phases of project Joint RAD/CNI applicants • Opens the Ongoing Mod Rehab Application Period 22 Aggregated Number of Unit Awards Issued RAD AWARDS TREND CHART 160,000 140,000 120,000 Awards-to-Date 100,000 80,000 60,000 Awards Expected Based on Application Trends Awards Expected Based on Current Outreach 40,000 Anticipated Future Awards 20,000 0 LENDERS AND TAX CREDIT INVESTORS Alliant Capital Boston Capital California Community Reinvestment Corporation Centerline Capital Group Community Affordable Housing Equity Corporation Community House Partners Development Corporation Direct Tax Credits, Inc. Enterprise Community Investment Georgia Department of Community Affairs Great Lakes Capital Fund Hudson Housing Capital Hunt Capital Parnters National Equity Fund Newport Partners LLC Ohio Capital Corporation Ohio Capital Housing Corporation PNC Real Estate Prestige Affordable Housing Equity Partners Raymond James Tax Credit Funds Inc. RBC Capital Markets Bellwether Enterprise Real Estate Capital LLC Arbor Commercial Mortgage Capital Fund Services Inc. Beekman Securities Crain Mortgage Group LLC Centerline Mortgage Capital Fifth Third Bank Chase Bank First Citizens Bank NA Columbus Bank and Trust Forest City Capital Corporation Continental Mortgage Corporation Great Lakes Capital Fund Federal Home Loan Bank of Chicago Highland Commercial Mortgage Hunt Capital Partners Lake Forest Bank & Trust Company McCan Communities Lancaster Pollard New Mexico Bank & Trust Love Funding NW Financial Group LLC M&T Rabobank N.A. PNC Real Estate Red Stone Equity Partners Prudential Huntoon Paige Associates LLC SunTrust Bank RBC Capital Markets Housing Finance Group TD Bank US Bank Red Mortgage Capital Red Stone Equity Partners Rockport Mortgage Richmon Group St. James Capital LLC Union Bank US Bank Community Development Corporation Walker Dunlop 24 RAD WEB PAGE RAD Notice, application materials, and additional resources can be found at www.hud.gov/rad Email questions to radresource.net 25