IV. Level IV: Considering the Implications of Behavioral Economics

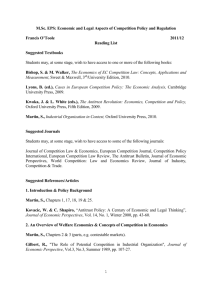

advertisement