Proportionate Dispositions - Pro

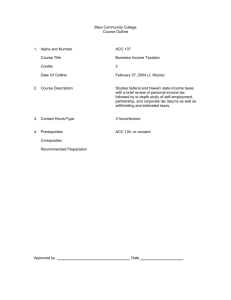

advertisement