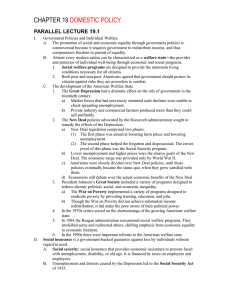

SOCIAL SECURITY

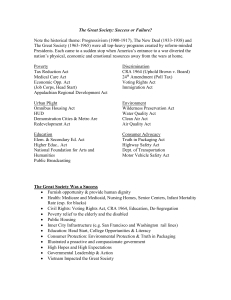

advertisement

Discretionary spending: Congress can adjust the amount spent on different programs through changes in annual appropriations bills. Mandatory spending: the federal government is legally required to spend the money. Social Security was founded in 1935 as part of the Franklin D. Roosevelt Administration’s New Deal Provides financial assistance to senior citizens, people with disabilities, and children whose wage-earning parents have died (the original intention was to take care of “widows and orphans”) Social Security is an entitlement program. Everyone who is eligible is legally entitled to receive benefits regardless of their means (even if they don’t need the money for their retirement/survival) – this differs from meanstested programs such as welfare. The amount of benefits is determined by a formula, and the amount determined by the formula is legally required to be paid out. Social Security and Medicare accounted for 36% of federal spending in 2011 and 43% in 2013. Social Security is funded through a payroll tax. Up to $118,500 of your income is subject to this tax. Your employer pays 7.65% of your income in payroll taxes. An equal amount is deducted from your check. 6.2% goes for Social Security and 1.45% for Medicare. If you’re self-employed, you pay the whole thing yourself (15.3%). The trust fund took in $590 Billion in payroll taxes in 2012. Source: Social Security Administration at socialsecurity.gov. Workers pay in (currently 167 million people) 85% goes to retirement trust fund 15% goes to disability trust fund Retirees collect 59 million current recipients You can begin to collect at age 62, but can’t collect full benefits until later Benefit level is based on what you paid in, based on your average income over 35 years of your career Higher-income workers eventually collect higher SS benefits Because of Cost-of-Living Adjustments and interest, you get out more than you paid in Average Social Security monthly benefit is $1328 as of January 2015. Never intended to be your sole source of retirement income Supplemental Security Income (SSI) for those with disabilities who are unable to work Federal SSI benefit is $733 per month for an individual and $1100 for an eligible couple; states may supplement this with their own money. Social Security benefits are not subject to federal income tax unless your income is above a certain level The practical effect of this is that if SS is your primary source of income, you don’t pay federal income taxes The program currently takes in more than it pays out. The trust fund currently contains $2.5 Trillion. BUT this money is borrowed from to fund other federal programs (makes the deficit look smaller than it actually is) And there’s another problem… 76 million Americans born 1946-1964 In the recent past, all of these people were at the peak of their earning capacity and paid large amounts into the trust fund over time First boomers turned 65 in 2011 and are now drawing benefits (even though some of them are still working and paying into the system) Eventually, this large group of people will be drawing benefits out instead of paying in. Without changes, the system will no longer be able to pay full levels of benefits after 2033 Without changes, the Medicare system will no longer be able to pay benefits after 2034 Without changes, the retirement system will no longer be able to pay benefits after 2036 Fixing Social Security requires short-term pain (raising taxes) for long-term gain (benefits that won’t be realized for decades) It’s easier for politicians to do nothing and kick the can down the road for future generations to solve. The bad news: It’s YOUR problem. The good news: You have 20 years to figure out how to fix it. Means testing (benefits only if you need them) Politically controversial – people have paid in with the expectation that they will receive benefits Decrease Cost-of-Living Adjustment (COLA) Benefits increased by 1.7% in 2015. It was announced that benefits will not increase in 2016 because there was no increase in the Consumer Price Index. A slower rate of growth than the increase in the cost of living (e.g., 1%) would prolong the life of the system. It’s easy to portray this as a “cut” in benefits. Raise age at which you can begin to collect full benefits – going up incrementally Born prior to 1937: age 65 1937-1942: 65 and some months 1943-1954: age 66 1954-1960: 66 and some months 1960 or later: age 67 May eventually be increased to age 70 Raise/eliminate cap on amount of income subject to payroll tax Bill Gates only pays Social Security payroll taxes on the first $118,500 of his income. Extremely high-income workers do pay a higher percentage of the Medicare payroll tax. Privatization: Proposal by GW Bush and others to allow people to pay less into the SS trust fund and more into private individual retirement accounts that could be invested in the stock market Potential for much greater return on investment than SS pays out What if the stock market goes down? (This proposal hasn’t been discussed much since the recession began in 2008) While an entitlement program such as Social Security is available to all who meet certain criteria (age 65 and older), a means test requires recipients to prove a lack of assets in order to qualify for benefits from a program. Traditional conservative view: Most poverty is caused by behavioral characteristics: laziness, stupidity, irresponsibility, bad choices (substance abuse, promiscuity, dropping out of school). Government can’t fix this. Traditional liberal view: Private enterprise cannot by itself provide enough jobs, opportunity or resources for everyone; historical discrimination and social structures exacerbate poverty and limit opportunity, so some people will be left out through no fault of their own. Government has an obligation to help these people. Eventual consensus: Government has a responsibility to provide for the truly needy, while behavioral dependency has to be addressed and personal responsibility has to be developed “Social safety nets (SSNs) are noncontributory programs that target the poor and vulnerable and are designed to reduce poverty and inequality, enable better human capital investments, improve social risk management, and offer social protection.” (World Bank) In the US and other developed countries, social safety nets generally refer to welfare programs for the poor. The US Constitution gives the Congress power to “provide for…the general Welfare of the United States,” but many social programs have been state-centered or coordinated between state and local governments. Social welfare programs either transfer income or provide services to individuals to improve the quality of their lives Technically, public education qualifies as a social welfare program Social Security and Medicare are not targeted specifically at the poor 31% of female-headed households in US are below the poverty line (down from 44.3% in 1996) Direct cash transfers (money, in the form of government checks, to individuals) – AFDC was a direct cash transfer program, TANF, SSI, EITC, some state programs In-kind programs provide goods and services: food stamps, Medicaid, child nutrition (WIC, school lunch) Social insurance: Social Security, Medicare, Unemployment compensation, Worker’s comp Medical programs are biggest category We’ll talk about Medicare, Medicaid, etc., when we discuss health care as our next topic Cash assistance programs are second biggest category Less than one-quarter of state welfare expenditures go to cash assistance programs (TANF, SSI, general assistance) 2014 federal poverty guideline for a family of four is $23,850 (poverty level is defined as three times the cost of food). 15% of total population is poor 21.8% of children 9.1% of senior citizens Sources: familiesusa.org; University of Wisconsin Institute for Research on Poverty at irp.wisc.edu FY 2012: 21.2% in Louisiana 7.4% in New Hampshire White 11.7% Black 27.2% Hispanic 25.6% Asian 12.7% States received $525 Billion in federal funds in 2011 for health, education and welfare Trends: Health care costs and expenditures are growing as welfare spending is shrinking Benefits tend to be higher in wealthier states – greater tax base and fewer needy people, greater political control by those whose interests are not served by generous welfare spending More politically conservative states spend less, even though many of them are poorer (Mississippi); states with larger African American populations tend to have stricter eligibility requirements for social programs Aid to Families with Dependent Children (AFDC) was established in 1935. Assistance to widows and orphans (most women weren’t in the paid workforce and the assumption was that they needed to be provided for) Eligibility criteria: Single-parent family or twoparent family where primary wage earner is unemployed, child under 18 Income eligibility was set by states No time limits, so welfare became a multigenerational way of life when it was intended as temporary assistance (if your child under 18 had a baby, the family was eligible until the baby turned 18) Emphasis on single-parent families (almost all of which are female-headed) discouraged marriage and promoted illegitimacy and poverty No expectation of improvement No incentive to get off welfare No job training or skill development to achieve economic self-sufficiency Greater benefits for larger families led to irresponsibility in having children More than two-thirds of recipients got it for more than eight years In the early 1990’s, several states were granted waivers from federal AFDC requirements to experiment with different types of welfare programs. Wisconsin developed “workfare” requirements South Carolina Family Independence Act of 1995 The success of these experiments led to the federal Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) “Reconciliation” is a budget term Replaced AFDC with Temporary Aid to Needy Families (TANF) “The four purposes of TANF are: Assisting needy families so that children can be cared for in their own homes Reducing the dependency of needy parents by promoting job preparation, work and marriage Preventing out-of-wedlock pregnancies, and Encouraging the formation and maintenance of twoparent families” (US Dept. of Health and Human Services) AFDC was primarily a federally-administered program with benefits direct to individuals, while TANF is primarily administered by the states, funded by block grants from federal government to states Time limits: 24 months consecutively, 60 months lifetime unless certain criteria are met for a waiver Work, school or job training requirements as a condition of receiving benefits Unmarried teenagers and their children, and children born while their mothers were receiving benefits, may be denied coverage Recipients may be required to complete high school Most recipients must work in order to receive benefits Single parents: 30 hours per week, or 20 hrs./wk. with a child under 6 Two-parent families: 35 hrs./week or 55 hrs. if they receive federal child care assistance Work activities: job, work experience, training, job search and coaching, vocational education, community service, secondary school attendance, providing child care to individuals participating in community service. Teenaged parents must live with their parents or in an adult-supervised setting TANF Block Grant $16.5 Billion to states in FY 2009. Less than 2% of families nationally Approx. 1% of population of SC (41,000); this is up substantially since the beginning of the recession in 2008, but about one-sixth the AFDC caseload prior to welfare reform in 1996 Average monthly benefit varies by state States may exempt parents of infants from work requirements Mother of two in SC: $163-$205 a month in benefits Child support enforcement Marriage initiatives Fatherhood initiatives Child care initiatives Abstinence Education Medicare (1965) Medicaid (1965) and SCHIP (1995) Head Start (1965) and Early Head Start (1995): Head Start: Comprehensive child development services for eligible low-income children from birth until mandatory school attendance. EHS is for pregnant women. Other social programs – some states have General Assistance programs Health care and Affordable Care Act – impact on poverty (to be discussed next time) Food Stamp program established 1964 Now called SNAP (Supplemental Nutritional Assistance Program) Funded by US Department of Agriculture and administered by states “Food stamps” replaced by EBT cards which can only be used for certain staple foods 46 million people received benefits at some point in 2014, generally about 16 million at any one time Maximum benefit for an individual is $194/month (larger for couples and families) Able-bodied recipients under 60 without dependents are eligible for three months of assistance over a three-year period Eligibility requirements make it difficult for many to apply SC EBT program WIC (Women, Infants and Children) Target population is pregnant and breastfeeding women, infants and children under 5. Administered by USDA, state agencies and local providers Means-tested, eligibility requirements vary by state Community Development Block Grant (1974) $4.7 Billion in federal funding in FY 2006, down to $3.02 Billion in FY 2014 Also federal aid for housing and development projects Section 8 rent subsidies Enacted 1975 Offsets burden of Social Security payroll taxes paid and can reduce the federal tax burden for low-income families Total income limits to qualify in 2014: $14,590 for single, childless taxpayer $20,020 for childless couple filing jointly Limits increase up to $52,047 for married couple with three or more children, filing jointly People are worse off if they can’t remain eligible for things like food stamps once they get jobs What if you have no transportation or child care – how can you work then? Are the jobs where the needy live? Fraud: As a practical matter, either you let people cheat in order to make sure that no truly deserving person gets left out, or you let truly deserving people get left out in order to make sure that no one cheats. Which is worse?