BUSINESS ANGEL

WIPO-INSME INTERNATIONAL TRAINING PROGRAM

ON THE ROLE OF INTELLECTUAL PROPERTY IN RAISING

FINANCE BY SMALL AND MEDIUM-SIZED ENTERPRISES jointly organized by

WIPO and INSME

Theme 9: Role of Business Angels in Supporting Your Innovation Plans

Mr. Paolo Anselmo

President of the Italian Network of Business Angels (IBAN)

Member of the Executive Committee of the European Network of Business Angels (EBAN)

Member of the INSME Association Board

Geneva - July 12, 2006

FINANCING OF THE PROJECT

►

►

►

DEBTS

PUBLIC FINANCING

VENTURE CAPITAL:

Formal Venture Capital

Informal Venture Capital (business angels)

FINANCIAL SUPPLY CHAIN

Prerequisites

Own resources

FFF

Banks

Guaranties

Leasing

Factoring

Loans on trust

Pre-seed

Loans for investors

Reimbursable advance payments

BA

Corporate

Venturing

Grants

Micro-credits

Other public support

Seed capital

VC

Tools Infrastructure: business angels networks, incubators, etc.

Advice: investment readiness program, tutorship

FFF : Family, Friends, Fools

BA : Business angels

VC : Venture capital

IPO : Initial Public Offering

IPO

Expertise: professional fund managers

THE ENTERPRISE FINANCING PROCESS

Financing needs

Grow th

High

Risk

GU

AR

AN

TI

ES

MARKET

GAP

Bu si ne

An ge ss ls ur

; ne

En tre pe m ily

Fa

Fri en

, ds

SEED

Se ed

Ca pi ta l

STAR T-UP PH ASE

MARKET

GAP

Ba nk

Lo an

Pu s bl ic

s ec

Fo rm al

Ve ntu re ca pi ta l to

E ARLY GROWTH r a id

Eq ui ty

I.P.

O

Low

Risk

EXP ANSION

Financing stage

THE ENTERPRISE FINANCING PROCESS

Efforts made by financiers

Risk

Cash flow

Time

Innovation

Seed Capital

Funds and

Public funding

Idea

Commercial and Savings Banks

Private

Investors and

Business

Angels

Start-Up Market introduction

Corporate Fund and

Venture Capital

Growth Maturity Transfer

THE ENTERPRISE FINANCING PROCESS

Stage in

Cycle

Type of

Funding

Source of

Funding

R&D

Proof of

Concept

Funding

Start-up

Seed

Corn

Public Sector

Founders, family and friends

Business angels

Corporate venturing

Early growth

First

Round

Accelerating growth

Second

Round

Sustaining growth

Maturity growth

Development

Capital

Replacement

Capital

MBO / MBI

Development

Capital

Venture capital funds

Public listing / IPO

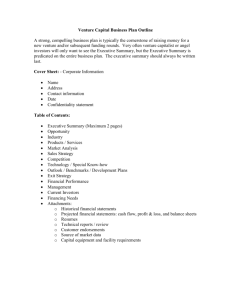

IS A COMPANY READY?

• Business plan?

• Stage of development of the company

• Type of investment?

• Valuation?

• Management team ready?

• Has the management team enough time and energy to raise funds?

• Is the team shaped to talk to investors?

• Does the company know where to go?

VENTURE CAPITAL (formal & informal)

►

Institutional operators

(formal venture capital)

►

Private subjects

►

►

►

Banks

Insurance

Corporate venture capital

►

Non-institutional operators

(informal venture capital)

►

Business Angels

BUSINESS ANGEL (BA) - definition

“A Business Angel is a middle aged male with reasonable net income, personal net worth, previous start up experience, who makes one investment a year, usually close to home or office, prefers to invest in high technology and manufacturing ventures with an expectation to sell out in three to five years time”.

(Kelly and Hay, 1996)

”Business angels (informal investors, independent investors) are investors who provide risk capital directly to new and growing businesses in which they have no prior connection”.

(Harrison and Mason, 1996)

BUSINESS ANGEL (BA)

Attitudes, behaviour and characteristics:

• male, rarely female

• successful experience as an entrepreneur or manager

• high net worth individual and / or sophisticated investor

• have a declared propensity to invest and to risk in a start-up firm

• invest their own money (around 50K – 250K euro) (part of their cash capital: 20 - 30 %)

• Seeking profit, but also fun (seeking minimum 20% return)

• are willing to share their managerial skills and their enterprise background

• often invest in their region of residence

• make one investment a year

• prefer high-technology and manufacturing

• take a minor participation – medium term investment

• are willing to wait for an exit for 3-5 years

ANGEL’S – success stories

Company name Angel Investor Business

Apple Computer (Name Witheld) Computer hardware

Investment

$91.000

Value at Exit

$154 million

Amazon.com

Blue Rhino

Lifeminders.com Frans Kok

Body Shop

Thomas Alberg Online bookshop

Andrew

Filipowski

Propane cylinder replacements

Ian McGlinn

$100.000 $26 million

$500.000 $24 million

Internet e-mail reminder service

$100.000 $3 million

Body care products

£4.000 £42 million

ML Laboratories Kevin Leech Kidney medical treatment

£50.000

Matcon Ivan Semenenko Bulk containers

£15.000

Source: partially adapted from unpublished data provided by Amis Ventures in 1999

£71 million

£2.5 million

ANGEL STRATEGY

High-growth start-ups: new businesses that are likely to see sales grow to around € 1M and employment to between

10 and 20 people in early years and export oriented.

Key selection criteria of risk capital investors (generally):

• New products or technological improved products in an existing market

• A product or service that can be taken to market without further development (i.e. past the initial concept stage)

• Creation of new markets

• Company’s growth should expected to be higher than market growth

• Increase of market share against competitors

• Superiority regarding competitors

ANGEL DUE DILIGENCE PROCESS

Technology

Technology development

Product development

Process development

Product supply

Deliveries

Organization

Recruitment

Board

Network of service suppliers

Office

Market

Marketing

Sales

PR

Competitors

IPR

Economy / Finance

Cash forecast

Finance activities

Cost estimate

Budget

PRIORITIES FOR EQUITY PROVIDERS

Equity providers

Business angels or informal investors

Eligibility Criteria

• Meeting or matching of individual entrepreneurs with the angel

• Atmosphere of trust between individuals

• Credible business plan in the eyes of the angel

• Good management

• Fiscal incentives

• Market knowledge of the entrepreneur

• Availability of exit route

• Return on investment (capital gain)

Venture capital and

Financial corporate venturing

• Business plan credibility

• Business plan with patent technology

• Track record (over previous years)

• Ability to grow fast and deliver quick ROI

• Management team quality

FORMAL AND INFORMAL EQUITY PROVIDERS

Business Angels

Personnel Entrepreneurs

Firms funded Small, early stage

Due diligence Minimal

Investment's Of concern location

Contracts used

Active 'hands-on'

Simple

Exiting the firm

Rates of return

Of lesser concern

Of lesser concern

*

Source: van Osnabrugge, 1998, p.2

Formal venture capital

Investors

Large, mature

Extensive

Not important

Comprehensive

Strategic

Highly important

Highly important

FORMAL AND INFORMAL EQUITY PROVIDERS

VC

– Easy to find via directories

– Your request is only one among many hundred a VC receives

– Can often via syndication provide large investment

– Thorough and formal due diligence and investment process

– Exit route very important

BA

– Difficult to find

– Request often strong personal involvement

– Limited amount to invest

– Investment decisions often quick and less formal

– Syndication more and more usual

– Exit route less in focus

OBTAINING RISK CAPITAL

►

Advantages for the

enterprise:

►

“science based” acquisition of financing for development

► operative and financial consultancy

► growth in prestige and visibility at international level

► attraction of talents with stock options

► reinforcement of negotiating power with the credit system, clients and suppliers

► possibility for way out and positive reevaluation

THE IRREGULATITY OF THE

INFOMRATION AVAILABLE

►

THE IMPORTANCE OF THE INFORMATION

NEEDS OF THE INVESTORS IN THE

EVALUATION OF THE PROJECT

to evaluate the yield of the investment

to reduce the risk of requests from opportunists

►

“WHAT” AND “HOW” TO EVALUATE

Economic and financial information

(quantitative/consumptive)

Business plan (quantitative/prognostic)

Qualitative judgment of the confidence of the project

THE FIRM-ORIENTED APPROACHES

►

1st Criteria: approaches based on costs

(historic and/or substitutions)

►

2nd Criteria: approaches based on value

►

??.., what is the OBJECT of the evaluation?

Immaterial and non-patentable factors

Intellectual property (importance if the “scientific dimension” vs the “economic/financial dimension”)

Prospective revenues (strong influence of the state of development of the product/service with respect to the market)

THE INDIVIDUAL-ORIENTED

APPROACHES

►

Approaches based on qualitative variables (subjectiveness of the proposers):

►

►

Demographic variables of the entrepreneur

Social variables such as political editorials

►

The context: academic or industrial origin (technical-scientific and managerial capacity)

N.B.

THE CRITERIA OF EVALUATION DEPEND ON: THE TIMING OF

THE FINANCIAL INTERVENTION (enterprise’s phase); QUALITATIVE

JUDGEMENT OF THE INDIVIDUALS (human capital); QUANTITATIVE

ESTEEM OF THE ENTERPRISE (the reputation of the enterprise).

ROLE OF THE SCIENTIFIC COMMUNITY

►

(+) the KNOWLEDGE WORKERS “attracted”, why?

►

►

►

► opportunity to increase technical competences opportunity to enrich one’s CV to increase the visibility in one’s community access a global scientific network

► able management of eventual elitist attitude

►

(-) the intrinsic mobility of KNOWLEDGE WORKERS

(generation of a risk of unstable knowledge and/or cessation of know how to third parties)

THE REPUTATION OF THE ENTERPRISE

►

An extremely important resource in phase of start up in order to limit the environmental pressures and to attract the necessary resources

►

How it is constructed:

►

Collaborated vertical agreements (University, enterprises)

►

Relational systems and participation in networks

(social capital)

N.B. More social relations form an enterprise, the potential for the reputation and confidence should mature over time.

LEGITIMIZATION STRATEGIES

►

SEARCH FOR CONSENT - RELATIONAL CONTEXT (in order to increase the level aperture towards the outside world)

►

Access to scientific networks (in order to acquire qualified human resources)

►

Access to financial networks (to acquire financial resources)

►

Access to business networks (in order to acquire managerial resources)

►

STRATEGIES

►

►

Passive attitude (patenting of research results)

Active attitude (localization near innovation locations)

►

Proactive attitude (communication of the scientific successes obtained)

BAN – THE NETWORK

Venture Capital,

Business Angels and Banks

Network of

Intermediaries and

Universities

BAN

Universities, Professional

Thank you for listening!

and technology Business Support companies Organizations

Thanks for your attention

Ing. Paolo ANSELMO

IBAN – Italian Business Angels Networks c/o Centro Sviluppo Spa

Via Lavoratori Vittime Col du Mont, 24

11100 Aosta – Italy

T: +39 0165 305511 – F: +39 0165 305540 e-mail: presidenza@iban.it

www.iban.it

www.eban.org