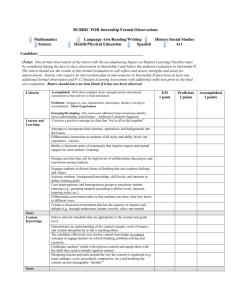

Working Under Age 19

advertisement

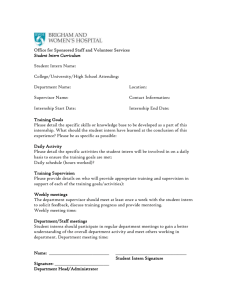

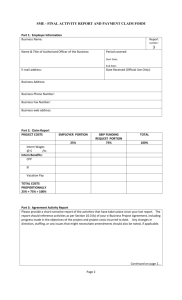

Presented By: Susan L. Swatski, Esq. Hill Wallack LLP April 9, 2015 Hiring Minors Child Labor Laws Wages Record Keeping Violations of the Child Labor Laws Federal Fair Labor Standards Act v. New Jersey Child Labor Law Which law applies? Where both the FLSA and state child labor laws apply, the higher minimum standard must be obeyed. Minimum Wage Federal Minimum Wage $7.25 per hour New Jersey Minimum Wage $8.38 per hour Minors under age 18 are exempted Exceptions to Minimum Wage Under Federal Law 29 U.S.C.A. 213 exempts all summer camp employees (not just minors) from minimum wage and maximum hour requirements Youth Minimum Wage $4.25 per hour to employees under age 20 for the first 90 consecutive calendar days of initial employment. After 90 days, the FLSA requires employers to pay the full federal minimum wage ($7.25). Federal Fair Labor Standards Act v. New Jersey Child Labor Law Who can work? Must be at least 14 years old (NJ and FED) Rules for Working Under Age 19 Rules for Working Under Age 18 Rules for Working Under Age 16 New Jersey’s Rules for Working Under Age 19 Working Under Age 19 The employer must keep a record which states: the name, date of birth and address of each person under 19 the number of hours worked by said person on each day the hours of beginning and ending such work the hours of beginning and ending meal periods the amount of wages paid The record shall be kept on file for at least 1 year Under Federal Law, once a minor reaches 18 years of age, the federal child labor provisions no longer apply to their employment. ** Note the grey area for which law applies to 18 year olds. Rules for Working Under Age 18 An individual cannot: Work for more than 8 hours a day or more than 6 straight days in any one week Work more than 5 hours without at least a 30 min. break Work more than 40 hours in any one week An individual between 16 and 18 years of age requires written permission from their parent to work after 11 p.m., but in no event may such a minor work between 3 a.m. or before 6 a.m. Rules for Working Under Age 18 Employment Certificate (Form A300) Everyone under age 18 when the term of employment starts needs to complete an Employment Certificate The Certificate is obtained from the school district where the minor resides, but if the residence is out of state, then look to the district in which the minor will be working Even if the employee worked at the camp last year, new papers are required Even if the employee is working for only a few days and worked for the camp prior years, a certificate is still required Rules for Working Under Age 16 An individual cannot: Work before 7 a.m. Work after 7 p.m. unless he/she has written parental permission Cannot work after 9 p.m. even with parental permission Posting Requirements Where a minor under 18 is employed, every employer shall conspicuously post: A printed abstract of the Child Labor Law A list of occupations prohibited to such minors (most often missed) Schedule of hours of labor, including: Name of each minor under 18, The maximum number of hours he/she shall be required to work each day, The total hours per week, The time commencing and stopping work each day and The time for the beginning and ending of the daily meal period. Record Keeping of Minors Under 19 Records must be kept on file for at least one year after the entry of the record Employers must keep records of all minor employees listing: Name and address, Date of birth, Amount of wages paid, Number of hours worked each day, Beginning and ending work hours for each day and Beginning and ending meal or break periods. Violation of the New Jersey Child Labor Law An employer who violates the Act shall be: guilty of a crime of the fourth degree subject to a fine of not less than $100 nor more than $2,000 for an initial violation and not less than $200 nor more than $4,000 for each subsequent violation Each day during which any violation continues shall constitute a separate offense Each minor so employed constitutes a separate offense In addition, the Commissioner of Labor and Workforce Development may assess administrative penalties of not more than $500 for a first violation, not more than $1,000 for a second violation, and not more than $2,500 for each subsequent violation Violation of the Federal Child Labor Law A civil penalty of $15,000, $25,000 or $40,000 will be assessed for each violation that causes a serious injury of a minor employee The fine depends on the severity and permanency of the injury A civil penalty of $6,000, $8,000 or $10,000 will be assessed for a labor violation resulting in a non-serious injury of a minor employee The maximum penalty for a non-serious injury is $11,000 Best Practices for Hiring a Minor NJ Law Against Discrimination Applies to Minors Ask the same information to/from all candidates Prepare a standard list of neutral questions for all candidates Have the seasonal worker complete an application that includes a Disclaimer of Employment Contract (i.e. a statement that nothing in the application creates an employment agreement or in any way alters the at-will status of employment if the candidate is hired). Ensure all notes are objective and job-related (notes are discoverable) Handling unsolicited information: remain neutral, don’t ask follow up questions into restricted or potentially charged areas Best Practices for Hiring a Minor (continued) Obtain a working certificate/No undocumented workers No sharing employees with neighboring camps Keep the certificate on file at the minor’s place of employment Require a signature for comparison with the signature on the certificate Provide at least a 30 minute lunch break Set up a system for documenting time worked Social Media: The New Water Cooler Have a written social media policy State whether and to what extent monitoring will take place State the legitimate business reason for the monitoring Provide examples of specific activities that may not be posted on line (i.e. photographs of campers, discussion of campers by name or physical description) Conduct training for each employee on the social media policy Require, as a condition of employment, each employee sign off on the social media policy Do not ask the employee/candidate for access to his/her social media account(s) Non-Paid Internships What is an Internship Who Must be Paid Criteria For An Internship 1. 2. 3. 4. 5. 6. Training similar to that given in a vocational school Academic credit Classroom-like structure College or university level program oversight No displacement of regular paid workers Close individual supervision by or shadowing of an experienced professional 7. The employer derives no immediate advantage from the intern’s activities 8. The internship is for the benefit of the intern 9. The intern is not necessarily entitled to a job after the internship 10. The internship should be for a fixed duration, established prior to its outset 11. The employer and the intern understand that the intern is not entitled to wages Best Practices for Hiring an Unpaid Intern Check with your insurance agent to be sure you have adequate business liability and worker’s compensation insurance 2. Issue the intern a copy of your employment manual a. Ask the intern to sign off on all company policies and procedures b. Provide a physical space in a professional work environment that is in close proximity to his/her direct supervisor 1. Best Practices for Hiring an Unpaid Intern (continued) 3. Provide necessary resources (e.g. desk, phone, email address etc. ) 4. Reimburse the intern for approved expenses 5. Check with the interns’ school to find out if the school has set internship guidelines that must be met in order for the student to receive academic credit 6. Only ask the intern to work the amount of time that the company can fill with substantive assignments, training and activities Volunteer Definition: The applicable regulation promulgated by the Department of Labor defines a “volunteer” to be “[a]n individual who performs hours of service for a public agency for civic, charitable, or humanitarian reasons, without promise, expectation or receipt of compensation for services rendered....” 29 C.F.R. 553.101(a). Employees may not “volunteer” to perform job-related tasks. In other words, you can’t “volunteer” to circumvent overtime laws, even if the employee consents. Thank you for attending! hillwallack.com