File - Zachary Nunn

advertisement

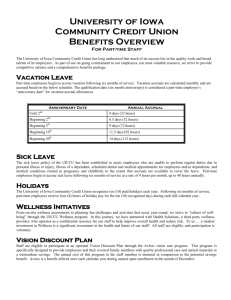

By: Zachary Nunn Aflac History •John, Paul and William Amos •Founded in 1955 in Columbus, Georgia •Originally named American Family Life Insurance Company •1958-Developed Groundbreaking Cancer Policy •1974-Obtained License to sell in Japan •1974-officially listed on NYSE •1989-Adopts the name Aflac, which stands for American Family Life Assurance Company •1990-Dan Amos becomes CEO Competitors Policies •Accident •Cancer/Specified Disease •Critical Care and Recovery •Dental •Hospital Confinement Indemnity •Hospital Confinement Sickness Indemnity •Hospital Intensive Care •Juvenile Life •Life •Lump Sum Cancer •Lump Some Critical Illness Subsidiaries American Family Life Assurance Company of Columbus American Family Life Assurance Company of New York Communicorp, Inc Aflac Information Technology, Inc Aflac Insurance Services Company, Limited Aflac Payment Services Company, Limited Aflac Technology Services Company, Limited Aflac Heartful Services Company, Limited Aflac in Japan •Began selling insurance in 1974 •One out of every four households in Japan •140,000 small businesses •Over 75 percent of revenue Aflac in the United States Has presence in all 50 states Employs more than 4,500 people Aflac is the Number 1 provider of guaranteedrenewable insurance in the United States More than 74,000 independent sales agents Strategies Expansion of product line Main focus is to provide policies that can be used to help out-of-pocket expenses that are not covered by existing major medical coverage Growing distribution system of independent insurance agents and brokers. Aflac focuses its products on the worksite market because that is where most Americans buy health insurance. Many of the workers we insure are employed by small businesses. Marketing “Worksite Marketing” The Duck January 1, 2000 Name recognition grew from 11% to 94% Commercials, Billboards, Newspaper, Magazines etc. Marketing and Sales into one Department Creating a team focused on brand and customer experience Social Responsibility & Contributions Donated millions to American Red Cross for disaster relief Donated $3 million to establish the Aflac Cancer Center at Egleston Children's Hospital. Joined with the Children's Cancer Association of Japan to build the Aflac Parents House. Social Media donations and fundraisers to help fund cancer research SWOT Analysis Strength 1. Focus on niche helping defend global market leadership in supplemental health insurance 2. Long standing relationships with banks continue contributing to recurring sales 3. Strong balance sheet providing financial strength 4. Unique products with high customer loyalty Weakness 1. Increasing concentration in Japan increases business risk 2. Losses on perpetual debentures likely to continue 3.Brand equity not strong enough compared to competitors Opportunity 1. Launch of new products likely to generate higher returns 2. Launch of new initiatives to enhance sales 3. Increasing natural calamities in Japan likely to enhance life insurance market growth potential Threats 1. Increasing competition in supplemental in health insurance sector 2. Increasing incidence and severity of natural disasters in Japan could affect underwriting profits Stock Chart Financial Overview Aflac Inc. (AFL)-NYSE 62.21 Revenues (millions):22,171.0-6.9% increase from 2010 Profits (millions): 1,964.0-down 16.9% from 2010 Assets (millions): 117,102.0 Stockholders' equity (millions): 13,506.0 Growing Aflac TO CONTINUE EXPANDING!!