Chapter 6

Internal Control in a

Financial Statement

Audit

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

LO# 1

Internal Control

Internal control plays an important role in how management meets

its stewardship or agency responsibilities. Management has the

responsibility to maintain controls that provides reasonable

assurance that adequate control exists over the entity’s assets and

records. Proper internal control not only ensures that assets and

records are safeguarded but also creates an environment in which

efficiency and effectiveness are encouraged and monitored.

Management also needs a control system that generates reliable

information for decision making.

The auditor needs assurance about the reliability of the data

generated by the information system in terms of how it affects the

fairness of the financial statements and how well the assets and

records of the entity are safeguarded.

6-2

LO# 1

Internal Control

The auditor uses risk assessment procedures to obtain an

understanding of the entity’s internal control and uses this

understanding to identify the types of potential

misstatements, ascertain factors that affect the risk of material

misstatement, and design tests of controls and substantive

procedures.

The auditor’s understanding of the internal control is a major

factor in determining the overall audit strategy. The auditor’s

responsibilities for internal control are discussed under two

major topics: (1) obtaining an understanding of internal

control and (2) assessing control risk.

6-3

LO# 2

Internal Control

Objectives

Reliability of

Financial

Reporting

Effectiveness

& Efficiency

of Operations

Compliance

with Laws &

Regulations

6-4

LO# 3

Controls Relevant to the Audit

Objectives

Reliability of

Financial

Reporting

Effectiveness

& Efficiency

of Operations

Compliance

with Laws &

Regulations

Generally, internal controls pertaining to the preparation

of financial statements for external purposes are

relevant to an audit.

6-5

LO# 3

Controls Relevant to the Audit

Objectives

Reliability of

Financial

Reporting

Effectiveness

& Efficiency

of Operations

Compliance

with Laws &

Regulations

Controls relating to operations and compliance

objectives may be relevant when they relate to data the

auditor uses to apply auditing procedures.

6-6

LO# 4

Components of Internal Control

Entity’s Risk

Assessment

Process

Control

Environment

Information System and

Related Business Processes

Relevant to Financial

Reporting & Communication

Control

Procedures

Monitoring of

Controls

6-7

LO# 4

Components of Internal Control

6-8

LO# 4

Components of Internal Control

6-9

The Effect of Information

Technology on Internal Control

LO# 5

6-10

LO# 6

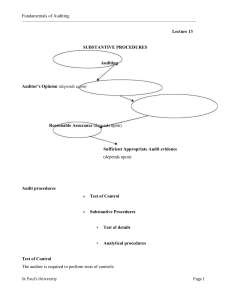

Planning an Audit Strategy

Audit Risk Model

AR = IR × CR × DR

In applying the audit risk model, the auditor must

assess control risk. The figure on the next slide

presents a flowchart of the auditor’s decision

process when considering internal control in

planning an audit.

6-11

LO# 6

Planning an Audit Strategy

6-12

LO# 6

Substantive Strategy

After obtaining an understanding of internal control, an

auditor may choose to follow a substantive strategy and set

control risk at the maximum for some or all assertions

because of one or all of the following factors:

Controls do

not pertain to

an assertion.

Controls are

assessed as

ineffective.

Testing the

effectiveness

of controls is

inefficient.

6-13

LO# 6

Reliance Strategy

Obtain

Understanding of

Internal Control

Plan to Rely on

Internal Control and

Assess Control Risk

Below Maximum

6-14

LO# 6

Assertions

Occurrence

Completeness

Authorization

Accuracy

Cutoff

Classification

6-15

LO# 6

Assertions

6-16

LO# 6

Assertions

6-17

Obtain an Understanding

of Internal Control

LO# 7

The auditor should obtain an understanding of each of

the five components of internal control in order to plan

the audit. This knowledge is used to:

Pinpoint the

factors that affect

the risk of material

misstatement

Identify types of

potential

misstatements

Design tests of

controls and

substantive

procedures

6-18

LO# 7

Control Environment

6-19

LO# 7

The Entity’s Risk

Assessment Process

The risk assessment process should consider external and

internal events and circumstances that may arise and adversely

affect the entity’s ability to initiate, record, process and report

financial data consistent with the assertions of management in

the financial statements.

Client business risk can arise or change due to the following

circumstances:

Changes in the

operating

environment

Corporate

restructuring

New personnel

Rapid growth

New or revamped

information systems

New technology

Expanded

international growth

New accounting

pronouncements

New business

models, products,

or activities

6-20

Information Systems and

Communication

LO# 7

An effective accounting system gives appropriate consideration

to establishing methods and records that will

1. Identify and record all valid transactions.

2. Describe on a timely basis the transactions in sufficient detail to

permit proper classification of transactions for financial reporting.

3. Measure the value of transactions in a manner that permits

recording their proper monetary value in the financial statements.

4. Determine the time period in which transactions occurred to permit

recording of transactions in the proper accounting period.

5. Properly present the transactions and related disclosures in the

financial statements.

6-21

LO# 7

Control Activities

Control activities are the policies and procedures that help

ensure that management’s directives are carried out. Those

control procedures that are relevant to the audit include

Performance

reviews

Information

processing

Physical

controls

Segregation

of duties

6-22

LO# 7

Monitoring of Controls

Monitoring of controls is a process that

assesses the quality of internal control

performance over time.

Internal

Auditors

An effective internal audit function

has clear lines of authority and

reporting, qualified personnel, and

adequate resources to enable these

personnel to carry out their assigned

duties.

6-23

LO# 7

The Effect of Entity Size on

Internal Control

While the basic concepts of the five

components should be present in all entities,

they are likely to be less formal in a small or

midsize entity than in a large entity.

6-24

LO# 7

The Limitations of an

Entity’s Internal Control

Management

Override of

Internal

Control

Human Errors

or Mistakes

Collusion

6-25

LO# 7

Factors Contributing to Fraud

6-26

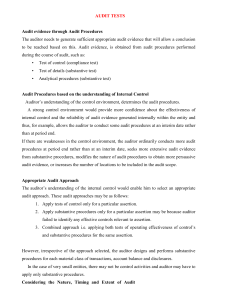

LO# 8

Documenting the Understanding

of Internal Control

Procedure Manuals

and Organizational

Charts

Narrative Description

Internal Control

Questionnaires

Flowcharts

6-27

LO# 9

Assessing Control Risk

Identify

specific

controls that

will be relied

upon.

Perform tests

of controls

Conclude on the

achieved level

of control risk.

6-28

LO# 10

Documenting the Assessed

Level of Control Risk

The auditor’s assessment of control risk and the

basis for the achieved level can be documented

using a structured working paper, an internal control

questionnaire, or a memorandum.

Let’s look at an example from

EarthWear Clothiers to see

how the control risk for two

accounts that differ in terms of

their nature, size and

complexity is documented.

6-29

LO# 10

Documenting the Assessed

Level of Control Risk

6-30

LO# 11

Substantive Procedures

6-31

LO# 12

Timing of Audit Procedures

Interim

Year End

Let’s look at the EarthWear Clothiers example

again to see the timing of their audit

procedures.

6-32

LO# 12

Timing of Audit Procedures

6-33

LO# 12

Interim Audit Procedures

Interim Tests of

Controls

Interim

Substantive

Procedures

1. Assertion being tested not significant

2. Control has been effective in prior audits

3. Efficient use of staff time

1. Assertion probably has low control risk

2. May increase the risk of material

misstatements

3. Still requires some year end testing

6-34

LO# 13

Auditing Accounting Applications

Processed by Service Organizations

In some instances, a client may have some or all of its

accounting transactions processed by an outside service

organization.

Because the client’s

transactions are subjected to

the controls of the service

organization, one of the

auditor’s concerns is the

It is not uncommon for service

internal control system in

organizations to have an auditor

place at the service

issue one of two types of

organization.

reports on their operations.

6-35

LO# 13

Auditing Accounting Applications

Processed by Service Organizations

Report #1

Describes the service organization’s

controls and assesses whether they

are suitably designed to achieve

specified internal control objectives.

An auditor may reduce

control risk below the

maximum only on the

basis of a service

auditor’s report that

includes tests of the

controls.

Report #2

Goes further by testing whether the

controls provide reasonable assurance

that the related control objectives were

achieved during the period.

6-36

LO# 14

Communication of Internal ControlRelated Matters

Reportable

Conditions

Significant deficiencies in the design or

operation of internal control that could

adversely affect the organization’s ability to

initiate, record, process, and report financial

data consistent with management’s assertions.

Material

Weakness

A material weakness is a significant deficiency,

or combination of significant deficiency that

results in more than a remote likelihood that a

material misstatement of the financial

statements will not be prevented or detected.

6-37

LO# 14

Examples of Reportable Conditions

6-38

LO# 15

Types of Controls in an IT

Environment

General

Controls

1. Data center & network

operations

2. System software

acquisition, change and

maintenance

3. Access security

4. Application system

acquisition, development,

and maintenance

Application

Controls

1.

2.

3.

4.

5.

Data capture controls

Data validation controls

Processing controls

Output controls

Error controls

6-39

Types of Controls in an IT

Environment

LO# 15

6-40

Types of Controls in an IT

Environment

LO# 15

6-41

Types of Controls in an IT

Environment

LO# 15

6-42

LO# 16

Flowcharting Symbols

6-43

End of Chapter 6

6-44