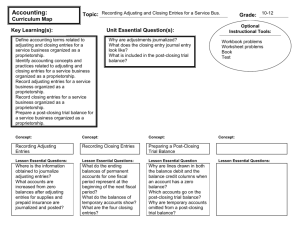

Accounting 30 Lesson 5

advertisement

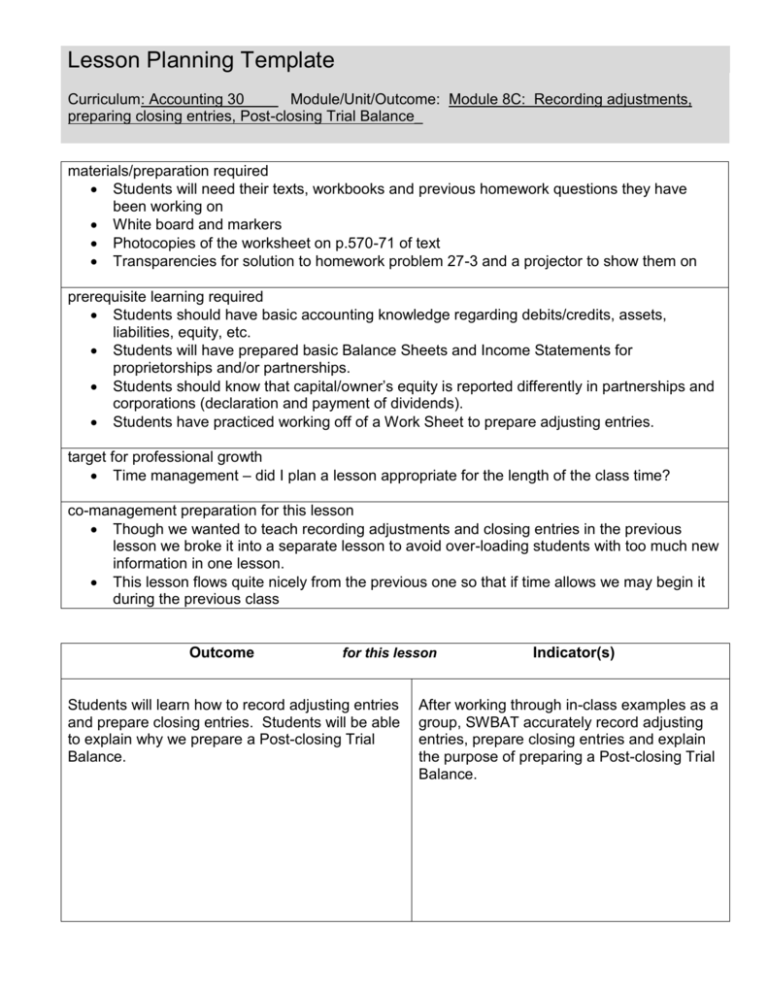

Lesson Planning Template Curriculum: Accounting 30____ Module/Unit/Outcome: Module 8C: Recording adjustments, preparing closing entries, Post-closing Trial Balance_ materials/preparation required Students will need their texts, workbooks and previous homework questions they have been working on White board and markers Photocopies of the worksheet on p.570-71 of text Transparencies for solution to homework problem 27-3 and a projector to show them on prerequisite learning required Students should have basic accounting knowledge regarding debits/credits, assets, liabilities, equity, etc. Students will have prepared basic Balance Sheets and Income Statements for proprietorships and/or partnerships. Students should know that capital/owner’s equity is reported differently in partnerships and corporations (declaration and payment of dividends). Students have practiced working off of a Work Sheet to prepare adjusting entries. target for professional growth Time management – did I plan a lesson appropriate for the length of the class time? co-management preparation for this lesson Though we wanted to teach recording adjustments and closing entries in the previous lesson we broke it into a separate lesson to avoid over-loading students with too much new information in one lesson. This lesson flows quite nicely from the previous one so that if time allows we may begin it during the previous class Outcome for this lesson Students will learn how to record adjusting entries and prepare closing entries. Students will be able to explain why we prepare a Post-closing Trial Balance. Indicator(s) After working through in-class examples as a group, SWBAT accurately record adjusting entries, prepare closing entries and explain the purpose of preparing a Post-closing Trial Balance. Lesson Construction: Set: (about 4 minutes) When students come into the classroom they will find the following “check list” written on the most prominent board in the class. The students will also have an entrance slip on their desks. (depending on where the students sit they may have to be redirected to sit closer to that particular board) Defined/discussed new terms and procedures regarding accounting for corporations Declaring and paying a dividend Planned end-of-fiscal-period adjustments for a corporation Prepared financial statements for a corporation There will be one item not listed and the question written below it: What do we have left to do? (There are two goals for this set: First to show students that we are almost there – we have almost completed all the tasks for this chapter. Second, it will encourage students to open their text books to look for the answer . . . they will have their books open at least to the chapter if not the relevant page of the text. Third, it demonstrates completion of the Accounting Cycle.) ANSWER: journalize adjusting and closing entries for a corporation (and prepare a post-closing trial balance to “tie it all together”) Three development sections follow; you may need more or less development sections depending on activities/tasks you choose to complete in order to achieve the indicators for this lesson. What do I need to adapt here to help all students be Development 1: (10 minutes) successful? Students will be instructed to take out problem 27-3 that they were supposed to have finished for today’s class. Since the question the students will be assigned today depend on them having finished problem 27-3 we will correct the question together in class. The assignment will be corrected by a peer. This is done for a few reasons: We will all know who has done their homework and who hasn’t. Students who aren’t as confident in their work may see that everyone makes mistakes. Or they may learn that they might seek help from one of their peers (who seems to know what they are doing) if that is more comfortable for them. Peer feedback is important – by viewing your classmates’ work you will better understand what they might need help with if they seem to be struggling. Solution will be presented on the overhead projector. December, 2010. This generic template was designed by T. Houk, based on the work of many print and online professional resources. Development 2: (about 20 minutes) Segway into recording adjusting entries by asking the students again what we have left to do – record adjusting entries. What report do we look at to record our adjusting entries? (the worksheet) Instruct students to look at the worksheet on pg.570-71 of the text. Ask: What columns are you going to look at when recording your adjusting entries? (the adjustment columns of the work sheet) Ask: How do you know what order to record the adjustments in? (look in the debit column and go alphabetically according to the small a, b, c, etc.) We will go through the sequence of entries on the worksheet ( asking specific students at random to come up to the board and write down what the next entry will be.) Ask if there are any questions. Have students take 10 minutes to complete #1 in problem 27-4 p. 590 Development 3: (about 20 minutes) We will move on to discuss closing entries. Oh, look! Another recipe on I picture the adjustment portion of this lesson to be quick (review really). We will work through the example for entering adjusting entries in the text. Students will be instructed to look at the worksheet from pg. 570-71 of the text. (even though the answers are in the text, hopefully the students will be able to (After students complete #1 in 27-4) BRAIN BREAK!! – In a single column on the board write the letters: MT_ _F_S and in a second column on the board write the letters: OT_F_ _SE_T Have the students stand up and tell them to sit down when they have figured out what each letter stands for. (I might give them the hint that we have been comparing our accounting work to steps in a recipe or a pattern. . .) ANSWER: the first is the days of the week, the second are the numbers one to ten. (of course we will disclose the answer once everyone is sitting down.) ** I will only spend two minutes on this so if they have not figured it out by then I will provide the answers . . . (or maybe save it for another day!!) To break up the repetitive nature of December, 2010. This generic template was designed by T. Houk, based on the work of many print and online professional resources. the bottom of p. 580!! I will read the first step in the “recipe” and have each of the three students read one of the remaining three steps. We will look at the examples of closing entries listed in the text book. Be sure to clarify along the way what a contra cost account is (an account that off-sets a cost account – example: Allowance for Uncollectible Accounts & Accumulated Depreciation – Supplies-and what a contra revenue account is (an account that off-sets revenue – example: Purchases Returns & Allowances) Ask if there are any questions once the example has been reviewed together. Give students 10 minutes to complete #2 for problem 27-3 on p. 590 of the text. Whatever is not done will be assigned for homework. doing this the same way we did adjusting entries, I may have students again use copies of the worksheet from p. 570-71. I would ask for one volunteer to go up to the board and be the recorder. The other two students would take turns offering up the names of the accounts used to do the closing entries. (after the first closing entry is complete the recorder will have the option to hand off their position to a different classmate) This would also promote an “if I write it I’ll remember it” effect for this information. I would ask guiding questions and lead the students through the examples just as above but they would be up and out of their seats and moving around. I will gauge this by the response I get in Development 2 of this lesson. I will ask the students if they would like to review the example in the text or if they would find it more useful to go straight into problem 27 – 3 #2 on p.590 of the text. Closure: 3 minutes Ask a few quick questions (letting the students know I want to hear from all of them) to tie the unit together: What is the very last thing we need to do? (prepare a post-closing trial balance) What is the purpose of this? (I expect someone will read to me out of the text!!) But why do we do this?? What’s the point? What do you do when you are done baking a recipe at home?? (I am looking for someone to realize that all the accounts we just closed will have a zero balance and we would not include them on the post-closing trial balance – it is like we did some tidying up so that when we start the next fiscal period we have a fresh start.) o evaluation/assessment that determines if each student has met the indicators for this lesson? Attach any documents or anecdotal notes that support this. Students will be assessed on completion of problem 27-4 at the end of the chapter as well as on the information/answers they provide during our closure discussion. December, 2010. This generic template was designed by T. Houk, based on the work of many print and online professional resources.