Assessing Ad Message Effectiveness Chapter Twelve

advertisement

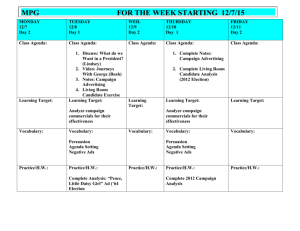

Chapter Twelve Assessing Ad Message Effectiveness Chapter Twelve Objectives • Explain the rationale and importance of message research. • Describe the various research techniques used to measure consumer’s recognition and recall of advertising messages. • Illustrate measures of physiological arousal to advertisements. 2 Chapter Twelve Objectives • Explicate the role of persuasion measurement, including pre- and posttesting of consumer preference. • Explain the meaning and operation of single-source measures of advertising effectiveness. • Examine some key conclusions regarding television advertising effectiveness. 3 Overview of Advertising Research It’s not easy or inexpensive but the value outweighs the drawbacks. • More than 80% of advertisers and agencies pretest television commercials before airing them on a national basis. 4 What Does Advertising Research Involve? Media Effectiveness (covered later) Message Research • To test effectiveness of messages • Pretesting ads during developmental stages • Posttesting to determine if messages achieve their established objectives 5 Four Stages At Which Ad Message Research Might Be Conducted 1. 2. 3. 4. Copy development stage “Rough” stage Final production stage After the ad has been run in the media 6 Industry Standards for Message Research PACT Principles Principle 1: provide measurements that are relevant to the advertising objectives Principle 2: requires agreement about how the results will be used in advance of each specific test Principle 3: provides multiple measurements because single measurements are generally inadequate 7 Industry Standards for Message Research PACT Principles Principle 4: based on a model of human response to communications Reception of a stimulus Comprehension of the stimulus The response of the stimulus Principle 5: allows for consideration of whether the advertising stimulus should be exposed more than once 8 Industry Standards for Message Research PACT Principles Principle 6: recognizes that a more finished piece of copy can be evaluated more soundly Alternative executions be tested in the same degree of finish Principle 7: system provides controls to avoid the bias normally found in the exposure context 9 Industry Standards for Message Research PACT Principles Principle 8: takes into account basic considerations of sample definition Requires that the sample be representative of the target audience Principle 9: can demonstrate reliability and validity A reliable test is one that yields consistent results A valid test is one that is predictive of the marketplace performance 10 What Can Be Learned from Message Research? • Message research is needed to diagnose an advertisement’s prospective equityenhancing and sales-expanding potential. • The ARF assessed which of 35 measures best predicts the sales effectiveness of television commercials. The only definitive conclusion of their study is that no one measure is universally appropriate or best. 11 Message Research Methods Qualitative Message Research Quantitative Message Research 12 Quantitative Message Research Measurement Understanding Control Improvement 13 Illustrative Message Research Methods 14 Advertising Research Methods Message Research Methods Recognition & Recall Physiological Arousal Persuasion Sales Response 15 Message Research Methods • Starch readership service (magazines) • Bruzzone tests (TV) • Burke day-after recall (TV) Recognition & Recall Physiological Arousal Persuasion Sales Response 16 Starch Readership Service Measures the primary objective of a magazine ad—to be seen and read Examines reader awareness of ads in consumer magazines and business publications Readers are classified 17 Starch Readership Service Classifications Noted—remember having previously seen the ad in the issue being studied Associated—noted the ad and saw or read some part of it that clearly indicated the name of the brand or advertiser 18 Starch Readership Service Classifications Read Some—read any part of the ad’s copy Read Most—read half or more of the written material in the ad 19 Starch Readership Service Indices are developed ADNORM index: compares an advertisement’s scores against other ads in the same product category as well as the same size (e.g., full page) and color classifications (e.g., four-color ads) 20 Measures of Recognition & Recall • 39% of people noted the ad, • 37% associated it, • 27% read some of it, and • 10% read most of the body copy contained in the ad. 21 Measures of Recognition & Recall • 58% of people noted the ad, • 54% associated it, • 39% read some of it, and • 39% read most of the body copy contained in the ad. 22 Starch Readership Service • Kia Sorento ad Adnorm index scores • 72 (noted) • 74 (associated) • 73 (read some) • 59 (read most) • The ad performed 28% worse than the average noted score for similar ads. • Jose Cuervo Especial Tequila ad • 107 (noted) • 108 (associated) • 105 (read some) • 229 (read most) • The ad performed slightly above average noted score for similar ads. 23 Bruzzone Tests Bruzzone test provides advertisers with a test of consumer recognition of television commercials. Anything identifying the brand is removed, to test whether viewers remember the name of the advertiser. 24 Measures of Recognition & Recall Bruzzone test Advertising Response Model (ARM) links responses to the 27 descriptive adjectives to consumers’ attitudes toward both the ad and the advertised brand and to purchase interest. 25 ARM for the “Thanking the Troops” Commercial 26 Measures of Recognition & Recall Bruzzone test Provides valid prediction of actual marketplace performance along with being relatively inexpensive Doesn’t provide a before-the-fact indication Tests offer important info for evaluating a commercial’s effectiveness and whether it should continue to run Tests are performed online 27 Measures of Recognition & Recall Burke Day-After Recall Testing • Used to assess the effectiveness of test commercials and to ID strengths and weaknesses (1) Claimed-recall scores—indicate the percentage of respondents who recall seeing the ad (2) Related-recall scores—indicate the percentage of respondents who accurately describe specific advertising elements 28 Measures of Recognition & Recall Burke Day-After Recall Testing Coke execs reject recall as a valid measure 1) Recall simply measures whether an ad is received but not whether the message is accepted 2) Recall is biased in favor of younger consumers 29 Measures of Recognition & Recall Burke Day-After Recall Testing 3) Recall scores generated by ads are not predictive of sales performance 4) Day-after recall testing is biased against certain types of advertising content Understate the memorability of commercials that employ emotional or feeling-oriented themes and are biased in favor of rational or thought-oriented commercials 30 Day-After Recall Vs. MaskedRecognition Research Findings 31 Message Research Methods Recognition & Recall • Psychogalvanometer • Pupilometer Physiological Arousal Persuasion Sales Response 32 Measures of Recognition & Recall Measures of Physiological Arousal • Ads that are better liked are more likely to be remembered and to persuade • Efforts are now made to measure consumer’s affective and emotional reactions to ads 33 Measures of Recognition & Recall Measures of Physiological Arousal • Galvanometer—measures minute levels of perspiration in response to emotional arousal • Pupillometric tests—measure pupil dilation • Advertising researchers use changes in physiological functions to indicate the actual, unbiased amount of arousal resulting from ads. 34 Message Research Methods • Ipsos-ASI Next*TV method • Rsc’s ARS Persuasion method Recognition & Recall Physiological Arousal Persuasion Sales Response 35 Measures of Persuasion Used when an advertiser’s objective is to influence consumers’ attitudes toward and preference for the advertised brand. 36 Measures of Persuasion Ipsos-ASI Next*TV Method • Performs ad research in more than 50 countries • Tests television commercials in consumers’ homes • Tells consumers to evaluate a TV program, but actually evaluating the commercials within the program 37 Measures of Persuasion Ipsos-ASI Next*TV Method • One day after viewing—personal contact with sampled consumers and measure their reactions to the TV program and the advertisements • Measures message recall and persuasion 38 Measures of Persuasion Ipsos-ASI Next*TV Method • Persuasion measured by: Consumers’ attitudes toward advertised brands Shift in brand preferences Brand-related purchase intent and frequency 39 Measures of Persuasion Ipsos-ASI Next*TV Method 1) Tests in a natural environment 2) Assesses the ability of TV commercials to break through the clutter 3) Determines how well tested commercials are remembered after this delay period 4) Allows the use of a representative national sampling 40 Measures of Persuasion The ARS Persuasion Method--rsc 1) Respondents indicate what brands they prefer to receive among a “basket” of options—the pre measure. 2) After exposure to a television program respondents again indicate what brands they would prefer to receive if their name were selected in a drawing—the post measure. ARS Persuasion Score = Post % for target brand – Pre % for target brand 41 Measures of Persuasion The ARS Persuasion Method--rsc The ARS Persuasion score simply represents the post-measure percentage of respondents preferring the target brand minus the premeasure percentage who prefer that brand A positive score indicates a shifted preference toward the target brand A higher-scoring commercial generates greater sales volume and larger market share gains 42 Measures of Persuasion The ARS Persuasion Method--rsc ARS Persuasion scores are valid predictors of in-market performance The higher the score, the greater the likelihood that a tested commercial will produce positive sales gains when the focal brand is advertised under realworld, in-market conditions 43 Predictive Validity of ARS Persuasion Scores 44 Message Research Methods Recognition & Recall • AC Nielsen’s SCANTRACK • IRI’s BehaviorScan Physiological Arousal Persuasion Sales Response 45 Measures of Sales Response Single-Source Systems Gather purchase data from panels of households using: (1) electronic television meters (2) optical laser scanning of universal product codes (UPC) at retail checkout (3) split-cable technology 46 Measures of Sales Response Nielsen’s SCANTRACK SCANTRACK collects purchase data by having panel households use handheld scanners Panelists record purchases of every bar-coded product purchased regardless of the store where purchased 47 Measures of Sales Response Nielsen’s SCANTRACK Use handheld scanners to enter: Any coupons used Record all store deals Record in-store features that influenced their purchasing decisions 48 Measures of Sales Response IRI’s BehaviorScan IRI knows what items each household purchases by linking up optically scanned purchases with ID numbers Members provide IRI with detailed demographic information 49 Measures of Sales Response IRI’s BehaviorScan Single source data consists of: (1) household demographic info (2) household purchase behavior (3) household exposure to new television commercials that are tested under real world test conditions 50 Measures of Sales Response IRI’s BehaviorScan Uses optically scanned purchase data to know exactly which commercial each household had the opportunity to see and how much of a brand is purchased 51 Measures of Sales Response IRI’s BehaviorScan Two types of tests are offered: (1) weight tests and (2) copy tests 1) Weight tests—panel households are divided into test and control groups 2) Copy tests—holds the amount of weight constant but varies commercial content 52 Conclusions by rsc • Ad copy must be distinctive • Ad weight without persuasiveness is insufficient • The selling power of advertising wears out over time • Advertising works quickly if it works at all 53 Conclusion 1: All Commercials Are Not Created Equal: Ad Copy Must Be Distinctive • Commercials having strong selling propositions are distinctive and tend to achieve higher ARS Persuasion scores. • Commercials for new brands tend to be most persuasive, but commercials for established brands can be made persuasive via brand differentiation. 54 Illustration Of a Commercial With a Strong Selling Proposition 55 Evidence from Frito-Lay’s Copy Tests 56 Conclusion 2—More is Not Necessarily Better: Weight Is Not Enough • Ad weight means the number of gross rating points (GRP) that support an advertising campaign. • An ineffective ad (not distinctive or persuasive) has no likelihood of increasing sales even if the ad weight is doubled or tripled. 57 Relations Among Advertising Weight, Persuasion Scores, and Sales. 58 The Role of Sales-Effective Advertising for an Undisclosed Campbell Soup Brand 59 The Relationship Between Media Weight and Creative Content 47 commercials for established brands were tested and classified as: 1. Rational information 2. Heuristic appeals 3. Affectively based cues Finding: increased advertising weight led to significant sales increases in sales only for commercials using affective cues. 60 Conclusion 3—All Good Things Must End: Advertising Eventually Wears Out • Advertising ultimately wears out and must be refreshed to maintain or increase brand sales. • Familiar brands have been shown to wear out more slowly than unfamiliar brands. 61 Conclusion 4—Don’t Be Stubborn: Advertising Works Quickly or Not at All • Some advertisers tend to “hang in there” and wait for an ad to increase sales. • Most of the sales impact occurs in the first three months of a new ad. • “Sunk costs” are an issue to consider, but if an ad is not working at first, it probably never will. 62