Public Sector Internal Audit in Lithuania - PPT - PSC

advertisement

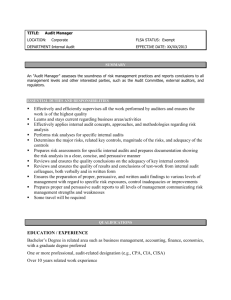

PUBLIC SECTOR INTERNAL AUDIT IN THE REPUBLIC OF LITHUANIA Mr. Jonas Vaitkevičius Head of Internal Audit and Financial Control Methodology and Monitoring Division Internal Audit and Financial Control Methodology Department (CHU) Vilnius, 27–28 May 2014 Contents o Legal basis o Internal Audit System o Co-operation between IA and SAI Legal Basis (1) • • • • • Law on Internal Control and Internal Audit (PIFC Law) Standard Charter of the Internal Audit Unit Rules of the Professional Ethics for Internal Auditors Standard Internal Audit Methodology Audit Needs Assessment • Internal Audit Guidelines (approved by SIC; supplemented with standard questionnaires for MCS, IS, public procurement audits) Legal Basis (2) • PIFC Law - the Law on IC and IA (2003) – The basic legal framework, goals and procedures for the functioning of internal control, including financial control and internal audit in a public entity, as well as responsibilities of its heads (according to international principles: COSO, IIA, etc.); – Support by DG Budget, SIGMA, Twinning partners. Legal Basis (3) • The activities of the IAU shall be governed by the Internal Audit Charter, approved by the head of the public legal entity. • The Rules of the Professional Ethics for Internal Auditors (the Code of Ethics) defines the principles and norms of professional conduct of internal auditors. • The Standard Internal Audit Methodology aims at assisting the IAU in drafting the internal audit methodology, having regard to the characteristics of activities performed by the public legal entity. Legal Basis (4) • The Internal Audit Guidelines serve as an additional and comprehensive reference tool to provide the internal auditors of the public legal entities with principles, concepts and recommendations, which are to support them in conducting their activities and in preparing the specific manuals on internal audit. • Audit Needs Assessment determines the level of sufficient staffing resources. Internal Audit System: Background Information SEIMAS – the Parliament of Lithuania, the highest national legislative authority GOVERNMENT – the highest executive authority of the Republic of Lithuania (the Cabinet of Ministers) CHU – a central harmonisation unit responsible for developing and promoting financial control and internal audit methodologies (Internal Audit and Financial Control Methodology Department in the MoF) IAU – department, division or other independent structural unit of the public legal entity, set up for the purpose of carrying out internal audit Internal Audit System: IAUs • Decentralized system for internal audit is introduced (note: IAUs of the municipalities and some public legal entities are centralised); • IAUs are set up in Office of the President, Office of the Parliament, Office of the Government, all ministries, municipal administrations, other public legal entities (under the PIFC Law); • Internal audits of public legal entities are performed by IAUs, which are subordinate and accountable to the head of a public legal entity. Other legal entities are audited by a centralised IAU of a superior institution; • The entire public sector including municipalities is covered by the internal audit (~ 169 IAUs; ~ 400 internal auditors; ~ 1500 internal audits per year). Internal Audit System: Functional Independence of the IA Internal auditor’s functional independence can be described as follows: Free in determining the scope of internal audit, performance of audit work and communicating results; Not involved in the performance of any managerial function of the public legal entity; Reports directly to the head of a public legal entity; CHU’s role (annual reporting; disagreements discussed; appointment and dismissal of the head of the IAU monitored; training programme provided). Internal Audit System: CHU (1) The functions of the Central Harmonisation Unit (CHU) were assigned to the Internal Audit and Financial Control Methodology Department of the Ministry of Finance of the Republic of Lithuania, which: Develops the legislation and methodological guidance on internal audit and financial control; Performs external reviews of IAUs’ activities (on-the-spot checks); Analyses the functioning of the internal audit system in the public sector and reports on an annual basis to the Government and the Seimas (Parliament) Audit Committee; Internal Audit System: CHU (2) Coordinates the training in the field of internal audit (certification of public internal auditors; six level training modules; 188 (44 %) public internal auditors already certified) and financial control; Analyses the annual reports on financial control condition received from the public legal entities and prepares the Report on Financial Control Condition in the public sector. The CHU ensures the continuous development of the best internal audit and financial control practice throughout the public sector. The CHU is strong in networking (workshops, help-desk, consultative visits, group meetings, electronic forum). Internal Audit System: Annual Reporting (1) The PIFC Law (Subparagraph 2 of Paragraph 1 of Article 11): „The Ministry of Finance (CHU) shall prepare and each year by July 1 submit to the Government and the Seimas Audit Committee the annual report on the functioning of the internal audit system in the public legal entities“. The Annual Report is prepared on the basis of information collected from the IAUs (each year, by March 1, the head of the IAU shall prepare and submit the annual report on the activities of the unit including the information about the functioning of the internal control system of public legal entity to the Ministry of Finance). Internal Audit System: Annual Reporting (2) The Annual Report covers the following information: • changes in the IA sector (public legal entities and municipalities) during previous year; • implementation of the IAUs’ annual activity plan; • review on the implementation of the IA recommendations; • professional development of the IA staff; • internal audits of EU funds; • quality assurance reviews of the IAUs; • weaknesses of the internal control system. Co-operation between IA and SAI (1) • Internal and external auditors differ in: objectives, lines of accountability, qualifications, activities. • But both sides: haves mutual interest in the same objectives related to internal control, consider public management (executive branch of Government) as an important addressee of their efforts related to internal control. Co-operation between IA and SAI (2) Possible modes of co-operation: • Joint development and educational efforts • SAI could be asked to give CHU comments on draft regulations, guidelines, standards, etc. • Co-ordination of annual audit plans • Using each other’s work Co-operation between IA and SAI (3) Given their common interest in well functioning internal control, SAI and IA support each other in: sharing information about internal control, EU funding; increasing scope for use by both internal and external auditors of each others work; eliminating the overlaps in audit work; agreed methods for the sharing of audit findings and other information; internal auditor’s training format. Co-operation between IA and SAI (4) Renewed Agreement on the Co-operation and Cooperation System among National Audit Office, Public Sector Internal Auditors, Municipal Controllers and Certified Auditors, Performing External Audit in the Public Sector (of 30th December 2010) Co-operation between IA and SAI (5) Co-operating parties: National Audit Office of Lithuania Ministry of Finance of the Republic of Lithuania Lithuanian Chamber of Auditors Association of Municipal Controllers in Lithuania Institute of Internal Auditors (Lithuania) Co-operation between IA and SAI (6) While implementing the Co-operation Programme measures, Joint Working Group on the Internal Control Issues has been set up, which should: review internal control assessment methodologies, used by different public sector auditors; develop common internal control assessment principles; amend methodologies, used by different public sector auditors, following the unified principles of internal control. Co-operation between IA and SAI (7) While implementing the Co-operation Programme measures, a number of joint seminars have been organised on the following issues: public sector audits, audit training programmes, audit quality assurance, methods and practices of IT audits, results of financial audits, etc. Thank you! E-mail: j.vaitkevicius@finmin.lt