Beginnings of Intuit

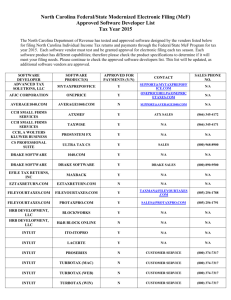

advertisement

Marisol Ramirez May 13, 2013 BUS 550 2 Beginnings of Intuit Since 1983- Founder: Scott Cook Began with software for personal finance management- Quicken 1992- QuickBooks 1993 IPO Acquired ChipSoft, maker of TurboTax Always looking to make personal tasks easier and quicker 3 Intuit’s Business Units Small Business Group Tax Financial Services Other Businesses Revenue is cyclical due to their type of service QuickBooks and TurboTax make up almost 50% of revenue 4 User Contribution System Active (direct) and Passive Main characteristic: They convert information from users into a system that is useful to others 5 Soure: Intuit Case Study 6 User Contribution Systems cont. They can employ user feedback as well as having professionals regulate or refine the answers Why should companies use this Can help in product development and is always being updated Frees companies of the responsibility of providing content to the users Risks User feedback may not be accurate or may be biased Should companies be inclusionist or delitionist Negative feedback 7 First Try: Tax Almanac 2005- Cook expressed idea of a user generated system which would add value to Intuit Tax Almanac- solving the tax professionals problem of getting answers to obscure questions Forum for tax professional to discuss tax laws By 2010 had 1.98 mill unique visitor and over 170,000 pages of discussion Yet, Intuit did not find a way to monetize so they went back to the drawing board Zipingo also in 2005 – for use with Quicken 8 Focus on Turbo Tax Tax preparation product for users to file their own tax return Main Weakness of TurboTax: Preparation done in an interview-like process with questions with Decision Tree process based on the answers It did not sufficiently answer users’ questions while they were preparing their taxes Some Solutions 1. 2. FAQ Commercial Search Engine 9 C.I.A. aka Live Community 2006- Collective Intelligence Agent Question and Answer format between users (non-professionals) Tested idea by implementing it in one of the TurboTax branches Feedback within Intuit Tax professionals working for Intuit were skeptic Prior market research showed users of Tax software would not trust non-tax experts 10 11 Challenges & Decisions Market Research Groups of users to experiment Decision to keep going or not Studies failed: users had already filed taxes and received returns therefore did not feel the need to use the Q & A Cook believed in the concept but was uneasy about application Brad Henske, TurboTax General Manager saw cost effectiveness of this application Test idea with the Online Home and Business TurboTax (small portion but still in the 100,000’s of units ) 12 Launch of Live Community January 2007 – Live Community Launched Contributors not only users but tax professionals as well New problem: Surplus of answers Solution: increase in servers Questions, Questions, and more Questions! 13 14 Impact of Live Community Intuit confirming Behavior is what is necessary to measure consumer reaction to products Also, the need to slowly immerse a consumer into the product “Market Research is very good at exposing problems with a product but not good at testing solutions” 15 Impact of Live Community cont. By 2009-Live Community expanded to all TurboTax versions The rest of the business units at Intuit were not as excited to create their own L.C. Until 2008 version of L.C. made for QuickBooks Launch of more services based upon user contribution like: Small business hiring QuickReceipts Accountant Work Exchange 16 Intuit: Now “We seek to be a premier innovative growth company that improves our customers’ financial lives so profoundly they can’t imagine going back to the old way.” Not only online feedback, now personally noting the take home experience Smith, CEO identifies events in the Market which offer opportunity for growth 1. 2. 3. 4. Participation driven innovation No Borders Mobile Experience has won! Data 17 Discussion Intuit’s path to a successful product How does this differ from other measures of product success? How does this tie back to the user contribution systems? 18 Review Questions 1. What was the main weakness of TurboTax? a. There were not enough users who bought the paid version b. It did not sufficiently answer users’ questions while they were preparing their taxes c. The users had difficulty navigating through the software 19 Review Questions 2. Which of the following is not a risk when employing a user contributions system? a. User feedback can be biased and not accurate b. Negative posts might influence further contribution c. Users might develop a relationship with the company 20 Review Questions 3. I. II. What was the impact of Live Community’s success? All versions of TurboTax implemented Live Community Allowed Intuit to realize the flaws of Market Research III. The other business units adopted the idea a. I only b. I & II c. II only d. I,II, & III 21 References http://www.intuit.com/ http://network.intuit.com/ http://www.latimes.com/business/technol ogy/la-fi-tn-intuit-pioneer-delight20130509,0,7874694.story?page=1&track=r ss http://www.taxalmanac.org/index.php/T axAlmanac:About https://ttlc.intuit.com/