ZEROS, QUALITY AND TRADE: TRADE THEORY AND TRADE

advertisement

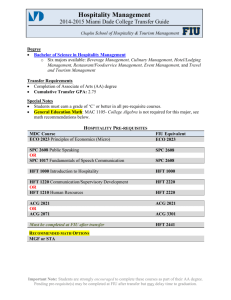

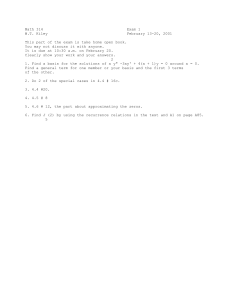

ZEROS, QUALITY AND TRADE: TRADE THEORY AND TRADE EVIDENCE Richard Baldwin & James Harrigan Presented by: Lasha Chochua Introduction: Verification and Falsification • Gravity equation relates bilateral trade values to distance and country size, usually with “good” results. However, many potential good explanations for the success of gravity equation do not provide basis for discriminating among trade models • Moreover, the value of trade depends: 1. The number of goods traded 2. The amount of each good that is shipped 3. The price they are sold for Most studies of trade volumes have not distinguished among these factors, but it appears that focusing on how the number of traded goods and their prices differ as a function of trade costs and market size turns to be informative about the ability of trade theory to match trade data Introduction: Verification and Falsification • The authors establish some new facts about product-level U.S data and present inconsistency between most trade models and regularities found in data • More precisely, 1. They generate testable predictions concerning the spatial pattern of trade flows and prices for comparative advantage (Eaton and Kortum, 2002), monopolistic competition (a multi-country Helpman-Krugman (1985) model with trade costs) and monopolistic competition with heterogeneous firms and fixed-entry costs (a multi-country version of Melitz (2003)) models Predictions are confronted with highly disaggregate U.S. data on bileteral trade flows and unit values New model is offered 2. 3. Some Notes • The models studied in the paper share some assumptions and notations. There are C countries and a continuum of goods. Preferences are given by indirect CES function • Transport costs are assumed to be of iceberg form. The only factor of production is labor, which is in fixed supply and paid a wage – w • What is a product? The least aggregated trade data is used – the U.S. ten-digit level of Harmonized system (HS 10). HS 10 categories are referred as “codes”, recognizing that each code may contain products that are made by different firms Some Notes • Some examples of HS10 codes exported by U.S. in 2005 include: 6110110020 – women’s or girls’ sweaters 8803200010 – undercarriages and part for use in civil aircraft 9013200000 – lasers, other than laser diodes • Export Zero is defined as a trade flow which could have occurred but did not. For example, an export zero occurs when the U.S.A. exports an HS10 code to at least one country but not all • Bernard, Jensen, and Schott (2009) report that more than a quarter million different firms exported from the United States in 2000 on just over 8500 HS10 codes, or more than 30 firms per code on average Comparative advantage: Eaton-Kortum (EK) • • • • • Head-to-head competition: countries compete in every market on the basis of c.i.f. prices “Winner takes all” form of competition means that importing country buys each good from only one source Country’s competition depends on its technology, wage and bilateral trade costs Stochastic technology-generation process is employed Denoting the producer country as nation ‘o’ and the unit labor coefficient for a typical good j as ao ( j ) , each labor coefficient is an independent draw from the cumulative distribution function: • The price that each nation-o could offer for good-j in destination-d is • Equilibrium price in destination-d will be : EK Model: Finding Comparative Advantage • • To find the probability that a particular nation is the lowest cost supplier in a particular good in a particular market, a series of probability calculations are required First, the cdf of pcd ( j ) is where • Note that • Since all draws are independent across nations, the probability that all other prices are higher will be which simplifies to • Since pod ( j ) is just one of many offer-prices that nation-o may have drawn, we must integrate over all possible draws, the result follows EK Model: Finding Comparative Advantage • It is easy to find the equilibrium CES price index for destination-d • Solving the integral gives the result • The distribution of prices in market-d in equilibrium is • The average c.i.f. price of goods imported from every partner should be identical and related to nation-d price index EK Model: Finding Comparative Advantage • The EK model does not yield closed form solution for equilibrium wages, so a closed form solution for od is unavailable, but by employing the market clearing conditions for all nations, we can get • Note, that EK Model: Empirical Implications • The formula for probability of exporting and the distribution of prices in country-d, give possibility to conclude: 1. The probability that exporter-o sends a good to destination-d is decreasing in the distance (if distance is correlated with trade costs) between o and d, and also decreasing in the size of d. A fall in trade costs reduces the incidence of Zeros Considering products sold by o in multiple destinations d, the average f.o.b. price is decreasing in the distance between o and d, and unrelated to the size of d 2. • The different extensions and modifications of EK model, like Bernard, Eaton and Kortum (2003), where they introduce imperfect competition, do not alter qualitatively the predictions of the model, presented here Monopolistic Competition • • • • • • Standard assumptions about utility function applies Manufactured goods are produced under conditions of increasing returns and under Dixit-Stiglitz monopolistic competition Unlike the EK model, all firms in all countries face the same unit labor requirement, a. Developing a new varity involves a fixed set up cost, namely the amount of labor Fi Dixit-Stiglitz competition imlies that “mill pricing” is optimal, that is, nation-o firms charge consumer (c.i.f) prices in nation-d equal to The CES price index for typical nation-d involves the integral over all prices Monopolistic Competition • With mill pricing and CES demand, the value of bilateral exports for each good is • It appears that spatial patterns are exceedingly simple in the MC model. Consumers buy of every good with a finite price, so there should be no zeros in the trade matrix – if a good is exported to one country it is exported to all. Neither size of destination nor the distance has any bearing on the probability of observing a Zero • As Mill pricing is optimal, f.o.b export prices should be the same for all destinations. Since trade costs are fully passed on to consumers, the c.i.f. import prices should increase with distance, but no connection to the size of the importer country Monopolistic competition – Empirical Implications • The model with CES utility predicts zero Zeros. With Linear demand function, the probability of a Zero increases in the distance between o and d, but unaltered to the size of d. A fall in trade costs will reduce the probability of zeros with Linear demand • The model with CES utility predicts no variations in f.o.b. export prices. With Linear demand, the f.o.b price is decreasing in the distance between o and d, and unrelated to the size of d • With Linear demand, only the results are presented in the paper. A Multi-Nation Asymmetric Heterogeneous-Firms Trade Model (HFT) • The original paper of Melitz (2003) works with symmetric countries, so the spatial pattern can not be addressed, thus a multi-country HFT model with assymetric countries is discussed • The model shares all of the features of monopolistic competition discussed above and adds in two new elements – fixed market entry costs and heterogeneous productivity at the firm level • Firm level heterogeneity is introduced via a stochastic technologygeneration process. When a firm pays its set-up cost, e.g. the innovation cost of developing a new verity, it simultaneously draws a unit labor coefficient from the Pareto distribution A Multi-Nation Asymmetric Heterogeneous-Firms Trade Model (HFT) • The assumed Dixit-Stiglitz competition means that: (i) a firm’s optimal price is proportional to its marginal cost, and (ii) its operating profit is proportional to its revenue • From the revenue a nation-o firm would earn if it sold in market-d and with constant operating profit share, the cut-off conditions that define the bilateral maximum-marginal-cost thresholds, are derived • The spatial pattern of zeros comes from the cut-off conditions, so entryconditions, employment condition and national budget constraint are not discussed A Multi-Nation Asymmetric Heterogeneous-Firms Trade Model (HFT) • The probability that a firm producing variety-j with given labor coefficient will export to nation-d is the probability that its labor coefficient is less than the threshold defined in previous slide • The conditional probability, i.e. the probability that a firm exports to market i given that it exports to at least one market is given by • The wage drops out. The probability that an exporting firm exports to a given market decreases in distance and increases as a market size rises. A fall in variable trade costs increases the marginal cost cut-off for profitable exporting, and hence reduces the probability of export zeros A Multi-Nation Asymmetric Heterogeneous-Firms Trade Model (HFT) • Because the model relies on Dixit-Stiglitz monopolistic competition, mill pricing is optimal for every firm, so the f.o.b. export price of each good should be identical for all destinations. It will be unrelated to distance and to the size of exporting and importing nations • However, the range of goods exported does depend to the size and distance, so the average bilateral f.o.b. price will differ. The weighted average price of all varieties exported from nation-o to nation-d will be • Solving integral results in: A Multi-Nation Asymmetric Heterogeneous-Firms Trade Model (HFT) • Melitz and Ottaviano (2008) work with the Ottaviano, Tabuchi and Thisse (2002) monopolistic competition framework with linear demand. The prdictions are altered, results are presented below • The probability of export zero is increasing in bilateral distance. The effect of market size on the probability of an export zero is negative in the baseline model and positive in Melitz-Ottaviano variant. A decline in trade costs reduces the incidence of zeros • Considering a single product sold by o in multiple destination, the average f.o.b. price is decreasing in the distance between o and d, since only the cheapest varieties are sold in distant markets, the effect of market on average f.o.b. price is positive in the baseline model, and negative in the Melits-Ottaviano variant Summary of Model Predictions Trade Data – How many zeros? • • For exports, a zero occurs when the U.S exports a HS10 code to at least one country but not all In 2005 the U.S. exported 8880 HS10 codes to 230 different destinations, of these 82% are zeros. A quarter of codes were exported to at least 59 destinations, and only 1% of codes were sent to a unique partner Positive trade flows, distance and market size Econometric Model Estimation • The Linear probability and random effects logit models are estimated. In the linear probability model a generic two-way error components structure is imposed (with fixed code and random country effects) • While Linear probability model provides with consistent estimators, marginal effects from the random effects logit model can not be trusted. The assumption that random product effects are orthogonal to country characteristics is a strong one, which can be rejected statistically, and the second, the covariance matrix estimator assumes that errors for each export market are independent across goods, which is to restrictive. In any event, the marginal effects from the logit are broadly consistent with the coefficients of linear probit model Results of Estimation Export Unit Values • The following model is estimated • The dependent variable is the log of the f.o.b. average unit value of code i shipped to country c • Different samples are estimated and the results are given in the following table • The results found are consistent with the findings of Hummels and Skiba (2004) Statistical determinants of U.S. export unit values, 2005 The Quality HFT Model (QHFT) • There are a number of different approaches to modeling for quality. The most common is to model preferences for what might be called box-sizequality: the utility of consuming two boxes of variety j with quality 1 is identical to consuming one box of variety j with utility 2. In the standard CES monopolistic competition setting this means that consumers make their decisions on quality-adjusted price rather than the observed price • Most of the assumptions and notation of DHFT model are in keeping with HFT model discussed above, with two main changes. On the demand side consumers now care about quality, and on the supply side forms produce varieties of different quality The Quality HFT Model (QHFT) • The utility function has the following form • The corresponding expenditure function for nation-d is The Quality HFT Model (QHFT) • Manufacturing firms have constant marginal production cost and several types of fixed costs. The first fixed costs is the standard Dixit-Stiglitz cost of developing a new variety. The other fixed costs are beachhead costs that reflects the one time expense of introducing a new variety into a market • It costs F units of labor to introduce a variety into any market and potential manufacturing firms pay Fi to take a draw of unit labor coefficient. By assumption, quality is linked to marginal cost by • The assumed distributions of the labor coefficients is • Notice that it is necessary to flip the usual Pareto distribution to ensure that there are fewer high quality firms than low quality firms The Quality HFT Model (QHFT) • At the time fir chooses price, it takes its quality and marginal cost as given, so it faces a demand that can be written as • Since price enters in the standard way, the Dixit-Stiglitz results are obtained. Mill-pricing is optimal for all firms and operating profit is a constant fraction of firm revenue. From these facts, we can write cut-off condition for selling to typical market-d • Notice that aod ( j ) here are minimum cost thresholds rather than maximums as in standard HFT model The Quality HFT Model (QHFT) • We can derive the probability of exporting B a od 1 (1 ) od 1 ( 1) d ( 1) wo f 1 ( 1) a ok K wo f G ( a od ) 1 Bd • As for average prices, in QHFT the highest priced varieties are the most competitive, the basket of varieties sold in distant markets will have higher average price than the basket for a near-by market The Quality HFT Model (QHFT) • The probability of Export zero is increasing in bilateral distance, and decreasing in market size • Considering a single product sold by o in multiple destinations, the f.o.b. price is increasing in the distance between o and d. The effect of market size on average f.o.b. price is negative • The QHFT model is the only model that generates predictions that are in consistency with the regularities observed in U.S trade data Some Ideas • Can variety-level predictions translated in firm-level predictions? • Is the regularity found for U.S. trade data common for developed countries? • What is the effect of U.S. market size?