ecosystems and spontaneous orders

advertisement

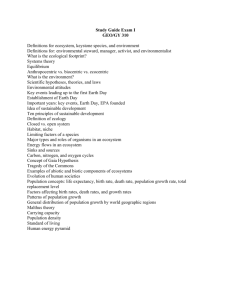

ECOSYSTEMS AND SPONTANEOUS ORDERS CRITICAL REVIEW: A JOURNAL OF POLITICS AND SOCIETY, FORTHCOMING ANDY LAMEY Students: Mario Conti, 250466 Valentina Fiore, 251286 Dalila Putignano, 248298 Professor: Paolo Fabbri KEY CONCEPTS Non intervention in financial and ecological systems Understanding the ecosystem as spontaneous order INTERFERENCE implies the operation of a process that proceeds by itself on certain principles because its parts obey certain rules. (Hayek, Law Legislation and Liberty) ECOSYSTEM ECOSYSTEM is defined as “the whole system”, including the complex organisms and physical factors that forming what we call the environment. (Hayek) There is an affinity regarding our ignorance of financial and ecological systems. SPONTANEOUS ORDERS SPONTANEOUS ORDER is one that no individual has designed and which aims at no particular purpose. (Hayek) Characteristics: Inevitability Complexity Abstraction of components Not created by an outside entity ECOLOGICAL IGNORANCE • Static ignorance related to limited awareness of the number of existing species. • Dynamic ignorance about the interactions of countless different organisms. The same type of reasoning can be also applied to price THE MORAL ASPECT • Moral obligation not to harm human beings • It must be extended to animals and non-sentient life • International environmental and financial organizations: Greenpeace, WWF and IMF • Sometimes the intervention is not just permitted but recommended EXCEPTIONS: PERMITTED INTERVENTIONS Such manipulations of the environment (nature or market) are allowed weather they contribute to the same outcomes that a spontaneous order should reach itself. Ecosystem DISRUPTIVE MANIPULATION CORRECTIVE MANIPULATION Market GROWN ORDER MADE ORDER Imperfect information system is the cause of impossibility to know what will be the future outcome of spontaneous order. INTERVENTIONS INTO ECOLOGICAL ORDER DATTEL MUSSEL GLOBAL WARMING 5 km of coast for year + 4°C in the last 11000 years 80 years to grow Kyoto Protocol, 1997 Lex 25 October 1988 United Nations Climate Change Conference (UNFCCC), 1992 Intergovernmental Panel on Climate Change (IPCC), 1988 INTERVENTIONS INTO MARKET ORDER OIL’S PRICES Organization of Petroleum Exporting Countries (OPEC), 1960 Oil Crisis in 1973 leads to the increase of oil’s price by 70% Austerity policies (such as Sunday Walking) SUB-PRIME MORTGAGES US recession (2008-2009) Community Reinvestment Act in 1977 Promotion of affordable housing CONCLUSION Human actions break the spontaneous order and then can restore it. It is a mistake to think we can take all, or most of the nature and the market under our control. When we do seek to manipulate the ecosystem or the market, as we inevitably must, we should do so in a manner that seeks as much as possible to preserve the number of species or the level of prices they contain. BIBLIOGRAPHY AND WEB LINKS Andy Lamey, A journal of politics and Society, Forthcoming Hayek, Law Legislation and Liberty, volume I and II Maurizio Cortese, Cose che è necessario io riesca a comprendere: i datteri di mare non si mangiano, www.dissapore.com Subprime Mortgage, www.Investopedia.com UNFCCC and Kyoto Protocol, www.un.org www.opec.com www.treccani.it www.wikipedia.com