ACCTG833_f2007_CHPT01D3

Chapter

1

Tax Research

(Day 3)

Dr. Richard Ott

ACCTG 833, Fall 2007

Sources of Tax Law

Statutory authorities

Administrative authorities

Judicial authorities

Slide D3-2

Judicial Authorities

Judicial Authorities

Lower Courts

U.S. Tax Court

(formerly Board of Tax Appeals)

U.S. District Courts

U.S. Court of Federal Claims

(formerly U.S. Claims Court)

Appellate Courts

U.S. Courts of Appeal

U.S. Supreme Court

Slide D3-4

Slide D3-5

Citations of Court Cases

See examples of proper citations for court cases in the Prentice Hall textbook

Check for appeals (possibly reversals)

Check changes in underlying IRC sections

Check for an IRS acquiescence or nonacquiescence for the case

Judicial Authorities

Lower Courts

Slide D3-7

U.S. Tax Court

Court hears only federal tax cases

Judges are tax specialists

Generally, best court for technical tax issues

No jury trials allowed

Jurisdiction is not limited to residents of any specific geographical region

Taxpayer does not have to pay the disputed amount before going to court

Slide D3-8

U.S. Tax Court

Precedents the Court follows:

Supreme Court decisions

Court of Appeals decisions (Golsen Rule)

U.S. Tax Court decisions

Golsen Rule

Follows the decisions of the Court of Appeals having jurisdiction over the taxpayer

May reach opposite conclusions for taxpayers with identical facts from different jurisdictions

Slide D3-9

U.S. District Courts

Courts hear all types of federal cases

Judges are generalists, not tax specialists

Taxpayer can request a jury trial

Many decisions are poorly structured or poorly conceived from a technical standpoint

Jurisdiction is geographically limited

Taxpayer must pay the disputed amount and then sue the government for a refund

(taxpayer is petitioner, IRS is respondent)

U.S. District Courts

Precedents the Court follows:

Supreme Court

Court of Appeals for that District

Own District Court

Slide D3-10

U.S. Court of Federal Claims

Slide D3-11

Court hears all cases involving monetary claims against the federal government

Judges are generalists (not tax specialists)

No jury trials allowed

Jurisdiction is not limited to residents of a any specific geographical region

Taxpayer must pay the disputed amount and then sue the government for a refund

(taxpayer is petitioner, IRS is respondent)

U.S. Court of Federal Claims

Slide D3-12

Precedents Court must follow:

Supreme Court

Court of Appeals for the Federal Circuit

U.S. Court of Federal Claims

Taxpayers usually pursue cases in this court when applicable District Court and/or

Tax Court decisions are adverse

Judicial Authorities

Appellate Courts

Federal Appellate Courts

Slide D3-14

First level

U.S. Court of Appeals

Final level

U.S. Supreme Court

U.S. Court of Appeals

13 Courts of Appeal

11 geographic courts assigned to states

(Kansas is 10 th and Missouri is 8 th )

1 court assigned to Washington, D.C.

1 court assigned to cases coming from the

U.S. Court of Federal Claims

Precedents the Court follows:

Supreme Court

U.S. Court of Appeal for that circuit

Slide D3-15

Slide D3-16

U.S. Supreme Court

Final level of appeal and sovereign legal authority for all federal cases

Permission to present case must be requested by writ of certiorari (may or may not be granted)

Only hear about a dozen tax cases annually

Tax cases generally involve an issue at conflict among the U.S. Circuit Courts of Appeal or an issue of major importance

Evaluating Authorities

Slide D3-18

Statutory Authority

The Internal Revenue Code is the law as enacted by Congress and signed by the

President, therefore, carries the highest weight of authority

Slide D3-19

Treasury Regulations

Treasury Regulations carry the second highest weight of authority

Supreme Court has held that regulations issued under general authority of IRC § 7805(a) have full force and effect of law unless they conflict with the current statute

Supreme Court has held that regulations issued under specific legislative authority have the full force and effect of law (unless in conflict with

Congressional intent)

Slide D3-20

Other Administrative Authority

In general, these provide good indications of the IRS’s position but they are frequently revised and/or superceded and can be overturned by court decisions

If there is a supporting court case with a high weight of authority, taxpayer can take a position contrary to an administrative pronouncement

PLRs and TAMs carry a lower weight of authority than Revenue Rulings or Procedures

Slide D3-21

Judicial Authority

Supreme Court cases carry the highest weight next to the Internal Revenue Code, their decisions can only be changed if:

Congress amends the underlying statutes or

The Court decides to reverse itself

Slide D3-22

Judicial Authority

Court of Appeals cases carry a high weight of authority but less than Supreme Court

If court decisions are in conflict across circuits, decisions in taxpayer’s own circuit have higher value as precedent than those of other circuits

2 nd , 9 th and D.C. circuit decisions are important due to numerous innovative, unusual and/or controversial judicial interpretations of law

Slide D3-23

Judicial Authority

Tax Court cases also carry a high weight of authority (but less than the Supreme Court), particularly when the issue has not been addressed by a Court of Appeals

U.S. Federal Court of Claims cases carry a significant weight of authority

U.S. District Court decisions carry a very low weight of authority (especially if the taxpayer is not in that district)

Slide D3-24

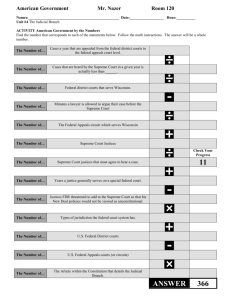

Review Question 1

A taxpayer need not pay the disputed tax in advance when the suit is initiated in which lower court?

a. U.S. Court of Federal Claims

b. U.S. Tax Court

c. U.S. District Court

Review Question 2

A jury trial is permitted in which court?

a. U.S. District Court

b. U.S. Tax Court

c. U.S. Court of Federal Claims

Slide D3-25

Slide D3-26

Review Question 3

The Tax Court departs from its general policy of ruling uniformly for all taxpayers in what situation?

a. a U.S. District Court in the taxpayer’s jurisdiction has ruled differently on the issue

b. the IRS has issued a nonacquiescence to a previous court decision on the issue in the taxpayer’s jurisdiction

c. the Court of Appeals for the circuit to which the decision may be appealed has ruled differently on the issue

Slide D3-27

Review Question 4

When the Tax Court follows the opinion of the Circuit Court of Appeals to which the taxpayer may appeal, the court is following what rule?

a. Goldberg Rule

b. Greenspan Rule

c. Golsen Rule

Slide D3-28

Review Question 5

The IRS may issue an acquiescence or nonacquiescence to which of the following court decisions?

a. U.S. Tax Court

b. U.S. Courts of Appeal

c. U.S. Supreme Court

d. All of the above

e. a. and b. only

Slide D3-29

Review Question 6

In researching a tax position to be taken by taxpayer: a Kansas taxpayer, you find the following

9 th Circuit Court of

Appeals decision sources for and against the position:

Tax Court decision

(California taxpayer)

Do you take the position?

For the Against the taxpayer:

8 th Circuit Court of Appeals decision

Tax Court decision

(Missouri taxpayer)

Private letter ruling Revenue Ruling