This review of the ESAs - although early in their existence

advertisement

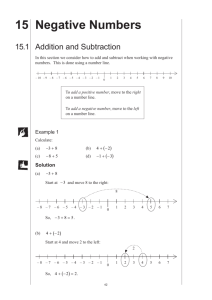

PARLIAMENTARY FINANCIAL SERVICES EPFSF Briefing “Review of the European Supervisory Authorities” Background Since the financial crisis began in 2007, Europe’s financial regulatory architecture has undergone significant reform. This continuing process was formally initiated by Commissioner Barroso, who in 2008 established and mandated an expert group – chaired by Jacques de Larosière - to advise on the future of European financial regulation and supervision. As recommended in the group’s final report published in February 2009, regulations establishing a new European System of Financial Supervision (ESFS) comprising a new European Systemic Risk Board (ESRB) and replacing each of the three Level 3 Lamfalussy Committees with three sector-focussed a European Supervisory Authority (ESA): Committee of European Banking Supervisors (CEBS) European Banking Authority (EBA). Committee of European Insurance & Occupational Pension Supervisors (CEIOPS) European Insurance and Occupational Pensions Authority (EIOPA). Committee of European Securities Regulators (CESR) European Securities & Markets Authority (ESMA). The ESFS seeks to address both micro and macro prudential weaknesses of the previous system. It was fully operational on 1 January 2011 with its principal focus remaining the creation of a single EU rulebook and improved coordination between national supervisors, whilst raising the quality of supervision within Member States and promoting the convergence of supervisory outcomes. The ESFS Review The regulations establishing the ESAs and the ESRB provide for the European Commission to review their structures and performance three years after their establishment and at regular intervals thereafter. In each case, the Commission shall produce a report and forward this to the European Parliament and Council of Ministers, together with any accompanying proposals, as appropriate. In the case of the ESRB, the Parliament and the Council shall examine the Regulation on the basis of the Commission’s report and, after having received an opinion from the ECB and the ESAs, shall determine whether the mission and organisation of the ESRB need to be reviewed. On 26 April 2013, the European Commission launched a public consultation on the effectiveness of the ESAs and ESRB within the ESFS and on the ESFS as a whole. This was organised into five sections: i. ii. iii. iv. v. ESAs (Effectiveness and efficiency of the ESAs, Governance) ESRB (mandate and experience with systemic risks; institutional framework and governance of the ESRB; access to data; external relations and communication) Cooperation and interaction between the ESAs (micro) and ESRB (macro) Structure of the ESFS Miscellanea The Commission received 94 responses1. Its review, expected at the end of February / beginning of March 2014, will also address the potential impacts of the creation of a single supervisory mechanism (SSM) on the ESAs, the ESRB and the ESFS as a whole, given the core role attributed to the ECB, and will assess whether this necessitates further adaptations to the legal framework underpinning the ESFS. In addition, the European Parliament’s Committee on Economic and Monetary Affairs (ECON) is working on an own-initiative report (Rapporteur: Sven Giegold, Greens/EFA) to provide the Commission with its 1 http://ec.europa.eu/internal_market/consultations/2013/esfs/contributions_en.htm www.epfsf.org 1 FORUM EUROPEAN PARLIAMENTARY FINANCIAL SERVICES recommendations on the review of the ESFS. The recommendations of the final report will not be legally binding but will feed into the general consultation process. ECON will most likely vote on the report in mid-February with a plenary vote expected for March/April. The ECON vote will already give a clear signal of where the European Parliament is heading politically and can be taken into consideration by the Commission before it publishes its review. Focus on the review of the European Supervisory Authorities Some areas that have been suggested would benefit from improvement are: ESAs objectives: The extent to which the ESAs have fulfilled their objectives, including improving the functioning of the internal market; protecting depositors, investors, policyholders, consumers and other beneficiaries; ensuring the integrity, efficiency and orderly functioning of financial markets. At this relatively early stage in the life of the ESAs, examples include ESMA’s monitoring of financial products; ESMA’s investor warnings (including joint warning with EBA on “CFDs”; EIOPA’s work on IMD2, ESMA’s Work on EMIR and MIFID II. While EBA has played a more limited role in consumer protection to date, according to the IMF’s Financial Sector Assessment Program for the EU (March 2013), among the ESAs, as would be expected, the EBA has played the most active role in handling the European banking crisis. This includes the June 2011 stress tests and the June 2012 recapitalization. Resources: current limits on resources could impact the ability of the ESAs to discharge their growing responsibilities and in delivering the detailed rule making that is critical to the broader process of European regulatory reform. This is especially the case for the EBA and ESMA, whose work programs include the completion of the Single Rulebook as well as the development of the Single Supervisory Handbook and delivery of detailed rule making for example for CRR and MiFID/R. Currently, the ESAs’ funding is based on different models. The budgets of EBA and EIOPA are part of the Commission’s budget, with 40% coming from the EC section and 60% coming from the NCAs. ESMA has three sources of funding: a subsidy from the Commission (46%), a contribution from the NCAs (30%) and a fee levied on CRAs under its direct supervision (20%). The budget process and its subordination from the Commission has important implications for the ESAs’ staffing policies and flexibility to react to market events. According to some stakeholders this constraint could be addressed by creating a specific budget line in the Community budget which would finance the ESAs. Governance: Some stakeholders feel that there is a need to reform the governance of the ESAs in order to make them more independent, both from the European Commission and from national authorities and boost the ESA’s role in for instance mediation, participation in supervisory colleges, direct supervision, supervisory convergence and highlighting breaches of EU law. This could include a review of their voting system. In fact, along with the establishment of a Single Supervisory Mechanism, the EBA regulation has been partially amended by envisaging a new voting-system, according to which a double-majority is necessary for the approval of several types of decisions, among which decisions on mediation, in order to ensure that they are backed by both a majority of the SSM and the non-SSM countries. While acknowledging that the amendment was introduced to ensure member states not participating to the banking union would not be outvoted, according to some stakeholders and the EBA chairman this new system risks to make more complicated than in the past the exercise of EBA’s mediation role to solve possible conflicts and making it less likely that EBA will act at its own initiative to start an infringement proceeding against a national competent authority. At the moment the ESA governing bodies are composed of an overwhelming majority of members who are full-time employed by the national supervisory authorities. If this is seen as a constraint, one way of addressing the issue could be by changing the composition of its bodies with members to be nominated at the European level (balancing the number of national representatives). More specifically, some suggest replacing the ESA’s Management Board with an Executive Board. These could be composed of full time individuals which would need to commit to independence and be full-time long-term and nonrenewable jobs, along the lines of the ECB Executive Board. The Board of Supervisors (BoS), currently composed of the ESA’s Chairperson with no voting rights and one representative for each national supervisory authority who are currently the only voting members, could include the members of the ESA Management Board. www.epfsf.org 2 FORUM EUROPEAN PARLIAMENTARY FINANCIAL SERVICES Rule making: some stakeholders question whether the EFSF as a whole has helped to maintain an effective balance of power between the co-legislators, the ESAs and the Commission in which the independence of the ESAs, the rights of the Commission and the rights of scrutiny of the co-legislators on Level 2 measures can be taken effectively into account. Impact assessment: many stakeholders call for impact assessments to be fair and realistic, with clarity on the marginal costs and benefits of specific proposals and their net benefit to society / the economy.. The experience of the co-legislators, industry and interest groups of the new supervisory architecture should equally help to identify the priority areas going forward. Legal certainty and implementation times: the experience to date seems showing that there have been instances in which there has been insufficient legal certainty or unforeseen circumstances which affected the ability of industry and end-users to comply or otherwise has left insufficient time to implement Level 2 measures. In such cases, some stakeholders question whether a temporary relief from regulation should be considered as a possible solution and if so, ask how would such a process work and what would be the role of the ESAs. EU convergence: aside from the development of regulations and standards, it is often considered also that the ESAs (and ESMA in particular) could play a more active role in ensuring a consistent application of EU law and supervisory practices through a wider use of their powers in this field (e.g. peer reviews, breach of Union law procedures). Admittedly, this would also constitute a call on resources. International convergence: it is generally acknowledged that the ESAs need to play a more relevant role in helping to deliver an international level playing field for financial services, by giving them adequate powers to interact with third-country regulators. The continuing discussions between the EU and the US on extraterritoriality in cross border derivatives regulation illustrate the practical difficulties of conducting international negotiations and the issues than can arise as a result of differences in legislative process and objective, scope and interpretation Focus on the review of the ESRB Whilst the ESRB is designed to take a broad view of the concentration of risk in the EU financial system as a whole (which includes the banking system as well as any potential risk transmission through the nonbanking system), the ESRB is currently composed largely of banking supervisors. There have been instances of recommendations including application of tools designed for banking supervision (such as capital) to be deployed in other areas of financial services, with potentially profound impacts on business models and the ability of entities such as asset managers, insurance companies and pension funds to serve their clients2. A broader-based composition of the ESRB to include expertise in insurance, asset management and pension funds is a potential solution. An additional suggestion might be to have an independent chair to ensure that EU–wide concerns – for example about the integrity of the Single Market – are adequately addressed. In terms of process and governance, many commentators agree on the need to strengthen and simplify the way the ESRB operates and improve its visibility. Any reform of the ESRB governance should aim to ensure: an appropriate balance between national, Eurozone and wider EU interests, including the integrity of the Single Market; and the capability for macro-prudential to be used at both national, Eurozone and EU levels to prevent or mitigate risks to overall financial stability. In this respect, it is crucial that the ESRB pay adequate attention to the role that the ECB will play within the SSM in the exercise of macro-prudential powers and tools. This could include a progressive integration of national macro-prudential objectives and policies within the SSM, with a view to avoiding fragmentation along the lines of national interests and ensuring the overall EU financial stability. 2 See for example ERSB recommendation on Money Market Funds (20 December 2012): http://www.esrb.europa.eu/pub/pdf/recommendations/2012/ESRB_2012_1.en.pdf?da67c161c0b112b5594c54d5ba5f caaf www.epfsf.org 3 FORUM EUROPEAN PARLIAMENTARY FINANCIAL SERVICES Conclusion This review of the ESAs - although early in their existence - is a welcome opportunity to take stock of the evolution of the ESFS. A lesson of the crisis is that the system needed to change and there is widespread approval of the decision to create the ESAs as part of the ESFS. That said, there are a number of additional factors to consider as part of this review. First, that institution-building takes time and resources and it is arguable that the ESAs so far have not had enough of either. Second, that the introduction of the ESAs has affected the balance of rights and responsibilities of the European Commission and the co-legislators and that this needs to be recognised and any weaknesses addressed going forward. In addition, the closer links being created between the Eurozone countries has implications for the balance of rights and responsibilities between the Eurozone countries and the remainder of the EU Member States. The relationship between the EBA and the ECB, for example, is a crucial part of the equation. The future challenge will be to ensure effective implementation of the regulation that has been negotiated and to consider more the external dimension as Europe seeks to forge workable agreements with regulators from third countries. In this way, the ESAs can contribute to the preservation of stability and enhance the opportunities for growth. The ESFS with the ESAs at its heart has a crucial role to play in this process and it is therefore essential that the system as a whole carries the broadest possible support from the widest group of stakeholders. ______ www.epfsf.org 4 FORUM EUROPEAN PARLIAMENTARY FINANCIAL SERVICES Briefing notes are prepared by the Financial Industry Committee to the European Parliamentary Financial Services Forum. For further information on the subjects raised in the briefs please contact the Chairman, Members or Secretariat of the Financial Industry Committee. Chairman Financial Industry Members Guido Ravoet, EBF Chief Executive Avenue des Arts 56, B-1000 Brussels Tel: +32 2 508 37 11 / Fax: +32 2 502 13 30 E-mail: g.ravoet@ebf-fbe.eu Steering Committee Burkhard Balz MEP Sharon Bowles MEP Antonio Fernando Correia de Campos MEP Philippe De Backer MEP Herbert Dorfmann MEP James Elles MEP Frank Engel MEP Sari Essayah MEP Diogo Feio MEP Elisa Ferreira MEP Vicky Ford MEP Ashley Fox MEP Jean-Paul Gauzès MEP Ana Maria Gomes MEP Sylvie Goulard MEP Roberto Gualtieri MEP Malcolm Harbour MEP Roger Helmer MEP Monika Hohlmeier MEP Gunnar Hökmark MEP Danuta Maria Hübner MEP Anne Jensen MEP Ivailo Kalfin MEP Othmar Karas MEP Sean Kelly MEP Mojca Kleva MEP Wolf Klinz MEP (SC Chair) Philippe Lamberts MEP Boguslaw Liberadzki MEP Baroness Sarah Ludford MEP Olle Ludvigsson MEP Astrid Lulling MEP Arlene McCarthy MEP Gay Mitchell MEP Bill Newton Dunn MEP Antonyia Parvanova MEP Sirpa Pietikäinen MEP Godelieve Quisthoudt-Rowohl MEP Paul Rübig MEP Antolín Sánchez Presedo MEP Olle Schmidt MEP Richard Seeber MEP Peter Skinner MEP Theodor Dumitru Stolojan MEP Kay Swinburne MEP Michael Theurer MEP Ramon Tremosa i Balcells MEP Emilie Turunen MEP ––––––– Angelika Werthmann MEP Auke Zijlstra MEP Secretariat Catherine Denis, EPFSF Director Avenue des Arts 56, B-1000 Brussels Tel: +32 2 514 68 00 / Fax: +32 2 514 69 00 E-mail: cdenis@epfsf.org Financial Industry Committee Association for Financial Markets in Europe (AFME) Banco Bilbao Vizcaya Argentaria (BBVA) Banco Santander Barclays BlackRock CitiGroup Chartered Financial Analyst – Institute (CFA) Commerzbank AG Crédit Agricole Danske Bank Deutsche Bank AG Deutsche Börse AG DTCC – The Depository Trust and Clearing Corporation Euroclear European Association of Public Banks (EAPB) European Banking Federation (EBF) European Central Securities Depositories Association (ECSDA) European Federation of Accountants (FEE) European Fund and Asset Management Association (EFAMA) European Mortgage Federation (EMF) European Payment Institutions Federation (EPIF) European Savings Banks Group (ESBG) European Structured Investment Products Association (EUSIPA) Federation of European Securities Exchanges (FESE) Futures and Options Association (FOA) Goldman Sachs International HSBC ICAP ING International Swaps and Derivatives Association (ISDA) Insurance Europe Intesa Sanpaolo JP Morgan KBC KPMG Lloyds Banking Group NASDAQ OMX NVB – Dutch Banking Association PensionsEurope PricewaterhouseCoopers Prudential Plc Royal Bank of Scotland Société Générale Standard & Poors State Street UBS AG UniCredit Group VISA Europe Western Union International Bank Zurich Insurance Company www.epfsf.org 5 FORUM EUROPEAN