Pamela J. Miller, OD, JD - Management & Business Academy

advertisement

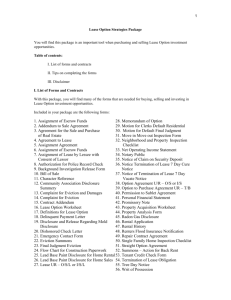

Welcome Legal Aspects Of Optometric Practice Pamela J. Miller, O.D., F.A.A.O., J.D. Highland, California Pamela J. Miller, O.D., J.D. • Became owner: 1974 • Staff size: 3 • Member: AOA, former member CA St. Bd. of Optometry, National Academies of Practice in Optometry, staff O.D. San Bernardino Co. Medical Center • SCCO 1973 Dr. Miller and staff Mission statement: To provide premium vision care by a warm, caring and supportive doctor and staff Legal terms you need to know • • • • • • • Plaintiff Defendant Doctrine of informed consent Duty to warn Duty to mitigate Document The average reasonable person standard Legal concepts you need to know • • • • • Respondeat superior: Let the master answer Deep pockets Joint and severable liability Res ipsa loquitur: The thing speaks for itself Rebuttable presumption of negligence: instrument causing injury was in defendant’s exclusive control and the accident was one which ordinarily does not occur in the absence of negligence Documentation • • • • The most important piece of legal advice Document completely but judiciously Do not change, erase or alter a writing Adding to a writing is permissible – sign, date, state why you are adding to the document (ex. new information, research, addendum, etc.) Contract law “A promissory agreement between two or more persons that creates, modifies, or destroys a legal relation.” “An agreement consisting of a promise or mutual promises which the law will enforce or the performance of which the law in some way recognizes as a duty.” Contract basics • • • • Oral or written Express or implied UCC – commerce, goods Statute of frauds Contract statute of frauds • “No action shall be maintained on certain classes of contracts or engagements unless there shall be a note or memorandum thereof in writing signed by the party to be charged or his authorized agent.” • Personal services, sale of land, etc. Contract requirements “Four corners of the document” • • • • Offer Acceptance (mirror image) Consideration Parties with at least limited capacity (duress, fraud, free will, mental capacity) • Mutuality of terms It’s as simple as A Act B Breach C Consequences D Damages Damages • Actual • Compensatory – Unforeseeable: future earnings – Foreseeable: actual expenses, retraining, lost wages, counseling • Nominal • Punitive Contracts you’ll encounter • Real estate - office Purchase rental Lease Rent Construction • Practice Purchase Partnership Merger Shared overhead • Employment Independent contractor Employee • Equipment Purchase Lease • Third party provider Panel member Employee health care Always read the fine print! Pre-nup • • • • • • • Pre-nuptial agreement Pros and cons Spousal involvement in business Purchase/sale of office and assets Protection from liability Tax filing – married, filing separately Keeping it separate vs. co-mingling Legal entities Solo Partnership it’s just you, all the way Group 3 or more Affiliation Merger Franchise share overhead; separate (but equal?) joint owners (equal?) 2 or more practices join purchase the right to be part of a larger organization in return for specific privileges, expense sharing, etc Hiring: Your responsibilities • • • • • • Human resources Educate Inform Follow-up Oversee Evaluate and re-evaluate Stop litigation before it starts • • • • • • • Review your policies Keep up on the law Post required notices Accept no nonsense Set an example Treat everyone equally and fairly Watch your opinions New hires • Contract • Office policy manual • Verify education, experience, references • Background check, criminal or court records • Complete all hiring forms; copy of right to work verification; federal forms • Introduce to office, duties • Continued employment predicated on successful completion of physical and drug test, if applicable • Provide training • Safety training; passwords, keys, etc. • Employee has opportunity to explain or refute information • Learning, not probationary period Independent contractor or associate Independent contractor • New practice owners often are also independent contractors (or employees) in other settings to supplement their income • Clearly defined by the IRS • Not an employee • Responsible for all taxes and contributions • Look to the relationship between the parties Employee contracts • • • • • • Policy vs. contract What should I include What should I exclude How comprehensive should it be Court interpretation Burden of proof Employment at will • Disclaimer • Termination at any time • With or without cause Protect interests by • • • • • • Confidentiality agreements Covenant not to solicit patients Covenant not to solicit employees Covenant not to compete during employment Return of property upon leaving the practice Beware of out-of-state corporations Confidentiality agreement Non-disclosure agreements • Designed to protect the employer, seller or partner from disclosure of trade secrets – i.e. May contain trade secret protections • Separate from non-competition clause • May be severable from a non-compete agreement so not to violate “right to work” Confidentiality agreement Non-disclosure agreements cont. • Covenant not to compete arising from sale of business or partnership dissolution may be valid • Employers may not force an employee to sign a covenant not to compete or a condition of employment – unfair competition • Look to geographic area, time, activity, public’s right to receive care • State court may differ from federal court Covenants • Covenant not to compete • Competition agreement Purpose: To protect practice value and goodwill Covenant not to compete • Restrictive or a restraint of trade – Is it reasonable, consistent with public welfare and bargained for pursuant to lawful contact? • Goal is to prevent patient or record stealing or punish someone who does • Enforceable if reasonable in light of the facts and circumstances Covenant not to compete cont. • Cannot restrain trade – cannot be too restrictive and unfair to the parties involved or public welfare • Generally not honored in CA – check state law – Reasonable time limit only long enough to enable former employer or buyer to protect the practice • Part of an employment contract, purchase agreement, partnership or “pre-existing” relationship Compete clause (Employees, partners, mergers, associates) • Shows greater durability and enforceability • Doctor #2 can leave doctor #1, BUT to practice in the same town, he or she must pay X to #1 • Holds up in court • Must have consideration • Must be reasonable and specific • Designed to mitigate damages – liquidated damages Boilerplate language • • • • • • • Confidentiality Employment at will Privacy Electronic media Harassment Discrimination Zero tolerance Employer Taxes – 2008 • • • • • • • • Paid by FICA – social security Medicare SDI (CA) Federal State SUI ETT Employer 6.20% 1.45% 3.4% 0.10% on 1st $7000 (employer training tax) • Workers’ comp Employee 6.20% 1.45% 0.08% schedule schedule schedule Hire to fire documentation • Handbooks – policy manual • Handbooks vs. Application • Be understanding of personal problems • Supervisor Training • Evaluations – written warnings; document • Communicate, communicate, communicate • Don’t stress out • Consistency – praise & suggestions for improvement • Resignation • Post-Termination • No surprises • No discussion once termination is necessary – end of day, end of pay; stand and escort to door • Return keys, change codes Hire defensively • Be specific about rules • Be vague about rights – Progressive discipline policies • Oral warnings • Written warnings • Suspensions • Terminations Employment application • Authorizations – Background check – Reference check – Drug & alcohol testing – Certification that all info provided by applicant is true Successfully enforce policies – – – – – Don’t ignore a situation or conflict Take action to achieve resolution Document your actions Employee should sign all performance reviews & keep a copy Pyramid any disciplinary measures if possible Develop a game plan • • • • • • • Address a complaint or issue immediately Employee rights Following through - consistency Posting Right of Privacy Annual review - Do not puff Review/update office policy manual periodically Boilerplate language • Employment at will • “Employees are forbidden from disclosing, taking, or copying confidential information” • “Zero tolerance” • Right of privacy • ADA - “reasonable accommodation” What is sexual harassment or discrimination? • • • • • • Unwanted and offensive touching Objectionable behavior Unwelcome sexual advances Requests for sexual favors Boss has no special right Hostile environment Protect yourself • Prompt and effective action to end alleged harassment after complaint • Employee must make a complaint • If no action is taken to resolve the complaint, the employee may sue and receive actual damages, court costs, attorney’s fees, and even punitive damages for willful violation RED YELLOW GREEN • RED: Not allowed - always unacceptable • YELLOW: Questionable Usually unacceptable or inappropriate • GREEN: Allowed - acceptable The golden rule • All employees must be treated with dignity and mutual respect • By everyone, at all times • You set the example and are responsible for the whole office Office illness and injury prevention manual Leases & purchase agreements Equipment Real property Practice Equipment lease • Lease purchase – annual tax paid – $1 buy out or fair market value buy out – May be higher cost; shown as expense – Doesn’t show as an asset or liability • Outright purchase vs. finance • Write-off value: depreciation per year • Lease without option of purchase Office lease considerations • Mistake to pay operating expenses based on leased space rather than on leasable space • Lease rate: rent + operating expenses and how calculated; increases • Maintenance and upkeep; remodeling • Amount of free rent • Length of time space has been available; % occupancy; length of current tenant’s leases, lease incentives to current residents • Any exclusionary businesses (i.e. other optical) Office lease considerations cont. • In event of fire, loss of use, loss of space/contents; remodeling, improvements, change of entrances, relocation; hours of business; square footage, parking • Termination clause – right to sublet • Tax indemnification clause • Ownership change; buy-out clauses and down payments • Insurance specifications • Warranties on premises, equipment, etc. • Included services, signage, hours of operation Is it better to purchase or own? • Real property – Purchase outright – Finance – Lease to own • Equipment – Purchase outright – Finance – Lease to own • Employees Practice purchase or sale • Lump sum is not the best option • Serial sale: interest on sale is paid monthly (with principal). Tax may be computed on this interest – as a gift tax against the selling doctor unless the interest is already worked into the price • Structured sale (best option): buyer has option to speed up payments • Check with your accountant and tax attorney Own your own Advantages – Cash accounting system – Liability mitigation: notice not required – Control Disadvantages – Repair and upkeep – Annual price hikes or upon lease renewal – Liability Partnerships Protect your partnership • • • • • • • Choose wisely, carefully, consider a “trial run” Balance the work load; establish your roles Compromise Have a contingency plan Consult an attorney and put it in writing Communication is important to avoid a divorce Keep your spouse out of the business Considerations • • • • • • • • Events causing termination of a relationship Retirement Voluntary termination to leave To start a competitive practice Involuntary termination –principals disagree Death Disability Felony conviction – loss of license Partnership contracts • • • • • • • Name, time commitment; prohibited acts, duration Contributions, allocations & cash flow Loans & leases; partnership sale or adding new partner Income, expenses, capital expenditures & withdrawals Books & records Competition agreements Partner relations – death, disability, buy out, resignation • Insurance: how to be paid? Read carefully • • • • • • • Document everything Never argue; never yell Never get angry Do your research Don’t be greedy Remember, act in haste, repent in leisure Plan and prepare for the worst Going for help • • • • State chamber of commerce Professional associations Buying groups State/federal employment agencies To do list • • • • • • • • Take a basic tax preparation class Select a CPA for small businesses Review contracts and categorize by topic Create a profit-and-loss statement Set 5- & 10-year financial & practice goals Write or re-evaluate office policy document Establish emergency protocols Develop a mentor relationship References • Classe, John, O.D., J.D. - Legal Aspects of Optometry • Dufour, James T. - Optometric Office Injury& Illness Prevention Guide • Miller, Pamela J. O.D., J.D. - A Handbook for the Ophthalmic Practice Documentation and Record Keeping Made Easy • AOA References cont. • Primary Eyecare Network - Personnel File Desk Reference Set • Steinberg, Craig S. O.D., J.D. - Employer’s Guide for Optometrists • The Optometric Office and Illness Prevention Guide - Vision West • California Compliance Catalog– www.calbizcentral.com Thank you Pamela J. Miller, O.D., F.A.A.O., J.D. 909.862.4053 drpam@omnivision.com