Long Term Financial Forecast Model

advertisement

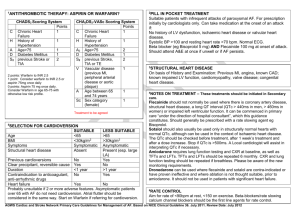

Local Government Forecasting Model v3 LGFP CFO and Finance Managers Forum 24 July 2015 Local Government Forecasting Model Agenda LGFM Features and benefits Using the LGFM to tell your Council’s financial story 2 Local Government Forecasting Model v3.0 Features and benefits 3 LGFM v3 New Features Business units Ability to ‘normalise’ “Bottom-up” revenue & expense forecasting Different loan types are catered for Improved treatment of grants Improved cash flow timings More accurate interest expense Better reporting More accurate depreciation User comments Run sensitivities and scenarios Improved notifications 4 LGFM v3 Features Business Units Develop financial forecasts for up to six internal business units Calculate financial sustainability metrics for each business unit Assess the profitability of your commercialised business units Model internal transactions, including internal operating revenues and expenses, borrowings, dividends and tax equivalents. 5 LGFM v3 Features Business units Whole Council Whole ofofCouncil Revenue & Expenses Assets QTC Debt Cash Miscellaneous 6 LGFM v3 Features Business units Whole of Council Assets Revenue & Expenses QTC Debt Cash Miscellaneous Allocation to business units General Business unit 1 Business unit 2 Business unit 3 Business unit 4 Business unit 5 7 LGFM v3 Features Business units – operating internals Whole of Council Assets Revenue & Expenses General Business unit 1 Operating internals QTC Debt Business unit 2 Business unit 3 Cash Business unit 4 Miscellaneous Business unit 5 Operating internals 8 LGFM v3 Features Business units – internal loans General Internal Loan Loan repayments + internal margin Business unit 1 Business unit 2 Business unit 3 Business unit 4 Business unit 5 9 LGFM v3 Features Business units – dividends General Tax equivalents and dividends Business unit 1 Business unit 2 Business unit 3 Business unit 4 Business unit 5 10 LGFM v3 Features Built-in Scenario Manager Efficiently develop scenarios to – Sensitise specific aspects of your business > Applying different growth factors to revenue and expense line items – Quantify how a particular course of action may impact your financial sustainability 11 LGFM v3 Features Built-in Scenario Manager Model scenarios with a high degree of flexibility, including – Adding or removing a particular capex project – Adding or excluding additional debt repayments 12 LGFM v3 Features Normalise results Easily eliminate the impact of the revenues and expenses associated with a specific subsidy program (eg, NDRRA) 13 LGFM v3 Features Reporting capability Generate dashboard-style, visual reporting for decision makers Generate user-specific reports, including ‘favourite’ ratios and metrics Create custom reports from blank templates View reports for whole-ofcouncil and individual business units 14 LGFM v3 Features Asset flexibility Add capital expenditure events on any date to produce more accurate depreciation estimates and cash balance forecasting Assign residual values to new capital expenditure with the depreciation forecast adjusted automatically Base revaluations, for new assets, on user-defined rates according to asset class, with depreciation calculations adjusted automatically Assign work-in-progress to individual assets or projects 15 LGFM v3 Features Improved debt forecasting Model debt with a greater range of loan types which closely approximate QTC debt products Add loans at any date in the forecast period (no longer fixed at 30 June) 16 LGFM v3 Features Cash forecasting Forecast with more flexibility around the timing of cash flows for revenues, expenses, capital expenditure, borrowings and debt repayments More accurately estimate interest with bi-monthly cash forecasts that: – reflect council’s cash cycle – identify minimum cash requirements and surplus cash 17 Dashboard Detailed cash forecasts 18 Local Government Forecasting Model v3.0 Telling your financial story 19 LGFM v3.0 Using LGFM to tell your financial story Completeness check (Checklist) Accuracy check (Notifications) Interpret / analyse (Dashboard – sustainability indicators) Normalise - elimination of abnormal items (eg, NDRRA) Review standard or customised reports Run sensitivities and scenarios 20 Model completeness and accuracy Checklist page Step 1 General information Model setup Information about the council and business units Completed on 21 Oct 14 by Mark Baseley Grant programs Define grant, subsidy, contribution and donation programs to be forecast Completed on 21 Oct 14 by Mark Baseley Days receivable and payable Set the default number of days receivable and payable Incomplete Financial growth rates Consumer Price and Council Cost Indices Incomplete Staff Full-time equivalents and enterprise bargaining agreement growth Incomplete Regional data Population and rateable properties Incomplete Custom growth indices & drivers User defined indices by actual numbers or growth rates Incomplete Revenue All operating revenue including operating grants Incomplete Revenue discounts Discounts and pensioner remissions Incomplete Expenses All operating expenses including internal operating transactions Incomplete Current asset base with forecasted depreciation New expenditure on assets in the forecast period Incomplete Non-financial data Step 2 Revenues & expenses Step 3 Assets Existing assets Capital expenditure Incomplete 21 Model completeness and accuracy Notifications page 22 Interpret and analyse Dashboard 23 Interpret and analyse Dashboard - key sustainability metrics 24 Generate standard and custom reports Operating performance report – extract Operating Performance Page 1 of 2 Operating result ($'000) 400,000 Operating efficiency ratio (%) 120% 350,000 300,000 250,000 100% 100% 80% 80% 60% 60% 40% 40% 20% 20% 200,000 150,000 100,000 50,000 (50,000) -% Jun-13AJun-14AJun-15BJun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F Operating result Operating revenue Operating expenses -% Jun-13AJun-14AJun-15BJun-16FJun-17FJun-18FJun-19FJun-20FJun-21FJun-22FJun-23FJun-24F Operating efficiency ratio (%) Operating surplus ratio (%) 3% Sales, contracts and recoverable works margin (%) Debtor and creditor days 90 80 2% 70 2% 60 1% 50 8% 1% 40 6% -% 30 -1% 20 -1% 10 -2% - Jun-13AJun-14AJun-15BJun-16F Jun-17F Jun-18F Jun-19FJun-20F Jun-21F Jun-22F Jun-23F Jun-24F 12% 10% 4% 2% -% Jun-13AJun-14AJun-15BJun-16FJun-17FJun-18FJun-19FJun-20FJun-21FJun-22FJun-23FJun-24F Operating surplus ratio (%) Creditor days Actual Jun-13A Jun-15B Jun-13AJun-14AJun-15BJun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F Gross interest expense as a portion of average term debt (%) Interest revenue as a portion of average cash (%) Debtor days Budget Jun-14A Interest to debt and interest to cash balance ratios (%) 14% 3% Operating performance indicators Sales, contracts and recoverable works margin (%) 120% Forecast Jun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F Actual (FY10-14) Annual average Forecast (FY15-19) Forecast (FY15-24) Operating performance metrics Operating surplus ratio (% ) Operating efficiency ratio (% ) Sales, contracts and recoverable works margin (% ) Creditor days Debtor days Gross interest expense as a portion of average term debt (% ) Interest revenue as a portion of average cash (% ) -1.2% 98.8% 100.0% 77.5 54.3 6.6% 7.6% 2.5% 102.6% 100.0% 62.0 36.8 6.7% 7.1% 0.0% 100.0% 100.0% 59.4 37.0 6.7% 7.3% 0.2% 100.2% 100.0% 59.4 37.0 6.8% 8.7% 0.2% 100.2% 100.0% 59.8 37.0 6.7% 9.9% 0.4% 100.4% 100.0% 59.8 37.0 8.0% 11.7% 0.2% 100.2% 100.0% 59.9 37.0 6.8% 10.9% 0.9% 100.9% 100.0% 59.9 37.0 6.1% 10.5% 0.7% 100.7% 100.0% 60.1 37.0 6.1% 10.2% 0.7% 100.7% 100.0% 60.1 37.0 6.1% 10.7% 0.7% 100.7% 100.0% 60.2 37.0 6.1% 10.7% 0.7% 100.7% 100.0% 60.2 37.0 6.1% 10.6% -1.0% 99.1% 100.0% 76.0 50.0 6.6% 7.6% 0.2% 100.2% 100.0% 59.7 37.0 7.0% 9.7% 0.5% 100.5% 100.0% 59.9 37.0 6.5% 10.1% Operating result ($'000) Operating revenue Operating expenses Operating result 292,831 296,332 (3,501) 290,683 283,321 7,362 277,013 276,981 31 285,339 284,797 542 295,470 294,794 676 307,385 306,102 1,284 319,724 319,187 536 329,326 326,457 2,870 339,299 337,074 2,225 348,440 346,166 2,273 359,096 356,424 2,672 370,010 367,300 2,710 1.2% 0.6% 79.4% 1.9% 2.4% -40.8% 2.4% 2.6% -9.5% 25 Generate standard and custom reports Liquidity position report – extract Liquidity Position Page 1 of 2 4 years Time period for the chart from the start of the forecast 6.0 Cash cycle by cash segments ($'000) 200,000 Cash expense cover (months) 7.0 5.0 4.0 3.0 150,000 2.0 1.0 Jun-13A Jun-14A Jun-15B Jun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F 100,000 Cash expense cover (months) QTC—upper bound Working capital ratio (times) 3.5x 50,000 QTC—lower bound 3.0x 2.5x 2.0x - 1.5x 1.0x 0.5x (50,000) Jun-13AJun-14AJun-15BJun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F 120,000 Cash cover Cash cover (unfunded) Externally restricted Externally restricted (unfunded) Internally restricted Internally restricted (unfunded) Long-term surplus Short-term surplus Overdraft Cash balance Approved working capital facility limit Closing balance of cash and cash equivalents ($'000) 180,000 Working capital ratio (times) Annual unrestricted cash balance range (high, median, low) 120,000 QTC—lower bound QTC—upper bound Closing cash balance and median annual cash balance 160,000 100,000 100,000 140,000 80,000 120,000 80,000 100,000 60,000 60,000 80,000 40,000 60,000 40,000 40,000 20,000 20,000 20,000 Jun-13AJun-14AJun-15BJun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F Externally restricted Internally restricted Unrestricted - Jun-15B Jun-16F Jun-17F Jun-18F Jun-19F Jun-20F Jun-21F Jun-22F Jun-23F Jun-24F Jun-13AJun-14AJun-15BJun-16F Jun-17F Jun-18FJun-19F Jun-20F Jun-21F Jun-22F Jun-23FJun-24F Cash and cash equivalents—closing balance Cash and cash equivalents—median balance 26 Sensitivities and scenarios Control Panel allows users to sensitise, normalise and control outputs Control Panel 1. Select Scenario 2. Whole of Council or Business Units? Whole of Council Selected Business Units 3. 4. Select Business Units Whole of Council [Inactive BU] 4 [Inactive BU] 2 [Inactive BU] 5 [Inactive BU] 3 [Inactive BU] 6 Normalise Results 5. Print Use median cash balance for ratios Print All Use alt. min. liquidity for cash chart Operating Performance Normalise for selected grant program Fiscal Flexibility Asset Sustainability Liquidity Select the Base Case or Alternate Case Look at either the whole-of-council or individual BUs Select which BUs Normalise results to view On the dashboard, we can print specific sections 27 Summary LGFM v3 Features What to look for Business units Completeness (checklist) Scenario manager Accuracy (notifications) Normalise results Interpret and analyse (dashboard) Reporting capability Asset & debt improvements Run standard and custom reports Enhanced cash forecasting Sensitivities and scenarios 28 Resources available to LGs LGFM v3 On QTC Connect: – Model – User guide – Quick Reference guide – FAQs guide – Video Tutorials One-on-one training and support 29 Questions Ross Kline, Senior Advisor T: 07 3842 4898 E: rkline@qtc.com.au 30 Disclaimer QTC has prepared this presentation for use solely for the LGFP CFO and Finance Managers Forum. The recipient shall not use the presentation for any purpose other than the purpose for which the presentation was expressly provided. The presentation contains confidential information. None of its contents may be provided or disclosed to any other party without QTC’s express written consent. The information in this presentation is provided by QTC in good faith in relation to the information available at the time of its preparation and on the basis of information supplied to QTC by third parties. QTC has not independently verified the information supplied to it and accordingly does not represent that the information provided to QTC is accurate or complete and it should not be relied upon as such. QTC is under no obligation or duty to notify anyone if there is any change in any information or any new information or if it forms a different opinion at any time after the date of this presentation. Neither QTC nor any of its employees or agents accepts any liability for any loss or damage suffered by any person as a result of that person or any other person placing any reliance on, or acting on the basis of, the contents of this presentation. To the extent permitted by law, QTC expressly excludes any representation or warranty in relation to the accuracy, currency and completeness of the presentation. To the extent permitted by law, QTC limits its liability to the amount of any fees paid to QTC for this presentation. The recipient acknowledges that QTC is not a legal, tax or accounting advisor and that independent expert advice from practitioners in the relevant disciplines should be obtained on those matters before acting upon the information contained in this presentation. © Queensland Treasury Corporation 2015 31