Financial Wellness: MyBudgetCoach

advertisement

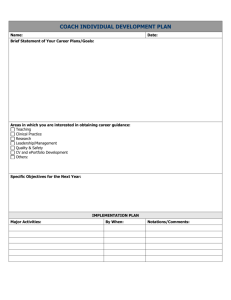

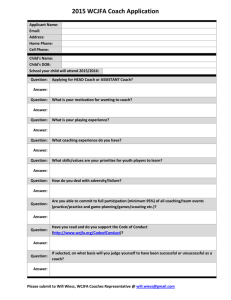

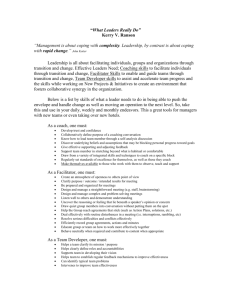

Financial Wellness: MyBudgetCoach www.ohiofoodbanks.or g www.mybudgetcoach.or g Chrisann Leaman, United Way of Greater Stark County Jessica Weitthoff, Ohio Association of Foodbanks Learning Objectives • Who is your financial expert? • Learn about resources so you can answer your financial questions • Understand MyBudgetCoach and how to get involved • Slides can be found: goo.gl/KcXBc6 2 Kahoot.it • Test Run • Let’s play a game. 3 Let’s Play A Game! 1.Take out your phones and go to: Kahoot.it 2.Enter your favorite food followed by a number that means something to you 3.Enter the number on the screen when asked. 4.You will see the actual questions up here. Pick the color/shape that corresponds to the right question. 4 3 Main Reasons Why People Don’t Do Well Financially 1. Failure to plan 2. People are uninformed 3. People are misinformed Royce, C. (May 15, 2015). [Video file]. Chris Royce - Financial Wellness Workshop Presentation Retrieved from https://www.youtube.com/watch?v=cgLGH_PclBo 5 6 Savings •Banking •Emergency •Retirement •529 Plan 7 Where to put your money •Savings •Emergency •Checking •Automate direct deposit Ohio Banks Credit Unions community-oriented serve people, not profit 8 401K 9 529 Plan •College Advantage - Ohio’s 529 Savings Program 10 Debt •Credit cards •Bankruptcy Help •Rewards •House •Auto •Student loans 11 Student Loans • Federal Student Loans • You for loan forgiveness, •FAFSA on OBB cancellation or • The U.S. Department of discharge. Two popular Education will provide help loan forgiveness for FREE. Private companies programs include: may contact you to help for a • Public Service Loan fee – it’s not necessary! Forgiveness • Teacher Loan Forgiveness Credit Report/Score • Check your credit report for free •The Fair Credit Reporting Act (FCRA) •Federal Trade Commision - Dealing with Debt • Consumer Financial Protection Bureau How to get and keep a good credit score 13 14 15 Tracking Income and Expenses 16 Agenda • • • • • • • What is MyBudgetCoach® Member Skills that members will acquire Coach Relationship Manager Training Support Site 17 About MyBudgetCoach • Online financial wellness tool • Client driven • Year-long cycleone module a month Photo Credit: taxcredits.net 18 MyBudgetCoach® The MyBudgetCoach® tool helps working families improve their ability to budget and make well-informed financial decisions. Understanding the importance of budgeting is generally recognized as the first step in successful financial planning. 19 Roles • Member - client or customer • Coach- facilitates monthly meetings • Relationship Managerruns administrative aspects of the program • The site 20 How the MyBudgetCoach program works Client is referred to MyBudgetCoach Program Relationship Manager will complete daily check lists verify other reports and will be the 1st line of support for coaches Coach will schedule the 1st session with client within 1 week Client will complete the intake process with staff person/Relationship Manger Staff person/ Relationship Manger matches client with coach within 72 hours via phone or e-mail 21 Member • Drives the process, makes decisions in each module • Works with a coach in-person or remotely • Must be willing and able to meet for all 12 sessions and work throughout the year to achieve financial and non-financial goals • Computer literacy including a comfort level using a variety of online tools 22 Members should be… • Ready to tackle the emotional topic of personal finances Photo Credit: Alan Cleaver • Ready to make a yearlong commitment • Comfortable with a computer • Earning an income 23 Skills members acquire • • • • • • • • Develop and maintain a household budget Reduce debt Increase savings Understand ways to improve credit score Increase overall net worth Reduction in delinquent bill payments Build a relationship with financial institution Increase in confidence in regards to personal finance 24 Coach A coach may be a staff member or volunteer. Once a coach/member pair has been established the coach is responsible for reaching out to the member and setting the meeting date, time and location. Ensure that all in-person meetings are set in an business office or public building (i.e. library, coffee shop). 25 A coach should be…. • Be comfortable with a computer • Be a good listener • Be willing to partner and explore issues with the member • NOT tell the member what to do • Either be staff members, or volunteers 26 Coach – contd. • Coaches are required to complete training class • Encourage member to set goals and outline strategies • Keep all data and information confidential pertaining to the member • As a coach you are a catalyst for good financial behavior, delivering the tools and information members need to achieve their financial goals 27 Relationship Manager (RM) • Will oversee recruitment of members and coaches • Training coaches • Matching coaches with members • Monitoring the progress of the member/coach pair as they progress through the program • From time to time, the RM will intervene in the coach/member relationship to ensure the pair progresses through the coaching session in due course and running on schedule • The RM may also be a coach 28 Relationship Manager (RM) continued • Contact potential members within one business day to schedule intake • Briefly explain the program requirements and expectations • Process daily, weekly, reports to keep you up to date and current on all clients and coaches progress 29 Relationship Manager (RM) • Handles most of the administrative functions • Recruits and pairs Members and Coaches • Tracks progress 9 The Site • Service delivery site agreement • If you become a relationship manager, you become a site • Open versus closed • Individual sites 31 Coach training • Completed in a classroom setting with a MBC certified instructor • MBC Coaching Training Manual is available • Hands on training, with point, click and entering instructions through several sessions 32 Overview of trainings • Relationship Manager training (30 minute online training) •Must be a site or associated with a site prior to coach training • Coach Training (4 hours) 33 34 General Strategy of Coaching Inspire Empower Guide Restore Engage 35 Coaching Guidelines Know your role Resist the urge to fix Retain your inner circle Know your boundaries Keep in mind the emotional ties with money 36 How the MyBudgetCoach program works Client is referred to MyBudgetCoach Program Relationship Manager will complete daily check lists verify other reports and will be the 1st line of support for coaches Coach will schedule the 1st session with client within 1 week Client will complete the intake process with staff person/Relationship Manger Staff person/ Relationship Manger matches client with coach within 72 hours via phone or e-mail 37 Build a good rapport • Make the first interaction pleasant and non threatening. This will help the coach understand the clients’ financial habits, attitudes, values, behaviors and emotional triggers. • Allow the client to pinpoint their own strengths and challenges and identify changes they want to make; goal-setting. • Checking assumptions and suspending judgments is crucial to being a successful coach, Making an assumption, or belief that something is true without evidence, leads to stereotypes. • Tie financial topics back to the client’s situation and goals while explaining what they mean for him or her. Avoid judging. Choices are not necessarily good or bad; they depend on the client’s situation. 38 MyBudgetCoach® Dashboard 39 Some Budget Coaching Soft Skills • Remember that you are coaching, not counseling • Be someone that listens and asks questions • Help the clients refine their own goals, objectives and strategies • Someone who also holds clients accountable for their intended goals, providing as sounding board 40 Launching a coaching session 41 Beginning a session Wow I am so excited! I Know, right! 42 Goal Tracker 43 Set financial & non-financial goals 44 Enter Expenses 45 Create a budget 46 Resource Area that includes items for homework assignments, daily budgeting forms, ideas & agreement form • • • • • • • • • • • • • • Wheel of Money Net Worth Calculator Guide to Financial Services Benefits, Obstacles & costs Worksheet Income Generation Guide Thinking Outside The Box worksheets Financial Organization Strategies Plug Your Spending Leaks Money Gobblers Needs vs. Wants Budgeting FUNdamentals Quiz Budget Coaching Agreement Form Pocket Expense Tracker Calculating Monthly Income 47 Example of a few forms 48 Message Center 49 Support Site www.support.mybudgetcoachohio.org support.mybudgetcoachohio.org 50 Always Remember…… remember… Your members drive the process. They make the decisions about what actions they want to take. Each member is responsible for his or her own success. As a budget coach, you will simply encourage members to set specific and achievable goals and to outline steps they can take to reach their goals. You will also celebrate with them the progress made along the way toward these goals. 51 A Always Member’s View: Remember…… When I initially started MyBudgetCoach, my goal was to eliminate disconnect notices. After approximately one year with the program, I not only have no disconnect notices, but I’m paying my bills on time every month, have a standard savings account, have become organized in my finances to the point where I saving for Christmas (I’m trying to have a mostly cash Christmas, a 90/10 or 95/05 ratio). Because of the structure the program gives me, I can afford to pay my monthly expenses with money and even when I “backslide” (which isn’t often) I can identify when the problems and come up with plans to fix them. MyBudgetCoach has been a tremendous help to me and I recommend to anyone who is looking for a turnaround in their finances. 52 So jump in and become a MyBudgetCoach Site! • MyBudgetCoachOhio.org • Click on relationship manager • Click on training • Enter the password _____________________ 53 If we made millions…. • Athlete who budgeted right 54 Questions? E-mail mybudgetcoach@ohiofoodbanks.org for additional questions 55