5.02 UNIT NOTES All costs for a specific period of time are called

advertisement

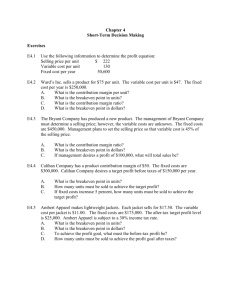

5.02 UNIT NOTES All costs for a specific period of time are called total costs. The amount spent for one unit of a specific product or service is called unit cost. Costs that change in direct proportion to a change in the number of units are called variable costs. The total variable cost varies with a change in the number of units. The unit variable cost remains the same regardless of the number of units. Costs that remain constant regardless of change in business activity are called fixed costs. Gross profit is determined by subtracting cost of merchandise sold from net sales. Income determined by subtracting all variable costs from net sales is called contribution margin. Contribution margin allows managers to determine the income available to cover fixed costs and provide a profit. (Contribution margin = Fixed costs + Planned net income) Unit contribution margin is the unit selling price minus the unit variable costs. Contribution margin ratio is the contribution margin stated as a percentage of sales. Divide the contribution margin by sales. Contribution Income Statement reports all costs as variable or fixed and shows the contribution margin. For a business to make a profit, the contribution margin must exceed fixed costs. The amount of sales at which net sales is equal to total costs is called the breakeven point. At the breakeven point, neither a net income nor a net loss occurs. At sales levels above breakeven, net income occurs. At sales levels below breakeven, net loss occurs. Breakeven allows managers to determine the amount of sales needed to start earning a profit. Breakeven can be stated in sales dollars or unit sales. The amounts required to calculate a breakeven point are obtained from an income statement prepared to report contribution margin. Management uses an alternative method to determine breakeven with new products to determine how many units must be sold to break even. The breakeven income statement is a projection of sales and costs under specific assumptions. If the breakeven point is accurate, net income is zero. The breakeven analysis can be used to calculate the dollar and unit sales needed to earn a specified amount of planned net income (target net income). Businesses that sell two or more products can also use breakeven point calculations to assist managers in planning. Relative distribution of sales among various products is called sales mix. The sales mix must be calculated to determine the breakeven point for a company that sells more than one product. Businesses must be able to determine the change in net income that would result from changes in the relationship of sales, variable costs, and fixed costs. o Managers ask the following questions: What would net income be if sales increase or decrease? Would it be profitable to change production methods? What would be the effect on net income of a decrease in unit sales price and an increase in sales volume? Effect of volume changes on net income: o As unit sales increase, net income increases. o As unit sales decrease, net income decreases. Effect of cost changes at average and above average volume: o Variable and fixed costs influence the decisions a company may make. o Total variable costs increase or decrease as sales increase or decrease. o Total fixed costs remain constant regardless of sales amount. Effect of changes in sales price: o If price is set too high, potential customers will buy from another business. o If price is set too low, the company may not earn enough money to cover costs and may suffer a loss. o The objective is to set sales prices that provide a reasonable amount of net income while keeping prices competitive. Contribution Margin ÷ New Contribution Margin per Unit = Unit Sales Required to Maintain Planned Net Income UNPACKED CONTENT I. Calculating Contribution Margin Per Unit A. Total contribution margin = Net sales minus variable costs B. Contribution margin per unit = Total contribution margin ÷ Units sold II. Calculating Breakeven Point and Breakeven Point for New Products A. Calculating breakeven point 1. Contribution margin ÷ Net sales = Contribution margin rate 2. Total fixed costs ÷ Contribution margin rate = Sales dollar breakeven point 3. Sales dollar breakeven point ÷ Unit sales price = Unit sales breakeven point B. Calculating breakeven point for new products 1. Unit sales price − Variable cost per unit = Contribution margin per unit 2. Total fixed costs ÷ Contribution margin per unit = Unit sales breakeven point 3. Unit sales breakeven point x Unit sales price = Sales dollar breakeven point III. Decisions That Affect Net Income A. Calculating sales to earn planned net income (Target Net Income) 1. Total fixed costs + Planned net income = Required contribution margin 2. Required contribution margin ÷ Contribution margin rate = Sales dollars B. Using breakeven to plan sales mix 1. Product sales ÷ Net sales = Sales mix (The total product mix must equal 100 %.) 2. Contribution margin ÷ Net sales = Contribution margin rate 3. Total fixed costs + Planned net income = Required contribution margin 4. Required contribution margin ÷ Contribution margin rate = Total sales dollars 5. Product sales mix x Total sales dollars = Product sales dollars 6. Product sales dollars ÷ Unit sales price = Product unit sales (indicates the number of units that must be sold to achieve the planned income) KEY TERMS Total costs Unit cost Variable cost Fixed cost Gross profit Unit contribution margin Contribution margin Contribution income statement Contribution margin ratio Sales mix Breakeven point