Business Plan Guide 2016

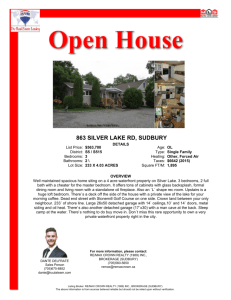

advertisement