Please call 757-385-4769 If you have any

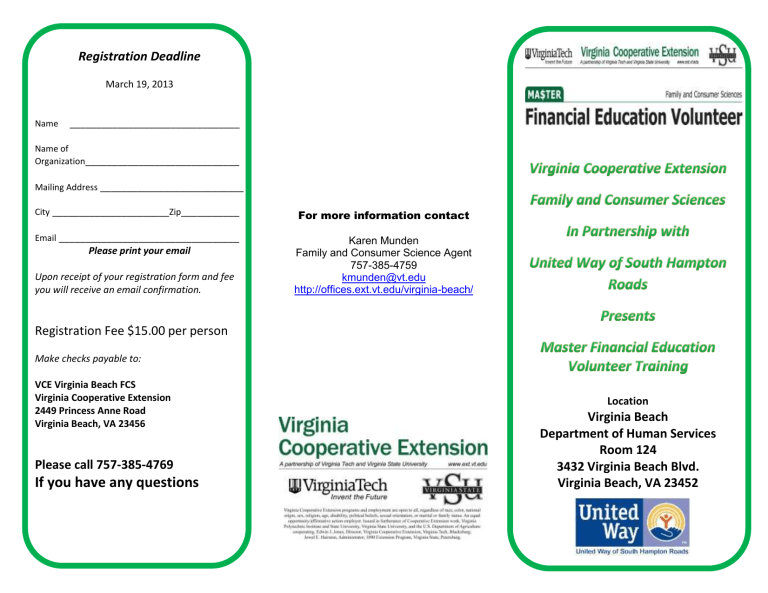

Registration Deadline

March 19, 2013

Name ________________________________

Name of

Organization _____________________________

Mailing Address ___________________________

City ______________________ Zip ___________

Email __________________________________

Please print your email

Upon receipt of your registration form and fee

you will receive an email confirmation.

Registration Fee $15.00 per person

Make checks payable to:

VCE Virginia Beach FCS

Virginia Cooperative Extension

2449 Princess Anne Road

Virginia Beach, VA 23456

Please call 757-385-4769

If you have any questions

For more information contact

Karen Munden

Family and Consumer Science Agent

757-385-4759 kmunden@vt.edu

http://offices.ext.vt.edu/virginia-beach/

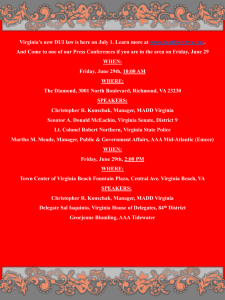

Location

Virginia Beach

Department of Human Services

Room 124

3432 Virginia Beach Blvd.

Virginia Beach, VA 23452

8:30 to 11:30 a.m.

Tuesday, March 26 th

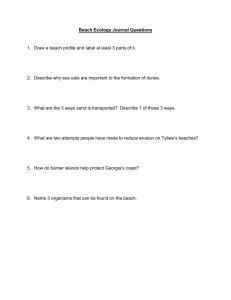

Setting Goals

Learn the advantages of setting financial goals

Learn how to write SMART goals

Communication Skills

Learn basic listener and speaker rules for conversations

Learn the importance of communicating about money

Learn the steps to a productive money talk structure

Tuesday, April 2 nd

Financial Recording Keeping

Learn the basic principles of recordkeeping

Identity Theft Protection

Learn strategies to prevent

Identity Theft

Your Financial Health

Learn the basic principles of a balance sheet

Learn basic principles of an income/expense statement

Learn how to calculate a debtto-income ratio, and how it can help determine your ‘financial health’

Tuesday, April 9 th

Developing Spending Plans

Learn the basic principles of a spending plan

Learn the different methods of tracking your spending

Cash Management Strategies

Learn the 4 tools of cash management

Learn information regarding savings and checking account

Learn basics of online banking

Credit and Debt Management

Learn how to pay off your credit

Learn how to communicate with creditors

Learn about relevant credit and debt laws

Tuesday, April 16 th

Credit Reports

Learn what makes up a credit report

Learn how to correct errors on credit reports

What to do when you can’t pay your bills

Learn how bankruptcy works

Learn what to do when your items have been repossessed

Predatory Lending

Learn how to spot and avoid predatory lenders

Learn the 6 different predatory loans and how to avoid them

Tuesday, April 23

Interview Techniques

Learn key concepts for one-onone financial education

Learn interview strategies

Learn the basics of the family financial life cycle

Program consists of 20 hours of classroom training. Individuals are asked to give as least 40 hours of financial education programs back to the community within one year.

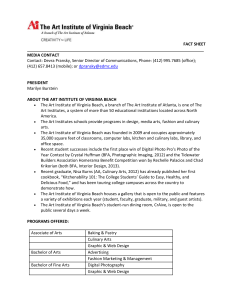

Individuals that complete the Master

Financial Education Volunteer training program will have the opportunity to help reach untapped audiences and provide consumers with up-to-date research-based knowledge to improve financial management techniques and their quality of life.