P-Card Intro. - Black River Technical College

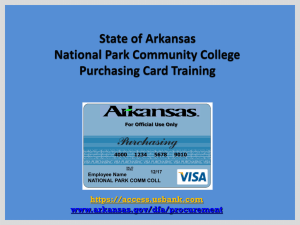

advertisement

For Official Use Only Purchasing 4000 1234 5678 9010 12/17 Norma Little DFA/Office of State Procurement https://access.usbank.com www.arkansas.gov/dfa/procurement 1 With Freedom Comes Responsibility All state agency employees MUST attend OSP-directed P-card training before receiving a p-card. 2 P-Cards What is a p-card? It is a Visa card provided by US Bank. These cards allow delegated employees to purchase goods, services for state entities, colleges and universities. The card is issued in the employee’s name and the employee is responsible for the security of the card(s) and the transactions on the card. The Purchasing Cards are for Official State Business Only. 4 Benefits of using a P-Card Time Savings • Receive goods faster • Less time than going through processes of purchasing department. • Fewer checks written Increased Vendor Selection • They are a VISA card, not store branded • Can shop online • NO Purchase Order required • Vendors get their money within 24-48 hours 5 Benefits of P-Card (cont.) Paper Savingsto BRTC • Only one invoice per month • Only one check per month • Online reporting capability Purchasing Control • Per month spending limit (per individual) • Per transaction spending limit • Block vendors based on MCC numbers • Access to cardholder account via the internet 6 How Do I Use the Card Arkansas State Procurement Laws apply to the to the use of the p-card. Rules and procedures specific to BRTC MUST also be followed. Every P-Card purchase MUST be documented on the standard purchase request form with all the approval signatures BRTC requires. Indicate in RED at the top of the form “PCARD” to alert purchasing. The P-card is just like a regular credit card. The use of the p-card is an agency liability, not a personal liability for the cardholder, your CREDIT rating will not be affected in any way. You understand the intent of the program and agree to follow the established guidelines as listed in the Purchasing Card Manual. 6 ● The P-Card blocks specific categories of merchants via MCC Numbers What is an MCC Number/Code? A Merchant Category Code (MCC) is a four-digit number used by the bankcard industry to classify suppliers into market segments. There are approximately 600 MCCs that denote various types of business (e.g., 5111 Office Supplies, 7299 Dog Grooming Services, 5722 Household Appliance Stores). The MCC is assigned by the Acquiring financial institution when a supplier first begins accepting Visa payment cards. The MCC is assigned based on the supplier’s primary line of business. For example, if a supplier primarily sells computers, it may be assigned MCC 5732 “Computer Hardware”. If a supplier primarily repairs computers, it may be assigned MCC 7379 “Computer Maintenance, Repair, and Services 7 “Non-allowed Charges for the P-Card” Employee Travel related charges Alcoholic Beverages Vehicle Rentals Printing - Amendment 54 ATM - Cash Advances Gift Cards Personal Purchases Items on State Contract without vendor approval Using automated monthly procedure to pay vendors SPLIT PURCHASES – (A “split purchase” occurs when the total cost of a single purchase is broken up into multiple transactions with the express purpose of circumventing state bid requirements, monthly bid limits, or any other agency restriction.) Any Purchase without Agency approval 8 Mandatory State Contract Items Ammo Restroom supplies and paper goods Paper stock & Copy Paper Dairy Letterhead & Envelopes Fuel (with Fuel Card) Tires Light Bulbs 9 Making a purchase Over the counter (point of sale) Fax Telephone Over the internet You must have a detailed receipt for each store purchase, clearly identifying each item purchased 11 Circumstances for A Card to be Declined Exceeding single transaction limit Exceeding monthly limit Blocked MCC You attempt to use the card for a blocked merchant category Credit card is Not activated 11 Cardholder Responsibilities Register your card on https://access.usbank.com. This gives the cardholder the access to view and verify all transactions weekly. You are responsible for the safekeeping of your p-card account number. Check your account transaction list weekly. If you suspect fraudulent charges, contact your liaison immediately. (Betty White) Obtain all original receipts and submit them with your purchase req form. Every transaction (purchase) must have a p/r form. As with every purchase, the p/r must indicate the specific department or funding grant and the applicable account (i.e. office supplies, instructional supplies). 12 13 14 Lost or stolen P-card. The cardholder needs to contact US Bank immediately at 1-800-344-5696 and then contact your agency liaison, Betty White. 15 MISUSE OF CREDIT CARD The p-card is a privilege granted to you by the State of Arkansas, and it is expected that you will use it responsibly. The State will seek restitution for any inappropriate charges made to the p-card. Fraudulent or intentional misuse of the card will result in revocation of the card and/or possible criminal charges, including termination. 16 Rebates, Refunds, Rewards, Gifts, Points, etc. Any manufacturer rebates received by the Cardholder as results of a P-Card transaction shall be credited to the P-Card account. Documentation reflecting the transaction shall be submitted to the reviewer/accounts payable according to your agency policy. Any rebates, coupons, rewards, gifts, points, frequent flyer miles, cash cards, etc. must accrue to the state entity and utilized only for official State business. No personal gain by making purchases with the State Purchasing Card is permitted. Misuse of this section could result in disciplinary action. 17 How Will My Credit Card Be Audited? P-Card accounts are audited by Legislative, system auditors, by DFA/Office of State Procurement Credit Card Section, and by BRTC Fiscal personnel for compliance of the following : Detailed receipts for charges and/or credits. Have the charges and credits been approved? Are items being purchased allowed by Procurement laws? Is the charge being split in order to avoid the transaction limit on p-card? 18 19 TYPES OF DISCIPLINARY ACTION Any violation of Arkansas P-Card Program policies is considered an “occurrence” which may result in disciplinary action. Types of disciplinary actions taken against a cardholder include, but are not limited to, the following: Written warning Suspend the usage of the P-Card for 90 days Revoke p-card Privileges Employment suspension/termination Criminal charges filed with state and/or local authorities 20 Activating Your Credit Card 1. Dial 1-800-344-5696 2. Listen and respond to each prompt a. Enter your 16-digit account number b. Enter your five digit Zip Code (Business Address) c. To activate you account, Press 1 d. Key in the last four digits of your Social Security number e. Enter your business telephone number, beginning with the area code f. Your account has been successfully activated. Note: If you have any problems activating your account you will be transferred to a Customer Service Representative for personal assistance. 21 22 Questions 23 NEXT… Accessing and Monitoring your transactions ONLINE 24 Monthly Transaction Cycle Begins on the 16th of each month and ends on the 15th of the next month unless the 15th falls on a weekend 25 US Bank Web address https://access.usbank.com 26 Card Registration Registering your card online with access.usbank.com – Gives you the cardholder the ability to view and track all your purchases. Register Online 27 Online Registration Organization Short name for The State of ARKANSAS is: STAR Then click on register this account Enter your Credit Card Number, Expiration and Zip Code The “back to” feature in Access Online is at the bottom left corner on every page that has a back to previous page feature 28 Always read the Message from U.S. Bank after logging in. From time to time US Bank is off line to maintain the system and update functions. 29 Viewing the transactions on your p-card account. Click on Transaction List Click on Transaction List 27 Trans date – when purchases were made Posting date – when purchases are posted to the account 31 Tips Let us know as soon as possible of any extended leave time (your card should be inactive) circumstance which may put your p-card at risk for compromise Please let us know of any comments or suggestions you may have. 36 Credit Card Contacts: Angie French – Purchasing X 4035 Betty White – LIASON X 4042 Darlene Hicks – State Credit Card Manager 501-371-1405 Norma Little – State Credit Card Coordinator/Instructor 501-683-2217