Engineering Economic Analysis - 8th Edition.

advertisement

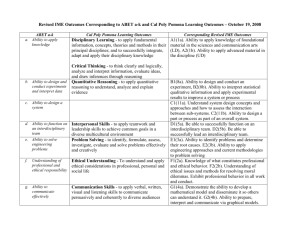

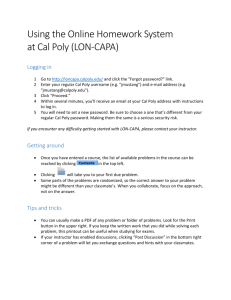

Chapter 12 - Replacement Click here for Streaming Audio To Accompany Presentation (optional) EGR 403 Capital Allocation Theory Dr. Phillip R. Rosenkrantz Industrial & Manufacturing Engineering Department Cal Poly Pomona EGR 403 - The Big Picture • Framework: Accounting & Breakeven Analysis • “Time-value of money” concepts - Ch. 3, 4 • Analysis methods – – – – Ch. 5 - Present Worth Ch. 6 - Annual Worth Ch. 7,7A,8 - Rate of Return (incremental analysis) Ch. 9 - Benefit Cost Ratio & other methods • Refining the analysis – Ch. 10, 11 - Depreciation & Taxes – Ch. 12 - Replacement Analysis EGR 403 - Cal Poly Pomona - SA15 2 Replacement Analysis • When should a new truck replace the existing truck? • When should a process be redesigned? • When should a product be redesigned? The most common question asked in industry is when should the existing be replaced? EGR 403 - Cal Poly Pomona - SA15 3 Replacement Analysis Terms • Defender - the existing equipment or building previously implemented. • Challenger - the proposed replacement currently under consideration. EGR 403 - Cal Poly Pomona - SA15 4 Aspects of Replacement Analysis • Using available data to determine the analysis technique. Determining the base comparison between alternatives. Using analysis techniques when: • • • • • • • Defender marginal cost can be computed and is increasing. Defender marginal cost can be computed and is not increasing. Defender marginal cost is not available. Considering possible future challengers. After-tax analysis. EGR 403 - Cal Poly Pomona - SA15 5 The Replacement Problem • Engineers replace the existing due to: – Obsolescence - technological change. – Depletion - loss of market value. – Deterioration - wear that is overly expensive to repair. Shall the defender be replaced now or be maintained for one or more periods. EGR 403 - Cal Poly Pomona - SA15 6 Issues (Consider Before Starting) • Is it morally or ethically right to do this project? • If a unit fails, must it be removed permanently from service? Or repaired? Are standby units available if the system should fail? • Do components or units fail independently of the failure of other components? • Is there a budget constraint? • In the event that the unit can be repaired after failure is their a constraint on the capacity of the repair facility? EGR 403 - Cal Poly Pomona - SA15 7 Issues (Continued) • Is there only one replacement allowed over the planning horizon? Are subsequent replacements allowed at any time during the study period? • Is their more than one replacement unit (price and quality combination) available at a given point in time? • Do future replacement units differ over time? Are technological improvements considered? • Is preventative maintenance included in the model? EGR 403 - Cal Poly Pomona - SA15 8 Issues (Continued) • Are periodic operating and maintenance costs constant or variable over time? • Is the planning horizon finite or infinite? • Are consequences other than economic impacts, i.e., sociotechnical issues considered? • Are income tax consequences considered? • Is “inflation” considered? • Does replacement occur simultaneously with retirement, or are there nonzero lead times? • Are cash flow estimates deterministic or stochastic? EGR 403 - Cal Poly Pomona - SA15 9 Replacement Analysis Decision Chart Where Compare Defender Marginal Cost Defender Marginal Cost Defender Best Challenger 1 Available Increasing Next-year Marginal Cost EUAC at Minimum Cost Life 2 Available Not increasing EUAC at Minimum Cost Life EUAC at Minimum Cost Life 3 Not available EUAC over Remaining Useful Life EUAC at Minimum Cost Life EGR 403 - Cal Poly Pomona - SA15 10 What Is the Basic Comparison? • Identify the defender and the best challenger. – – – – – Product. Machine. Process. Personnel. Mix. Decision Criteria leads to one of the following: If the defender is more economical, it should be retained. If the challenger is more economical, it should be installed. EGR 403 - Cal Poly Pomona - SA15 11 Minimum Cost Life of the Challenger • Calculate the EUAC for each value of the useful life (e.g., n = 1, n = 2, n = 3, etc.) • The number of years at which the EUAC is minimized is the minimum cost life (economic useful life) • Consider Example 12 - 1 – $7500 initial cost (P) – $900 arithmetic gradient maintenance cost (G) – $500 uniform cost (A) and 400 arithmetic gradient operating cost (G) EGR 403 - Cal Poly Pomona - SA15 12 EUAC calculations for increasing values of useful life Year EUAC of Capital Recovery Costs EUAC of Maintenance and Repair Costs EUAC of Operating Costs Initial year -7500 0 -500 Arithmetic gradient 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 EUAC Total Interest rate 8% -900 $8,100.00 $4,205.77 $2,910.25 $2,264.41 $1,878.42 $1,622.37 $1,440.54 $1,305.11 $1,200.60 $1,117.72 $1,050.57 $995.21 $948.91 $909.73 $876.22 -400 $0.00 $500.00 $432.69 $692.31 $853.87 $879.50 $1,263.56 $1,061.58 $1,661.82 $1,238.59 $2,048.71 $1,410.54 $2,424.30 $1,577.47 $2,788.67 $1,739.41 $3,141.93 $1,896.41 $3,484.18 $2,048.53 $3,815.55 $2,195.80 $4,136.17 $2,338.30 $4,446.19 $2,476.08 $4,745.75 $2,609.22 $5,035.01 $2,737.78 EGR 403 - Cal Poly Pomona - SA15 $8,600.00 $5,330.77 $4,643.62 $4,589.55 $4,778.84 $5,081.62 $5,442.31 $5,833.19 $6,238.94 $6,650.43 $7,061.93 $7,469.68 $7,871.18 $8,264.69 $8,649.02 <-----MIN 13 Graph of EUAC by n. Economic Useful Life is where Total EUAC is minimized EGR 403 - Cal Poly Pomona - SA15 14 Marginal Costs • Marginal Costs are the year by year costs for keeping an asset. Example 12-2 illustrates the calculation of the marginal costs for a new item. • Marginal Cost includes: – Loss in value of the asset by retaining it for one more year – Lost interest on the money tied up in the asset – Costs and expenses directly related to the project or asset (e.g., insurance, operating and maintenance) EGR 403 - Cal Poly Pomona - SA15 15 Marginal Cost for a New Item: Example 12-2 Expense Cost Investment Cost $25,000.00 Annual O&M $ 2,000.00 Cost Annual Insurance $ 5,000.00 Cost Useful Life 7 (years) MARR 15% Year 0 1 2 3 4 5 6 7 Loss in Market Value Market Value $ $ $ $ $ $ $ $ 25,000.00 18,000.00 13,000.00 9,000.00 6,000.00 4,000.00 3,000.00 2,500.00 $ $ $ $ $ $ $ 0 Incremental cost thereafter $ - 1 $ 500.00 3 $ 1,500.00 Years Foregone Interest O&M Cost 7,000.00 $3,750.00 $ 2,000.00 5,000.00 $2,700.00 $ 2,500.00 4,000.00 $1,950.00 $ 3,000.00 3,000.00 $1,350.00 $ 3,500.00 2,000.00 $ 900.00 $ 4,000.00 1,000.00 $ 600.00 $ 4,500.00 500.00 $ 450.00 $ 5,000.00 EGR 403 - Cal Poly Pomona - SA15 Insurance Cost $ 5,000.00 $ 5,000.00 $ 5,000.00 $ 6,500.00 $ 8,000.00 $ 9,500.00 $11,000.00 Total Marginal Cost $17,750.00 $15,200.00 $13,950.00 $14,350.00 $14,900.00 $15,600.00 $16,950.00 16 Marginal Cost Data Defender Year 0 1 2 3 4 5 6 7 Expense Cost Years Investment Cost Annual O&M Cost Annual Insurance Cost Useful Life (years) MARR $15,000.00 0 Incremental cost thereafter $ - $10,000.00 1 $ 1,500.00 $ 15,000.00 14,000.00 13,000.00 12,000.00 11,000.00 10,000.00 $ Is the marginal cost of defender increasing? - Here the marginal costs are increasing. 5 15% Loss in Market Value Market Value $ $ $ $ $ $ - Example 12-3 $ $ $ $ $ 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 Foregone Interest O&M Cost Insurance Cost $2,250.00 $2,100.00 $1,950.00 $1,800.00 $1,650.00 $10,000.00 $11,500.00 $13,000.00 $14,500.00 $16,000.00 $ $ $ $ $ EGR 403 - Cal Poly Pomona - SA15 - Total Marginal Cost $13,250.00 $14,600.00 $15,950.00 $17,300.00 $18,650.00 17 Replacement Analysis Technique #1 Defender Marginal costs are increasing • Replace when the marginal cost of ownership of the defender is more than the EUAC of the challenger. EGR 403 - Cal Poly Pomona - SA15 18 Analysis Technique # 1 Is Appropriate When Replacement Repeatability Assumptions Hold • The best challenger is available in all subsequent years and will be unchanged in economic cost. • The period of needed service is infinitely long. These assumptions appear to be rather restrictive. EGR 403 - Cal Poly Pomona - SA15 19 Relaxing the Restrictions • This spreadsheet considers that: – The best challenger is available in subsequent years at the same economic cost. – The project life is known and limited. EGR 403 - Cal Poly Pomona - SA15 20 Replacement Analysis Technique #2 • If the replacement repeatability assumption holds, compare EUAC of the defender asset at its minimum cost life against the EUAC of the challenger at its minimum cost life. EGR 403 - Cal Poly Pomona - SA15 21 Replacement Analysis Technique #3 • Compare the EUAC of the defender over its stated life against the minimum EUAC of the challenger. •Here defining defender and challenger first costs can be an issue. –Trade-in value is not a suitable value. –Appropriate value is the market value. EGR 403 - Cal Poly Pomona - SA15 22 After Tax Replacement Analysis • Adds expanded perspective as changes occur in: – Remaining economic life of defender. – Economic life of challenger. – Defender vs. Challenger comparisons. • Affected by: – Depreciation MACRS. – Assets market value over time. EGR 403 - Cal Poly Pomona - SA15 23