Chapter 4 – RPP All Parts

advertisement

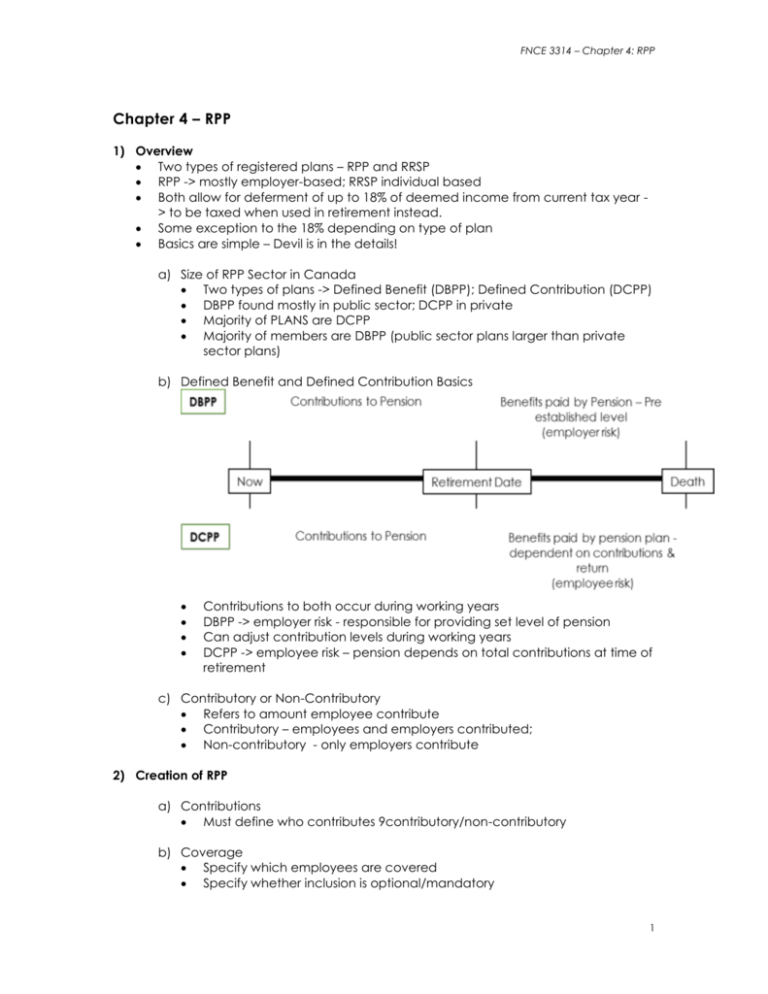

FNCE 3314 – Chapter 4: RPP Chapter 4 – RPP 1) Overview Two types of registered plans – RPP and RRSP RPP -> mostly employer-based; RRSP individual based Both allow for deferment of up to 18% of deemed income from current tax year > to be taxed when used in retirement instead. Some exception to the 18% depending on type of plan Basics are simple – Devil is in the details! a) Size of RPP Sector in Canada Two types of plans -> Defined Benefit (DBPP); Defined Contribution (DCPP) DBPP found mostly in public sector; DCPP in private Majority of PLANS are DCPP Majority of members are DBPP (public sector plans larger than private sector plans) b) Defined Benefit and Defined Contribution Basics Contributions to both occur during working years DBPP -> employer risk - responsible for providing set level of pension Can adjust contribution levels during working years DCPP -> employee risk – pension depends on total contributions at time of retirement c) Contributory or Non-Contributory Refers to amount employee contribute Contributory – employees and employers contributed; Non-contributory - only employers contribute 2) Creation of RPP a) Contributions Must define who contributes 9contributory/non-contributory b) Coverage Specify which employees are covered Specify whether inclusion is optional/mandatory 1 FNCE 3314 – Chapter 4: RPP BENEFITS ONLY CAN BE PAID TO PLAN MEMBER, THEIR BENEFICIARIES/ESTATE c) Funding the Plan Laws regarding how plan funded FUNDING OF PLAN 1. Insurance contract w/life insurance firm autho4rized ot conduct business in Canada 2. Trust company with agree where trustees are either a. Trust company b. Individuals of whom 3 live in Canada and one is “independent” (not significant shareholder, partner, proprietor or employee of participating employer) 3. Pension Corporation 4. Arrangement between fed. or prov. gov. or their agent 5. Combination of 1-4 Foreign employees’ plans with foreign fund admin allow Plan must be for foreign employees OUTSIDE Canada working for Canadian employer Benefits in plan must not be MORE beneficial than those in Canadian Plan d) Taxation Contributions are tax deductible for employers and employees Deducted from net income 100% taxable when received in retirement For DBPP a “pension adjust” is necessary to calculate an equivalent tax deduction while working 3) DCPP and DBPP Similarities a) Taxation Employers must contribute to both DCPP – min. 1% of value of employee wage by employer Contributions are tax deductible to both Easy to calculate how much contributed in DCPP ->$ value of contribution Taxable future benefits -> directly derived from Harder with DBPP -> value of contribution is not as directly related to value of future benefit Value of contribution not returned to me -> I earn a benefit Benefit might last for 1 year, 30 year -> depends how long I live b) Eligible Earnings and Prescribed Compensation Years and earnings for which pensionable service can be “earned” Years when working outside the company Unpaid leave up to two years Sabbatical, education, maternity, paternity, adoption, disability, military service leaves can be still eligible to accrue benefits <3 of service with company affiliated with employer Work with federal/prov gov., committee commission Loan to educational institute, union, charitable organization c) Additional Contributions 2 FNCE 3314 – Chapter 4: RPP Additional Voluntary Contribution allow for DCPP Allows for increased savings, increased tax deferral and hopefully more savings earning $s tax free AVC NOT allowed with DBPP -> however similar concept with “buy back” Members can “buy back” years of eligibility/service d) Investments Rules regarding the types of investments allow in RPPs Only certain types of investments are permitted. To ensure security e) Vesting “vested” when employers contributions belong to employee Must be member of plan for two years f) Portability Ability to take pension funds with them Funds can be used to port benefits to another plan Example Aaron has been a member of TIAN’s DCPP pension plan for 18 months. He has contributed $7,500 which are matched by his employer. He decides to start a brewery in Hawaii and quite his job. He would be entitled to his $7,500 Skye has been a member of SORECO’s DBPP pension plan for 5 years. The value of her contributions are deemed to be worth $15,000. The value of her employer’s contributions are deeme3d to be worth the same. She quits her job to go work with her boyfriend’s brother Aaron. She would be entitled to take the full $30,000 of pension credits with her. once vested the pension funds are portable rules over portability can take lump sum value (taxable) move into a locked in account (LIRA or LRSP) transfer to new RPP g) Surplus Funds Not common because DCPP can’t have a “surplus” Included here because it is included roughly here in your textbook Will discuss separately w/ further DBPP discussion. 4) DCPP Contributions and Benefits Min. 1% of employee’s salary must be contributed Upper limit is 18% or money limit Can be thought of like a tax protect savings/investment account No maximum benefit ->benefits paid out of accumulated funds in employee’s “account”/plan 3 FNCE 3314 – Chapter 4: RPP Benefits are paid out as an “life annuity” Can have “guaranteed number of years” Maximum lesser of 15 years; day of retirement to the day before the member’s 86th birthday Guaranteed portion paid after death to estate or beneficiary 5) DBPP Contributions and Benefits a) Contributions Contributions are made to plan while working Contribution finance plan but not the individual member By paying to the plan member is typically earning years of service Pension is based on years of service and typically a percentage of “best earning years” -> not based on contributions to the plan b) Eligible Service Agreements between pension plans can allow for service in one to be counted for service in another when a member changes jobs and plans EXAMPLE I work in BC and have earned years of service under the College Pension Plan. When I move to Alberta to teach, I leave the College Pension Plan and become part of the LAPP. My years of service in BC can be ported to count towards years of service under the LAPP. i) Factor Most DBPP have a “factor” to be eligible for full pension Typically age + years of service EXAMPLE To retire with full pension, LAPP members must have a factor of 85. 4 FNCE 3314 – Chapter 4: RPP Stan is 55 and has worked at NAIT for 20 years. His factor is 55 + 20 = 75. He is not eligible for a full pension. He may be eligible to take a partial pension. c) Surplus / Deficit Pensions are constantly being If pension is in deficit (i.e. can’t pay estimated pensions liabilities from current funding) then employer is responsible for making up deficit Can increase the contributions required by members Surplus results when current funding is greater than future estimated liabilities Excess surplus is when a “minimum surplus” level is surpassed Indication that members won’t receive the full value of contributions in retirement Less of: i) Going Concern Surplus ii) 20% of accrued liabilities iii) Greater of: 1) 10% accrues liabilities; normal contributions required for next 24 months Excess can be: i) refunded to employer/employees as taxable incomes ii) used to pay contributions (“contribution holiday”) iii) improve benefits d) Benefits Benefits based on formula including service and income -> not based on contribution amounts Typically earn a % of income for ever year of service EXAMPLE Teachers in OMERS earn 2% of their highest 5 year average annual salary for ever year of service up to a maximum of 35 Greg has worked for 40 years as a teacher in Thunder Bay. His highest average 5 years was $100,000 per year. His pension income would be 2% x $100,000 x 35 = $70,000 Benefits form a life annuity -> constant payments typically adjusted for inflation Rules regarding the maximum amount payable e) Combination with CPP (CPP Offset) Benefits from RPP are often reduce when member begins earning CPP RPP can specify age at which CPP offset begins 5 FNCE 3314 – Chapter 4: RPP f) Maximum Benefits Rules Benefit no more than 2% of pensionable earnings Benefit per year no more than the GREATER of: i) Overriding provision ($1722.22) ii) 1/9 money purchase limit ($22,000 for 2009 in book; $24,930 for 2014) iii) Usually limited to 35 years of service (used to be regulation but this regulation was lifted in 1992, some pension plans still have this rule) g) Exceptions to Maximum Benefit Rules Benefit doesn’t have to be paid as an annuity in certain circumstances Annuity <4% of Maximum Pension Earnings (lump sum commutation permitted) Short time to live according to doctor statement (lump sum commutation) Lump sum derived for AVC (only applicable in case of DCPP, or when plan is DCPP/DBPP hybrid Payments are integrated with CPP Paid as variable or escalating annuity for life (i.e. pension is indexed) Joint-and-last survivor pays less than amount to member (i.e. 60% of member’s pension) Commuted value transferred to locked-in plan to be paid as an annuity h) Additional Benefits i) Commutation Lump sum payment of benefits (essentially the PV of annuity) Annuity <4% of max. pension earnings Short time to live by doctor’s statement Lump sum for AVC On/after death (in guaranteed years case) Termination of employment Termination of plan before member retires Benefits transferred to spouse as a results of written agreement, decree, order judgment following marriage breakdown NOT COMMUTED: 1) Employee retires 2) change job but still part of same pension plan ii) Death Paid as lump sum if member dies before retirement Greater of: 1) accrued entitlement 2) total contributions plus income earned DEPENDEANTS PENSION BENEFITS paid to spouse, common law partner, parent, sister, brother, child financially dependent Must be “reasonable” amount (i.e. 60% is legislated, 66 2/3% in Manitoba) Paid as 1)lump sum 2) immediate annuity for life 3) deferred annuity for life (before beneficiary turns 65) iii) Life Insurance Some RPP has life insurance provision paid if member dies before retirement 6 FNCE 3314 – Chapter 4: RPP iv) Termination If employee or plan terminated before retirement Paid as lump sum Installments or annuity certain no later than earliest date pension could be payable under plan Life annuity maturing before member turns 71 Combination Can also be transferred to other RPP; RRSP Value subject to max. pension rules 6) Eligibility Eligibility based on “normal retirement age” Usually 65 -> some plans define it different (i.e. often firemen are 60) Regulation NRA -> 60 to 71 If retiring before 65, must have actually retired to collect benefits Can collect benefits after age 65 if “deemed” retired and still working a) Partial Pension Can receive pension before 65 if they have reached NRA and: i) Compensates for reduced earnings ii) Further delay would result in pension exceeding Maximum Limit b) No More Accrual of Benefits If member receiving full/partial pension AND i) Remains employed OR ii) Return to employment after break c) Working Past 71 Can receive pension benefits and continue to work after age 71 Cannot accrue further benefits if working and not collecting pension Time will still count towards eligibility Can “partially” retire after NRA and still earn income d) NRA < 60 At least: i) 60 years service ii) service + age <= 80 Can require retirement d/t i) Automation ii) Inability to keep knowledge up to date with tech advances e) Early Retirement can be written into the pension plan (i.e. can retire at age 50) in DBPP can happen before NRA if PV of pension payments < max. value of pension paid as i) single life annuity ii) 60% joint-and-survivor annuity beginning at 1) 60 or 2) NRA or 3)age of disability f) Early Retirement for Disability Allow for full pension d/t retirement from disability 7 FNCE 3314 – Chapter 4: RPP Smaller pension can be paid if person can return to work in job paying less than previous Salary + dis. Pension must be LESS than dis pension 8