Presentation

advertisement

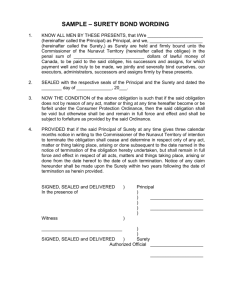

Name of Event Organization Date Surety Bonds &Construction Risk I – Construction Risk “Then You Shall be his Surety” William Shakespeare Merchant of Venice Construction Risk 2015 Construction Risk = Risk of Contractor Failure. The number and severity of contractor failures increased in recent years. Recent Challenges: Reduction of available work; oversaturated market = tighter margins Onerous contract conditions. Downloading of risk Paradigm Shift: AFP’s, P3’s Construction Risk 2015 From 2010-14, the Surety industry paid out almost $800 million in claims; more than all of the previous decade. 2013 a year to forget: Loss ratio; 52% - industry unprofitable Premiums flat after two years of decline Across all lines and all sectors of the country 2014 showed improvement with lower loss ratios and premium growth … but…. 2015 ? Impact of Oil Prices in western Canada and political and economic instability Construction in Canada 2015 Canada the new construction “mecca”. Ongoing commitment to infrastructure Federal commitment $48B over 10 years. By 2020 Canada to be world’s 5th largest construction market (9th in 2010) Increased foreign investment from depressed areas (e.g. Europe) Larger and longer projects Challenges to small and mid-sized contractors Protect Against Construction Risk Surety Bonds Performance Bonds Labour & Material Payment Bonds Liquid Security Irrevocable Letters of Credit Cash/Negotiable instruments on Deposit Default Insurance Products Why Contractors Fail Unqualified Contractors; the lowest “irresponsible” bidder Insolvency of Contractor Contractor default for non-financial reasons: Over Extension Inability to complete Incapacity of Key people Unpaid subs and suppliers resulting in liens Warranty problems II – Surety Bonds What are They? How do they Work? Surety is not Insurance Surety is not Insurance INSURANCE 2 party agreement; Insured & Insurer Premiums actuarially determined Losses anticipated No recourse against insured in the event of loss SURETY 3 party agreement; Principal, Surety & Obligee Premiums only a service charge No losses anticipated Recourse against the Principal via indemnity agreement Surety Bonds: 2 Essential Services Prequalification: Assurance that the bonded contractor is qualified for the job for which they are contracted. Security: Financial Protection in the event that the bonded contractor should default on its obligation. Prequalification Ongoing, Thorough & Value Added Intensive: Ongoing Comprehensive: Value Added Standard Construction Bonds Prequalification Prequalification Letter Bid Bond Consent of Surety Security Performance Bond Labour & Material Payment Bond Renewable Multi-Year Bonds (service contracts) Prequalification Letter Not a bond but a letter from bonding company to the project owner confirming “bondability”. Used during the pre-tender phase; i.e before contract terms, scope or pricing details are known. Non-binding – surety and principal reserve the right to review the details before firm commitment. Typically refer to the project at hand. SAC standard form available on SAC website. Bid Bonds protection from the “lowest irresponsible bidder” provide assurance that contractor will: enter into contract provide the required security Typically required in the amount of 10% of tender if contractor defaults, surety pays the difference between successful bid and second bidder Tender must be accepted within time frame set out in tender documents seven months to file suit Consent of Surety Not a bond at all; a letter of commitment from the Surety to the Obligee to execute performance and/or payment bonds No penal sum set out; payment not an option Typically, bonds must be required within 30 days following award No standard (CCDC) form in existence, many variations in wording Performance Bonds Guarantees Contractor will perform contract in accordance with its terms & conditions. Contractor must be in default and the default must be declared Owner must perform their obligations 4 options available to Surety: Remedy the default Complete the Contract Arrange for new contractor to complete Tender Payment Two years to file suit Labour &Material Payment Bonds Guarantee that the contractor will pay all direct subcontractors, suppliers for materials and services provided to bonded project. Obligee is trustee on behalf of the claimants Claimant must have a direct contract with the Principal Claimants may only claim for goods and services supplied to the bonded job Claim must be filed within 120 days of the last day worked or the date material shipped One year to file suit III – Surety Bonds How are they Obtained? Who Obtains the Bond? Lender Includes bonding requirement in loan agreement with borrower (project owner). Project owner then includes bonding requirement in tender documents or contract specifications The contractor obtains the bonding Selects a professional surety bond broker or agent who assists in submitting case to a surety underwriting company How is a Bond Obtained? Contractor Submits Financial Statements and other background information to Surety Participates in prequalification process: an in-depth look at contractor’s business operations and financial structure. Surety’s Financial Analysis Balance Sheet Working Capital / Net Worth Ratio Analyses Receivable/Payables aging analysis Work on hand; profitability, maturity, trending Income Statement Profitability Revenue Trend Analysis; 3 to 5 years Cash Flow Analysis Accountant’s Opinion/Explanatory Notes What Else does a Surety Need? Complete details on Affiliated / Related Companies; ownership, financial information, etc. Detailed Work on Hand Schedules Aged Listing of Receivables and Payables Organization Chart of Key Employees Detailed Resumes of Principal & Employees Business Plan & Contingency Plans Subcontractor & Supplier References What Else does a Surety Need? Details of construction operations; areas of expertise, list of key projects, key people, etc. Letters of Recommendations from Owners Evidence and details of a Line of Credit from a Financial Institution Details of business continuity plans in the event of death or incapacity of owners/key people Reports on Similar Completed Projects Owner, contract price, date completed, profit earned IV– Surety Bonds Myths & Misconceptions Myths & Misconceptions Myth #1: Sureties Don’t Respond to Claims. A surety bond will provide: Professional prequalification to weed out unqualified contractors. True performance security; i.e. provides owners with a completed project in the event of default. Payment protection to subs and suppliers. A surety bond will not provide: Cash-on-demand. There MUST be a default. Dispute resolution. A “magic lamp”. Protection beyond the scope of the contract. Myths & Misconceptions Myth #1: Sureties Don’t Pay Claims. Also…. Owner must have fulfilled its contract obligations L & M Claimants must comply with the terms of the bond and be prepared to document claim Problems or questions? Contact the Surety Association of Canada Phone: 905-677-1353 Fax: 905-677-3345 email: sness@surety-canada.com Myths & Misconceptions Myth #2: A 50% Bond only provide 50% Protection 50 percent bond gives you 100 percent protection up to the bond amount Example: Contract Price = $ 1 million 50 % Performance bond ($500,000) Contract is 50% complete Surety arranges completion for $ 700,000 Surety’s loss is ??? Myths & Misconceptions Myth #3: Bonds are a “Barrier” (especially to small contractors). Barrier? Bonding companies need to write bonds. Sometimes a time problem – for contractors without a bond company it takes time to establish a facility. Some sureties will ONLY bond small contractors, others have small contractor divisions Small firms will secure bonding for jobs within their realm of expertise Bonds are a barrier to unqualified contractors Myths & Misconceptions Myth #4: Payment Bonds Don’t Help Owners Ensure that subs working on your jobs will be paid. Many are local rate payers. Ease the Administrative burden in the event of default. Reduces the Owner’s Legal Exposure. More competitive prices from subs who are now certain of being paid Speedier resolution of a default; continuity of team. Myths & Misconceptions Myth #5: We don’t need a bond; our contractor is huge. Excerpt from “Why Contractors Fail” by Hugh Rice and Arthur Heimbach, FMI Corporation 2007 “Recent history has shown that construction firms are not too big to fail even though they may have annual revenues ranging from hundreds of millions to several billions of dollars.” “There are bonding safeguards to protect project owners and others when a contractor fails.” V – Surety Bonds What Happens when a Contractor Defaults? Before a Default is Declared Surety has extensive experience with contracts and solving construction problems. Surety has intimate knowledge of contractor and its operation Can provide informal assistance to solve problems that can lead to a default Will convene meeting or teleconference among the parties to address problems. Assist in formalizing solutions. Claims When A Contractor Defaults: Surety will promptly acknowledge notice of default and being to gather information. Surety will begin an investigation as soon as possible. Surety will conclude the investigation as soon as possible. If requested by owner, surety will provide periodic written updates on investigation status and best estimates as to completion date. Claims During and After the Investigation: Surety will cooperate with the owner to protect work from damage or deterioration. Surety will work with the owner to: Identify and implement a solution. Minimize delays, keep the job going and protect the rights of all parties. Pay valid labour and material payment bond claims as promptly as possible to ensure continuity of subs and suppliers. How can the Project Owner Help Comply with bond & contract terms! (e.g. proper notifications, payments and certifications) Communicate: keep surety appraised of problems and provide default notice promptly. Cooperate: Ensure surety has access to knowledgeable staff and relevant documents. Keep expectations realistic. Claim Example 1 Highway Development Project Provincial Government Declares Default on Highway Project Case Background: The Principal, a road building company, was working on a provincial transportation project when it experienced financial distress and could not complete the project, valued at $5.8MM. The Obligee, a Provincial Government transportation department held surety security for 50% of the project amount to mitigate both contract performance risk and labour & materials payment risk. Claims Example 1 Highway Development Project Surety’s Action: The Surety Company advised the Obligee it would start preparing the tender package to complete the work. The Obligee expressed interest to choose its own completion contractor. The Surety Company and the Obligee settled for financial payment; where the Surety paid the Obligee the anticipated completion costs. Claims Example 1 Highway Development Project At the same time, the Surety Company paid out multiple subcontractor and supplier claims under the labour and material payments bond. Total amount paid out by the surety on this project were $3.3MM. Claims Example 1 Highway Development Project “[this] is certainly a good example of the value of having a performance bond [and labour & materials payment bond] and we were pleased that the bonding company offered flexibility in coming to a solution that met our needs. The negotiated settlement provided advantages to us, as the Owner, in that it gave us control of the work, which enabled the completion to be expedited in an efficient manner…” Owner Testimonial Claim Example 2 Underground Contractor Defaults on 13 Municipal Projects Claim Example 2 Case Background: The Principal, a sewer, watermain, curb/gutter, and roadwork contractor with approximately $10 million annual sales was forced into receivership when bank called its loan. A regional municipality was left with 12 unfinished contracts. Another municipal owner was impacted with 1 uncompleted contract as well. Total value of the contracts underway were $7.4 million. Project contracts were anywhere from $500 thousand to $3 million range. The surety: Claim Example 2 worked with the owners to ascertain the status of each contract and identified the remaining work to be completed. obtained quotes for completion of outstanding work, presented these to Obligees and arranged for completion contracts to be executed. reviewed claims from unpaid 48 trades and suppliers. All claims settled within 72 hours. total surety payout in excess of $6.7 million. All 13 Contracts completed with no loss to Obligee. VI – Surety Bonds Unseen Services to Owners & Lenders Unseen Services of Surety Bonds A surety can provide assistance and default prevention services to owners & lenders by: Facilitating the resolution of construction performance issues that could lead to default Providing management and business assistance to assist contractors with administrative issues. Providing financial assistance to financially distressed contractors Providing technical/engineering expertise if required Unseen Services of Surety Bonds Confederation Bridge New Brunswick to PEI Confederation Bridge Fixed Link from PEI to mainland 12.9 km 3 ½ year project; cost of $800 million. Opened June 1997. Performance & Payment Bonds provided by a three member co-surety pool. Owner: Public Works Canada Contractor: Strait Crossing Development Inc; a private consortium of four companies. Senior Partner: Morrison Knudsen Inc. of Boise Idaho – 35% share. Confederation Bridge Morrison Knudsen; Established 1932, $2.86 billion in sales 1996 – MK files for Chapter 11 bankruptcy protection; threatens survival or project. Sureties act quickly; arrange to finance MK through to completion to allow for the company to be sold. Default prevented and project completed on time. NOT ONE DAY OF WORK WAS MISSED. The local community, the general public unaware of any problems VII - Other Forms of Contract Security Liquid Security (LOC’s) Yield cash; not performance Provide no prequalification assurance Available in smaller; perhaps insufficient amounts (5% to 10%) Deplete a contractor’s borrowing power and can bring on the very problem they seek to avoid No dedicated protection for subs or suppliers Work well for financial risks Contractor Default Insurance (CDI) Introduced in 1996 to protect very large general contractors from subcontractor default. Indemnity product – compensates for loss incurred Significant deductibles and co-payment Insured should have in house construction administration experience and strong cash flow. Does a good job at providing the protection for which it was designed; i.e. protecting large G.C.’s against construction default. NOT designed to protect owners from risks associated with default of prime contractor. The “CDI for Owners” Non-Solution Large general contractors approaching owners and lenders with a “cost savings” proposal. Sign on to G.C.’s CDI policy “better protection, more cost effective better management of subcontractors”, etc. Save the bond premium. The “CDI for Owners” Non-Solution What they don’t tell you…. CDI is NOT an alternative to Surety Bonds OWNERS NOT PROTECTED FROM G.C. DEFAULT Owners have limited or no access to CDI benefits Endorsement only responds when G.C. is insolvent. Contracts with unpaid trades are unenforceable If Prime Contractor should default: No Protection “Cost Savings” are minimal or non-existent. CDI protects Contractors; NOT Owners Waiving Final Bonds Owners Save the bond premium by calling for bid security and waiving requirements for final bonds. Penny-wise; Pound Insane. Contractor failure can bring catastrophic consequences if not adequately managed. Contractor failures on the rise as the economy continues to struggle. NO contractor; large or small is immune to financial and economic forces Morrison Knudsen: from Fortune 500 to Chapter 11 in two years. VIII – e-Bonding Did someone mention “paperless” ??!!! Electronic Delivery of Bonds Issues and Challenges Commercial Legal Technological SAC’s Efforts to Address the Issues & Challenges Commercial Issues & Challenges SAC encourages and promotes electronic delivery of surety bonds. Don’t Act on your own. Will only work with industry buy-in. Flexibility; evaluate; establish criteria and standards, leave it to others to find a way to meet them.. Electronic equivalent of a courier. Legal Issues & Challenges PIPEDA passed by parliament in 2000. Umbrella legislation Each jurisdiction followed with its own legislation over the next two years Challenge: What about seals? Deed vs Contract - “Deemed” sealed, overt act of sealing will constitute seal equivalent. Verbiage not sufficient. Friedmann Equity vs Final Note – Supreme Court of Canada Technological Issues & Challenges Technology is in place; systems have been developed and marketed in Canada and U.S. All systems are NOT created equal; different focus; different capabilities Criteria: Integrity of content; Secure access Verifiable / enforceable SAC & e-Bonding Publications on SAC website: Designing Electronic Pathways Together. Vendors Guideline. Criteria checklist. Position Paper: Surety Bonds in a Digital World. Working with owners and vendors: Mock Tender – Defense Construction Development of template language for inclusion in tender documents. Six e-Tendering Tips for Owners 1) Consult Consult Consult: Without Buy-in from other stakeholders, the advantages can be squandered. 2) Don’t Reinvent the Wheel: Learn from what’s been done. Are you in the software development business? 3) Insist on Verifiability… whatever the approach, know that the bond is valid and enforceable. Six e-Tendering Tips for Owners 4) … But be Flexible About Everything Else: Allow vendors to find ways to meet the criteria and standards you set. 5) It’s Up to You: Initiative has to come from owners and end-users. SAC can provide guidance but only you can start the journey 6) Take the Time to Get it Right: Pilot projects; Phase-in implementation. Allow for time to work out the kinks and for the industry time to adjust. Mock Tenders. IX – Surety Bonds &The New Paradigm Discount Surety Company Good News – I hear the paradigm is shifting The New Paradigm There are still too many contractors in the business and there will be a shakeout, but if you are good, there will be work for you. The market has favoured larger builders over smaller ones. The smaller guys are getting squeezed because the projects themselves have grown. Five years ago, who would have heard of a billion dollar project, but now there are two in the Toronto area alone and business models are changing too. Now you have to design, build, finance and, if you are smaller it’s become tougher. Geoff Smith – President & CEO; EllisDon Bigger, Longer & Tougher New Models of Project Delivery and Procurement P3’s, AFP’s Bundling Building Information Modeling (BIM) The need and the will to address Infrastructure deficit Already here, small to mid-sized contractors feeling the squeeze Just Starting …and Faster - Technology Last 20 years, internet, social media…etc… revolutionize business and life. Gen Y …Gen Z … the “WrRU” generation Demand for instantaneous information and immediate satisfaction. Pressure for quicker, more expedient resolution to construction and other business problems. Evolving Political Environment Globalization of the construction industry with the collapsing of trade barriers Canada Europe Free Trade Agreement, Plurinational Trade Service Agreement Participation of large multinationals will increase completion further. liquid balance sheets and demand for liquid security The New Paradigm The business model is changing, but there is no way to really predict how it is changing. Ask our clients what they want from us, and they aren’t exactly sure yet. I spend a lot of time at night thinking, ‘Okay, how will it all work out?’ Geoff Smith – President & CEO; EllisDon X – So What are we doing about it?? SAC Performance Bond SAC consultations with Owners & Contractors; More “certainty” in the claims process. More responsiveness to a claim More frequent and effective communication between sureties and owners. New “enhanced” performance bond provides construction buyers with more timely &responsive claim service. Has been used by owners across the country and will be adopted by CCDC as the new standard. Provides more responsive services to owners by….. SAC Performance Bond Pre-Demand Conference to allow surety and owner to prevent problems from turning into a default. Timelines for Surety’s Response: 5 days to acknowledge a response & request info. 21 days (from receipt of information) for surety to respond to owner with their response. Emergency Remedial Work: Allows Owner to address urgent issues (e.g. safety) under the bond. Post-Demand Conference: Mechanism to minimize or eliminate work stoppages while surety investigates. Contact Coordinates: Contact information for all parties to facilitate notices and communication. Surety Bonds & P3 Projects Comprehensive performance & financial security against construction default on mega-P3 projects. Sufficient capacity for mega-projects. Broad and flexible protection packages which include: Professional surety prequalfication Specialty P3 bonds designed by member sureties: Provide liquid / cash on demand protection. Built-in “fast-track” dispute resolution Early Response; surety involved pre-default. Protection for trades & suppliers via the payment bond. Called for on Infrastructure Ontario Build-Finance and Design-Build-Finance projects. Renewable Multi-Year Bonds Only applicable to service contracts; e.g. Waste Management, Snow Removal, etc. Initial Term is open. Renewal Terms are typically 1 year periods can be extended to two. Surety issues an annual Renewal Certificate. Failure to renew the Bond is not a ‘default’ under the Contract or the Bond 2-year suit limitation – runs from earlier of expiry of latest bonded ‘Term’ or date default declared Can be modified to address O&M components of P3’s Headstart Performance BondTM Created by The Guarantee Co of N.A. to protect GCs from sub default (competitive alternative to SDI) Industry Solution: available for use by other sureties. Flexibility: Obligee given two mitigation options: o Traditional Option: Surety investigates and implements solution (as in standard bond); or, o Headtstart Option: Obligee implements its own solution upon surety’s acceptance of Obligee’s completion proposal. Responsiveness: o First dollar protection(no deductible or co-payment). o Surety will respond in 3 days from receipt of Claims letter. o Standard claims notice and mitigation agreement. SURETY ONLINE LEARNING CENTRE The Surety Online Learning Centre accessible from SAC website; www.suretycanada.com. Five learning modules that introduce the basics of surety bonds and the suretyship process Learn at your own pace. Ideal for review or for colleagues who can’t attend a “live” information session. It’s FREE Contact Us Phone: 905-677-1353 Fax: 905-677-3345 email: surety@suretycanada.com or visit our website: www.suretycanada.com