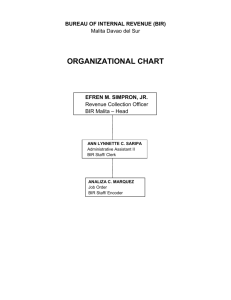

File - Accounting Division

advertisement

TOPIC OUTLINE • Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship • Revenue Regulations No. 19-2011 • Revenue Regulations No. 6-2012 • Revenue Regulations No. 8-2012 • Revenue Memorandum Circular No. 23-2012 Presented by: ROSANA P. SAN VICENTE Chief, Withholding Tax Division July 23, 2012 1 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Registration Requirement: Section 236 of the Tax Code – “(A) Requirements.- Every person subject to any internal revenue tax shall register once with the appropriate Revenue District Officer: (1) (2) (3) (4) Within ten (10) days from the date of employment, or On or before the commencement of business, or Before payment of any tax due, or Upon filing of a return, statement or declarations as required in this Code.” 2 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Registration Requirement: BIR Form to be accomplished – BIR Form 1901, to be submitted to the RDO having jurisdiction over the place where the service is being rendered, with the following attachments: > Birth Certificate or any document showing name, address and birth date of the individual; > Contract of Service /Job Order > Proof of payment of Annual Registration Fee of P500 [Sec. 236(B) of the Tax Code] 3 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: Section 237 of the Tax Code – “Sec. 237. Issuance of Receipts or Sales or Commercial Invoices.- All persons subject to an internal revenue tax shall, for each sale or transfer of merchandise or for services rendered valued at Twenty-five pesos (25.00) or more, issue duly registered receipts or sales or commercial invoices, prepared at least in duplicate, showing the date of transaction, quantity, unit cost and description of merchandise or nature of service: Provided, however, That in the case of sales, receipts or transfers in the amount of One hundred pesos (100.00) or more, or regardless of amount, where the sale or transfer is made by a 4 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: cont… person liable to value-added tax to another person also liable to value-added tax; or where the receipt is issued to cover payment made as rentals, commissions, compensation or fees, receipts or invoices shall be issued which shall show the name, business style, if any, and address of the purchaser, customer or client; Provided, further, That where the purchaser is a VAT-registered person, in addition to the information herein required, the invoice or receipt shall further show the Taxpayer identification Number (TIN) of the purchaser.” 5 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: cont… “The original of each receipt or invoice shall be issued to the purchaser, customer or client at the time the transaction is effected, who, if engaged in business or in the exercise of profession, shall keep and preserve the same in his place of business for a period of three (3) years from the close of the taxable year in which such invoice or receipt was issued, while the duplicate shall be kept and preserved by the issuer, also in his place of business, for a like period.” 6 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: SAMPLE OFFICIAL RECEIPT 7 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: BIR Form to accomplish BIR Form No. 1906 –Application for Authority to Print Receipts and Invoices, to be filed with the RDO where the individual is registered, with the following attachments: > Certificate of Registration > Proof of Payment of RF, current > Final and clear sample of Receipt/Invoice; > Previous ATP (for additional SI/OR to be printed); > Last booklet printed (for additional SI/OR to be printed) 8 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: Can the issuance of SI/OR be dispensed with? > Under Sec. 237, the Commissioner may, in meritorious cases, exempt any person subject to an internal revenue tax from the compliance with the issuance of SI/OR How? The individual shall apply for the “substituted issuance of OR” pursuant to the provisions of RR 14-2003. 9 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: Sec. 2 of RR 14-2003 – inserting new provisions under RR 2-98, as amended – “Sec. 5.128. xxxxx F) Substituted Official Receipt. - For sellers of services whose gross receipts have been subjected to the withholding of the 3% percentage tax, they shall be exempted from the obligation of issuing duly registered non-VAT receipts covering their receipt of payments for services sold. In lieu thereof, the issued “Certificate of Final Tax Withheld at Source” (BIR Form No. 2306), for payee with just one payor, or “Certificate of Creditable Tax Withheld at Source” (BIR Form No. 2307), for payee with several payors, shall be constituted and treated as the substituted official receipt, pursuant to the provisions of Section 237 of the Code” 10 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: Sec. 3 of RR 14-2003 – inserting new provisions under RR 2-98, as amended – “Sec. 9.245. xxxxx F) Substituted Official Receipt. - For sellers of services whose gross receipts have been subjected to 12% final VAT, they shall be exempted from the obligation of issuing duly registered VAT official receipts covering their receipt of payments for services sold. In lieu thereof, the issued “Certificate of Final Tax Withheld at Source” (BIR Form No. 2306), for payee with just one payor, or “Certificate of Creditable Tax Withheld at Source” (BIR Form No. 2307), for payee with several payors, shall be constituted and treated as the substituted official receipt, pursuant to the provisions of Section 237 of the Code” 11 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: Seller of services whose gross receipts were subjected to withholding of 3% percentage tax/12% VAT are exempted from issuing Non-VAT/VAT receipts. In lieu thereof, the following shall be constituted and treated as the substituted OR: “Certificate of Final Tax Withheld at Source” (BIR Form No. 2306) - for payees with just one payor; “Certificate of Creditable Tax Withheld at Source” (BIR Form No. 2307) - for payees with several payors 12 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: How will the payor know that the payee will avail of the “substituted OR” option? Payee is required to submit to the withholding agent-payor a “Notice of Availment of the Option to Pay the Tax through the Withholding Process”, copy-furnished Revenue District Offices having jurisdiction over the payor and the payee 13 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship BIR FORM NO.__________ Republic of the Philippines Department of Finance BUREAU OF INTERNAL REVENUE Revenue Region No. ___ Revenue District Office No. ___ ______________________________________________________________________________________________ NOTICE OF AVAILMENT OF THE OPTION TO PAY THE TAX THROUGH THE WITHHOLDING PROCESS Date __________________ Name of Taxpayer ______________________________________________________ Address ______________________________________________________________ Taxpayer Identification Number __________________________________________ Class of Profession or Calling ___________________________________________ CERTIFICATION This is to certify that I am availing of the option to pay my percentage tax/VAT through the withholding process pursuant to the provisions of REVENUE REGULATIONS NO. ____; that, in accordance with the said Regulations and Revenue Regulations No. 2-98, as amended, gross receipts on account of my sale of goods/service shall be withheld at 3% Percentage Tax or 10% VAT, as the case may be, by the withholding agent-payor; that, such tax withheld shall be constituted as a final tax provided that my source of income comes only from one payor, otherwise, the same shall be considered creditable which shall be applied against the total percentage taxes/VAT due for the month when such tax was withheld; and that, I have executed this Declaration under penalty of perjury, pursuant to the provisions of Section 267, National Internal Revenue Code of 1997. ____________________________ Taxpayer’s Name and Signature 14 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Invoicing Requirement: Withholding agent-payor is required to prepare BIR Form Nos. 2306 or 2307 in quadruplicate, to be distributed as follows: (Note: BIR Form 2306 must be signed by both payor and payee) 2 copies for the payee 2306 2307 1 copy to the payor 1 copy to be attached by the payor to BIR Form 1600 2 copies for the payee 1 copy to the payor 1 copy to be attached by the payor to BIR Form 1600 15 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Bookkeeping Requirement: “Sec. 232. Keeping of Books of Accounts.(A) Corporations, Companies, Partnerships or Persons Required to Keep Books of Accounts.- All corporations, companies, partnerships or persons required by law to pay internal revenue taxes shall keep a journal and a ledger or their equivalents: Provided, however, That those whose quarterly sales, earnings, receipts, or output do not exceed Fifty thousand pesos (P50,000) shall keep and use simplified set of bookkeeping records duly authorized by the Secretary of Finance wherein all transactions and results of operations are shown and from which all taxes due the Government may 16 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Bookkeeping Requirement: readily and accurately be ascertained and determined any time of the year: Provided, further, That corporations, companies, partnerships or persons whose quarterly sales, earnings, receipts or output exceed One hundred fifty thousand pesos (P150,000), shall have their books of accounts audited and examined yearly by independent Certified Public Accountants and their income tax returns accompanied with a duly accomplished Account Information Form (AIF) which shall contain, among others, information lifted from certified balance sheets, profit and loss statements, schedules listing incomeproducing properties and the corresponding income therefrom and other relevant statements.” 17 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Bookkeeping Requirement: Registration of Books of Accounts – included in BIR Form 1901, the registered books of accounts shall be used until all the pages are consumed. However, if the taxpayer wishes to use separate books of accounts for every calendar year, the registration thereof must be made on or before December 31 of each year. Preservation of Books of Accounts … shall be preserved for a period beginning from the last entry in each book until the last day prescribed by Section 203 within which the Commissioner is authorized to make assessment. 18 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Filing of Required Tax Returns: Income Tax Return – BIR Form Due Dates BIR Form No. 1701 On or before April 15 following the close of calendar year BIR Form No. 1701Q 1st Quarter –On or before April 15 of the current CY; 2nd Qtr - on or before August 15 of the current year 3rd Qtr – on or before November 15 of the current year 19 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Filing of Required Tax Returns: Percentage Tax Return – BIR Form Due Dates BIR Form No. 2551 M Within twenty days following the close of the month Value Added Tax Return BIR Form Due Dates BIR Form No. 2550 M Within twenty days following the close of the month BIR Form No. 2550Q Within twenty-five days following the close of the taxable quarter 20 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Filing of Required Tax Returns: Option to Avail of the Substituted Filing of Percentage Tax Return/VAT return – Who is qualified to avail? Individual with only one payor How to avail of such option? Individual must file with the RDO where he/she is registered the following: 1. Notice of Availment of the Option to Pay the Tax Through the Withholding Process”,; 2. Notice of Availment of the Substituted Filing of Percentage Tax Return 21 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship BIR FORM NO.__________ Republic of the Philippines Department of Finance BUREAU OF INTERNAL REVENUE Revenue Region No. ___ Revenue District Office No. ___ ________________________________________________________________________________ NOTICE OF AVAILMENT OF THE SUBSTITUTED FILING OF PERCENTAGE TAX RETURN Date __________________ Name of Taxpayer ______________________________________________________ Address ______________________________________________________________ Taxpayer Identification Number __________________________________________ Class of Profession or Calling/Business __________________________________ CERTIFICATION This is to certify that I am a NON-VAT registered person pursuant to the provisions of REVENUE REGULATIONS NO. ____; that, in accordance with the said Regulations, I have availed of the “Optional Registration under the 3% Final Percentage Tax Withholding, in lieu of the 3% Creditable Percentage Tax Withholding” System, in order to be entitled to the privileges accorded by the “Substituted Percentage Tax Return System” prescribed thereunder; that, this Declaration is sufficient authority of the Withholding Agent to withhold 3% Percentage Tax from payments to me on my sale of goods and/or services, in lieu of the said 3% Creditable Percentage Tax Withholding; and that, I have executed this Declaration under penalty of perjury pursuant to the provisions of Section 267, National Internal Revenue Code of 1997. ____________________________ 22 Taxpayer’s Name and Signature Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship BIR FORM NO.__________ Republic of the Philippines Department of Finance BUREAU OF INTERNAL REVENUE Revenue Region No. ___ Revenue District Office No. ___ ________________________________________________________________________ NOTICE OF AVAILMENT OF THE SUBSTITUTED FILING OF VALUE-ADDED TAX RETURN Date __________________ Name of Taxpayer _________________________________________________ Address _________________________________________________________ Taxpayer Identification Number _____________________________________ Class of Profession or Calling/Business______________________________ CERTIFICATION This is to certify that I am a VAT-registered person pursuant to the provisions of REVENUE REGULATIONS NO. ____; that, in accordance with the said Regulations, I have availed of the “Optional Registration under the 12% Final VAT Withholding, in lieu of the 12% Creditable VAT withholding,” in order to be entitled to the privileges accorded by the “Substituted VAT Return System” prescribed thereunder; that, this Declaration is sufficient authority of the withholding agent to withhold 12% VAT from payments to me on my sale of goods and/or services; that, I have executed this Declaration under penalty of perjury pursuant to the provisions of Section 267, National Internal Revenue Code of 1997. ____________________________ 23 Taxpayer’s Name and Signature Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship SWORN DECLARATION AND WAIVER OF THE PRIVILEGE TO CLAIM INPUT TAX CREDITS UNDER SECTION 110 OF THE TAX CODE In accordance with the provisions of Sections 106 and 108 of the National Internal Revenue Code of 1997, I hereby voluntarily depose and say: 1. That I am a VAT-registered seller of goods and/or service; 2. That I availed of the option to be taxed at 12% VAT; 3. That I hereby waive my right/privilege to claim input tax credits provided under Section 110 of the National Internal Revenue Code of 1997 that may be otherwise claimed against the output tax due on my sale of goods and/or services; and 4. That this waiver shall be effective until cancelled through the execution of a notice prepared for the purpose. I hereby declare under penalties of perjury that the foregoing representations are true and correct and the waiver of right/privilege is voluntarily and knowingly made in accordance with the provisions of the National Internal Revenue Code of 1997. _______________________ Date and Name of Taxpayer 24 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship BIR FORM NO.__________ Republic of the Philippines Department of Finance BUREAU OF INTERNAL REVENUE Revenue Region No. ___ Revenue District Office No. ___ ___________________________________________________________________________________ NOTICE OF CANCELLATION OF AVAILMENT OF THE OPTION TO PAY THE TAX THROUGH THE WITHHOLDING PROCESS Date __________________ Name of Taxpayer ______________________________________________________ Address _______________________________________________________________ Taxpayer Identification Number __________________________________________ Class of Profession or Calling/Business _____________________________________ CERTIFICATION This is to certify that in accordance with the REVENUE REGULATIONS NO.____, I have availed of the “Option To Pay The Tax Through The Withholding Process”; that, I am hereby cancelling and withdrawing my said NOTICE OF AVAILMENT TO PAY THE TAX THROUGH THE WITHHOLDING PROCESS effective ___________________, 200__; and that, I have executed this Declaration under penalty of perjury, pursuant to the provisions of Section 267, National Internal Revenue Code of 1997. ____________________________ 25 Taxpayer’s Name and Signature Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship BIR FORM NO.__________ Republic of the Philippines Department of Finance BUREAU OF INTERNAL REVENUE Revenue Region No. ___ Revenue District Office No. ___ ________________________________________________________________________ NOTICE OF CANCELLATION OF AVAILMENT OF THE SUBSTITUTED FILING OF PERCENTAGE TAX / VAT RETURN Date _______________ Name of Taxpayer ______________________________________________________ Address ______________________________________________________________ Taxpayer Identification Number __________________________________________ Class of Profession or Calling/Business __________________________________ Type of Registration [ ] VAT Taxpayer [ ] Non-VAT Taxpayer CERTIFICATION This is to certify that I am a Non-VAT/VAT -registered person pursuant to the provisions of REVENUE REGULATIONS NO. ____; that, in accordance with the said Regulations, I have availed of the “Optional Registration under the 3% final Percentage Tax on the Sale of Goods and/or Service /10% final VAT Withholding on the Sale of Goods and/or Service” in order to be entitled to the privileges accorded by the “Substituted Filing of Percentage Tax/VAT Return” prescribed thereunder; that, I am hereby cancelling and withdrawing my said NOTICE OF AVAILMENT OF THE SUBSTITUTED FILING OF PERCENTAGE TAX/VAT RETURN SYSTEM, effective ___________________, 200__; and that, I have executed this Declaration under penalty of perjury, pursuant to the provisions of Section 267, National Internal Revenue Code of 1997. ____________________________ Taxpayer’s Name and Signature 26 Taxation of Individuals Engaged in Providing Services under a Service Contract with no Employer-Employee Relationship Filing of Required Tax Returns: Notarized Sworn Declaration – • To be prepared in three copies (2 for the BIR & 1 for the TP, but shall be photocopied so that all his current income payors shall be provided with a copy); • To be submitted to the Collection Division having jurisdiction over the RDO where the individual is registered; • To be submitted fifteen (15) days after the end of the month where the individual’s income reaches P720,000 or June 30 of each year, whichever comes earlier. (However, if after June 30, the individual’s income reaches P720,000, another sworn declaration must be submitted) 27 SUMMARY OF THE TAX OBLIGATIONS OF INDIVIDUALS HIRED UNDER “CONTRACT OF SERVICE” > Register with BIR using BIR Form 1901; > Pay Annual Registration Fee of P500; > Keep Books of Accounts; > Issue Official Receipt for every receipt of income (not applicable to those who opted to pay PT/VAT through the withholding process); > File Required Tax Returns and information return; > Submit required document as may be required in any future revenue issuance 28 WHAT THE HIRING AGENCY SHOULD REQUIRE FROM THE INDIVIDUALS HIRED UNDER THE “CONTRACT OF SERVICE”/ “JOB ORDER” SCHEME? REQUIRE THE INDIVIDUAL TO REGISTER WITH THE BIR AS INDIVIDUAL ENGAGED IN BUSINESS OR PRACTICE OF PROFESSION, WHICHEVER IS APPROPRIATE CERTIFICATE OF REGISTRATION (COR) OF THE INDIVIDUAL ISSUED BY THE BIR UPON HIS REGISTRATION OFFICIAL RECEIPT FOR EVERY PAYMENT OF INCOME/ BIR FORM 2306 DULY-SIGNED BY BOTH PAYOR AND PAYEE COPY OF THE SWORN DECLARATION OF INCOME DULY RECEIVED BY THE BIR 29 INDIVIDUALS HIRED UNDER “CONTRACT OF SERVICE” APPLICABLE WITHHOLDING TAX: EWT PRESCRIBED UNDER SECTION 2.57.2 OF RR NO. 2-98 DEPENDS ON THE NATURE OF SERVICE RENDERED IF THE NATURE OF SERVICE IS NOT AMONG THE EXISTING ENUMERATIONS UNDER RR NO. 2-98, AS AMENDED, APPLY THE REQUIRED WITHHOLDING AS GOVERNMENT ENTITY UNDER SEC. 2.57.2 (N) OF RR NO. 2-98, AS AMENDED VAT OR PERCENTAGE TAX WITHHOLDING SHALL ALSO APPLY (REFER TO THE GOVERNMENT EXPENSE CHART) 30 REVENUE REGULATIONS NO. 19-2011 What are the objectives of RR 19-2011? 1. To prescribe the use of new Income Tax Returns (Annual) 2. Modify the provisions under RMC 57-2011 What are the new ITR forms? 1. BIR Form 1700 2. BIR Form 1701 3. BIR Form 1702 31 REVENUE REGULATIONS NO. 19-2011 BEFORE (BIR Form No. 1700) NOW (BIR Form No. 1700) Marking of an “X” on all applicable boxes Shading of all applicable circle 3 choices for ATC (II011; II 040; II041 2 choices for ATC (II041; II011) No question as to “joint filing” With question as to “joint filing” Information can be provided either through script writing or print All information is required to be written in all capital letters on each box provided No question as to “gender” With question as to “gender” Email address is not being asked Space is provided for the email address Three digits for the branch code Four digits for the branch code 32 REVENUE REGULATIONS NO. 19-2011 BEFORE (BIR Form No. 1700) NOW (BIR Form No. 1700) For the information on qualified For the information on qualified dependent children, there is no question dependent children, there is a question if mentally or physically incapacitated if mentally or physically incapacitated Personal and additional exemption is lumped under one data field Separate fields were provided for personal and additional exemption No Part IV – the return is composed of three (3) parts only. With Part IV – Supplemental Information No space provided for “new address” in case the registered address is no longer the current address Space is provided for the “new address” of the taxpayer, in case the registered address is no longer the current address 33 REVENUE REGULATIONS NO. 19-2011 What are the information required under Part IV? • Gross Income/Receipts subjected to Final Withholding Tax on income • Gross Income/Receipts exempt from income tax Under RMC 57-2011, declaration of information required under Part IV of the tax return is optional for calendar year 2011 but for 2012 onwards, the disclosure of these information is mandatory. Under RR 19-2011, it amended RMC 57-2011 wherein the filling-up of the fields provided under Part IV is made optional. However, in case information shall be provided, the same must be properly documented and/or substantiated 34 REVENUE REGULATIONS NO. 19-2011 BEFORE (BIR Form No. 1701) NOW (BIR Form No. 1701) Marking of an “X” on all applicable boxes Shading of all applicable circle 3 choices for ATC (II011; II 040; II041 2 choices for ATC (II041; II011) No question as to “joint filing” With question as to “joint filing” Information can be provided either through script writing or print All information is required to be written in all capital letters on each box provided No question as to “gender” With question as to “gender” Email address is not being asked Space is provided for the email address Three digits for the branch code Four digits for the branch code 35 REVENUE REGULATIONS NO. 19-2011 BEFORE (BIR Form No. 1701) NOW (BIR Form No. 1701) For the information on qualified For the information on qualified dependent children, there is no question dependent children, there is a question if mentally or physically incapacitated if mentally or physically incapacitated Personal and additional exemption is lumped under one data field Separate fields were provided for personal and additional exemption Part III-Details of Payment Part III- Availment of Tax Income Incentives/Exemptions No Part IV – the return is composed of three (3) parts only. With additional parts (Part IV –IX) IV- Details of Payment V- Breakdown of Income VI-Schedules VII-Details of Income Tax Incentives/Exemptions VIII- Applicable to Estate and Trust IX-Supplemental Information 36 REVENUE REGULATIONS NO. 6-2012 Amended the EWT rate applicable on the purchase of minerals, mineral products and quarry resources – Section 2.57.2 (T) of RR 2-98, as amended Before Now 10% 5% RR 7-2007 RR 6-2012 37 REVENUE REGULATIONS NO. 8-2012 Amended RR 5-2011 – RR 5-2011 Uniform and clothing allowance not exceeding P4,000 per annum RR 8-2011 Uniform and clothing allowance not exceeding P5,000 per annum 38 REVENUE MEMORANDUM CIRCULAR NO. 23-2012 Subject of this RMC - Reiteration of the responsibilities of employees and officials of government offices for the withholding of taxes on certain income payments subject to withholding taxes and the imposition of penalties for non-compliance thereof What are these responsibilities? 1. register; 2. require employee to accomplish registration/update form; 3. withhold; 4. remit; 5. do the year-end adjustment (withhold deficiency tax or refund excess tax withheld); 6. Issue certificate of income paid and tax withheld (BIR Form 2316; 2306; 2307) 7. file annual information return 39 REVENUE MEMORANDUM CIRCULAR NO. 23-2012 Penalties for Non-Compliance: Violation Non-withholding of required tax Under-withholding of tax Penalties Legal Basis Amount of tax not withheld Sec. 251, Tax Code 20% interest Sec. 249, Tax Code Fine of not less than P10,000 and suffer imprisonment of not less than I year but nor more than 10 years, upon conviction Sec. 255, Tax Code Amount of Under-withheld tax Sec. 251, Tax Code 20% interest Sec. 249, Tax Code 40 REVENUE MEMORANDUM CIRCULAR NO. 23-2012 Penalties for Non-Compliance: Violation Penalties Non-remittances of taxes Amount of tax not remitted withheld Late remittance /Late filing of withholding tax returns Legal Basis Sec. 251, Tax Code 20% interest Sec. 249, Tax Code Fine of not less than P10,000 and suffer imprisonment of not less than I year but nor more than 10 years, upon conviction Sec. 255, Tax Code 25% surcharge on the amount remitted late Sec. 248, Tax Code 20% interest Sec. 249, Tax Code 41 REVENUE MEMORANDUM CIRCULAR NO. 23-2012 Penalties for Non-Compliance: Violation Penalties Failure to refund Amount of tax not refunded excess taxes withheld 20% interest on compensation Failure to file withholding tax return or certain information return Legal Basis Sec. 252, Tax Code Sec. 249, Tax Code Fine of not less than P10,000 and suffer imprisonment of not less than 1 year but not more than 10 years, upon conviction Sec. 255, Tax Code P1,000 for each failure but not to exceed P25,000 during a calendar year Sec. 250, Tax Code Fine of not less than P10,000 and suffer imprisonment of not less than 1 year but not more than 10 years, upon conviction Sec. 255, Tax Code 42 REVENUE MEMORANDUM CIRCULAR NO. 23-2012 Penalties for Non-Compliance: Violation Penalties Legal Basis Failure to supply correct and accurate information Fine of not less than P10,000 and suffer imprisonment of not less than 1 year but not more than 10 years, upon conviction Sec. 255, Tax Code Violations of withholding tax regulations committed by Public Officers charged with the duty to deduct and withhold any internal revenue tax and to remit the same Penalty of not less than P5,000 but not more than P50,000 or suffer imprisonment of not less than 6 months and 1 day but not more than 2 years, or both, for each act or omission, upon conviction Sec. 272, Tax Code 43 REVENUE MEMORANDUM CIRCULAR NO. 23-2012 Penalties for Non-Compliance: Violation Penalties Legal Basis Acts or omissions Fine of not less than P50,000 but penalized under the not more than P100,000, for each Tax Code committed act or omission, upon conviction by any corporation, association or general co-partnership Sec. 256, Tax Code Violations of any provision of the Tax Code or any rule for which no specific penalty is provided Sec. 275, Tax Code Penalty of P1,000 or suffer imprisonment of not more than 6 months, or both, for each act or omission, upon conviction 44 ADDITIONS TO THE TAX Section 248 • Liable for the payment of 25% surcharge for any of the following violations: Filing of tax return with an internal revenue other than those with whom the return is required to be filed Failure to pay the full or part of the amount of tax shown on any return required to be filed under the provisions of the Tax Code , or the full amount of the tax due for which no return is required to be filed, on or before the date prescribed for its payment Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment 45 ADDITIONS TO THE TAX Section 249 • Liable to the payment of interest on any unpaid amount of tax at the rate of twenty percent (20%) per annum, until the amount is fully paid Section 251 • Liable to the payment of the tax supposed to be withheld but not withheld, or tax withheld but not remitted, inclusive of penalties for such failures Section 252 • Liable to penalty equivalent to the amount not refunded to the employee , in case of failure to refund to the employee the excess tax withheld 46 CRIMINAL LIABILITIES Section 255 Section 256 • Failure to file return, supply correct and accurate information, pay tax, withhold and remit tax and refund excess tax withheld on compensation – criminal penalty of not less than P10,000.00 or imprisonment of not more than 1 year but not more than 10 years • Penal Liability of Corporations/associations or general co-partnerships for any of the acts or omissions penalized under the Tax Code - Fine of not less than Fifty thousand pesos (P50,000) but not more than One Hundred Thousand pesos (P100,000) 47 CRIMINAL LIABILITIES Section 272 Section 275 • Failure to withhold and remit tax withheld committed by a government officer or employee charged with the duty to withhold- Fine of not less than P5,000 but not more than P50,000 or imprisonment of not less than 6 months and I day but not more than 2 years, or both • Violation of other provisions of the Tax Code or revenue regulations – compromise penalty of P1,000 48 Thank you 49