lesson plan - WordPress.com

advertisement

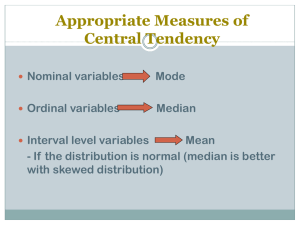

LESSON PLAN Subject Semester MeetingTime allotment Theme I. Competence Standard II. Basic Competence : Bahasa Inggris Bisnis Lanjutan : IV :1 : 2 x 50’ : Bussiness Financing: Stock :Reading Develop and apply reading strategies and skills (previewing, skimming, scanning, recognizing the main ideas of paragraphs guessing word meaning from context, summarizing, etc.) as well as academic vocabulary strategies and skills (understanding reference words, using the dictionary, etc.) :Reading General literal comprehension and details, scanning, predicting, and building background knowledge through advance organizer. III. Indicators: Cognitive Process : Students able to comprehend the meaning of the text and translate the text into Indonesian correctly Product : Students able to find the main ideas of the text and able to answer the questions Affective Character : Do the assignments diligently and carefully. Social : Students able to do the assignment in groups; work with others IV. Learning Objectives The aims of this lesson are: 1. Students are able to comprehend the text’s meaning. 2. Students able to translate the text into good Indonesian. 3. Students able to find information from the text. V. Materials Business Financing: Stock Text: Page 1 of 10 The corporation is the dominant form of business organization in most developed countries. Although proprietorships and partnerships are more numerous, corporations transact more business and are larger in terms of total assets, sales revenue, and number of employees. Most well-known companies, such as CBS, General Motors, IBM, and Boeing, are corporations. Their full names include Corporation or Incorporated (abbreviated Corp. and Inc.) to indicate that they are corporations for example, CBS, Inc. and General Motors Corporation. Corporations may finance their operations in many different ways. One of them is by issuing stock. A corporation issues stock certificates to its owners or investors in exchange for their investments in the business. The basic unit of capital stock is called a share. A corporation may issue a stock certificate for any number of shares-one share one hundred shares, or any number. The certificate shows the company name, stockholder name, the number of shares, and the par value of the stock. Stock in the hands of stockholder is said to be outstanding. The total number of stock outstanding at any time represents 100 percent ownership of the corporation. Because stock represents the corporation’s capitals, it is often called capital stock. Corporations issue different types of stock to appeal to a wide variety of investors. The stock of a corporation may be either common or preferred and either par or nopar. Every corporation issues common stock, the most basic form of capital stock. Unless designated otherwise, the word stock is understood to mean “common stock.” Common stockholders are the owners of the business. They have four basic rights, unless they are specially withheld, of stock ownership: the right to participate in management by voting, the right to receive a proportionate part of any dividend, the Page 2 of 10 right to receive a proportionate share of any assets remaining after the corporation pays its liabilities in liquidation and the right to maintain one’s proportionate ownership in the corporation. Owners of preferred stock also have the four basic stockholder rights, unless a right is specifically denied. Often the right to vote is withheld from preferred stockholders. Preferred stock gives its owners certain advantages over common stockholders. These benefits include priority to receive assets before the common stockholders if the corporation liquidates. Because of the preferred stockholders priorities, we see that common stock represents the residual ownership in the corporation’s assets after subtracting the liabilities and claims of preferred stockholders. Companies may issue different classes of preferred stock and each class is recorded on a separate account. Stock may be par value stock or non-par stock. Par value of their common stock quite low J.C Penney’s common stock par value is 50 cent per share, but Bethlehem Steel’s common stock par value is $8 per share. Par value of preferred stock is often higher; $100 per share is typical, but some preferred stocks have par value of $25 and $10. Par value is used to compute dividends on preferred stock. No-par stock does not have par value but some no-par stock has a stated value, which makes it similar to par value stock. The stated value is also an arbitrary amount that accountants treat as though it were par value. Comprehension Questions: Exercise 1: Information Questions Answer the following questions briefly. Base your answer on the text above. 1. What is the topic of the text? 2. What is a share (of stock)? 3. What is one purpose of issuing shares of stock? Page 3 of 10 4. What information can you find in a stock certificate? 5. What does a share stock represent? 6. What is meant by outstanding stock? 7. How many types of stock may a company issue? 8. What rights do stockholders have? 9. What is the advantage of investing in preferred stock (as compared to investing in common stock? 10. How does per stock differ from non-par stock? Exercise 2: True or False Determine whether the following statements are true or false. Write T if it is true and F if it is false. Then correct the false statements. 1. There are more corporations than partnerships or proprietorship. 2. Corporations have smaller sales value than partnerships or proprietorships. 3. Issuing stock is the only way of business financing. 4. Different people are interested in different types of stock. 5. Capital stock refers to the total number of outstanding stock. 6. All stockholders have all the four basic stockholder rights. 7. One of the stockholder rights is the right to pay the corporation’s liability in liquidation. 8. Holders of preferred stock often don’t have the right to vote. 9. Holders of preferred stock will receive the remaining assets when a corporation liquidates. 10. Residual assets means the remaining assets after all liabilities are paid. VI. Class Activities Meeting today: A. Pre-activity [10’] 1. Orientation Teacher greets the students. Teacher explains classroom’s rules. Page 4 of 10 Teacher distributes attendance list to students. Teacher tells students about today’s materials. 2. Apperception Teacher asks students about learned materials or last meeting materials. 3. Motivate Teacher tells students the learning objectives of the materials. Teacher explains to the students about the class group discussions and the group distributions (3 groups). B. Main Activities [80’] 1. Exploration [30’] Teacher asks students to open the book page 85 (Unit 16) The assigned groups will read aloud the text and translate the sentences. Teacher reveals the answers in the slideshow. 2. Elaboration Teacher asks the groups to do comprehension questions in 10 minutes. [10’] Each group will answer the questions in class discussions [20’] Teacher asks the groups to have the chance answer the exercise 2 (True or false). [20’] 3. Confirmation Teacher gives applause to the groups. C. Post-activity [10’] Teacher concludes the materials. Teacher gives the students chance to ask. Teacher gives students home assignments. Teacher informs the students the material they are going to learn on the next meeting. Teacher leaves-taking. Teacher dismisses the class. VII. Teaching Methods Lecturing Page 5 of 10 Class Discussions Group Discussions VIII. Media Textbook Power Point Presentation LCD Projector E-Dictionary Chalk or Marker Post-it IX. Assessment Key answer: Business Financing: Stock Pembiayaan Bisnis: Saham Text: Perusahaan merupakan bentuk yang dominan dari organisasi bisnis di sebagian besar negara maju. Meskipun bisnis kepemilikan tunggal dan bisnis kerja sama jumlahnya lebih banyak, perusahaan melakukan lebih banyak transaksi bisnis dan lebih luas lagi dalam aset, pendapatan, dan jumlah pegawai. Kebanyakan perusahaan terkenal, seperti CBS, General Motors, IBM, dan Boeing, adalah korporasi. Nama-nama mereka termasuk golongan Korporasi atau Inkorporasi (disingkat menjadi Corp. dan Inc.)untuk menunjukkan bahwa mereka adalah badan usaha yang sah, contohnya, CBS, Inc. dan General Motors Corporation. Korporasi dapat membiayai pelaksanaan mereka dalam berbagai cara. Salah satunya adalah melalui penerbitan saham. Sebuah korporasi menerbitkan sertifikat saham kepada pemiliknya atau investor sebagai ganti dari investasi mereka dalam Page 6 of 10 bisnis. Unit pokok dari saham modal disebut saham. Sebuah korporasi dapat menerbitkan sebuah sertifikat saham dalam jumlah saham berapapun-satu saham seratus saham, atau berapapun. Sertifikat menunjukkan nama perusahaan, nama pemegang saham, jumlah saham, dan nilai nominal dari saham tersebut. Saham istimewa ditangan pemegang saham dikatakan tidak terbatas. Jumlah keseluruhan saham istimewa yang beredar setiap saat mewakili kepemilikan 100 persen korporasi. Dikarenakan saham merupakan modal korporasi, saham sering disebut modal. Korporasi menerbitkan berbagai jenis saham yang berbeda untuk menarik investor secara luas. Saham dari korporasi dapat berupa umum atau khusus dan juga pari atau tidak pari. Setiap perusahaan menerbitkan saham umum, bentuk paling dasar dari modal saham. Kecuali jika ditunjukkan sebaliknya, kata stok dipahami sebagai “saham biasa.” Pemegang saham umum adalah pemilik bisnis. Mereka memiliki 4 hak dasar, kecuali jika hak tersebut ditahan secara khusus dari kepemilikan saham: hak untuk berpartisipasi dalam manajemen melalui voting, hak untuk menerima bagian proporsional dari dividen manapun, hak untuk menerima bagian proporsional dari setiap aset yang tersisa setelah korporasi membayar kewajiban dalam likuidasi dan hak untuk mempertahankan kepemilikan proporsional seseorang dalam korporasi. Para pemilik saham preferen juga memiliki keempat hak fundamental pemegang saham, kecuali jika satu hak tersebut diingkari. Sering hak untuk memberikan suara ditahan dari pemegang saham preferen. Saham preferen memberi pemiliknya keuntungan tertentu dibandingkan pemengang saham biasa. Keuntungan ini termasuk prioritas untuk menerima aset sebelum pemegang saham biasa jika perusahaan Page 7 of 10 dilikuidasi. Dikarenakan prioritas dari pemegang saham preferen, kita dapat menlihat bahwa saham biasa menunjukkan kepemilikan yang tersisa pada aset korporasi setelah dikurangi dengan hutang dan tagihan dari pemilik saham preferen. Perusahaan bias menerbitkan saham preferen berbeda dan setiap golongan dicatat pada rekening yang berbeda. Sahan yang bernilai pari atau tidak bernilai pari. Nilai ini tergantung dari kesepakatan pemegang saham. Kebanyakan perusahaan menentukan nilai pari saham biasa pada harga yang rendah. Saham biasa dari perusahaan J.C. Penney nilai parinya 50% per lembarnya, tetapi saham biasa dari perusahaan Bethlehem Steel nilai parinya $8 per lembarnya. Nilai pari saham preferen seringkali lebih tinggi; $100 per lembar adalah wajar, akan tetapi beberapa saham preferen memiliki nilai pari $25 dan $10. Nilai pari digunakan untuk mengkalkulasi deviden pada saham preferen. Saham tanpa nilai pari tidak memiliki nilai pari, namun beberapa saham tanpa nilai pari memiliki nilai tertulis, yang mana mirip dengan nilai nominal saham. Nilai yang tertera juga merupakan jumlah yang sewenang-wenang yang dianggap oleh akuntan seolah-olah nilai pari. Comprehension Questions: Exercise 1: Information Questions Answer the following questions briefly. Base your answer on the text above. 1. Stocks of a company. 2. The basic unit of capital stock. 3. To finance the corporations’ operations. 4. The company name, stockholder name, the number of shares, and the par value of the stock. 5. A stock certificate for any number of shares-one share one hundred shares, or any number. Page 8 of 10 6. The total number of stock outstanding at any time represents 100 percent ownership of the corporation, the stock represents the corporation’s capitals, it is often called capital stock. 7. 4; the stock of a corporation may be either common or preferred and either par or no-par. 8. 1The right to participate in management by voting, 2the right to receive a proportionate part of any dividend, 3the right to receive a proportionate share of any assets remaining after the corporation pays its liabilities in liquidation and 4the right to maintain one’s proportionate ownership in the corporation. 9. Holders of preferred stock will receive the remaining assets when a corporation liquidates. 10. No-par stock does not have par value but some no-par stock has a stated value, which makes it similar to par value stock. Exercise 2: True or False Determine whether the following statements are true or false. Write T if it is true and F if it is false. Then correct the false statements. 1. There are more corporations than partnerships or proprietorship. Partnerships or proprietorship are more numerous than corporations. 2. Corporations have smaller sales value than partnerships or proprietorships. Corporations have larger sales value than partnerships or proprietorships. 3. Issuing stock is the only way of business financing. Issuing stock is one of the ways of business financing. 4. Different people are interested in different types of stock. 5. Capital stock refers to the total number of outstanding stock. 6. All stockholders have all the four basic stockholder rights. Could be denied. 7. One of the stockholder rights is the right to pay the corporation’s liability in liquidation. The stockholder only has the right to receive proportionate share of any assets remaining after the corporation liquidates. The company will pay the liabilities. 8. Holders of preferred stock often don’t have the right to vote. Only withheld. Page 9 of 10 9. Holders of preferred stock will receive the remaining assets when a corporation liquidates. 10. Residual assets means the remaining assets after all liabilities are paid. Source: Mukarto. 1998. English for Students of Accounting. Yogyakarta: Pusat Penerbitan Akademi Akuntansi YKPN (p: 85-89) CAOLD 3rd Edition Prepared by: Tamarischa Pradhini Putri 101214019 English Language Education Study Program Page 10 of 10